U.S. stocks experienced a positive session with gains across sectors like Technology, Consumer Services, and Industrials. The Dow Jones Industrial Average rose by 1.07%, the S&P 500 added 1.67%, and the NASDAQ Composite gained 2.50%, reflecting strong investor sentiment.

Source: Euro News

Tech and Industrials Power Market Gains as Breadth Turns Broadly Positive

On the New York Stock Exchange, rising stocks outnumbered declining ones by a ratio of 2033 to 769, with 39 stocks remaining unchanged. On the Nasdaq Stock Exchange, 2418 stocks rose, 890 declined, and 118 stayed unchanged, showing an overall positive market breadth.

The Technology sector saw significant strength, led by NVIDIA Corporation (NASDAQ: NVDA), which rose 3.86% to $102.71, and Amazon.com Inc (NASDAQ: AMZN), which added 4.28% to $180.60. Both companies were boosted by positive investor sentiment, following strong earnings expectations. In the Consumer Services sector, Boeing Co (NYSE: BA) also had an impressive session, jumping 6.02% to $172.31. Meanwhile, the Industrials sector saw strong overall gains, contributing to the market’s rally.

Source: CNBC

The CBOE Volatility Index (VIX), which measures implied volatility for S&P 500 options, decreased by 7.03% to 28.42, signaling lower market anxiety and a calmer outlook for the near term.

Boeing and Jayud Soar as Tech and Logistics Rally

On the Dow Jones, Boeing Co (NYSE: BA) was the best performer, rising 6.02% to $172.31, followed by Amazon.com Inc (NASDAQ: AMZN), which gained 4.28% to $180.60, and NVIDIA Corporation (NASDAQ: NVDA), which was up 3.86% to $102.71.

In the S&P 500, Amphenol Corporation (NYSE: APH) surged 8.21% to $71.15, Super Micro Computer Inc (NASDAQ: SMCI) rose 7.55% to $32.89, and Palantir Technologies Inc (NASDAQ: PLTR) gained 7.23% to $100.79.

The NASDAQ Composite saw an even more impressive performance, with Jayud Global Logistics Ltd (NASDAQ: JYD) soaring 161.27% to $0.27, Ensysce Biosciences Inc (NASDAQ: ENSC) climbing 96.25% to $3.67, and AGM Group Holdings Inc Class A (NASDAQ: AGMH) gaining 93.33% to $0.06.

Source: WSJ

Energy and Healthcare Stocks Lead Declines Across Major Indices

On the downside, Johnson & Johnson (NYSE: JNJ) was the worst performer on the Dow Jones, falling 1.50% to $155.38, followed by Procter & Gamble Company (NYSE: PG), which declined 1.28% to $165.73, and Verizon Communications Inc (NYSE: VZ), which lost 1.18% to $42.68.

In the S&P 500, Enphase Energy Inc (NASDAQ: ENPH) saw a significant drop of 15.61%, closing at $45.09, while Otis Worldwide Corp (NYSE: OTIS) lost 6.76% to $92.26 and Baker Hughes Co (NASDAQ: BKR) dropped 6.47% to $35.88.

The NASDAQ Composite saw sharp declines from Ocean Biomedical Inc (NASDAQ: OCEA), which fell 46.75% to $0.02, Charles & Colvard Ltd (NASDAQ: CTHR), which lost 35.24% to $0.53, and eLong Power Holding Ltd (NASDAQ: ELPW), which dropped 30.76% to $2.69.

Source: Yahoo Finance

Gold and Oil Fall as Dollar Strengthens

Gold Futures for June delivery gained 1.45%, or 45.75 points, to close at $3,191.75 per troy ounce. Crude oil for delivery in May rose 0.27%, or 0.19 points, to hit $71.39 per barrel, while the June Brent oil contract increased by 0.03%, or 0.02 points, to trade at $74.51 per barrel.

Source: Financial Times

International Issues

IMF Sounds Alarm: Global Debt Could Hit 117% of GDP by 2027

The IMF has warned that higher tariffs and escalating geopolitical tensions could drive global government debt to unprecedented levels, potentially surpassing 95% of global GDP this year and reaching near 117% by 2027. The U.S. and China are expected to be the primary contributors to this debt increase, with U.S. debt projected to rise to 128.2% of GDP by 2030. The IMF cautioned against providing excessive support to businesses affected by tariffs, advising governments to focus on targeted, temporary fiscal aid rather than long-term financial assistance. The IMF also emphasized the need for prudent fiscal policies to reduce debt and restore fiscal stability, especially amid rising global borrowing costs driven by bond market volatility. The rising debt could have broader implications for poorer countries, increasing their borrowing costs as well.

