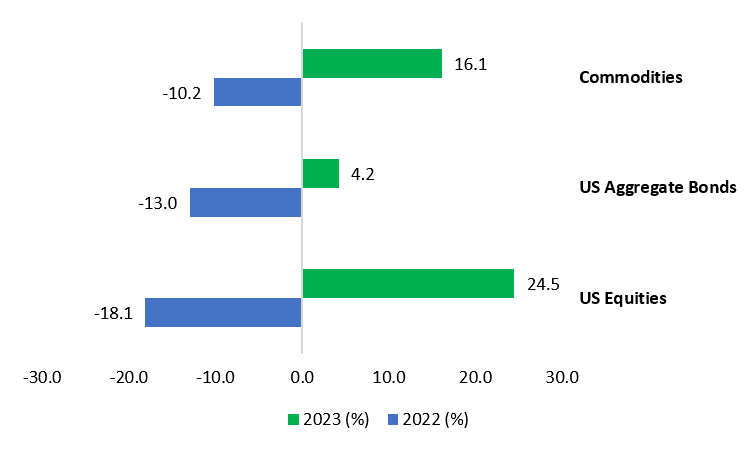

The previous year, 2022, was highly turbulent with the outbreak of the Ukraine-Russia war and tumbling equities.

Once resilient supply chains had been dismantled, lockdowns to contain the global pandemic had stretched on, unprecedented fiscal stimulus packages had propelled inflation to multi-decade highs, and economic forecasters were convinced that a severe recession was in the offing.

However, through 2023, the picture has been starkly different, with near-panic over rising Fed rates and a seemingly fragile jobs scenario being replaced by a robust labour market, consistently cooling inflation, and growing confidence in the no/soft-landing narrative.

Having said that, the last twelve months have not been without serious pitfalls including the fall of SVB, Silvergate, and Signature Bank, as well as the broader regional banking crisis; the debt ceiling debacle; and the outbreak of the Israel-Palestine war, sanctions on Russia, and the recent confrontation in the Red Sea.

TL;DR

- In 2023, the US economy outperformed expectations and seems to be headed for a no/soft landing.

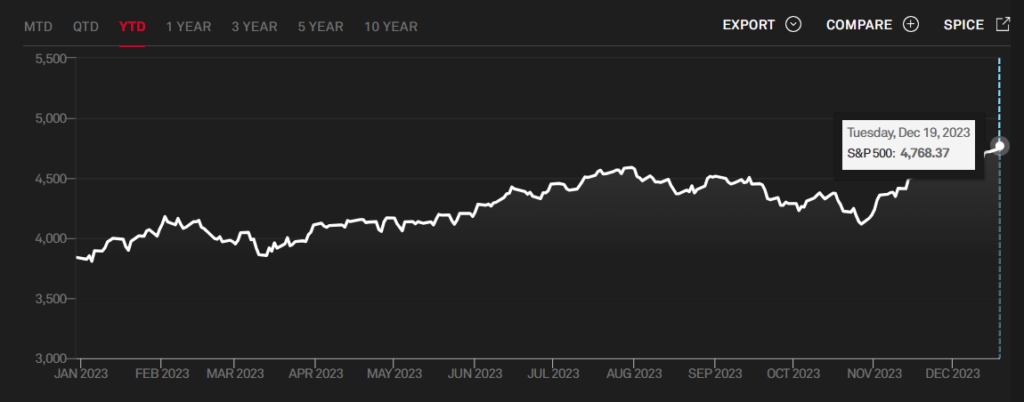

- Equities performed well with the S&P 500 approaching the 2021 high and are pricing in a soft or no- landing ahead.

- Price returns were heavily concentrated but are now beginning to show signs of broadening.

