Bulls had a ball for 18 months, but when bears scooped in, the S&P 500 went into a tailspin and lost over 24% from its January record highs!

The markets have had a lot to worry about in 2022…

Persistent high inflation, central bank tightening, intensifying fears of a recession, worsening geopolitical crises, high commodity prices, disrupted supply chains, and a stronger dollar — all these have dampened investor sentiment and also enhanced volatility in the markets.

However, these issues seem to be well understood by the markets now…

At the beginning of the year, it was unclear how far inflation would surge and how aggressively central banks would respond. But now, the core inflation in the US appears to be peaking, and markets are pricing in relatively aggressive tightening paths for most central banks.

Currently, other warning signs of a slowing global economy are popping up…

China’s economic woes continue to mount, showing no sign of abating…The Japanese Yen is depreciating at an unprecedented pace, while Europe’s energy crisis is forcing factories to go dark.

Additionally, developments in geopolitical powderkegs and increasing credit risks have posed new challenges to financial stability.

New macro, market and economic realities have replaced the earlier realities with new and equally troubling ones.

In this post, we will delve into the eight biggest macro trends and risks currently looming over the markets, so you can be better prepared to profit from the potential market drivers!

1. The European Energy Crisis: Recession clouds are gathering!

Europe is currently battling an energy crisis that might result in rolling blackouts, factory closures, and a catastrophic recession.

The primary cause:

Russia has choked off the supplies of cheap natural gas that the continent has relied on for years to run factories, generate electricity and heat homes.

The crisis deepened when Russia indefinitely blocked the “Nord Stream 2” — a natural gas pipeline that supplies more than 20% of Europe’s gas demand from Russia.

Currently, the entire Europe is facing a severe energy crisis. The scarcity of natural gas and increased cost of all imported fuels has been compounded by heat waves and drought conditions in many European countries.

To cite one specific example, according to Bloomberg, a recent survey indicated that 6 in 10 British factories may be forced out of business in the next twelve months due to rising energy costs.

Global markets are currently underestimating the extent of economic devastation that can be brought by the current energy crisis in Europe, which could lead to a severe economic recession in the months ahead.

2. The Japanese Currency Crisis has severe economic repercussions!

Japan’s central bank has defied the global trend toward tighter monetary policy and decided to keep the interest rate unchanged and at ultra-low levels.

Japan, like the rest of the world, is battling with inflation. However, its government is dealing with another major issue: the falling value of the Yen.

Relative to the dollar, the currency’s value has fallen by more than 20% this year.

JPYUSD Daily chart

That’s largely because the Bank of Japan has maintained low-interest rates while the US Fed has been raising them. And that makes Japanese government bonds less attractive to investors and makes imports more expensive for Japanese consumers.

To support the Yen, the Japanese government is currently buying its own currency and selling off reserves of other currencies.

However, given the difficulty of influencing the value of the Yen in the vast global forex market, currency intervention can easily backfire on Japan, resulting in an even worse devaluation of the Japanese Yen.

A rapid devaluation in currency makes it difficult for firms to set business plans and also heightens uncertainty about the Japanese economy.

3. China's economy is struggling, and things could get worse!

China is currently beset by severe economic problems. Growth has stalled, youth unemployment is at an all-time high, the housing market is collapsing, and businesses are struggling with ongoing supply chain headaches.

The world’s second-largest economy is grappling with the impact of severe drought, while its vast real estate sector is suffering from the consequences of running up too much debt.

The prolonged pandemic in China and Hong Kong and; the vain attempts to achieve ‘zero COVID’ by locking people up for months have made matters even worse for the Chinese economy.

Recently, the World Bank revised down its forecast for China’s GDP growth to 2.8%, compared with 8.1% last year.

At the same time, China is struggling with political instability as there have been rumors that China’s president Xi Jinping is under house arrest.

Given the significant macro-headwinds confronting China’s economy, analysts believe the Chinese economy is unlikely to repeat its former GDP growth rate of 5.5% or 6% for the next two years.

4. Rome’s financial volatility may destroy the Eurozone!

Italy stands out as the most conceivable candidate to exit the eurozone for a variety of reasons.

First, with a debt-to-equity ratio of a whopping 171.8%, Italy’s government owes a significant excess amount of money compared to how much the country produces each year.

Furthermore, the recent Bond borrowing patterns highlight that investors are heavily betting against the Italian bonds in anticipation that bond values will fall prior to the debt redemption deadline.

According to S&P Market Intelligence, €37.20 billion in Italian bonds were borrowed as of August 23. Bond borrowing has been at its highest level since the beginning of the Great Recession in January of 2008!

The $37 billion in short positions implies that market speculators believe Rome will default on its debt, and if this occurs, the financial shock may spread like a contagion across Europe.

5. The Russia/Ukraine Conflict is Escalating

Increased risk of additional sanctions from Western countries due to Russia’s ongoing invasion of Ukraine has seen Russian stocks plunging since September 20th, 2022.

Notably, the Russian MOEX index fell below 2,000 points for the first time since late February, losing more than 20% in a single week.

High volatility seemed to be a hallmark of Russian stocks as president Putin mobilized thousands of extra military troops and threatened to use nuclear weapons, further escalating the conflict in Ukraine.

With the current mobilization news and more reports surfacing that parts of the mobilization process are being performed violently, the conflict is escalating, which may reignite high commodity prices and put downward pressure on equities.

Whether this is transitory or a more permanent occurrence will be evident in the following months.

6. A perfect economic storm is battering emerging markets!

An unprecedented energy crisis that’s gripping some highly indebted emerging economies may soon worsen as more fuel suppliers refuse to sell oil to these nations.

