Introduction

There remain many skeptics on green or climate change related investments. Some of these concerns relate to whether green investing is sustainable, or perhaps just a fad.

Others relate to fears surrounding this area being very new and young, and therefore is likely to be very volatile and uncertain, which is typical of investments in infancy areas.

Therefore in this article we plan to share existing facts and data, in chart format, why it supports the view that investments in green energy are gaining traction and momentum.

In total, we will share 5 charts with you herein, courtesy of Bloomberg!

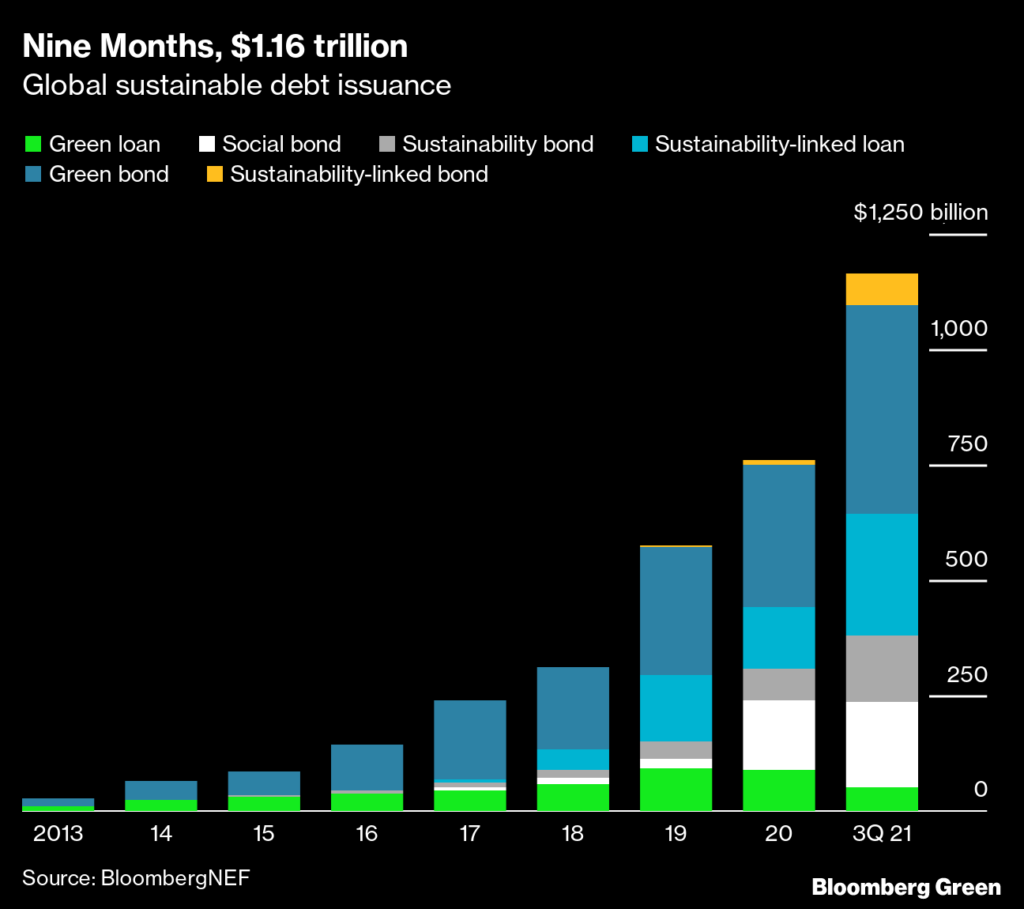

Sustainable Environmental Debt Trend

By the third quarter of 2021, the total amount of global sustainable debt issuance amounted to $1.16 trillion.

Sustainable debt products are essentially loans and bond related products that are designed to provide positive environmental investment or to further social objectives and governance for companies.

Bearing in mind, sustainable debt only started as an instrument in 2013, it took only a short 8 years period to reach a trillion dollar valuation!

