For investors all over the world, 2022 was a year of despair. The turbulent S&P 500 declined a shade under 20%. At the same time, US 10-year yields peaked at over 4.3%, nearly unthinkable, not so long ago.

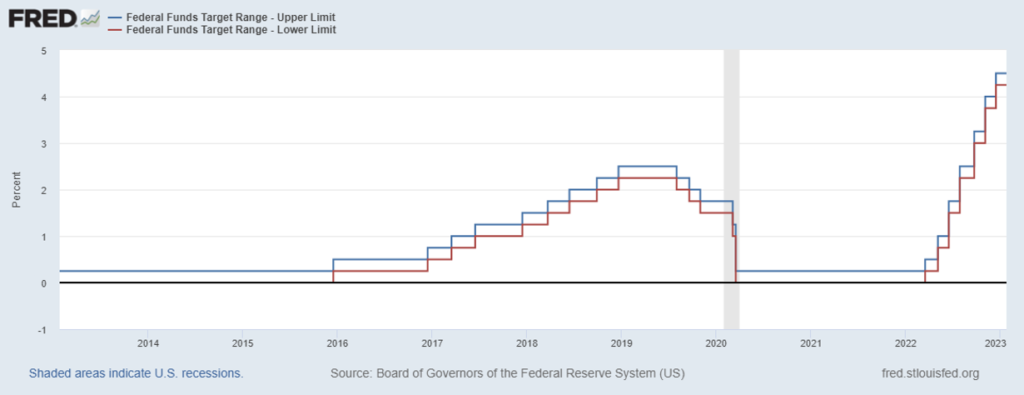

Much of the volatility that plagued the markets was fuelled by the unprecedented pace of monetary tightening deployed by the Federal Reserve (“the Fed”). The aggressive measures taken by the Federal Open market Committee (“FOMC”) were in response to runaway inflation, which surged to an eye-popping 9.1% YoY in June.

During the last meeting of 2022, the Fed raised the fed funds corridor to 4.25% – 4.50%, the highest level since 2007, from effectively zero earlier in the year.

As a result, capital flows accelerated into the dollar throughout much of 2022, while the greenback was also supported by safe-haven demand. The Dollar Index (“DXY”) peaked during Q4 2022 and eased following recessionary concerns and expectations of the Fed easing monetary policy.

Other significant threats to the US and the wider global economic balances came in the shape of the Ukraine war, sanctions on Russian energy exports and the harsh lockdowns in China.

TL;DR

With mounting concerns that rates were hiked too fast in 2022, as well as cooling inflation, the Fed is expected to slow its pace of tightening to the traditional 25 bps during its upcoming meeting.

Ideally, monetary authorities would look to continue to hike by 25 bps in March and May as well.

Growth impulses would be pressured by rates heading closer to 5%, with the US economy already vulnerable to falling into an official recession in the next few months.

However, this may prove to be a so-called ‘mild recession’ supported by falling commodity prices, improved efficiency of supply chains and the re-opening of the Chinese economy.

For equities, a shift to higher rates would expose their underlying weaknesses, as is already clear from mixed earnings results.

Although the Fed has continued to voice a hawkish narrative, cracks are beginning to emerge.

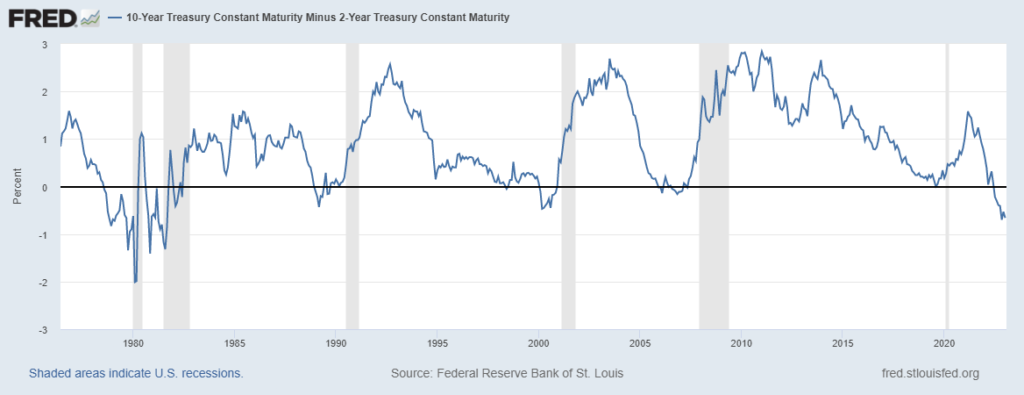

Chief amongst these is a weakening in the perceived strength of the labour market, the increase in recessionary risks, a deeply inverted yield curve and the accumulated effect of monetary lags

The unemployment rate stands at historic lows, but the loss of nearly half a million full-time jobs in the previous seven months, a rise in continuing claims, and the heavy cuts to temporary worker headcount suggest the labour market may not be as robust as initially thought.

