Would you be surprised if we told you that Millennials expect the highest investment returns compared to other generations?

Earlier in 2020, Schroders conducted an online global investor study, which surveyed 23,450 investors between April and June when the economy had been beaten down by Covid-19 badly.

Interestingly, the results showed that Millennials (18 – 37 years old) expect an average annual total return of almost 12% of their investment portfolio in the coming 5 years! Bear in mind that this survey was conducted between Apr – Jun 2020 in the midst of a pandemic-fueled crisis when the stock market plunged the quickest -40% ever on record. Yet, expectations of positive returns were still extremely high on those polled.

The survey also found that the older the age group, the lower the expectations of returns. Generation X (38 – 50 years) expect 11% and baby boomers expect a 10% average annual total return. Even so, do you think these expectations are realistic? You may wonder what returns are considered realistic?

Rupert Rucker, head of income solutions at Schroders, mentioned that “much of millennials’ investment experience has been shaped from the period of very strong market performance since the global financial crisis, which might have distorted long-term return expectations.”

Rucker also drew attention to the fact that millennials are typically more likely to take higher risks due to the fact that they have a long way to go to retirement, and hence may have higher expectations when it comes to investment returns. Additionally, there has been consistency with regard to the findings for the past few years which indicate that regardless of the market conditions, investors of a younger age have the tendency to be more positive than the older generations.

TAKEAWAY

- A recent 2020 survey shows that most investors, especially Millennials, expect a 10 – 12% average annual returns on their investment portfolio in the next 5 years.

- The expectation of a normal retail investor seeking an average 12% annual return in 5 years is not realistic, and there are statistics to prove it.

- Only 1% of traders are profitable net of fees, which demonstrates the extremely low probability of achieving a positive return for a normal retail trader/investor with a short investment horizon (<5 years).

- Most investment products available to the average retail investor cannot achieve a long term average annual return in excess of 10%.

- There are many “Trading Gurus” that advertise successful returns in excess of 20%. However these returns may not be real, are one-offs, or may just be success case snippets of the traders’ actual profits without showing the losses.

- It is extremely important for our readers not to fall prey to such instances for they are aplenty. We strongly recommend our readers exercise caution when they are in search of external help in their trading journey. Very often, it pays to scrutinize the real performances of these “Trading Gurus”.

OUR POINT OF VIEW

The team at AlgoMerchant has come to realise the importance of having realistic expectations of what to expect from the market, and knowing exactly what the common pitfalls that are either overlooked or poorly addressed in the internet. By doing so, these will greatly help our traders in the Algomerchant community.

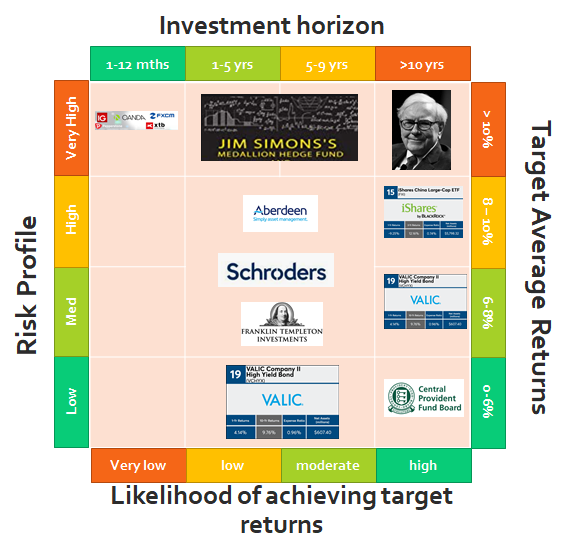

Hence, in order to make it more illustrative and easier to understand, we have put together a visual 4-factor matrix below that seeks to put into perspective how well-known and popular investment products can deliver the average target returns across the following:

Different

investment

horizons

Risk profile

Likelihood

of achieving

target returns

Target

average return

REALISTIC RISK REWARD BENCHMARKING

Let’s explore how realistic the findings are from the Schroders study. The first question is if a 12% average annual return within 5 years, realistic?

Looking at the matrix below, there actually is a famous hedge fund strategy called the Medallion Fund by the Hedge Fund Renaissance Technology that can deliver that kind of performance within that investment horizon – 12% returns year in year out.

The bad news is that this strategy is so secretive and elusive that it is currently only available for employees of Renaissance Technology. No other high profile, wealthy or normal day-to-day investor like you and I have access to it.

Hence, other than the aforementioned strategy, an average 12% annual return in 5 years is simply not realistic.

Now, you may be thinking, “Wait, that doesn’t sound right! I’ve seen so many successful traders advertising on the internet that they’ve successfully beat the market way in excess of 12%!”

The reality is that based on studies conducted by economic scientists after analyzing actual broker data and performance of traders, only 1% of traders do profit net of fees. This indicates that even if there were indeed successful traders that can consistently beat the market, they are very few and far between. Therefore, in the top left corner of the matrix, we have assessed discretionary traders that can generate good returns (>10%) within a short time frame, at very low probabilities!

Let’s say we relax the criteria slightly to allow an average 12% annual return with a longer investment horizon (> 10 years); the odds of achieving those returns do get higher. However, you probably have to trade as well as Warren Buffet in order to generate such returns!

Also, did you know while Buffet’s average annual return is 19% from 1965 to 2020, but his past decade’s average annual return (2010-2020) is actually less than 7%? Thus, even the seasoned and arguably most famous investor in the world is unable to generate the kind of returns that the Millennial generation is expecting!

Then what are the returns profiles for the typical investment product(s) available to the average retail investor?

The honest truth is that products like Unit Trusts Funds, Mutual Funds and Exchange Traded Funds may be very popular to the masses, but they are unable to generate the kind of returns (>12%) expected by most investors. We would also like to highlight that many of these funds’ performances listed are actually before commission and fees. After accounting for them, investors will earn less than the amount listed. Even the lowest cost Exchange Traded Fund (S&P 500) has a long term track record of an average of only 10% from 1920 – 2020!

Set The Right Expectation & Be Careful!

There are many “Trading Gurus” that advertise successful returns in excess of 20%. However these returns may not be real, are one-offs, or may just be success case snippets of the traders’ actual profits without showing the losses.

It is extremely important for our readers not to fall prey to such instances for they are aplenty. We strongly recommend our readers exercise caution when they are in search of external help in their trading journey. Very often, it pays to scrutinize the real performances of these “Trading Gurus”.