What is interesting is the trend of the product mix, which shows green bonds being the highest in composition, but yet green loans are declining. To achieve ‘Green’ status, companies must be able to justify that they are procuring green equipment for green projects. This means that, in general, private bond investments by individuals and institutions are gaining more traction compared to banks approving green related loans for green projects.

This may suggest a higher risk appetite by non-bank related entities towards green financing compared to banks.

On the other hand, Sustainability-Linked Loans do not restrict use of proceeds; instead, borrowers commit to sustainability performance targets, and are awarded a reduction in the loan interest rate if their sustainability targets are met.

Sustainably linked products are also gaining more market share of the entire debt issuance market, which therefore implies market acceptance that the world is first transiting towards creating environmentally sustainable practices, before being able to fully transit towards net carbon neutral or negative.

Trade idea #1

The world will likely see a higher growth rate in Sustainability linked investment products compared to full Green investment products, at least in the short to medium term.

This implies that investors and traders should focus on Sustainability linked efforts or projects by companies in the immediate future that are expected to gain higher momentum.

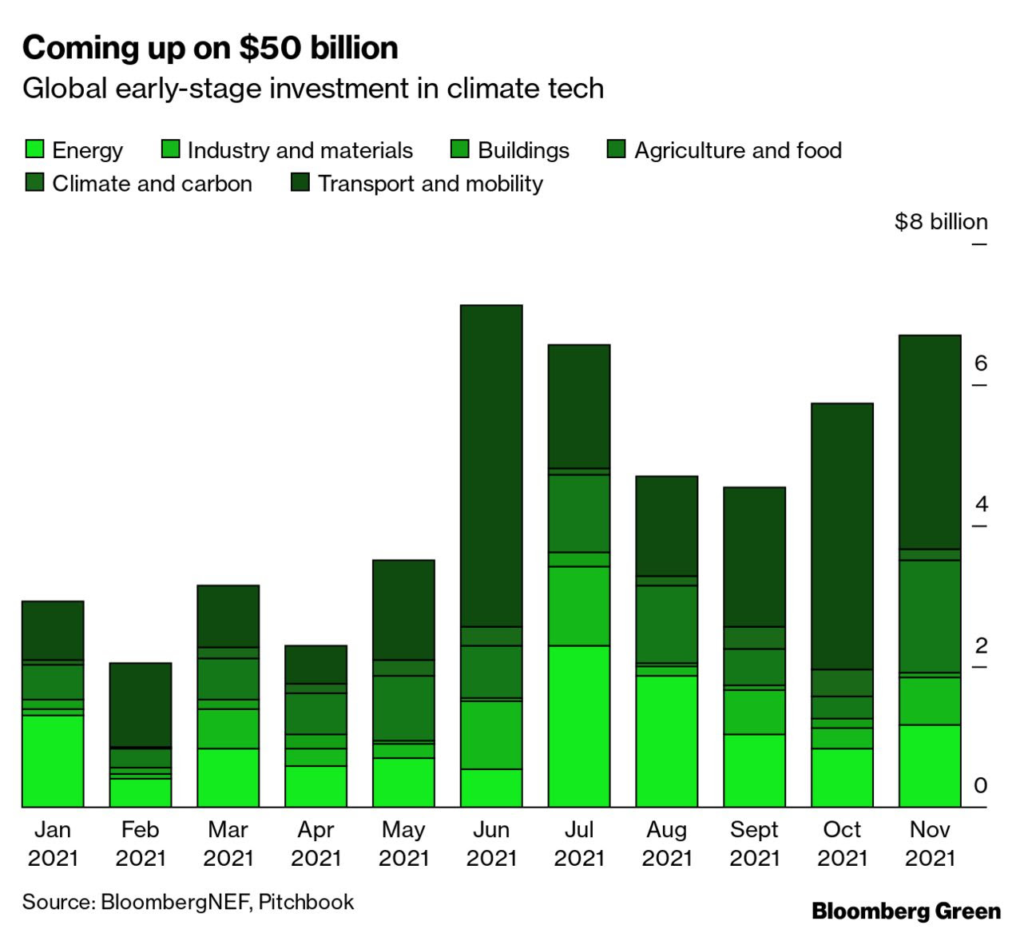

Early Stage Climate Tech Investment

There is much risk appetite shown towards early stage investment in climate tech companies.

