Everything is expensive now, from food to clothes, medicine to cars, everything has been hit by the sky-rocketing inflation!

The search for safe havens from the worst inflation in four decades appears to be much more difficult, especially for individual investors whose investment options are confined to the standard asset classes.

So what to do now?

The adversity of finding the best investments leaving investors feeling vulnerable, and many are trying to protect themselves by hedging against inflation.

Most investors are turning towards classic inflation hedges like gold, real estate, commodities, and Treasury inflation-protected securities (TIPS), while others are looking for less conventional alternatives, like cryptocurrencies.

But, what are the best inflation hedges to defend our portfolios? What exactly works in the recent environment, and what doesn’t?

Well, there is no one-size-fits-all answer to this question because they will occasionally come through for you by launching a magnificent show of inflation-busting missiles, while other times, they’ll fall flat on their faces.

So, what to do? Which one to choose? Let’s find out.

Gold: The Classic Inflation Hedge

Whenever a crisis has struck for centuries, gold has proven to be a time-tested friend of investors. It has proven to be a lifesaver for many who have suffered significant losses in other assets and earned a reputation as a great inflation hedge!

So, do we already have a winner? The best hedge against inflation?

Sadly not!

Though considered a classic inflation hedge, gold isn’t necessarily going up. In fact, it’s been at the same level for the last couple of years when inflation is hitting record highs.

Even though the price of gold is 50 times higher than it was in 1971, stocks have performed even better.

|

The S&P 500 has returned an annualized 11.2% since August 1971, compared to 8.2% for gold. |

Furthermore, the correlation of gold to the stock market has been positive at times, which is just the opposite of what it should be to reduce the portfolio’s risk.

One such instance occurred during the waterfall decline during the Covid era, when gold-mining stocks fell by 39%, even more than the 34% drop in the S&P 500.

Crude Oil: The Volatile Hedge

Crude oil long ago lost its investment allure. Since its 1980 peak, oil has not only lagged behind other assets, but it also hasn’t protected well against stock market declines.

Crude oil plummeted during the 2000-2002 market downturn, lost two-thirds of its value during the 2008 global financial crisis, and briefly turned negative amidst the Covid pandemic.

Recently, though, oil prices have surged to almost an all-time high amid geopolitical concerns, and everyone appears to be flocking to oil as an appealing inflation hedge or even a long-term investment!

But how could “the great underperformance” of the last 14 years be justified? Crude had been trading sideways since 2008, with a massive drawdown during the 2020 pandemic. However, the rebound since the Covid lows has been nothing short of spectacular, with Crude knocking on the door of the 2008 highs.

Such crude oil price fluctuations are like bond-like returns while also having crypto-like volatility, making it the worst-of-both-worlds situation!

TIPS: The Natural Hedge

Treasury inflation-protected securities (TIPS), a type of U.S. Treasury bond, are considered a natural inflation hedge because they were designed primarily to protect investors from inflation by the U.S. Government.

And as they’re backed by the full faith and credit of the U.S. Government, TIPS has become a go-to inflation trade for all.

However, there are a few risks/disadvantages that are important for investors to keep in mind:

- TIPS usually perform poorly when deflation strikes or there is low inflation. That’s because deflation or low inflation drags down its par value, resulting in lower interest payments.

- TIPS are illiquid instruments with little trading volume, making them difficult to sell without incurring slippages. And if interest rates fall when you wish to redeem, you may lose even more.

- Furthermore, TIPS have underperformed almost every major asset class out there. They have barely gained more than 2% in value over the last ten years, so they have certainly not tracked inflation which has increased more than double digits since the Covid pandemic in 2020.

Cryptocurrencies: An emerging inflation hedge?

Theoretically, it should be a great hedge against inflation because:

- It has a limited supply, making it a scarce asset.

- It is fungible, meaning, these coins can be exchanged for another without any loss in value.

- It is also easily accessible, enjoys widespread acceptance and has proven appreciation as well.

Great! What’s the problem then?

Well, cryptos do not generate any real cash flows, and according to Warren Buffett, the best way to value anything is to examine the cash flows it produces.

If you can’t value something, it’s inherently speculative! -Warren Buffett |

Additionally, the debate about whether or not cryptocurrencies are legit inflation hedges comes down to limited evidence of less than 15 years.

Finally, cryptocurrencies are facing numerous regulations from lawmakers across the world. And its prices are often at the mercy of these institutions and governments. Any strict regulations against them can hinder the adoption of the asset, resulting in deprecating prices.

So, where does that leave us, more disillusioned than ever…?

Throughout history, there have been bouts of high and low inflation, each accompanied by factors that were unique to the period.

And the ‘inflation hedge’ has never been this simple or straightforward!

Then, what is the best way to hedge when inflation takes off?

Well, to position your portfolio correctly and even build wealth in such challenging environments, legendary investor Warren Buffett has some golden nuggets about protecting against inflation as he has been successfully dealing with it for a very long time now.

