The stock market experienced a mixed performance following fresh inflation data that showed consumer prices rising to 3%, dashing hopes for near-term interest rate cuts. The Dow Jones Industrial Average suffered a notable decline, shedding 225 points, or 0.5%, while the S&P 500 also dropped by 0.3%. On the other hand, the Nasdaq managed to eke out a small gain, marking its highest intraday comeback since November, a sign of resilience in the tech-heavy index. Despite the overall negativity, the Nasdaq’s positive movement indicated that some segments of the market, particularly technology, continued to show strength. The small-cap Russell 2000 Index, however, followed the broader trend and posted a decline, reflecting the general weakness across U.S. equities.

Source: AP News

The market’s cautious sentiment was largely driven by a high inflation report, which stirred up concerns that the Federal Reserve may keep interest rates elevated for an extended period. This, combined with rising bond yields, led to a selloff in several sectors. Inflation fears fueled investor uncertainty, and the expectation that the Fed may remain on hold for some time added to the volatility in the broader market.

U.S. Inflation Surges in January, Dashing Hopes for Fed Rate Cuts

The Labor Department reported that consumer prices rose by 0.5% in January from December on a seasonally adjusted basis, the largest monthly increase since August 2023. This pushed the annual inflation rate to 3%, well above economists’ expectations. Core inflation, which excludes volatile food and energy prices, rose by 0.4% month-over-month and 3.3% year-over-year, the largest increase in nearly two years. Key drivers of the inflation surge included higher prices for used cars, auto insurance, and eggs, the latter of which saw a 15% monthly increase due to a bird flu outbreak.

The inflation data dashed hopes for near-term Federal Reserve interest rate cuts. Fed Chair Jerome Powell, in a congressional hearing on February 12, emphasized that the central bank is not in a hurry to reduce rates, stating, “We are close, but not there on inflation…. So we want to keep policy restrictive for now.” Powell reiterated that the Fed’s current policy stance is appropriate given the economy’s resilience and the need to ensure inflation moves decisively toward the 2% target. The Fed had cut rates three times between September and December 2024 by a full percentage point but has since adopted a wait-and-see approach.

Source: Forbes

Economists, including Matthew Luzzetti of Deutsche Bank, noted that the January inflation report was particularly discouraging, as it showed broad-based price pressures across goods and services. Luzzetti does not expect the Fed to cut rates in 2025, especially with the potential for additional inflationary pressures from President Trump’s recent 10% tariffs on Chinese imports. These tariffs, if sustained, could boost consumer prices by March or April, similar to the rapid passthrough seen with washing machine tariffs in 2018.

Oil Prices Drop 2% as U.S. Crude Stockpiles Surge and Geopolitical Talks Begin

In the commodity markets, oil prices experienced a pullback after a three-session rally. The retreat was triggered by a significant build in U.S. crude inventories, which rose by 4.1 million barrels according to the Energy Information Administration (EIA). This unexpected increase in stockpiles, combined with the first drawdown in gasoline stocks in three months, led to a decrease in crude oil prices. U.S. crude, or West Texas Intermediate (WTI), settled down 2.7% at 71.37 per barrel, while Brent crude fell by 2.4% to to $75.19 per barrel.

Source: The Economic Times

The oil market also found itself reacting to geopolitical developments, with President Trump and Russian President Vladimir Putin agreeing to start negotiations aimed at ending the Russia-Ukraine war. This development added further complexity to the oil market’s outlook. Despite the negative movement in oil prices, OPEC held steady with its forecast, maintaining its 2025 oil demand growth estimate at 1.45 million barrels per day.

Corporate Bankruptcies Hit Highest Level Since 2020

Another significant development in the U.S. economy was the increase in corporate bankruptcy filings. According to S&P Global Market Intelligence, January saw 70 bankruptcy filings, a sharp rise that matched the levels seen in June 2024. This marked the highest total since the pandemic in 2020, reflecting the strain many companies continue to face. The majority of the bankruptcies were concentrated in the industrials and consumer discretionary sectors, following a trend from December 2024.