10 years ago, climate focused companies were only able to raise a few billion dollars across asset classes, deal stages and technologies. Today, climate tech companies are raising that much in a month at every stage from pre-seed to pre IPO rounds. By November 2021, climate tech companies have raised almost $50 billion for early stage activities!

In the context of product mix for early stage climate tech investment, there is a clear trend since June 2021 towards the transport and mobility segment, in favour of the energy segment which was the main winner in 2020.

Trade idea #2

Since 70% of the world’s hydrocarbon is used for transport related activities, it appears that investments are going towards green transportation tech companies.

Investments in Electric Vehicles are likely to remain strong in 2022 going forward.

Trends in Renewable Energy Investments

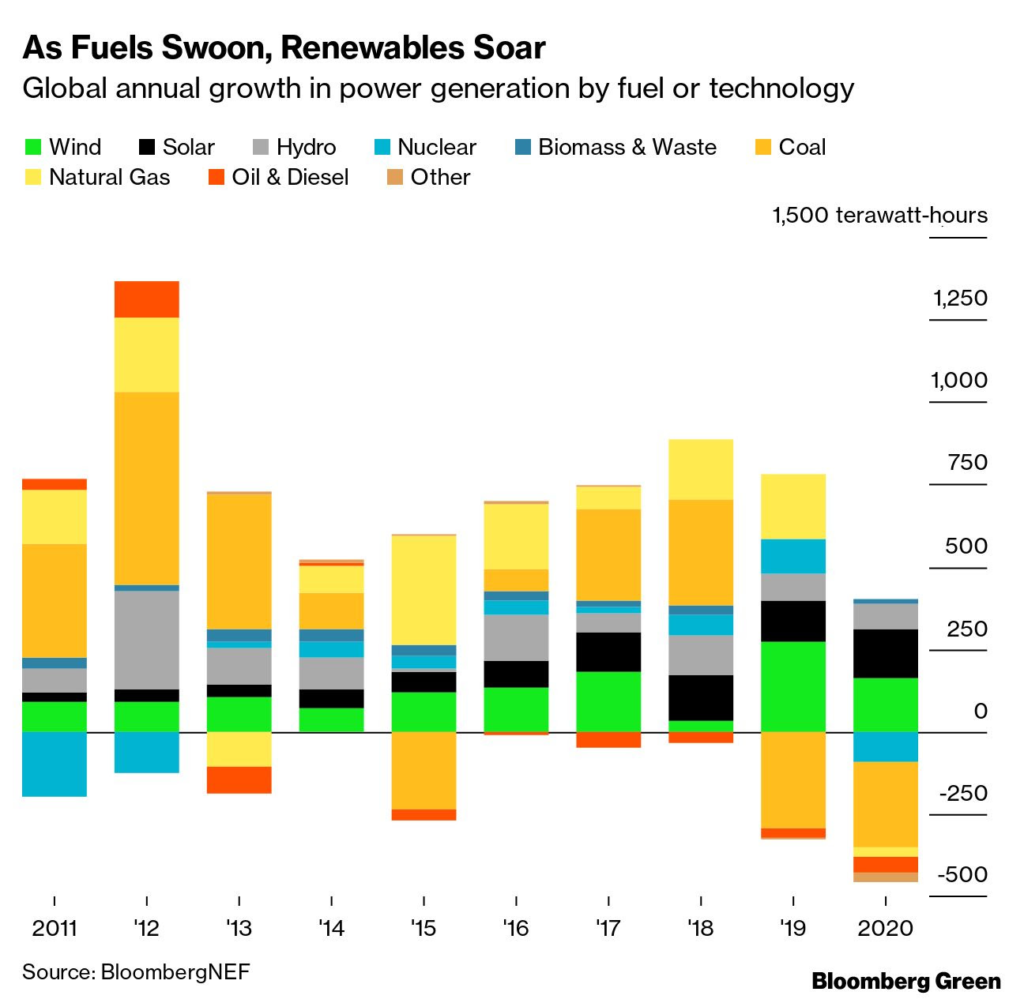

The chart above shows the global annual growth rate in power generation by technology or fuel source.

