As we approach the end of 2024, the US economy displays mixed signs of resilience and challenges. The OECD (Organization for Economic Cooperation and Development) reports a slight pickup in the global economy, expecting a 3.2% increase in global output for both 2024 and 2025. The US has significantly contributed to this upward revision due to falling interest rates and recovering real wages, which should drive growth. However, despite this improved outlook and cautious optimism, consumer confidence remains low. Persistent inflation in food prices, which has stayed above pre-pandemic levels, is a major concern.

Source: Bureau of Labor Statistics

TAKE NOTES

Inflation, a critical concern for policymakers and consumers, appears to be easing. The OECD predicts that inflation rates will fall to central bank targets by the end of 2025. In response, the Federal Reserve is gradually lowering interest rates, with an additional reduction of 1.5 percentage points expected by the end of 2025.

However, the situation remains unstable. While there is cautious optimism about the outlook, the OECD warns that uncertainties—such as the impact of high interest rates on demand and potential escalations in geopolitical conflicts in the Middle East—could disrupt current projections.

Investment Opportunity & Risk

Micron Technology (MU)

- Micron has seen a significant surge in its stock price, jumping about 12% after the company reported better-than-expected quarterly results. Driven by robust demand for AI-related chips, Micron’s revenue nearly doubled compared to the previous year, signaling strong momentum heading into 2025.

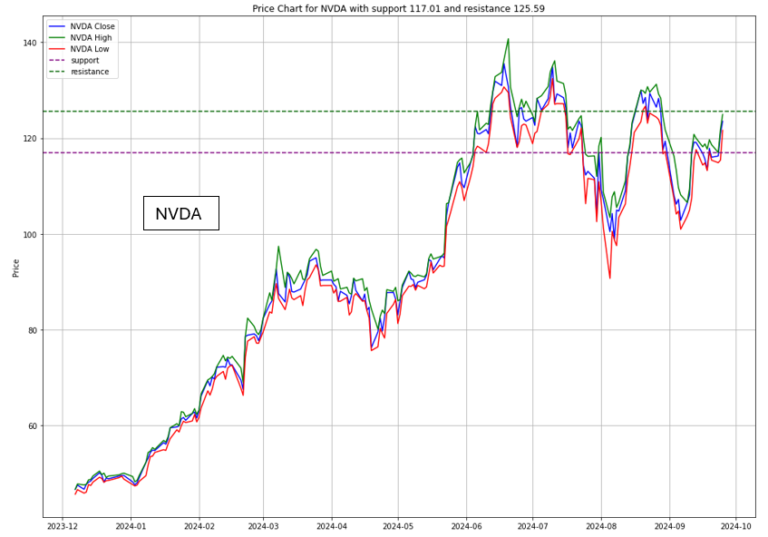

Nvidia (NVDA)

- Nvidia continues to be a major player in the AI hardware market, with a recent report predicting that the market could grow to nearly $1 trillion by 2027. This optimism has helped Nvidia’s stock to rise, despite concerns about the pace of AI spending in the coming years.

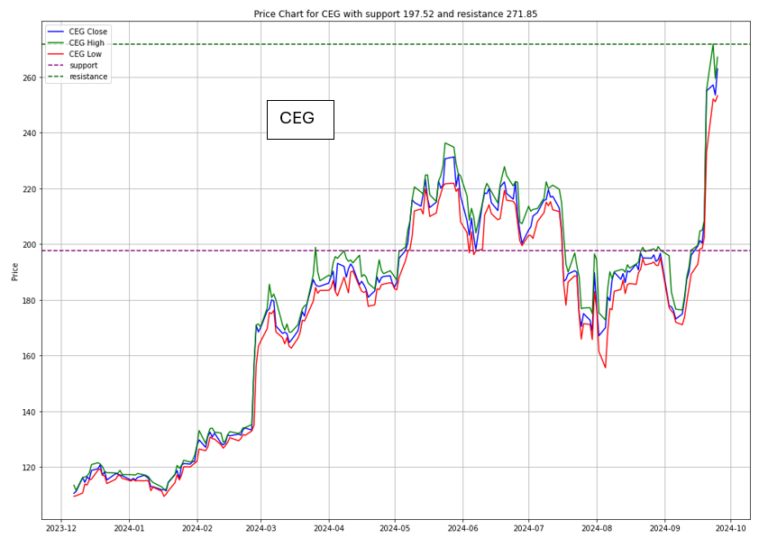

Constellation Energy (CEG)

- Constellation Energy is positioning itself as a key player in the AI-driven power demand surge. The company plans to reopen the Three Mile Island nuclear facility to meet Microsoft’s massive energy needs, marking a significant step in the revival of nuclear power in the US. The deal with Microsoft has already propelled Constellation’s stock to new highs.