Together, these two sectors accounted for 28% of all bankruptcy filings in January. This rise in bankruptcies underscores the financial challenges that many companies, particularly in these sectors, are grappling with. Compared to the pandemic-induced economic downturn of 2020, the current wave of bankruptcies highlights a persistent vulnerability within certain industries.

Inflation Concerns Rise as Consumer Confidence Wavers

The inflation surge has become a significant economic and political issue, with many Americans expressing frustration over higher prices. President Trump, who campaigned on lowering prices, has implemented policies such as import tariffs and deregulation, which some economists argue could exacerbate inflation. However, his administration has also emphasized boosting energy production and other measures to offset price pressures.

Source: WSJ

Consumer confidence, which surged after the November election, has shown signs of weakening in February, according to a small-business survey by Vistage Worldwide. This decline in confidence reflects concerns over Trump’s rapid-fire tariff threats, deportation raids, and executive orders. Despite these challenges, the labor market remains stable, with unemployment ticking down to 4.0% in January 2025, providing some support to the economy.

WATCHOUT

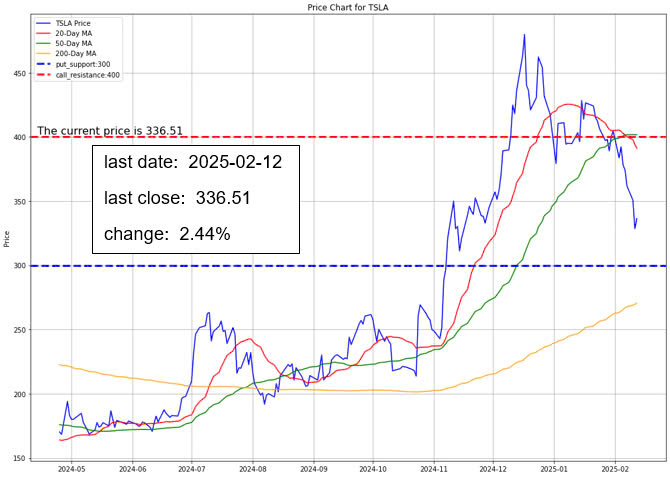

Tesla Stock Slumps 32% Amid Musk Distractions and Competitive Pressures

Tesla stock has recently faced significant declines, dropping about 23% since January and 32% from its mid-December peak. Various factors contribute to the slide, including Elon Musk’s distractions with the Department of Government Efficiency, his $97 billion bid for OpenAI, and concerns over competitive pressures from China’s BYD, which is introducing driver assistance technology.

Additionally, Tesla’s disappointing fourth-quarter earnings and revised first-quarter estimates, along with fears that potential large stock sales by Musk could depress share prices, have weighed on investor sentiment. While some analysts remain optimistic about Tesla’s future growth in electric vehicles, robotics, and self-driving technology, the stock has shown significant volatility, and analysts are closely watching support levels around $315 per share. Investors are hoping that the release of new models or a quieter period for Musk could provide a catalyst for recovery.

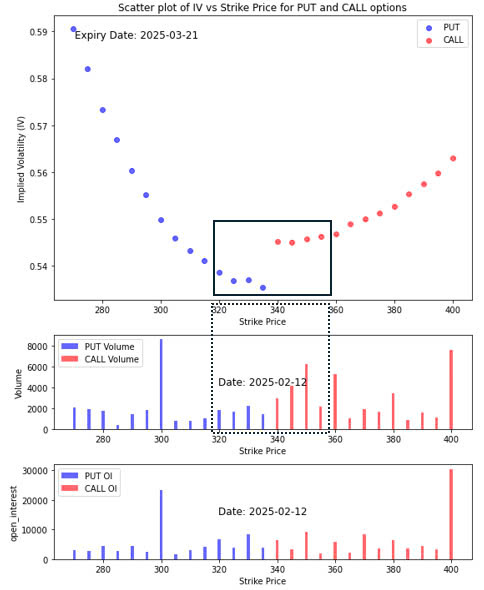

Option Smile Chart for TSLA

- Our in-house system assigns a bullish index score of 0.659 on a scale where 0 represents completely bearish and 1 represents completely bullish.

