In this month’s meeting, the Federal Reserve suspended tightening after 10 consecutive hikes.

Rather than a pause, the FOMC announced that this was a ‘skip,’ and expected to raise rates again in their July meeting, and once further during 2023.

This action was designed to give the economy time to catch its breath, allow the Fed to track fresh data and gain further intelligence on the impact of monetary lags, even as core inflation remained sticky.

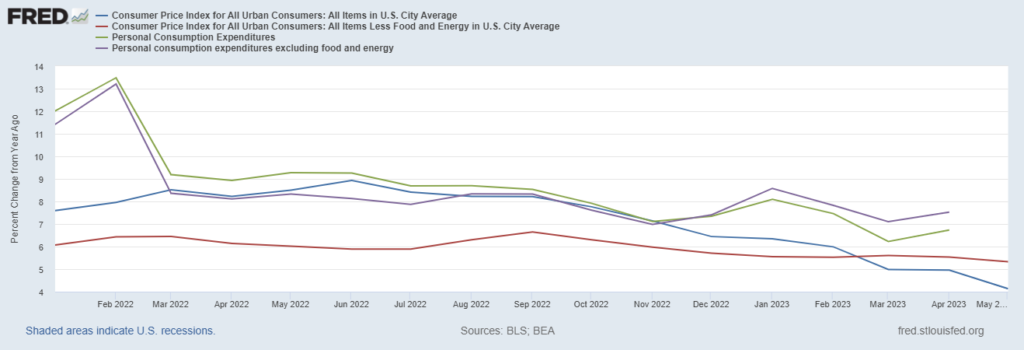

Encouragingly, headline inflation has reduced drastically since the CPI hit a high of 9.1% in June 2022, with the May report marking the lowest annualized rate since March 2021.

Crucially, Fed rates are now positive compared to inflation.

In another major development in recent weeks, lawmakers reached a deal on the debt ceiling, which should allow financial markets to breathe easy for the next two years or so.

The agreement also allowed the US to avert a recession and bring the economy back on track for a soft landing.

TL;DR

- The Federal Reserve’s FOMC chose to ‘skip’ a rate hike in its June 2023 meeting after 10 consecutive increases.

- Jerome Powell expects to raise rates in July and again this year to reach a target of 5.50%-5.75%.

- The skip allows the Fed to collect more data, while the economy has time to digest the effect of monetary lags.

- Inflation has dropped significantly from its 2022 highs but remains above the 2% target, while core CPI is sticky.

- Resolving the debt-ceiling crisis played an important role in side-stepping an immediate recessionary crisis.

- Payroll growth has continued to be very robust while unemployment shifted higher and wage growth moderated.

- The strength of the labour market as well as the stability of the financial sector are important drivers contributing to the Fed’s hawkish stance.

- Although growth projections have improved significantly, consumer purchases are expected to slow which may moderate growth prospects in 2024.

- Given the strength of the labour market, a recession is unlikely to occur this year, and if it does, it will likely be a mild one.

- In its Summary of Economic Projections, the FOMC revised GDP growth and core PCE upward for 2023, while bringing unemployment lower.

- The dollar is likely to stay firm for the coming months, but will likely depreciate against other currencies once the Federal Reserve begins cutting rates.

MONETARY POLICY

Since March 2022, the Fed has hiked rates from 0% – 0.25% to 5% – 5.25% which has included six super-sized actions including four consecutive 75 bps increases.

This was in response to runaway inflation that worsened amid the global health crisis coupled with supply chain disruptions and prolonged easy money policies.

In its June meeting, the FOMC announced a ‘skip’, i.e., suspended rate hikes until the next meeting, with the intention of raising again in July and then once more later this year.

The committee’s key concern was that core inflation persists at high levels prompting Jerome Powell to say that he would,

“…continue to tighten monetary policy expeditiously”.

Source: FRED Database

The market is largely convinced of Powell’s intentions with FedWatch data, showing a 72% chance of target rate probabilities increasing to 5.25 – 5.50% in the July meeting.

As the meeting approaches and more data becomes available, we may see the probability of a 5.25 – 5.5% target rate hike increasing, especially if there are no bearish economic data surprises.