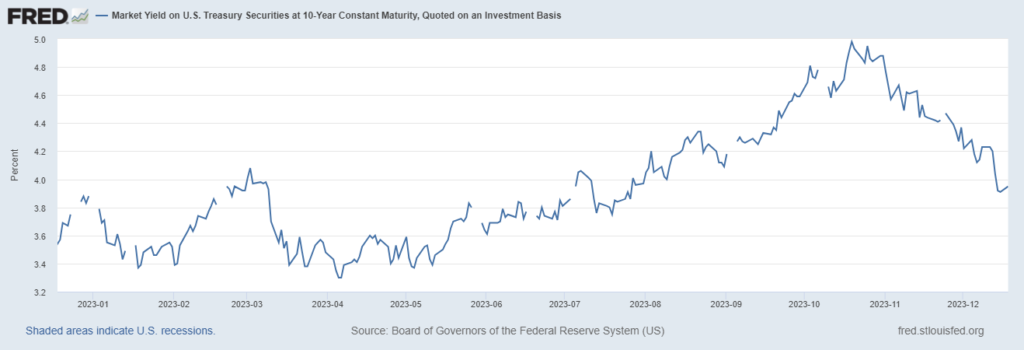

- The 10-year treasuries surged to nearly 5% earlier in the year but have since eased dramatically.

- The Fed maintained a hawkish stance for most of the year, while inflation has continued to cool.

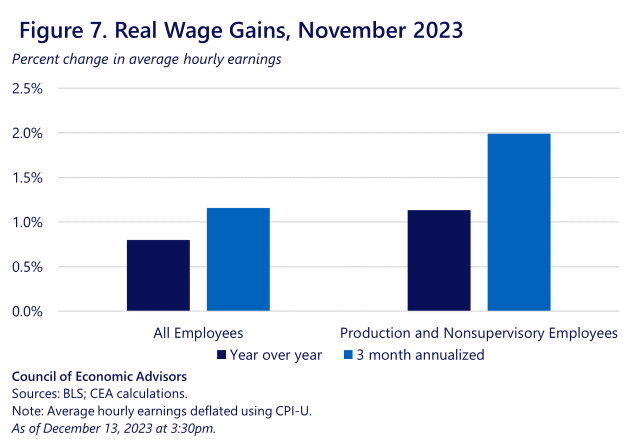

- Crucially, the labour market has stayed robust, and real wages began to show improvement.

- In December, Governor Powell indicated that rate hikes have likely ended, and cuts are “in view.”

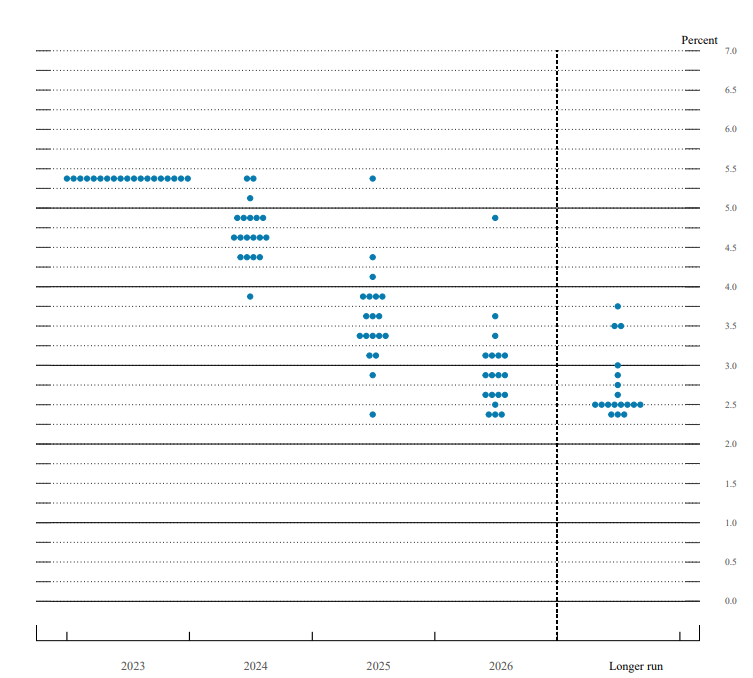

- The Fed’s dot plot signalled that inflation is no longer a policy threat.

- However, the market anticipated cuts to happen at a much faster rate than projected by the Fed.

- EY estimates four cuts in 2024, while Goldman Sachs expects five.

- The real estate segment is showing signs of improvement as mortgage rates reduce, while gold posted double-digit percentage gains through the year.

- Oil prices have nosedived on concerns of excessive supply.

- The key risk to portfolios in 2024 comes from the divergence in the perspectives of rate cuts by the Fed and market participants.

