There is a new Covid Variant that is making waves not only in mainstream media, but also the stock market.

This new variant is so ‘deadly’ it caused the Dow to tumble 900 points on the worst ever Black Friday in history since 1931. In reality this variant is so concerning to the stock market because it has created a lot of anxious chatter among medical professionals regarding a Covid 19 variant before.

What is this new Variant called?

What is the B1.1.529 Variant?

B.1.1.529 really moved very quickly. On 11th November it was first discovered in Botswana. 3 days later it was identified in South Africa. Subsequently Hong Kong was hit next with 2 cases found in Quarantine. Israel and Belgium were also not spared.

What is concerning is the Belgium case had no links to South Africa. It was an unvaccinated young woman that developed flu-like symptoms 11 days after travelling to Egypt via Turkey. The implication is that the virus is already spreading throughout society.

These are the reasons why B1.1.529 is creating so much chatter:

1

B.1.1.529 has 32 protein spike mutations. By comparison, Delta had 9 changes.

2

B.1.1.529 did not evolve from the Delta (not Delta plus)

3

4

5

6

7

What Facts do we have on hand?

Hong Kong Data

The first case in HK was a fully vaccinated (2 Pfizer doses in May/June 21) 36 year old male who travelled to South Africa. Prior to departing South Africa he was PCR negative but upon returning to Hong Kong he was tested PCR positive on day 4 of his quarantine. Apparently, he was also responsible for infecting another guest across the quarantine hotel hallway.

Some established facts:

1

2

3

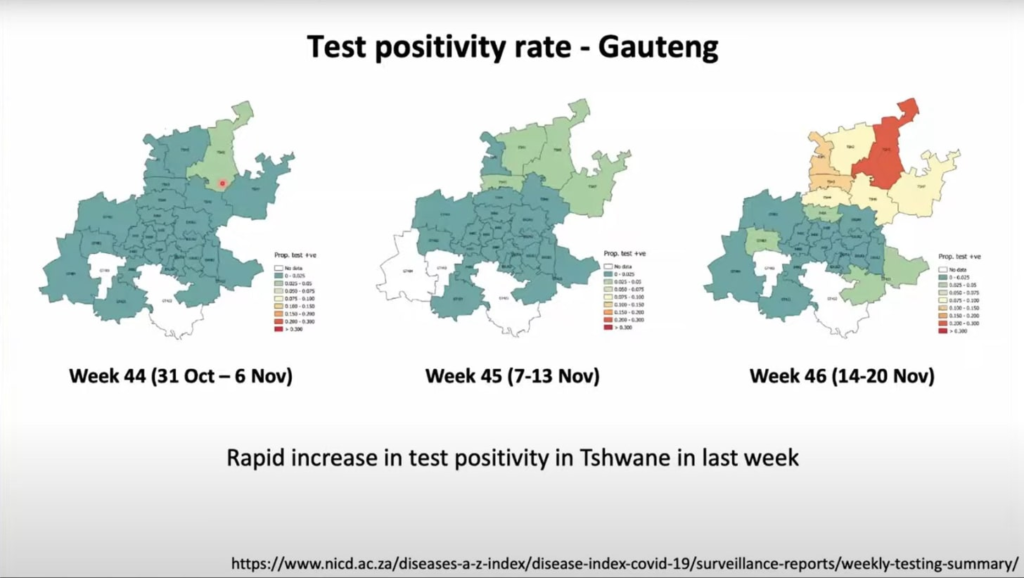

There are early indicators B1.1.529 is driving a new wave in South Africa, starting from Gauteng which has experienced a test positivity rate increase from 1% to 30% which is unprecedented.

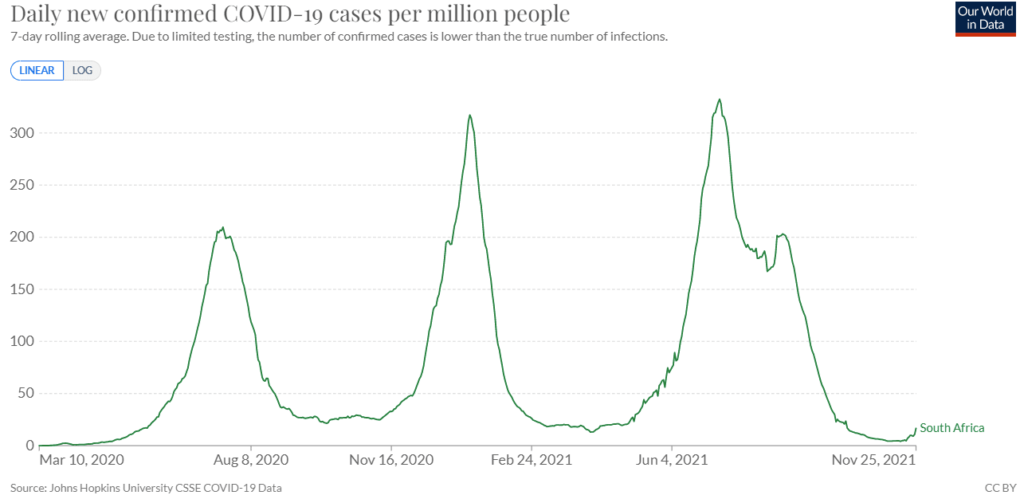

Looking at cases in South Africa as a whole, cases are starting to increase exponentially. Cases increased from 868 to 3500 within a week! While how many are associated B.1.1.529 is unknown, it is surely suspicious and coincidental.