These developments have fueled the notion that the Fed will be forced into prematurely pausing, or even pivoting, perhaps as early as Q1.

If monetary authorities were to cut rates, this may prove positive for deeply suppressed stock values although investors should not necessarily expect an immediate return to bullish sentiments.

The upcoming FOMC MEETING

Markets have turned their gaze to next week’s FOMC meeting.

Empowered by the Federal Reserve Act, the FOMC exercises monetary policy to achieve maximum employment and price stability. Simply put, it raises, cuts or maintains the Federal Funds Rate (the overnight rate at which banks borrow from and lend to each other) to meet these objectives.

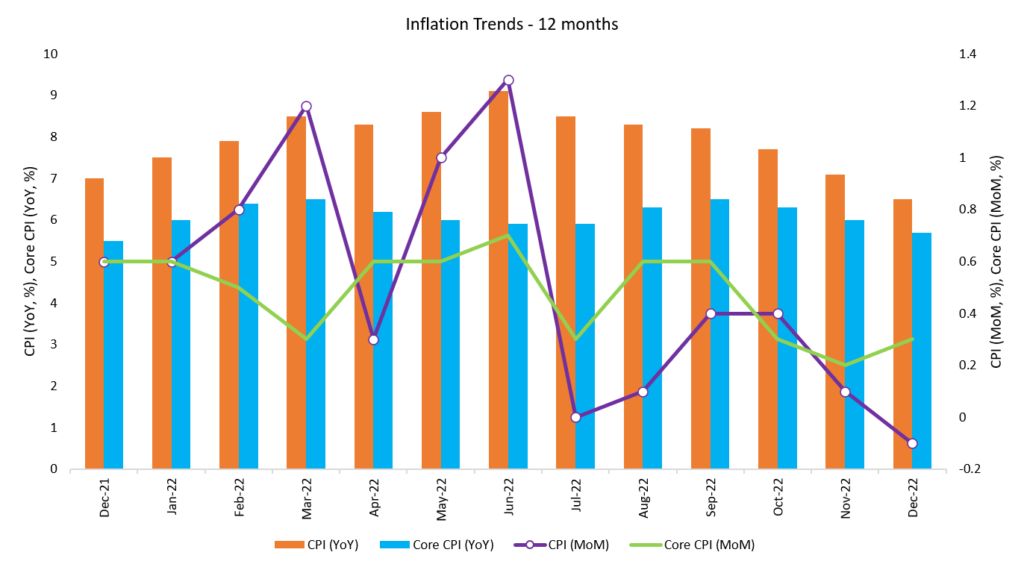

Despite criticism for having raised rates too hard, and too fast, there are clear signs that inflation may be sustainably cooling.

In its most recent release, the Bureau of Labor Statistics (“BLS”) reported that consumer inflation in December had moderated to 6.5% YoY, the first sub-7% reading since November 2021, led by easing food and energy commodity prices.

Simultaneously, the core CPI (excluding volatile components such as food and energy) had slipped to 5.7%, reaching its lowest level since December 2021.

Yet, inflation metrics remain elevated on a historic basis.

For instance, the Fed’s preferred inflation gauge, the annual change in the price index for personal consumption expenditures (or PCE, YoY%) still sits at 5.5%, nearly thrice the Fed’s stated inflation target, implying that further monetary tightening is the need of the hour.

However, owing to the easing of external factors such as commodity prices and supply chains, markets appear to be confident that the Fed will lower its pace of monetary tightening in the coming meeting.

The CME FedWatch Tool, a measure of the likelihood of the change to the Federal Funds Rate, registered a nearly 98.1% probability of a rate hike by 25 bps, the standard pace of monetary tightening, as of the 26th of January. This would be a meaningful downshift compared to the previous meeting which saw a 50 bps hike, and the four previous rate hikes which were 75 bps each.