INFLATION

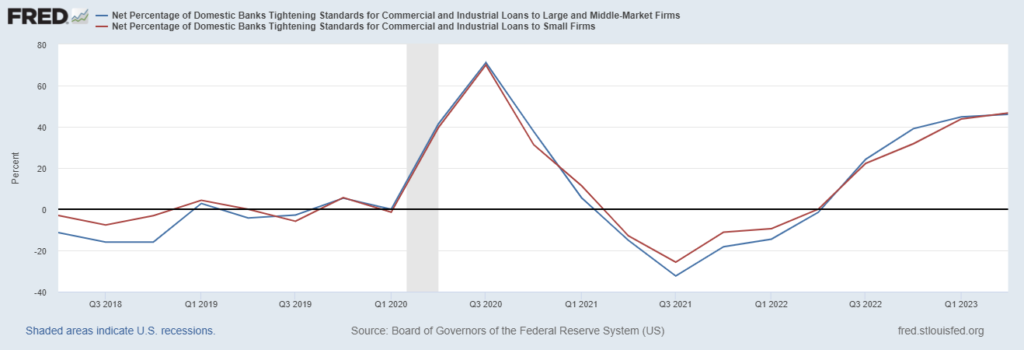

Although food and services prices continue to be sticky, due to falling inflation, tightening lending standards and the unpredictability of the lagged effect, Governor Powell chose to give the economy a breather while allowing time for more data to determine the Fed’s rate trajectory post-July.

An important source of relief has been declining energy commodities prices which fell by 20.4% YoY in the most recent CPI release.

The WTI has declined sharply from a high of above $110 per barrel to hovering around $70 at the time of writing.

Overall, inflation pressures are certainly weakening with three of the past six months showing a rise of 0.1% in the CPI, versus averaging 0.4% in the previous half year.

Perhaps most importantly, the core CPI is stubbornly sticky in large part due to the overhang from shelter costs which account for over a third of the index.

However, with mortgage rates being high and home prices sliding, inflation prints are expected to start coming down further in the coming months, and as a result, the overhang from shelter costs may be significantly less potent.

Even though rates may stay higher for longer, the FOMC’s rate hike cycle is looking like it is reaching its peak.

FURTHER ACTIONS

The banking sector seems to have overcome its contagion fears earlier this year and has given the Fed invaluable confidence in the financial stability of the US.

Thus, policymakers are confident in implementing more restrictive policies and will look to raise rates to 5.50-5.75% by year-end, while the Fed continues to wind down its balance sheet.

As per analysts at Wells Fargo, they are predicting that the FOMC may only look to ease policy in H2 2024, once rates have stabilized and inflation trends lower towards the 2% target.

Economists at Vanguard expect,

“…that the Fed won’t be in a position to cut rates until the middle of 2024.”

However, being data-driven, the Fed will maintain flexibility to respond to fresh scenarios due to monetary lags, spillovers, or tighter lending.

DEBT CEILING

In a letter to Congress earlier this year, Janet Yellen, the Secretary of the Treasury wrote,

“… (debt limit uncertainty could) raise short-term borrowing costs for taxpayers, and negatively impact the credit rating of the United States…cause severe hardship to American families, harm our global leadership position, and raise questions

about our ability to defend our national security interests.”

Given the urgency, lawmakers pulled together, and managed to reach a much-needed deal, averting both a historic US default and a potential recession due to the impending closure of the government.

Although repayment concerns persist, the increase in the debt ceiling likely means that investors and financial market participants can breathe easy for another 2 years.

The agreed-upon reduction in spending was not so significant and will likely not have a major impact on the near-term economic prospects.

LABOUR MARKET

Despite market concerns regarding the impact of concentrated rate hikes, the monthly nonfarm payroll (NFP) data has only gone from strength to strength.

In the May report, NFP increased by 339,000, smashing industry expectations of 190,000.

This was the 14th month in a row that the published numbers had outdone economists’ polls.

Since this has occurred at a time when interest rates have been accelerating at a near-unprecedented pace, the labour market has only further buoyed marked confidence.

Somewhat surprisingly, the unemployment rate did increase to 3.7% from a historic low of 3.4% in the previous month, despite labour participation remaining flat.

Furthermore, average hourly wages did moderate to 4.3% YoY, a tied-low for the year. This appears to be welcoming news to financial markets, which suggests that this may filter down eventually to lower inflation.

A further decline to a range of 3.0% – 3.5% YoY will likely be optimum for the Fed’s 2% target.