GROWTH

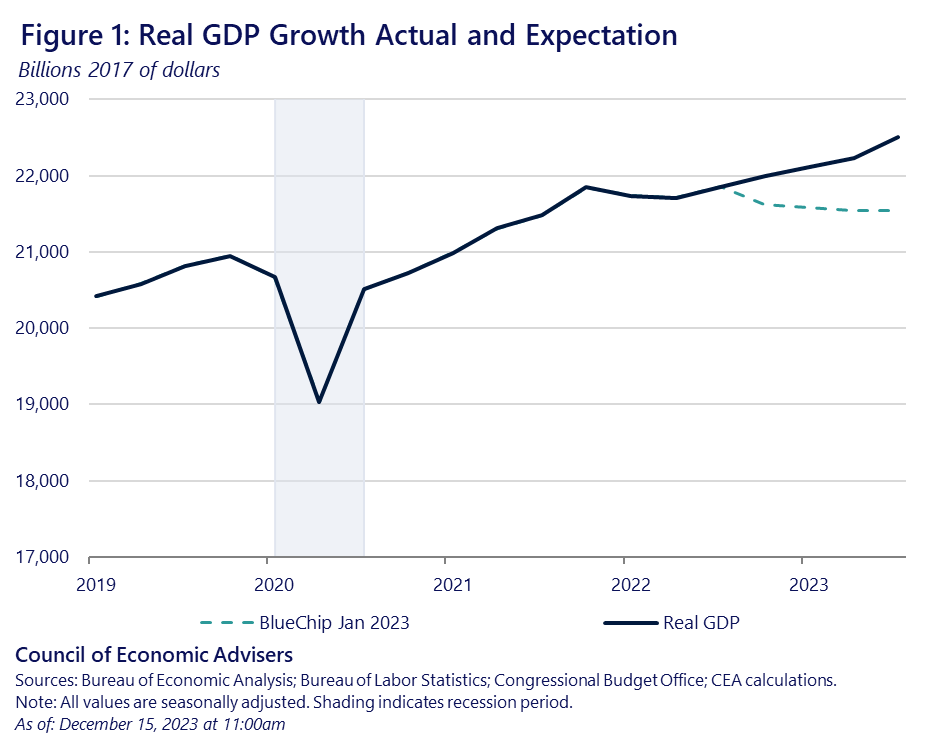

Rather than just dodge the sharp calls for a recession, remarkably, the US economy has gone from strength to strength, with a GDP growth of 2.9% YoY in Q4, even as Fed policy stands at a 22-year high of 5.25% – 5.50%.

Resilient consumer spending, relatively sound household balance sheets, a revival in manufacturing, and heavy lifting by state and local governments have played a significant role here.

Source: The White House

As per a report by Council of Economic Advisers at The White House (‘Council’) Prospects for broad economic growth have improved leaps and bounds with the Blue-Chip Economic Forecast at (-)0.1% in December 2022 now stands at 2.6% for this year.

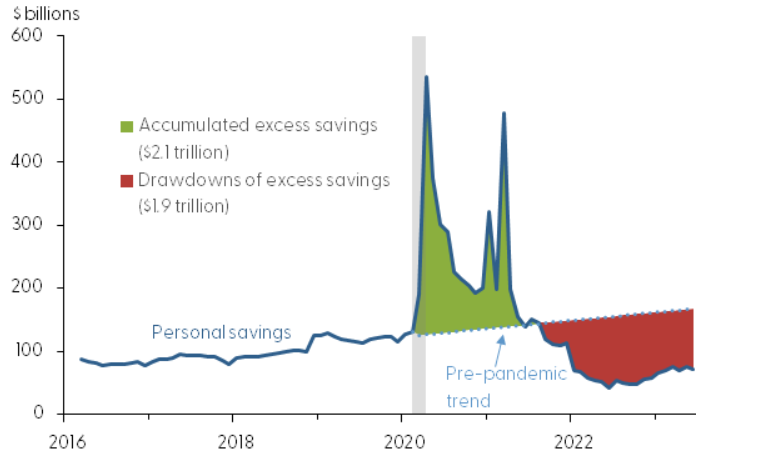

In addition, the excess household savings from pandemic-era fiscal injections have provided a vital cushion despite a challenging macroeconomic environment.