The strong conviction of the market follows last week’s data where producer prices eased below expectations, falling 0.5% MoM, and given lacklustre earnings reports in several sectors.

Having said that, inflation, especially core inflation, is unlikely to moderate in a hurry.

Shelter, which accounts for more than half of core inflation, rose by 7.5% YoY in the January 2023 release, and due to its lagged nature is unlikely to decline significantly for at least a couple of quarters.

To tame high but cooling inflation, the Fed is expected to raise rates by 25 bps in each of the first three meetings of 2023, before pausing at a terminal rate of 5% – 5.25%. Ideally, the Fed would look to keep rates elevated for the entirety of 2023.

However, it is not so likely that the Fed will be able to carry out its intended pathway, in light of the following factors.

What are the factors that could usher in a pivot?

In this section, we will go through 6 key market factors that will determine and may cause the Fed to deviate from its existing monetary tightening path.

1. RECESSIONARY ENVIRONMENT AND DAMPENED CONSUMER SENTIMENT

In the second estimate of Q3 GDP of 2022, real GDP increased 2.9% on an annual basis, far better than the contractions in both Q1 and Q2.

Despite this broadly positive show by the consumer, GDP growth may contract for the next two to even three quarters.

The reported increase was largely driven by slower inflation, easing commodities and the annualized improvement in some sectors such as travel, which was recovering from pandemic stoppages.

The Conference Board in its Leading Economic Index published on January 23rd, reported a decline of 1%, marking the 10th consecutive month of slowing performance.

Retail data was weaker than anticipated in December, contracting 1.1%, and registering the sharpest drop since December 2021.

In a special report by the Survey of Consumers, the University of Michigan published late last year, 45%, 47% and 5% of the upper third of income earners expect to see no change, cutbacks, or stoppages in spending in response to inflation, respectively, over 12 months.

As a result, over half of the surveyed top earners looked to cut back on spending, which will drive strong headwinds for economic growth and hiring. This would in turn adversely affect spending in other income brackets.

The inversion in the 10-2 yield curve since July 2022 is another indicator that a recession is around the corner, having been a usually reliable indicator of broad-based economic slowdowns.

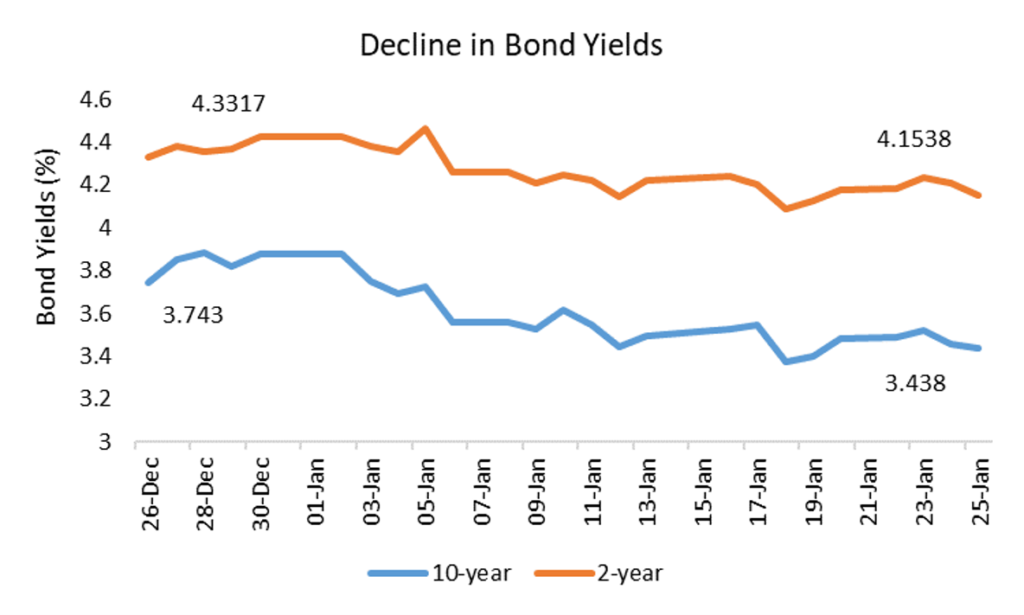

Despite the Fed’s hawkish comments, the bond market seems to already be factoring a shift to lower rates, with both the 10-year and 2-year seeing declining yields this month.