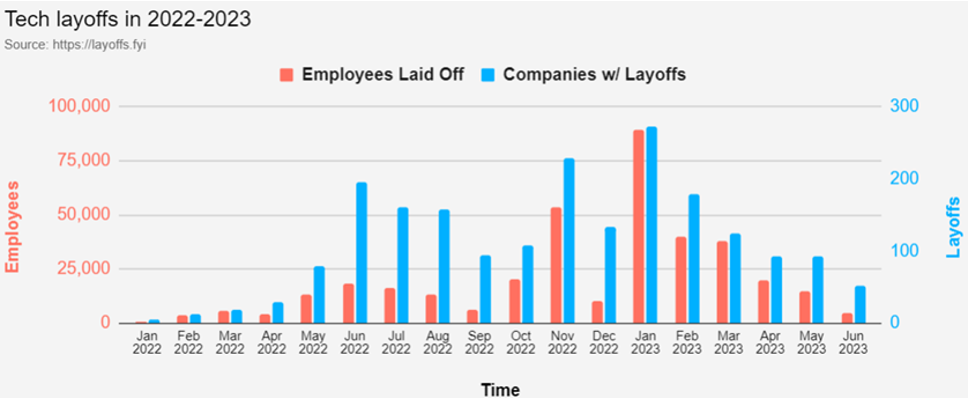

TECH LAYOFFS

A separate study showed that layoffs in the technology sector had reduced dramatically since January 2023, suggesting new-found tightness in this space.

Source: Layoffs.fyi (As of 26th June 2023)

Although some BLS data points suggested that manufacturing hiring may have peaked this year, the labour market continues to run hot, suggesting that the Fed still has room to hike.

SOFT LANDING IN SIGHT?

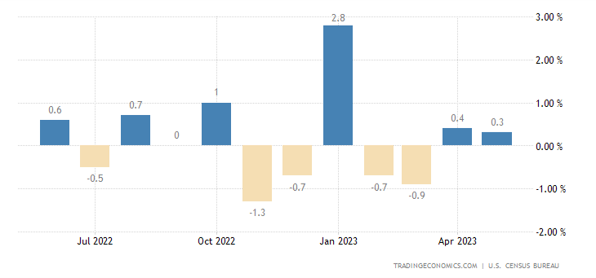

Since experiencing two-quarters of negative growth, US GDP has remained positive, although moderating over the past three releases.

Even so, retail sales have continued to show strength in the May report, although they moderated marginally since April 2023.

Source: TradingEconomics.com

Real consumer spending has remained robust rising 0.5% in April 2023, fueled by pent-up demand for travel services and entertainment.

The challenge for the consumer may come from falling appetite as excess savings of approximately $2.0 trillion amid the global health crisis, fell to roughly $600 billion with the aggregate savings rate shifting from a pre-pandemic 9% to a low 3% in Q42022.

However, the savings rate is expected to head towards 6% in the coming months, which will likely slow consumer demand.

NOT A RECESSION

Although there may be a slowdown in the coming months with rates climbing higher, the labour market resilience suggests that the Fed will likely avoid a recessionary dip.

This is despite some concerning indications from consumer sentiment data, accumulated monetary lags and the Conference Board’s Leading Economic Index which declined by 0.7% in its June 2023 report.

A frequently cited indicator known as the ‘Sahm rule’, states, “When the three-month moving average of the national unemployment rate is 0.5 percentage point or more above its low over the prior twelve months, we are in the early months of recession.”

In May 2023, the real-time Sahm Rule Recession Indicator stands at 0.03 and would suggest that a recession is not on the horizon unless there is an unexpectedly sharp deterioration in labour conditions.

Regarding banking, a recent Deloitte report noted, “Current lending conditions remain consistent with a slowing economy, not one that is entering a recession.”

Source: Federal Reserve

A key source of optimism has been the equity market, with the S&P having now officially entered a bull market and returned 13.2% YTD at the time of writing.

US export growth may be challenged going forward due to the ongoing conflict in Ukraine, slowing demand in the European bloc and the resilience of the dollar, particularly as seen this month.

However, the expansion of the shale industry has led the US to become the largest oil producer in the world and could be an

important source of exports if global energy supplies continue to feel the strain of geopolitical events and tighter supplies.

With rate cycles slowing down overseas, US export demand may benefit greatly once growth is restored in key markets.

POTENTIAL THREATS

Net domestic private investment has remained soft and declined by 29.9% YoY in Q1 2023, implying that businesses are not keen to expand capacity.

Source: Federal Reserve

If business owners deem that the environment has become more challenging, this could filter down to the jobs number and consumption statistics as well.

Industry forecasts suggest that business investment in equipment and intellectual property is likely to remain subdued in the medium term due to the prevailing higher rates policy.