Source: San Francisco Fed

However, these excess savings which promoted relatively robust consumer demand are not being extinguished, due to which households may become more vulnerable if rates or inflation were to remain high.

For the year, the Congressional Budget Office (CBO) upwardly revised GDP growth from 0.9% in July to 2.5% in December.

For 2024, the CBO projects that the economy will avoid a recession and growth by 1.5% YoY.

RESILIENT LABOUR MARKET

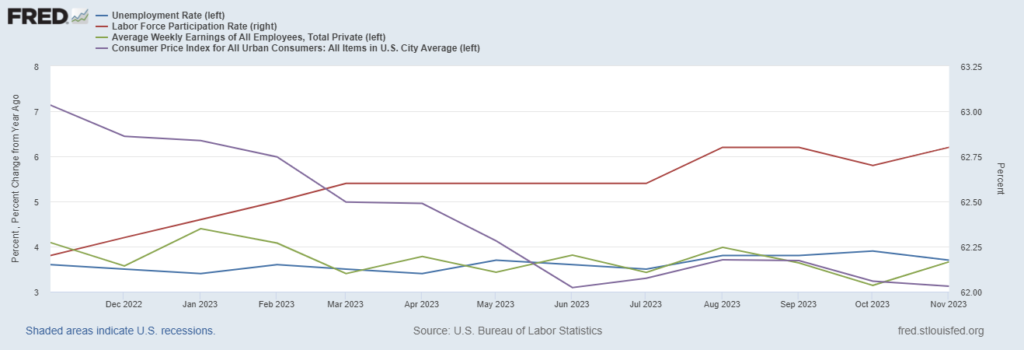

The key development over the past twelve months has undoubtedly been the unexpected resilience of the US labour market which has enabled the FOMC to march on with its monetary tightening agenda.

Source: FRED Database

Despite the Fed’s sustained hawkishness, the unemployment rate (U-3) has remained below 4.0% for 22 consecutive months.

Moreover, the measure reached all-time lows of 3.4% in January and April of 2023.

The White House report confirmed that although nonfarm payrolls (NFP) moderated from earlier in the year, they have averaged 232,000 per month for 2023, which is 55,000 per month higher than 2018 and 2019.

For the month of November, the NFP came in at 199,000, above market expectations of 180,000, suggesting continued resilience.

Further, the labour participation rate rose to near 63% with average hourly earnings at $34.1 equating to an improvement of 3.9% YoY with real wags having turned positive earlier in the year.

Source: The White House

Much of this improvement has materialized due to heavy contribution of real private fixed investment in manufacturing infrastructure which amounted to 0.3% of GDP in Q32023, while real private manufacturing construction investment reached its maximum levels since way back in 1958.

INFLATION

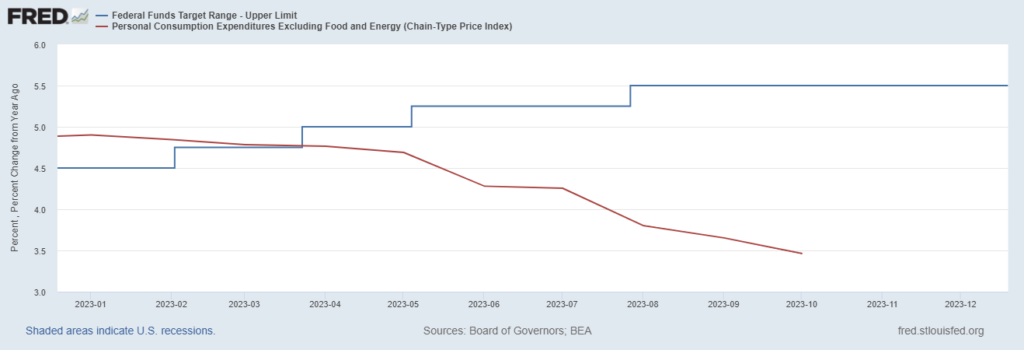

Source: FRED Database

As of October 2023, core PCE eased to 3.5% YoY from as high as 5.6% YoY in February 2022, and is now in decline for three consecutive months.