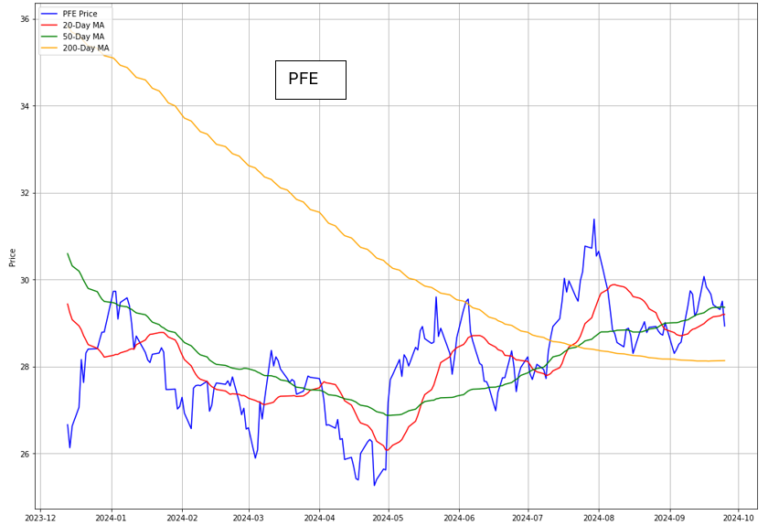

Pfizer (PFE)

- In a move that surprised many, Pfizer announced the withdrawal of its sickle-cell drug, Oxbryta, from worldwide markets. This decision follows clinical data suggesting that the risks of the drug now outweigh its benefits. Despite this setback, Pfizer does not expect the withdrawal to impact its full-year financial guidance significantly.

Stellantis (STLA)

- The Stellantis’s the maker of Jeep and Ram, is facing significant challenges in the US market, with declining sales and market share. CEO Carlos Tavares has acknowledged missteps and is now focused on reviving the company’s fortunes by adjusting pricing strategies and ramping up marketing efforts.

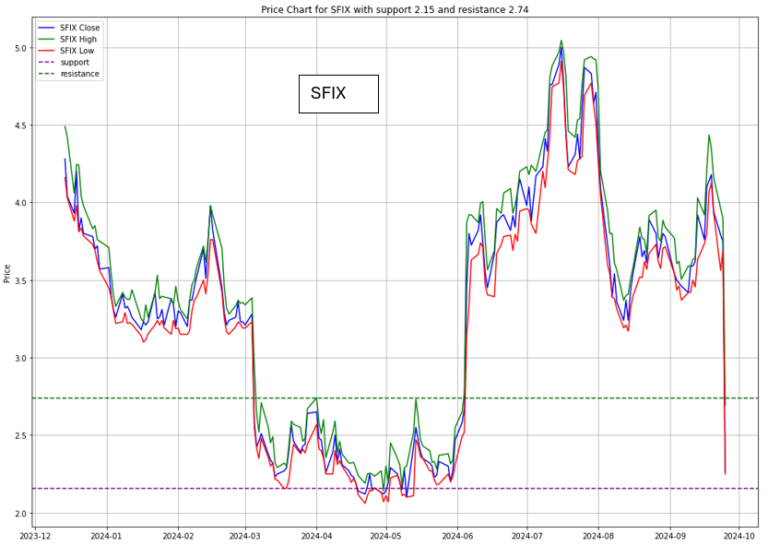

Stitch Fix(SFIX)

- The company’s stock has plummeted, highlighting the risks in the retail sector. Once a high-flying stock, Stitch Fix’s value has dropped dramatically, reflecting broader challenges faced by retailers in the current economic environment.

CONCLUSION

- The US economy and stock market are navigating a complex landscape, marked by both opportunities and risks.

- While certain sectors, particularly those linked to AI and technology, continue to thrive, others face significant headwinds.

- As inflation gradually comes under control, and with strategic adjustments by companies like Stellantis and Constellation Energy, there is cautious optimism for continued growth.

- However, investors should remain vigilant, especially in sectors facing high valuations or structural challenges.

Please note that all information in this newsletter is for illustration and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any investment products or services.

About the Author

Rein Chua is the co-founder and Head of Training at AlgoMerchant. He has over 15 years of experience in cross-asset trading, portfolio management, and entrepreneurship. Major media outlets like Business Times, Yahoo News, and TechInAsia have featured him. Rein has spoken at financial institutions such as SGX, IDX, and ShareInvestor, sharing insights on the future of investing influenced by Artificial Intelligence and finance. He also founded the InvestPro Channel to educate traders and investors.

Rein Chua

Quant Trader, Investor, Financial Analyst, Vlogger, & Writer.