- The implied volatility near the current stock price (ATM) of the put options are generally lower than that of the call options. That signifies the traders’ sentiments toward a rise in the stock price to be more than the anticipation that the price will fall.

- The volume near the current stock price (ATM) of the put options are generally lower than that of the call options. That shows the traders are placing more bets for the stock price to rise than for it to fall. However it pays to note that the traders are buying considerable put protection at the strike price 300.

- From the open interest chart, we observe that there is a major support level at 300 and a major support level at 400.

Super Micro Hit by Filing Delays and Regulatory Scrutiny

Super Micro Computer Inc. (SMCI) saw its stock rise 4.6% after issuing a business update, with investors focusing on the company’s optimistic long-term revenue outlook. Despite adjusted earnings and revenue for the second fiscal quarter falling below analysts’ expectations, the company projected $40 billion in revenue for fiscal 2026, well above the consensus.

However, the update raised concerns, including the company’s ongoing struggle to meet a crucial filing deadline for its annual report and first-quarter earnings, which must be submitted by February 25 to avoid delisting from Nasdaq. The company has faced challenges, including the resignation of its former auditor, Ernst & Young, in October due to financial reporting concerns, although no fraud was found in its internal investigation. Additionally, Super Micro revealed receiving subpoenas from the Justice Department and SEC regarding allegations made in a short-seller report from August 2024, raising further questions about its operations.

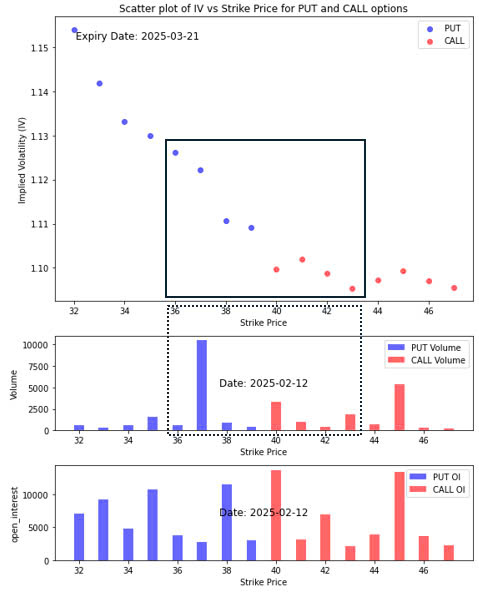

Option Smile Chart for SMCI

- Our in-house system assigns a bullish index score of 0.493 on a scale where 0 represents completely bearish and 1 represents completely bullish.

- The implied volatility near the current stock price (ATM) of the put options are generally higher than that of the call options. That signifies the traders’ sentiments toward a rise in the stock price to be less than the anticipation that the price will fall.

- The volume near the current stock price (ATM) of the put options are considerably higher than that of the call options. That shows the traders are placing more bets for the stock price to fall than for it to rise. Furthermore it pays to note that the traders are buying considerable put protection at the strike price 37.

- From the open interest chart, we observe that there are major put support levels at 35 and 38. The major call resistance level are at 40 and 45. The resistance at 40 may act as the barrier that discourages traders from adopting a more bullish perspective.