As per the Council, PCE inflation cooled from its peak of 7.1% YoY to 3.0% YoY in October 2023, a decline of 4.1%.

Ever since peaking in June 2022 at 9.1% YoY, the CPI has been in a downward arc, particularly due to easing food and energy inflation, and restored supply chains.

In explaining the deflationary dynamics, the Council noted the following in November 2023,

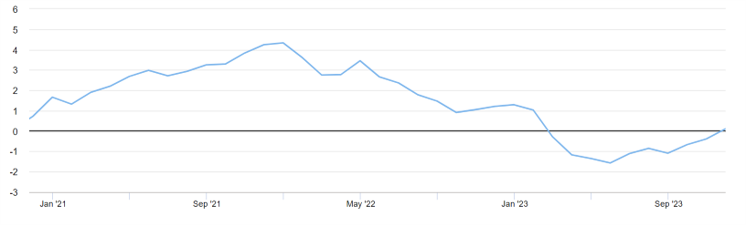

“…supply chains in some form -either alone…or in tandem with slack…- explain more than 80 percent of the disinflation the US has experienced since 2022.”

This view is supported by the New York Fed’s monthly Global Supply Chain Pressure Index (GSCPI), which eased considerably since the height of the pandemic.

Source: New York Fed

For the month of November 2023, the index is at 0.11, down from the January 2023 estimate of 1.03.

The index is a measure of standard deviations from the average, indicating that increasing values suggest that supply chains are pressurized.

Services INFLATION

A key metric here is that of services inflation which is fed by wage dynamics in the labour market.

Although services inflation in November 2023 ticked higher to 5.2% YoY from the previous month’s 5.1% YoY, it has moderated sharply from a peak of 7.6% YoY in January 2023.

While policy rates have been maintained at an elevated level, moderating consumer appetite due to the near-extinguishing of excess savings may help to counterbalance the further build-up of inflationary pressures.

FED RATE CUTS

The incredible robustness of the job market has been a major boon for US policymakers and enabled the FOMC to continue to tighten policy, and in turn bring inflation down closer to its 2.0% YoY target.

As expected, in the FOMC’s December 2023 announcement, policy rates were maintained at 5.25%-5.50% for a third consecutive meeting.

Federal Reserve chair Jerome Powell not only signalled peak rates, but also noted that rate cuts are coming,

“…into view.”

Broadly, markets had anticipated that the Fed would wait for more data before potentially announcing a rate cut strategy, which is what Governor Powell was trying to indicate, i.e. that although inflation is easing, rates may need to be held higher for longer.

However, in the Fed’s closely-monitored dot plot, not only did all 19 policymakers choose to not forecast any further hikes, but revealed that the average policy rate would be pulled-back to 4.6%, a half a percentage point lower than the previous projections of 5.1%.

Source: The Federal Reserve

Markets seemed to side-step Powell’s narrative and interpreted this as a sign that rate cuts are imminent.

To the surprise of the Fed, despite the rate cuts projected for the year, market players and bond markets are anticipating that these will be cut even faster – a sign that financial markets believe that the Fed is close to overtightening.

In response to the dot plot, Madison Faller, Global Investment Strategist at J.P. Morgan wrote,

“That’s still well above the roughly 3.8% that markets are calling for, but it’s a big decline that implies the Fed thinks it will cut rates three times next year.”

An article from the Wall Street Journal’s Nick Timiraos summarized the situation perfectly,

“Powell is finally getting what he wanted: A meaningful decline in inflation. But that is creating a familiar headache by making it harder for Fed officials, who want to keep their options open, to dissuade investors that rate cuts are imminent.”

EQUITIES AND DEBT

While the job market remains robust, and policymakers preparing to guide the economy into a soft landing, equities have surged on expectations of falling borrowing costs and end to higher-for-longer policies.

After a poor performance in 2022 following multi-decade highs in inflation, supply disruptions and geopolitical crises, stocks have performed very well in the past twelve months.

Source: S&P Global

At the time of writing, the S&P 500 is up 24.2% YTD, the DJIA is up 13.3% YTD and Nasdaq has surged 43.35% YTD. Nimble money market funds in particular are driving up stock prices.