2. Labour market beginning to weaken

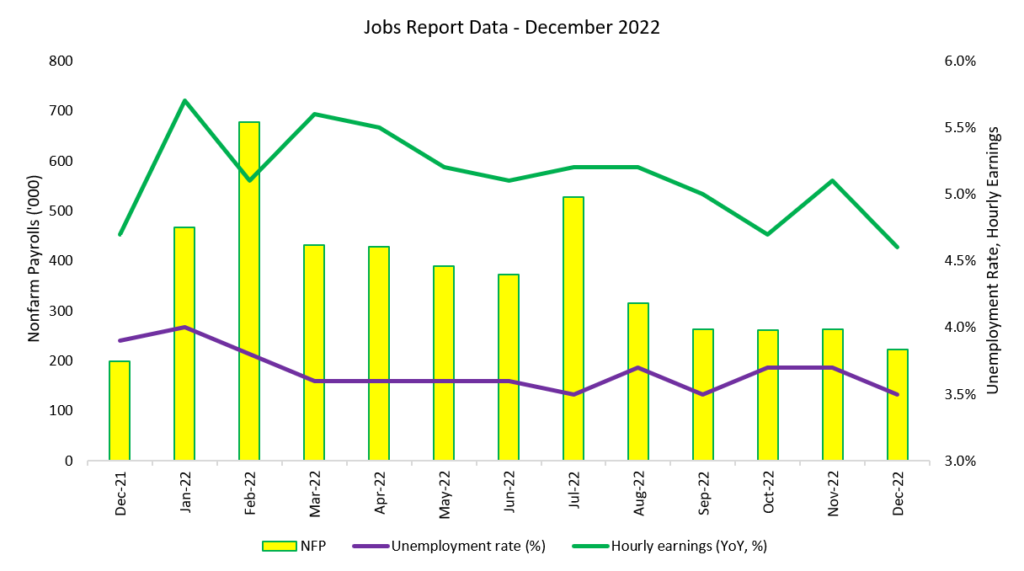

The resilience of the jobs market has been one of the strongest arguments in favour of the accelerated pace of tightening. Nonfarm payrolls (“NFP”) released earlier this month continued to show firm momentum, registering an increase of 223,000 in December. Yet, this is the slowest increase since November 2021.

Secondly, the historically low level of unemployment at 3.5% has been artificially supported by the exit of millions of workers since the pandemic, overstating the robustness of one of the central pillars of the Fed’s policies.

Thirdly, December wage growth rose 4.6% YoY, well below market expectations and is consistently unable to keep pace with inflation, exposing cracks in household finances.

Yet, the current wage growth is likely too high to return inflation to 2%, forcing the Fed to continue to walk a tightrope, and hike into broadening economic weakness.

The BLS also reported that total employment increased by 717,000 during the month of December.

However, 80% of these positions were on a part-time basis. Nearly a quarter of part-time entrants would have accepted full-time roles if they could secure them, betraying the underlying weakness in the market.

Nearly half a million full-time positions have gone off the market since May 2022, with several workers taking on additional part-time roles instead.

Last week’s continuing claims data showed an increase of 17,000 reaffirming that for those being laid off, fresh positions are also not readily accessible.

Lastly, the state of temporary workers is a major warning signal, with US companies cutting 35,000 such jobs last month, amid a broader trend that has seen over 110,000 workers lose their positions since August 2022.

This is an alarming sign that would likely see substantial weakening throughout the broader labour market as early as Q1.

3. monetary policy lags

Monetary policy acts with a lag, i.e., the effects of rate changes take time to be wholly absorbed by the economy, to reflect in prices and the actions of economic agents.

A recent study by the Federal Reserve Bank of St. Louis estimates that this lag lasts about 12 months. This is shorter than the conventional wisdom that full transmission could take up to a year and a half.

With the Fed having raised rates since March 2022, something may ‘break’ in Q1 itself.

4. Weak household budgets and zombies

Household finances have been squeezed with inflation reaching four-decade highs in 2022, and the exhausting of targeted fiscal stimulus.

A survey published this month showed that 86% of respondents were concerned about the effects of inflation on purchasing power, with 73% fearing that it would be difficult to pay their bills in a timely fashion.

At the same time, the household debt of US families has surged to $16.51 trillion in Q3 2022, the largest increase in over 20 years, led by credit card payments, mortgage debt and auto finance.