Investment Opportunity & Risk

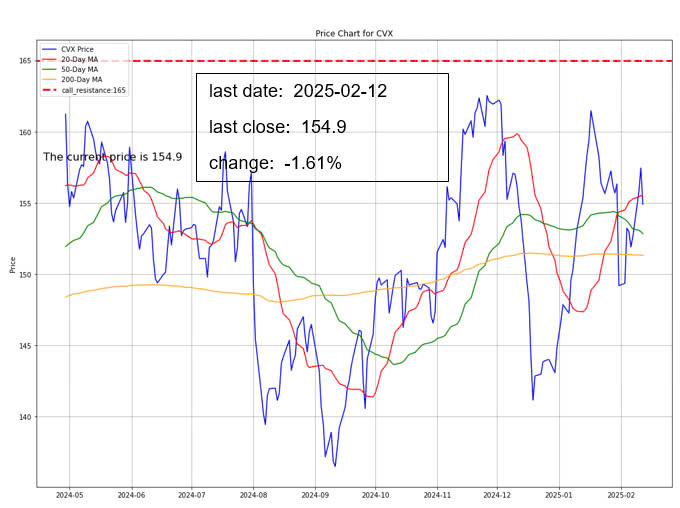

Chevron (NYSE: CVX)

Chevron has announced plans to lay off 15% to 20% of its workforce, roughly 6,000 to 8,000 employees, as part of a broader cost-cutting initiative aimed at improving efficiency and boosting cash generation. This move is part of the company’s strategy to streamline its operations, focusing on high-growth areas like the Permian Basin and offshore projects in the Gulf of America.

Despite the layoffs, Chevron has increased shareholder returns through higher dividends and $30 billion in share buybacks over the past two years. The oil industry has seen significant advancements in technology and operational efficiency, allowing for increased oil production with fewer workers. This trend of reducing headcount is not unique to Chevron, as other oil companies like Exxon Mobil are also cutting costs and adopting new technologies, including AI, to further improve their operations.

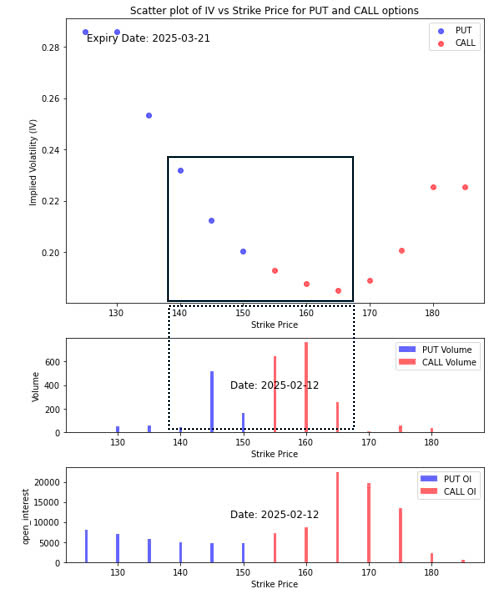

Option Smile Chart for CVX

- Our in-house system assigns a bullish index score of 0.773 on a scale where 0 represents completely bearish and 1 represents completely bullish.

- The implied volatility near the current stock price (ATM) of the put options are generally higher than that of the call options. That signifies the traders’ fear toward a drop in the stock price to exceed their greed for the rise in the stock price.

- The volume near the current stock price (ATM) of the put options are generally much lower than that of the call options. That shows the traders are placing far more bets for the stock price to rise than for it to fall. However it pays to note that the traders are buying considerable put protection at the strike price 145.

- From the open interest chart, we observe that there is no major support level and a major support levels at 165.

CONCLUSION

- Traditional indices declined, while tech stocks showed modest recovery.

- Inflation data and rising bond yields weighed heavily on the market.

- Oil prices fluctuated due to inventory reports and geopolitical factors.

- Corporate bankruptcies are rising, highlighting economic pressures.

- The Federal Reserve maintains a cautious stance on rate cuts.

- Persistent inflation and political uncertainties may prolong market volatility.

Please note that all information in this newsletter is for illustration and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any investment products or services.

About the Author

Rein Chua is the co-founder and Head of Training at AlgoMerchant. He has over 15 years of experience in cross-asset trading, portfolio management, and entrepreneurship. Major media outlets like Business Times, Yahoo News, and TechInAsia have featured him. Rein has spoken at financial institutions such as SGX, IDX, and ShareInvestor, sharing insights on the future of investing influenced by Artificial Intelligence and finance. He also founded the InvestPro Channel to educate traders and investors.

Rein Chua

Quant Trader, Investor, Financial Analyst, Vlogger, & Writer.