Fewer companies are proposing to sell fuel to Pakistan, while some banks have ceased financing and facilitating payments for energy imports.

Bangladesh, on the other hand, is having to schedule power cuts to conserve its fuel reserves.

Serial defaulter Argentina is once again in trouble. Sri Lanka has defaulted.

Following Russia’s invasion of Ukraine, rising commodity prices have devastated emerging markets around the world.

Although oil prices have dropped from their recent highs, the stronger dollar has caused currency devaluations in many emerging economies, making it more difficult for their highly-indebted governments to repay dollar-denominated debts.

That’s pushing the emerging markets to the brink of collapse when oil and energy are critical to their recovery from the pandemic’s crippling effects.

7. Will Midterm Elections Affect Market Performance?

Another potential source of stock market volatility looms in an already tough year for Wall Street: An approaching midterm U.S. election that will decide which political party controls Congress.

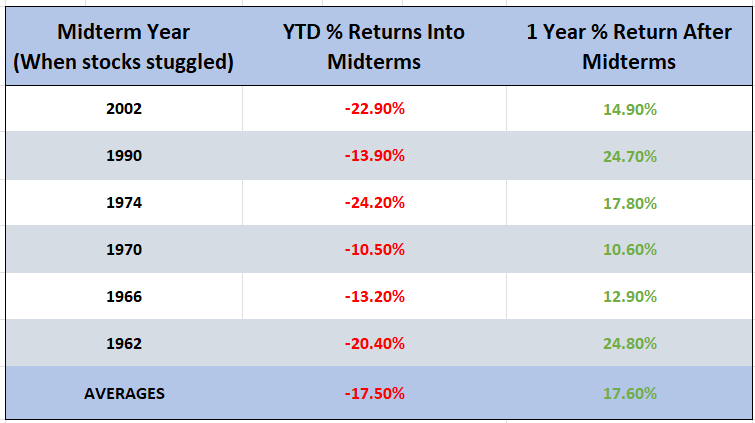

Even though the midterm elections are not an economic event, they do, however, have a long history of hurting financial markets in the months leading up to election day.

According to The New York Times report, they are frequently the weakest economic months of a presidential term.

So, with the midterm elections now in sight, investors are bracing for the market to repeat its history. The recent plunges we’ve seen in the S&P 500 and Nasdaq Composite are keeping with the previous trend.

If history is any guide, whenever the stock struggled before midterm elections, they ALWAYS soared after midterms!

However, it is worth noting that Post-election outperformance is often driven by the market’s expectation of increased government spending from a new Congress.

And given the unprecedented macroeconomic headwinds, pinning too much hope on midterm-year performance is ineffectual.

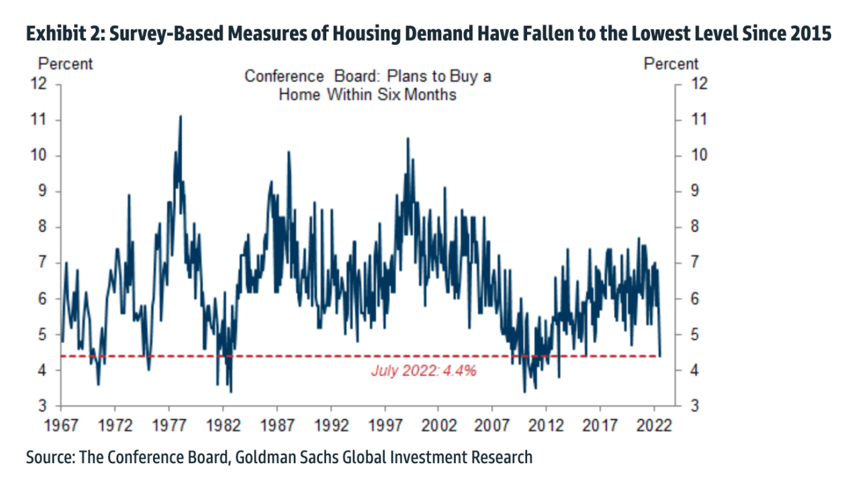

8. Goldman Sachs predicts a housing market crash by 2023!

After an unprecedented run-up in home prices, residential real estate across the developed world appears vulnerable to falling prices for the first time in over a decade.

But unlike the 2008 housing bust–the US won’t be at the epicenter of this housing pullback. At least that’s according to Goldman Sachs.

Through the end of 2023, the bank predicts a crash-like drop in home prices in Canada (-13%) Australia (-18%) and Newzealand (-21%).

For comparison, the US housing bubble saw home prices drop by 27% between the 2006 peak and the 2012 bottom.

In August 2022, average home prices fell 0.77% from the month prior, the “first monthly drop in nearly three years.” This has prompted the belief that a more significant correction may be on the way.

According to the bank’s research, a record number of homeowners are considering selling their homes, creating a risk of a housing market crash similar to 2008!

FINAL WORDS

It’s quite easy to paint a gloomy picture for the global economy these days.

If the war in Ukraine escalates, commodity prices may rise; and if China continues to pursue a Zero Covid policy amid rising case counts, supply chain headwinds may spike up again.

Ongoing currency intervention by Japan for dwindling Yen would send stagflationary alarm bells ringing through newspaper headlines…

While the severe energy crisis in Europe and Italy’s likelihood of debt default may pose a severe threat of a global economic recession.

Ultimately, not all adverse shocks will lead to system-wide failures, but it’s prudent to identify market vulnerabilities with the knowledge that a few more months of data could bring a lot more clarity on which “potential market drivers” transpire into “actuals.”

Please note that all the information contained in this newsletter is intended for illustration and educational purposes only. It does not constitute any financial advice/recommendation to buy/sell any investment products or services.