Wind power generation has a 16.6% CAGR in the past 10 years. Correspondingly solar power has a 38.8% rate. That means that generation from each technology doubles in less than five years and less than two years, respectively.

If wind generation were to grow at its current 10-year rate for just one more year, it would become the single biggest source of new power generation since 2010.

If solar were to grow in the same fashion, it would be the biggest contributor to power generation growth by 2023.

Trade idea #3

In terms of renewable power generation investments, look into solar and wind which will likely continue to gain more traction going into the future.

Nuclear investment may likely be volatile.

Nuclear appears to be losing ground

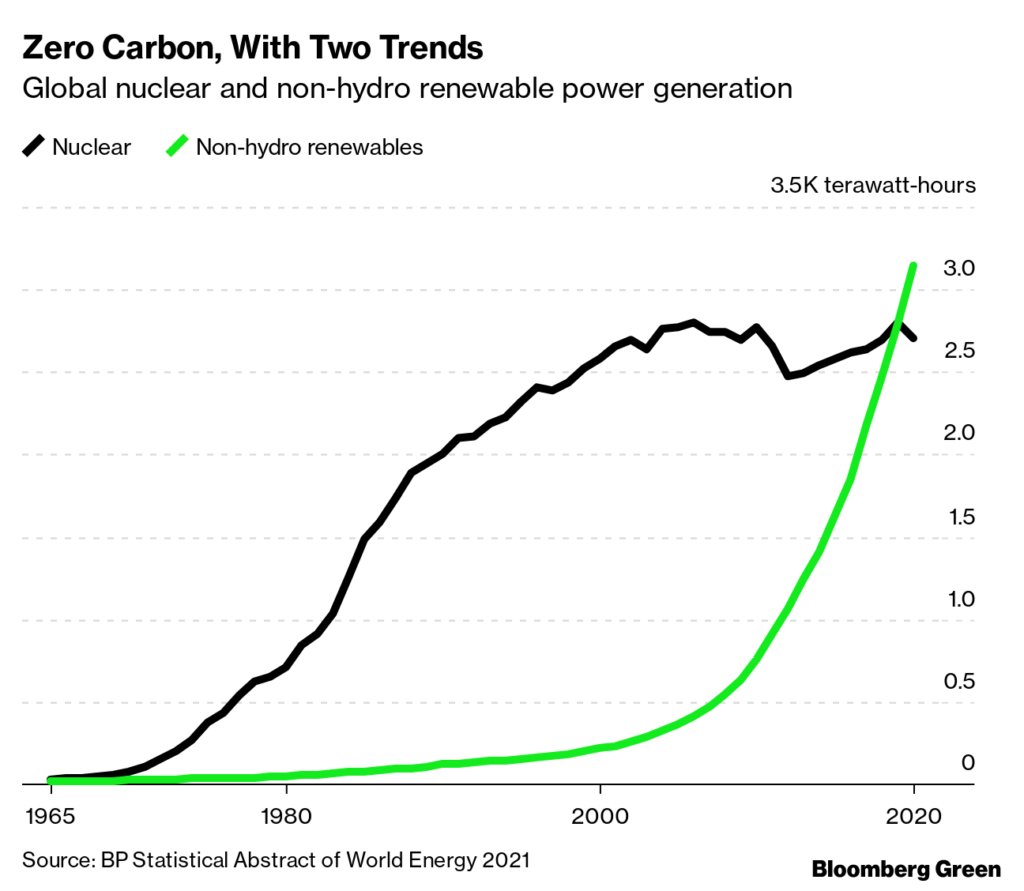

Just to provide some context, in 1965, 24 terawatt-hours a year was produced by nuclear power, compared to geothermal, solar, wind and biomass power production which amounted to 15 terawatt-hours per year.