Families have been on a collision course with higher borrowing costs, as delinquency rates continue to tick higher.

Corporate debt stress is also rising, which could see a slew of long-overdue failures among zombie companies.

5. manufacturing sentiment continues to Weaken

The PMI issued this month reached its lowest level since May 2020.

The Federal Reserve Bank of Philadelphia’s January 2023 Manufacturing Business Outlook Survey, reported ongoing weakness in industrial orders and shipments with declines in general activity for a fifth consecutive month.

The Federal Reserve also reported a 1.3% decline in manufacturing output in December, with capacity utilization falling to 78.8%, falling below its long-term average.

6. Housing market contracts

The housing sector was battered due to the sharp upswing in mortgage rates last year, forcing declining home affordability and pushing down sales by nearly a third on an annual basis.

Residential investment has continued to contract, with construction permits falling to their lowest since early 2016, except for during the pandemic.

Prices continued to edge higher as inventories remain pressurized, with supply shortages remaining only around the three-month mark.

Although mortgage rates have declined in recent weeks, they are still well above 6%, twice what they were last year, implying that the real estate market is likely to weaken in the coming months.

IS a mild recession possible?

By having aggressively tightened, and continuing to tighten into economic weakness, it is likely only a matter of time before the US economy shifts into a recession.

Fortunately, the moderation in commodity prices, overall improvement in supply chains and the optimism around China’s re-opening, may buffer the economy from an even deeper slowdown.

However, this is unchartered territory, and any one of several scenarios could potentially unfold and will only become clearer as fresh data emerge in the coming weeks and months.

Perhaps the biggest risk to economic stability today, is if the labour market is far weaker than initially thought, causing the Fed’s accelerated policies over the last three quarters to overshoot their target.

The looming debt ceiling and a divided government would add to the complications of managing any potential economic fallout.

What is the near-term outlook for equities?

In 2023, the markets have had the chance to catch their collective breath, with equities rallying 1.8% YTD on the S&P 500 at the time of writing.

The Dow gained 100 points in each of the past three sessions, although fundamental weakness persists in many sectors.

The improvement in equities has been primarily driven by expectations that the Fed will ease the pace of tightening or even pause completely in its next meeting.

With the easing of inflation metrics, the markets could see a bounce in certain discretionary stocks in the near term.

However, given the overall dampened consumer sentiment, lack of household savings, poor earnings, recessionary concerns and the accumulation of lags, stocks will likely decline further during Q1 and into Q2.

A sustainable recovery in assets is unlikely to materialize until the Fed takes its foot off the gas, and chooses to cut rates, which will require headline NFP to decline sharply, and hourly earnings to moderate further.

However, a pivot could lead to a de-anchoring of inflationary expectations, and the sluggish recovery of asset values.

FINAL WORDS

Indications are that key drivers in the US economy are slowing down, and point to an official recession within Q1.

- Although the Fed is expected to tighten by 25 bps in its next meeting, a fraction of market participants anticipate an all-out pause.

- The ongoing declines in CPI and PCE, as well as the stress on the labour market, household budgets and corporate entities, will likely trigger a pivot from the Fed during Q1.

- The underlying weakness in the labour market will significantly dictate the Fed’s decisions. Unemployment is likely to rise substantially, possibly to as much as 5%, as indicated by temporary layoffs.

- Equities are expected to decline during Q1, and may only see a sustainable recovery post a durable pivot.

Please note that all the information contained in this newsletter is intended for illustration and educational purposes only. It does not constitute any financial advice/recommendation to buy/sell any investment products or services.

The market has officially slipped into correction territory, dropping over 10% from its peak and leaving traders at a crossroads. Hold, buy the dip, or cut losses? History reveals a shocking truth: the first week after a correction can dictate the market’s fate for months. In this episode of Smart Money Insight, we uncover the hidden signals to watch next week, and whether a massive rebound or further decline is on the horizon. Don’t miss this critical breakdown!

The market has officially slipped into correction territory, dropping over 10% from its peak and leaving traders at a crossroads. Hold, buy the dip, or cut losses? History reveals a shocking truth: the first week after a correction can dictate the market’s fate for months. In this episode of Smart Money Insight, we uncover the hidden signals to watch next week, and whether a massive rebound or further decline is on the horizon. Don’t miss this critical breakdown!