The tech-heavy Nasdaq has benefited from the strong run-up in this segment, with much of the S&P 500’s gains being concentrated in the ‘Magnificent Seven’ – Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla.

With rising confidence that policy rates will no longer rise, the outlook has turned positive for companies that possess weaker financials, operate pro-cyclical businesses, and have a smaller market cap compared to the Magnificent Seven.

After having sunk to its recent low of approximately 4,120 in late October, the S&P 500 is now fast-approaching its all-time intra-day high on the back of the Fed’s dovishness and an expectation of lower capital costs.

Building on this momentum, Goldman Sachs analysts raised their 2024 target price by 8% and expect the S&P 500 to scale 5,100.

On the whole, equities have remained fairly bullish and are pricing in a soft or no-landing scenario at this time.

BONDS

Overall, bond returns have been on the weaker side this year, with inflation remaining intact for longer than initially anticipated, a higher than expected run up in rates, and monetary policy narrative that rates would have to remain elevated to bring inflation to target levels.

Sensing the Fed’s intentions to cut rates, the 10-year treasury yields have dropped a whole 1% since the 2023 peak in October which was pushing nearly 5% levels at the time.

Source: FRED Database

In the middle of the year, bond yields surged higher, far outdoing the earlier peak in March 2023 due to far-reaching uncertainty owing to the US debt downgrade by ratings giant Fitch, and the raging battle over government borrowing and the debt ceiling.

10-year paper fell below 4% levels in December 2023 for the first time since July 2023 amid the growing consensus on a weaker growth trajectory and lower inflation.

The 2-year paper which is closely aligned with Fed policy was trading above 5.2% in October 2023, having risen from a low near 3.5% in March 2023.

However, with expectations that inflation is cooling rapidly, the 2-year has also entered a downtrend and is currently trading at 4.38%

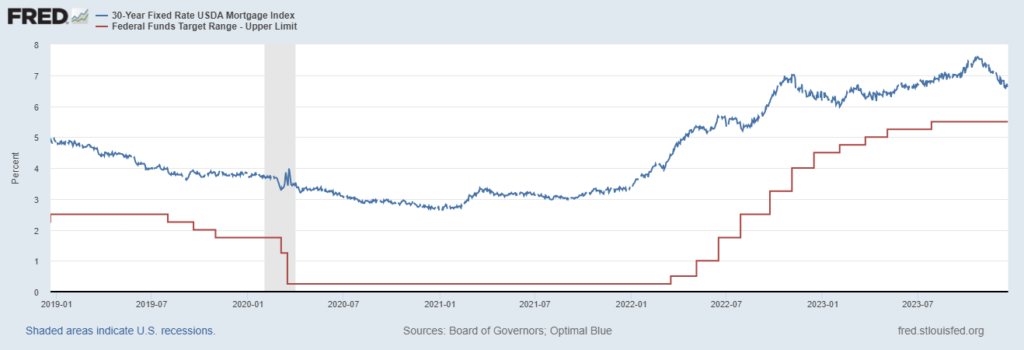

US REAL ESTATE, GOLD, AND OIL

With interest rates remaining elevated through 2023 and bond yields surging during the year, first-time home buyers found the market especially challenging as 30-year mortgage rates followed the Fed up to a two-decade high of 7.8%, while Q3 median home prices were above $400,000.

Source: FRED Database

The severity of the disruption becomes evident when we realize that 15-year fixed rates nearly tripled from an average of 2.4% in January 2022, to 6.6% in December 2023.

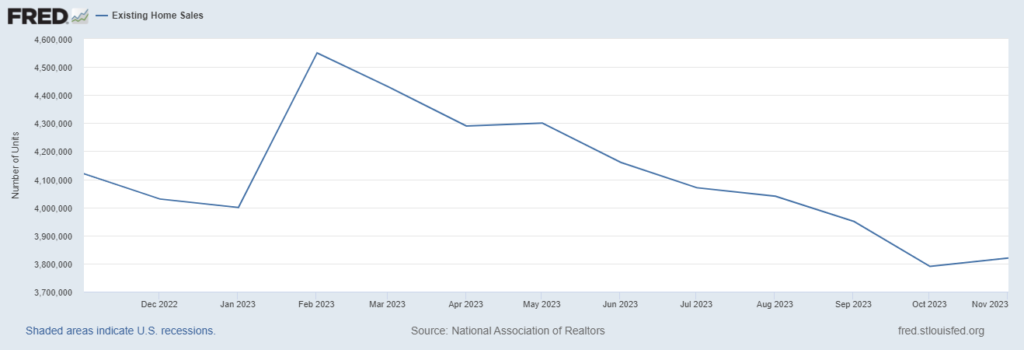

Given the environment, earlier this year, existing home sales fell to 3.8 million in October 2023, the lowest in over a decade.