This gap continued to widen for the next 40 years, however, starting in 2000, nuclear generation started to stabilise while other renewable sources started to exponentially increase, thereby closing the gap.

In fact, renewable power generation started to exceed nuclear power generation in 2020.

Investment Trends in Electric Vehicles

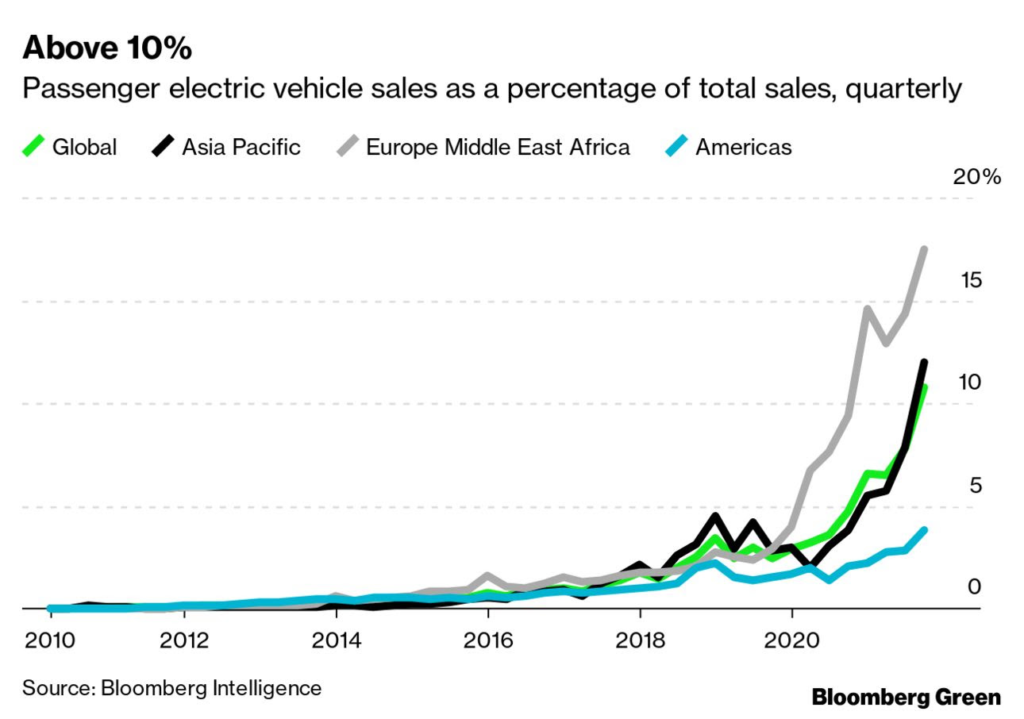

First and foremost, global vehicle sales are now 10% composed of Electric Vehicles, and 90% internal combustible engines (hydrocarbons).

This implies that investments in electric vehicles are still in the early innings.

Trade idea #4

Most importantly, if investors are interested in finding the best investment opportunities in Electric Vehicles, look no further than Asia Pacific and in particular China.

China’s electric vehicle sales growth in particular is extraordinary. The world’s largest car market is now nearly 20% EV sales on a monthly basis. To put its sales in perspective: U.S. buyers have picked up 2.2 million EVs to date. China’s vehicle buyers have bought more than that many EVs from February through October of this year.