Introduction

The past 10 years have been very favourable to a handful of large cap US tech stocks. They have significantly outperformed the market and some have achieved trillion dollars market valuation.

Investors that have stayed true to FAANG (Facebook, Apple, Amazon, Netflix and Google) have had very rewarding long term returns.

However, many analysts are predicting that while FAANG stocks should continue to stay strong and loved, they may no longer be able to sustain previously market-beating returns.

Goldman Sachs, one of Wall Street’s beloved analysts, is of the view that the next big opportunity will come from Europe. Since Europe lacks growth companies in general, especially in the Technology sector, European companies with strong balance sheets, low volatility growth and good dividend yields have emerged as Europe’s post financial crisis winners.

This group of highly favoured European stocks has been termed by Goldman Sachs as “GRANOLAS”.

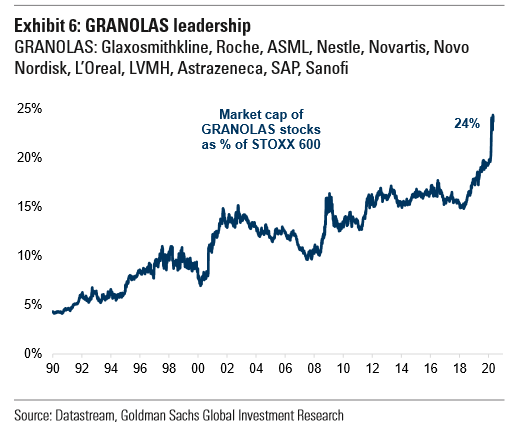

Did you know that GRANOLAS now dominates 24% of the Stoxx 600 index, which is significantly different from a decade ago with a cluster of oil, banks and telecom companies dominating Europe’s Stoxx 600 index? “This shift was a function of the lower interest rate environment and higher risk aversion that have characterised the post-global financial crisis world,” says Goldman Sachs.

What is GRANOLAS?

The increasingly popular GRANOLAS is made up of Glaxosmithkline, Roche, ASML, Nestle, Novartis, Novo Nordisk, L’Oreal, LVMH, Astrazeneca, SAP and Sanofi.

These are the reasons why Goldman Sachs is bullish GRANOLAS:

“We think the leaders of the forthcoming cycle will be companies that are able to generate earnings growth, sustainable dividend payouts and have healthy balance sheets. The GRANOLAS stocks may not all do well, but together we think they offer some quality: growth, stability and income.”

GRANOLAS Upside Narrative

Many analysts are estimating that the Stoxx 600 is not expected to see earning return to pre Covid levels until the end of 2022.

In contrast, the estimates for GRANOLAS’s earnings to exceed their 2019 peak by 30% by 2022.

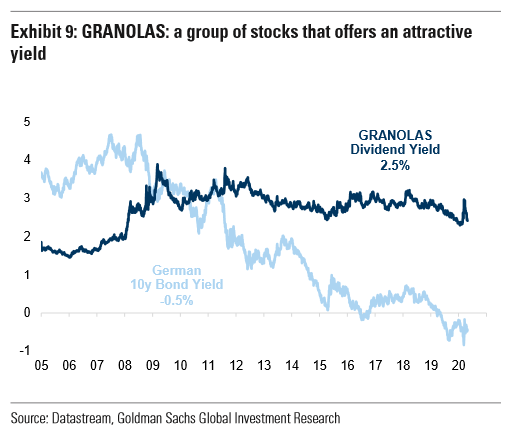

GRANOLAS has a dividend yield of 2.5%, which is quite attractive to long term buy and hold investors especially with bond yields so low.

Goldman Sachs states: “Their dividends should be sustainable and continue to grow over the long run. Indeed, we find that their payout ratio is around 50%, and they generally have a strong balance sheet.”

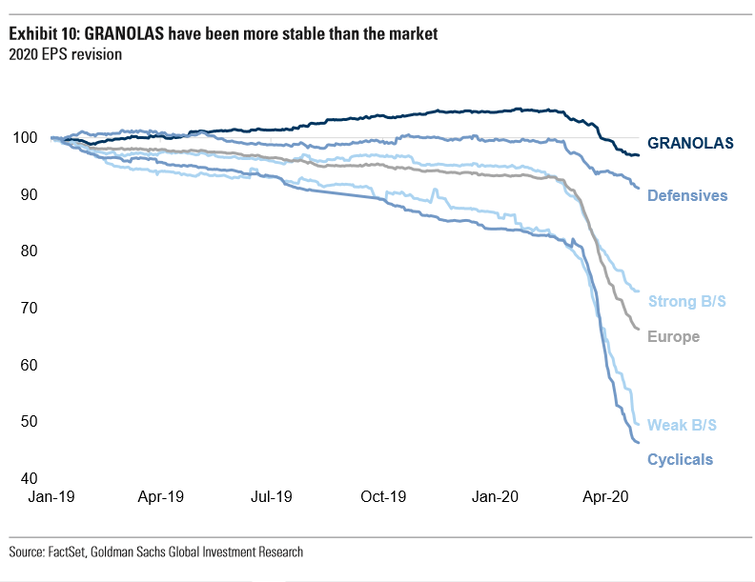

GRANOLAS has also been historically more resilient than the market Stoxx 600 index. While GRANOLAS’ EPS have been reduced downwards -7%, the Stoxx 600 index has comparatively been revised -30%.

Goldman Sachs states:

“We think this is a function of their size and their sectors. Indeed, all these companies are in healthcare, tech or consumer goods, three relatively stable industries. We would also note that the GRANOLAS are less volatile than the market or other growth companies.”

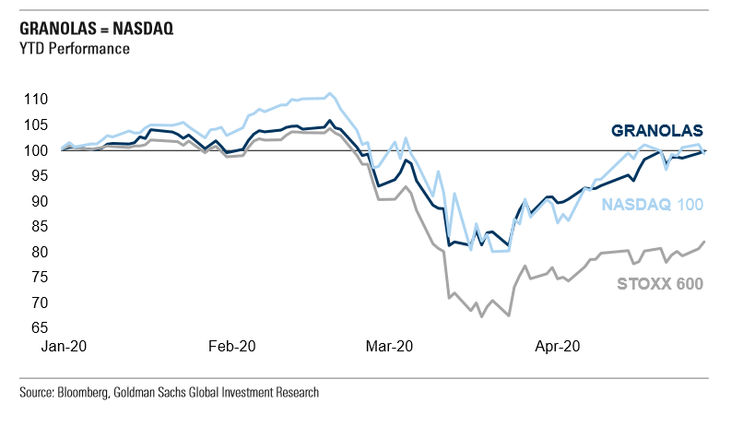

Furthermore, GRANOLAS has been as strong as the popular NASDAQ 100.

Conclusion

We are in an era of low interest rates and low nominal growth.

According to Goldman Sachs, they are of the opinion that the likelihood of compounding stocks will most likely come from companies with strong balance sheets, low volatility and stable growth.

Goldman Sachs has identified GRANOLAS based out of Europe that fulfils these requirements.

Please note that all the information contained in this content is intended for illustration and educational purposes only. It does not constitute any financial advice/recommendation to buy/sell any investment products or services.