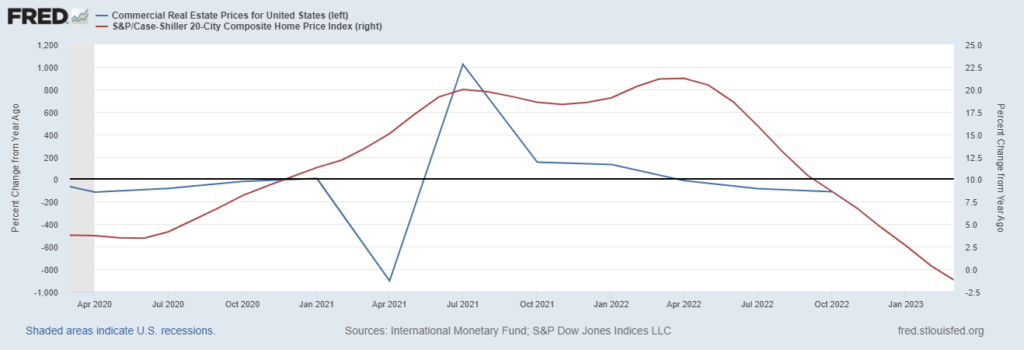

In addition, markets continue to face an inverted yield curve, as well as challenges in the commercial real estate and residential sectors.

These factors could in turn slower demand and reduced purchasing strength.

Source: FRED Database

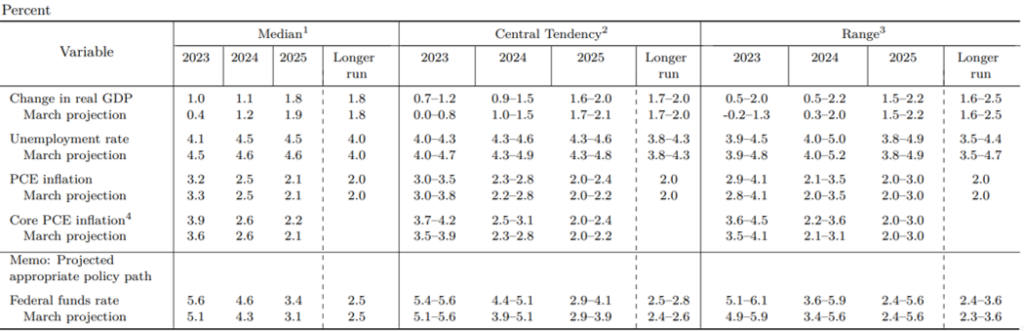

THE FOMC'S SUMMARY OF ECONOMIC PROJECTIONS

Although the accumulated effects of monetary tightening, tighter lending and a higher savings rate may slow economic growth, employment forecasts stay robust while the banking system is on a much stronger footing.

As a result, the likelihood of a soft landing has improved, and if a recession were to materialize, this would likely be a mild one.

Source: FOMC June 2023

The FOMC revised the 2023 unemployment projections for employment down from 4.5% to 4.1% owing to the strength of the labour market.

GDP for the year was also revised significantly higher from 0.4% in the March projection to 1.0%.

However, as growth-slowing forces accumulate, the committee revised the 2024 growth outlook downwards from 1.2% to 1.1%.

As discussed above, rates are likely to stay elevated, since the Fed’s favored inflation gauge, the core PCE for 2023, has seen an upward revision from 3.6% in March to 3.9% in June.

A QUICK NOTE ON THE DOLLAR

For the time being, the dollar is likely to stay steady, as US interest rates continue to rise.

However, the Fed may be able to reach its inflation target earlier than other leading central banks, and thus begin easing sooner.

As a result, in 2024, the dollar could weaken further against other currencies compared to today.

FINAL WORDS

In June 2023, the Fed ‘skipped’ its rate tightening after ten successive hikes.

Although inflation has eased considerably, core inflation remains sticky, particularly due to the shelter component.

Lower energy prices have contributed significantly to falling inflation, although food and services have remained elevated.

With the FOMC revising year-end core PCE higher, tightening is set to continue in the July meeting and is likely to rise to 5.50% – 5.75% by the end of the year.

- Given the strength of the labour market, the economy is well-positioned for a soft landing and based on data on-hand, is showing we are unlikely to see significant recessionary pressures.

- Some independent industry analysts expect that rates are likely to stay elevated through 2023, with the Fed looking to ease in the middle of 2024.

- Slower consumer spending, commercial real estate, falling house prices, inverted yield curves and geopolitical drivers may pose a threat to US growth in the coming months.

- The dollar is likely to stay relatively stable until the FOMC chooses to begin cutting rates.

Note: The information in this article is as of the 27th of April, 2023 but is also subject to rapid developments.