Source: Financial Times

Chipotle Misses Mark as Consumer Spending Weakens

Chipotle’s slower earnings growth and declining sales in the first quarter of 2025 could signal broader economic challenges, potentially pointing to an impending recession. The company’s revenue growth of 6.4% missed expectations, while same-store sales dropped by 0.4%, indicating weaker consumer spending and reduced restaurant visits. These results come amid growing concerns over inflation and a slowdown in consumer confidence, which are affecting even fast-growing companies like Chipotle. The drop in transaction volume and the slowdown in earnings growth, compared to the previous year’s robust performance, suggest that consumers may be cutting back on discretionary spending as recession fears mount. The pressure on the restaurant sector, combined with broader economic uncertainties, raises alarms that we may be entering a period of economic contraction.

Source: Yahoo Finance

Market Risk

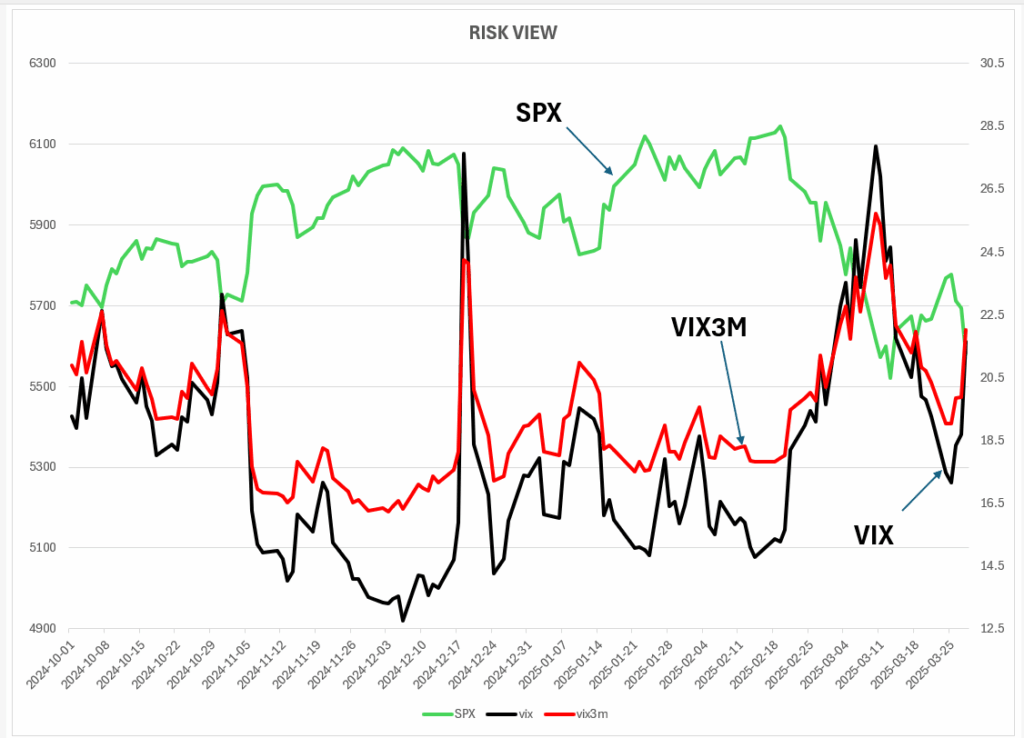

The interaction between the VIX and VIX3M shows that the equity market is still in high uncertainty region.

For more information: https://youtu.be/xMBph5aACUY

CONCLUSION

- U.S. stock market saw positive movement, driven by gains in the Technology, Consumer Services, and Industrials sectors.

- Concerns about an economic slowdown remain, despite short-term gains.

- IMF warns of rising global government debt, potentially exceeding 95% of global GDP in 2025, fueled by tariffs and geopolitical tensions.

- Chipotle’s underwhelming Q1 results reflect declining consumer spending and growing inflationary pressures.

- Signs of strain in the restaurant sector hint at broader economic weakness.

- Investors are advised to stay cautious amid increasing market volatility and global economic uncertainties.

Please note that all information in this newsletter is for illustration and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any investment products or services.

About the Author

Rein Chua is the co-founder and Head of Training at AlgoMerchant. He has over 15 years of experience in cross-asset trading, portfolio management, and entrepreneurship. Major media outlets like Business Times, Yahoo News, and TechInAsia have featured him. Rein has spoken at financial institutions such as SGX, IDX, and ShareInvestor, sharing insights on the future of investing influenced by Artificial Intelligence and finance. He also founded the InvestPro Channel to educate traders and investors.

Rein Chua

Quant Trader, Investor, Financial Analyst, Vlogger, & Writer.