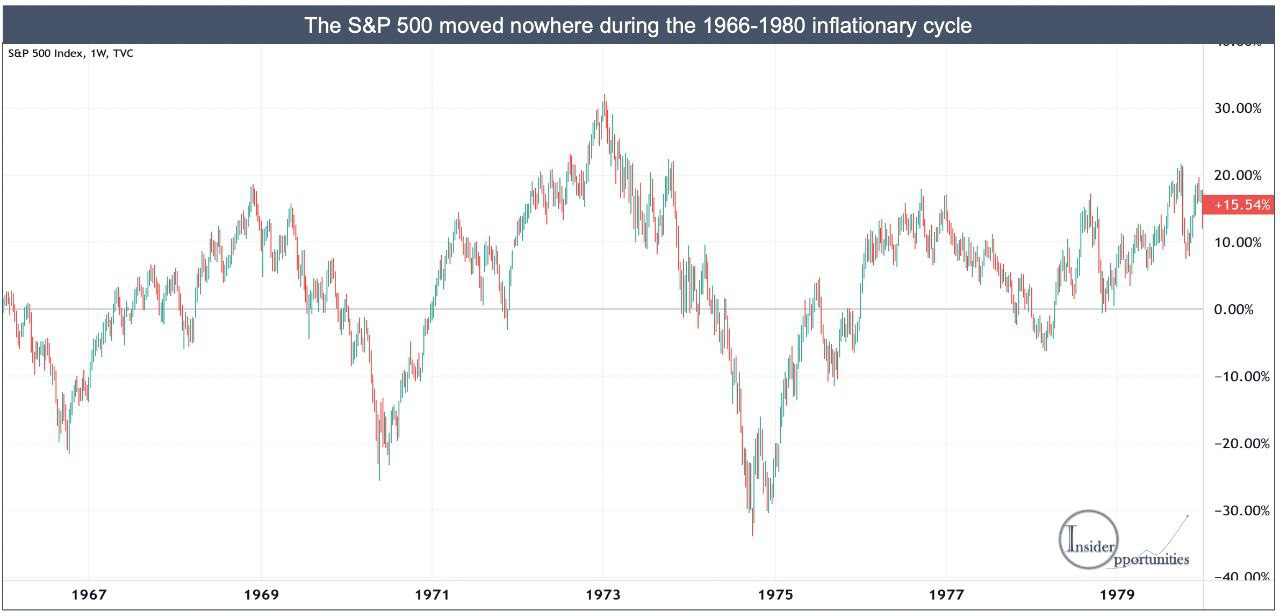

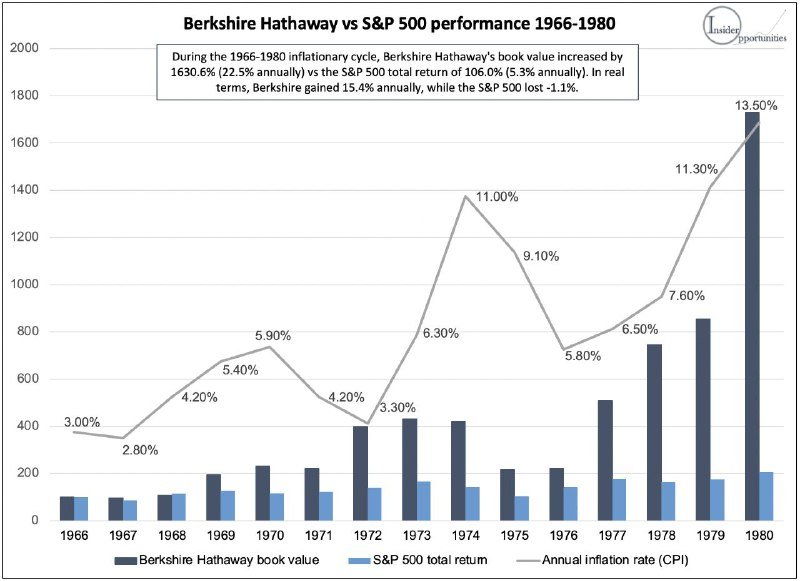

For reference, throughout the 15 years of economic turmoil from 1966 to 1980, the S&P 500 gained just about 20%, and the total inflation-adjusted returns were -1.1% annually.

Despite the economic downturn, Berkshire Hathaway’s book value climbed by 1631% from 1966 to 1980. (22.6% annually). Even after accounting for inflation, the investment conglomerate achieved an annual return of 15.4%.

Now, let's discuss the golden nuggets Warren Buffett has said about

protecting against inflation:

Even though the price of gold is 50 times higher than it was in 1971, stocks have performed even better.

“Inflation is a particularly ironic punishment for bad businesses” – Warren Buffett |

1. 2015 shareholders’ letter:

|

“The best businesses during inflation are those that you acquire once and then don’t have to make capital investments again,” while “any business that requires a lot of capital investment” should be avoided. |

He recommends real estate as a good investment during inflation since you can buy it once and profit from the increase in value; nevertheless, he advises against utilities and railroads as good investments during inflation.

2. 2009 shareholders’ letter:

|

“The best way to protect yourself from inflation is to invest in yourself and your skills: If you’re the best teacher, surgeon, or lawyer, you’ll get your part of the economic pie regardless of whatever the inflation is. |

“The second best protection is to buy good businesses,” he says, referring to companies whose products are in high demand even if the company has to hike prices.

3. 1981 shareholders’ letter:

Buffett may have spelt out as clearly as ever when he wrote:

Companies that tend to withstand an inflationary environment must have two characteristics:

- The ability to increase prices without fear of significant loss of market share and,

- The ability to expand with only minor additional capital investment.

Finally, Warren Buffet concluded the letter by stating that operating with a low debt-to-equity ratio and investing solely in low-leverage businesses can help mitigate the effects of soaring inflation.

FINAL WORDS

- Inflation is at 40-year record highs, and policymakers, including Fed Chairman Powell, are increasingly warning about rising prices.

- It’s still difficult to tell if the current inflation spike is likely to persist or if it will start to fade.

- Whatever the case may be, rather than attempting to hedge against inflation just to follow the current trend, individual investors can consider Buffett’s advice to:

- Invest in high-quality businesses with low capital needs.

- Look for companies that can raise prices during periods of higher inflation without the significant loss of market share.

- And stay away from companies with high leverage.

Please note that all the information contained in this newsletter is intended for illustration and educational purposes only. It does not constitute any financial advice/recommendation to buy/sell any investment products or services.