Source: FRED Database

Mortgage applications for the first week of December 2023 were down 17% YoY and are likely to show a positive trajectory amid rate cut expectations.

However, in November data released earlier this week, existing home sales unexpectedly rose by 0.8% MoM, although they remain more than (-)7% YoY lower.

These low levels are expected to have a negative impact on associated industries such as hardware stores and furniture retailers.

A TURNAROUND FOR BUYERS?

For the first time in three months, data from Freddie Mac showed that mortgage rates slipped under 7% last week, which should improve affordability.

Earlier this month, refinancing activities which were stunted during the year recorded two consecutive weeks of positive growth for the first time since 2021.

In addition, the latest building permits data released this week showed an improvement of over 4% YoY for November 2023, the first increase in 16 months, suggesting that lower rates may be breathing life into the real estate market.

Crucially, US single-family housing starts surged 18% during the month of November.

GOLD

Global gold prices have performed well this year, and rose 11.8% YTD, while also briefly marking a new all-time high of $2,152.30 on 4th December 2023.

This was short lived but prices have remained above $2,000.

The rally in the yellow metal has come despite the Federal Reserve’s higher-for-longer policies, even as it competes directly with interest bearing assets.

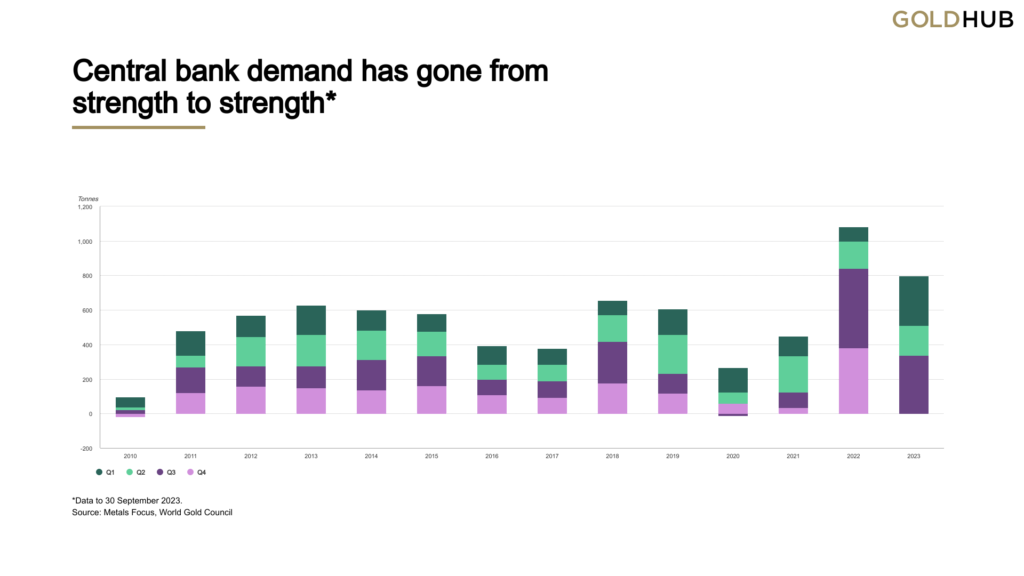

Support has come from the US’s regional banking crisis, concerns of a prolonged economic slowdown, geopolitical triggers, the sharp purchases by central banks, and as a hedge against rising inflation.

Source: World Gold Council (Q1-Q3, 2023)

The metal is likely to continue to rally into 2024, as inflation forecasts come down, rate cuts are operationalized, and the dollar weakens.