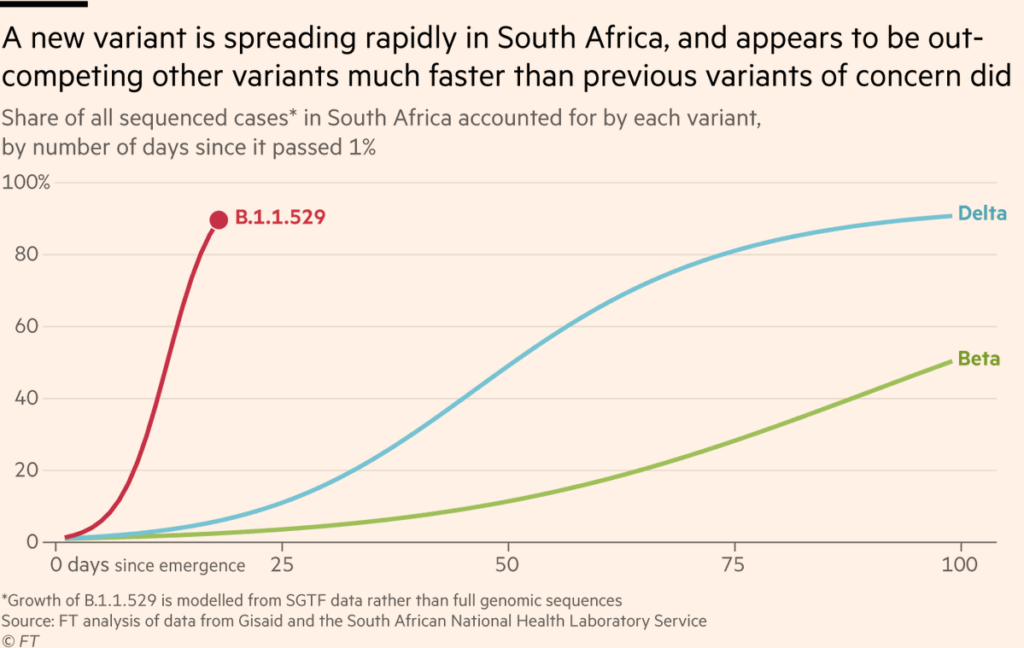

Disease modeling scientist Weiland estimated that B.1.1.529 is 500% more transmissible than the original Wuhan virus. (Delta was 70% more transmissible). John Burn-Murdoch (Chief Data Reporter at Financial Times) also found that B.1.1.529 is much more transmissible than Delta. He plotted the spread below.

Is there any Good News?

The answer is yes.

First, B.1.1.529 can be detected on a PCR test because it has a special signature like Alpha on the PCR directly. For example, when the PCR is positive it lights up two channels instead of three channels, indicating that it’s B.1.1.529. This should be treated positively because it means this virus can be tracked much easier compared to the Delta.

Second, let us not forget about response time, and compare it to the Delta variant that came from India. By the time Delta came to light in India, it was already spreading virally throughout the country before it infected the rest of the world as we know it. B1.1.529 is different. Due to the swift and effective response undertaken by South Africa, a country that has been communicating and trying to contain the outbreak before it escalates. Because of their quickness, we now have very capable researchers working to crack its code before further havoc is wrecked. It must be emphasized this did not happen as quickly as Delta occurred.

Third, many should be glad to hear that due to new biotechnology, mRNA vaccines are very quick and easy to alter. Furthermore, given both Pfizer and Moderna have regulatory approval, once this minor alteration is made only 24 trial participants are needed to ensure the updated vaccine works before mass production can commence.

Conclusion

At the time of writing this, there is still much uncertainty.

The reason why the stock market has sold off is because of this new uncertainty.

For full clarity, our readers must understand the stock market is pricing in ONLY uncertainty with regard to B1.1.529 rather than a full panic sell type situation like we experienced early 2020.

Therefore, if the situation escalates in the sense whereby B.1.1.529 causes a vaccine breakthrough that results in widespread hospitalisation and deaths even for the vaccinated, then lockdowns will occur again globally. This will inevitably impact the economy and stock market.

However, if the above scenario does not occur, the stock market will treat the outcome favourably and a ‘buy the dip’ response is likely.

Disclaimer: Please note that all the information contained in this content is intended for illustration and educational purposes only. It does not constitute any financial advice/recommendation to buy/sell any investment products or services.