OIL PERFORMANCE

Following the outbreak of the global pandemic in 2020, concerns of oil demand crashing drove WTI prices to south of $20 per barrel. While demand was still gingerly recovering over the next two years, geopolitical concerns, sanctions on Russia and the onset of the Ukraine-Russia war propelled oil prices well over $100 per barrel.

In January 2023, markets eased to about $80 per barrel.

During the year, both demand and supply have been relatively strong compared to forecasts, despite threats from the US regional banking crisis, continued lockdowns in China, and fears of a US recession.

In the past twelve months, WTI traded from a low of $63 per barrel to a high of $95 per barrel; while Brent too approached the $100 mark in September and October 2023.

However, year-to-date, the WTI and Brent have fallen 8.5% and 8.1%, respectively, and are both trading in the $70 range, owing to expectations of excessive supplies, contrary to the earlier belief that chronic underinvestment would lead to severe shortages.

Instead, oil prices have dived sharply over the past three months as supply growth from the US has remained near the 2 million barrels per day mark, even as OPEC+ operationalized four consecutive production cuts.

Prices and volumes are also likely being supported to an extent by the expected soft-landing scenario and the United States’ efforts to top up its Strategic Petroleum Reserve.

Karim Fawaz , Director in the Energy and Natural Resources group at S&P Global Commodity Insights believes that the Psychology of market has shifted from,

“…scarcity fears to we are in a comfortable situation.”

OUTLOOK AND DIVERGENCE CONCERNS

Although inflation has been in a downtrend in most advanced countries, the Fed’s recent declaration of rate cuts in 2024 may have fuelled over-optimism among market participants.

The dot-plot has led to considerable speculation that inflation will reach 2% levels much ahead of schedule

Perhaps markets have interpreted the Fed’s comments as an acknowledgement that risks of inducing a recession have increased, and that rapid softening is the need of the hour to avoid the prospect of overtightening.

This sudden shift in the narrative has been met with a variety of rate cut projections for 2024 and beyond, while confusion has been furthered by reports that two officials estimated zero and six quarter point cuts in the next twelve months.

Economists at EY anticipate four rate cuts in the year, while Goldman Sachs is projecting five rate cuts – three through H1, and twice more in H2.

Expectations of such deep actions are supported by CME FedWatch Tool which shows a 40% probability of policy rates reaching 3.75% – 4.0% by November 2024, even as Governor Powell tried to dissuade markets from believing that the March cut was a foregone conclusion.

This remarkable turnaround in market perception poses its own risks, particularly as PCE remains at 3.0% and the latest core PCE was 3.5%.

Even as a recession is no longer the core forecast, concerns of stubborn inflation appear to have instantly melted away despite the unclear impact of monetary lags, which could accelerate the risk of raising real interest rates.

Geopolitical risks and re-emerging widespread public health concerns could threaten longer inflation, leading to a stagflationary situation particularly if supply chains are compromised again.

Monetary easing should signal a soft-landing scenario, lower credit stress, and improved demand, which is likely to power a run up in equities.

The fact that markets may get ahead of themselves with strongly rising equities and compressed bond yields will require a careful assessment of risks, while the road to 2% may prove bumpier than anticipated.

FINAL WORDS

● The last 12 months have been sound for equity investors, although gains have been highly concentrated in the AI segment.

● Bond yields have eased significantly from 2023 peaks and are expected to continue to sink.

● In the December 8th meeting, Governor Powell indicated that the rate hike cycle has come to a close, and rate cuts are on the horizon.

● This suggests that policymakers believe that inflation is no longer a concern.

● Instead, it points to the possibility of overshooting on rate hikes, ad tightening excessively.

● However, inflationary concerns could still persist particularly due to geopolitical concerns and ineffective supply chains.

● Rate cut expectations are varied and have led to significant confusion, with estimates lying between zero cuts and six cuts in the year.

● Broadly speaking, market players who were looking for clues to how much longer the higher-for-longer policies may last have suddenly switched to expecting a rapid pace of easing.

● Falling mortgage rates may infuse confidence into the real estate sector, while gold prices are trading near all-time highs and oil prices have seen a steep decline over the past three months.

● Investors must be attentive to the risks of overestimating the speed of cuts by the Federal Reserve.