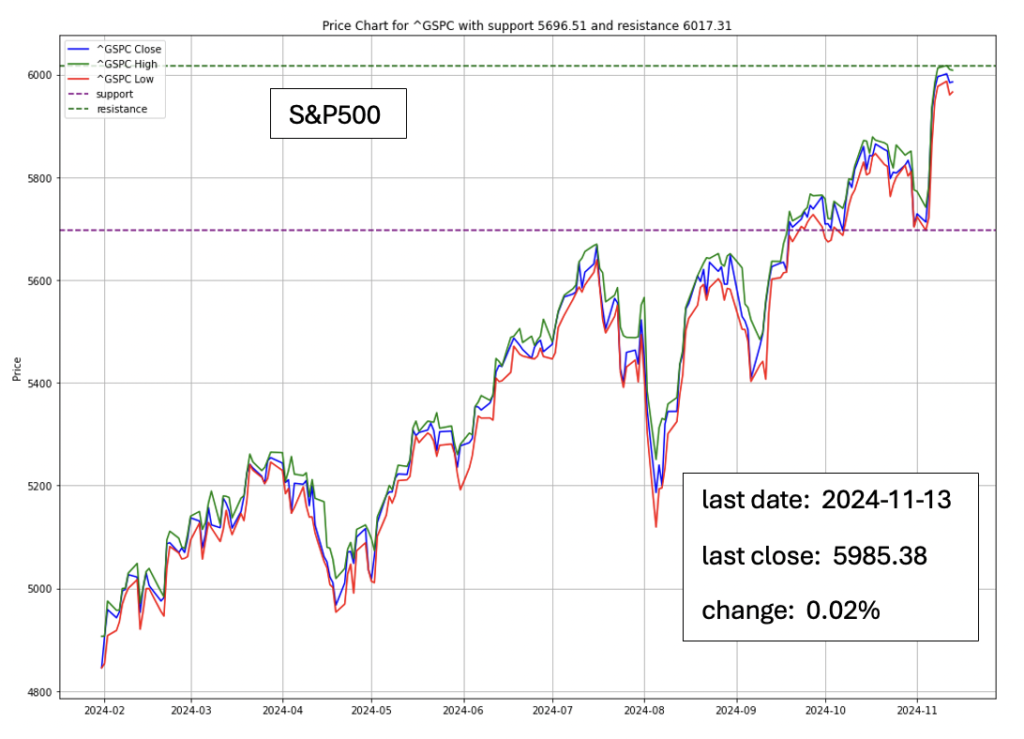

In New York trading, equities lost steam late in the session as inflation climbed, with the S&P 500 nearly erasing earlier gains that had been driven by expectations surrounding the latest inflation data.

The latest US Consumer Price Index (CPI) data reveals an annual increase of 2.6% as of October, up slightly from 2.4% in September. This slight rise indicates continued inflationary pressures, with core inflation, excluding food and energy, remaining steady at 3.3% year-over-year. Despite this persistence, inflation is still trending lower from the peaks observed in prior years, helping fuel market optimism for a December rate cut by the Federal Reserve. Analysts note the firm housing costs, which constitute a significant portion of the CPI increase, continue to challenge the Fed’s target.

Fed Expected to Cut Rates in December

Amid these inflationary concerns, as inflation climbs, market participants largely expect the Fed to proceed with a 0.25% rate cut in December. This comes as consumer spending and employment maintain steady growth, raising potential discussions within the Fed on tapering rate cuts in 2025. However, Fed officials have indicated caution, pointing to a possible ‘neutral rate’ where economic growth neither accelerates nor slows down significantly.

Source: NBC News

US Dollar Gains on Trade Protectionism Fears

The US dollar has strengthened against major G-10 and Asian currencies amid heightened trade protectionism concerns. This appreciation is partly due to expectations of a more aggressive trade stance under the upcoming administration, which could introduce tariffs impacting international trade. The prospect of such a shift has fueled demand for the dollar as a safe-haven asset, impacting global trade dynamics and the operations of US-based multinational companies, particularly those with significant international revenue like Apple and Microsoft.

Source: Nikkei Asia

Investors Track Inflation and Global Impact Through PPI

Investors are watching the upcoming PPI report for additional insights into inflation trends, with October’s PPI expected to reflect slight increases, signalling resilience in producer prices amid international inflationary pressures. Japanese economic data showing higher-than-expected producer prices, alongside a weakening yen, may prompt further policy interventions by the Bank of Japan, which could have cross-border implications for global trade and US multinational corporations.

WATCHOUT

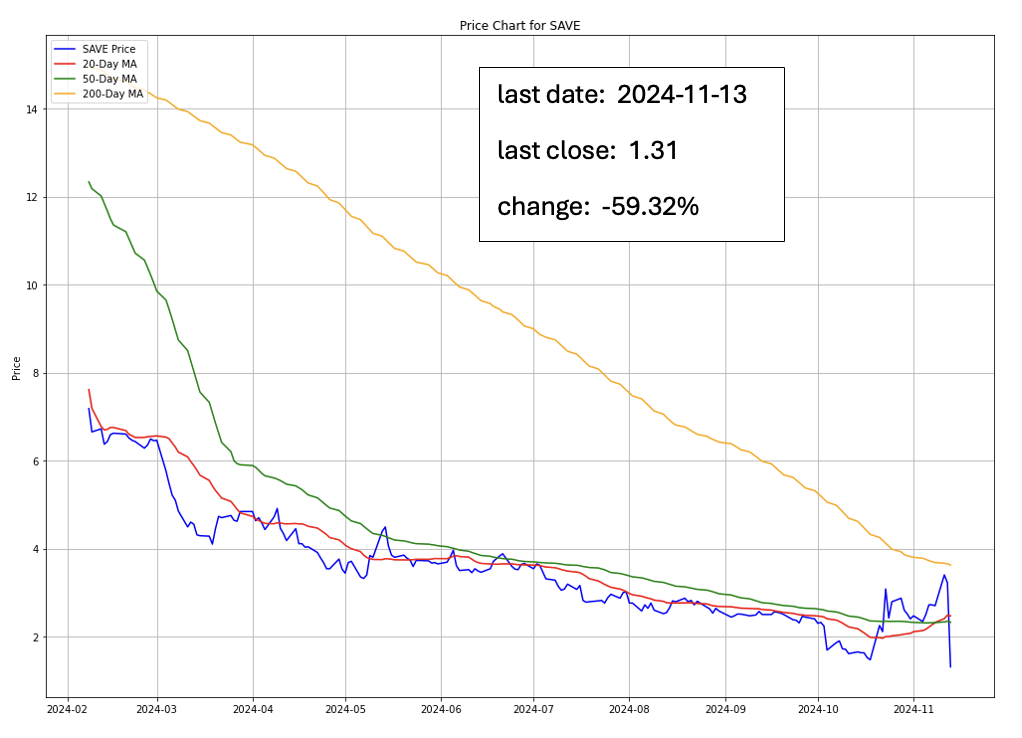

Spirit Airlines Falls Over Bankruptcy Concerns

In stark contrast, Spirit Airlines faced a precipitous decline of over 59% following reports that the company may seek bankruptcy protection. This development underscores the volatile nature of the airline industry, which continues to navigate post-pandemic challenges and economic headwinds.

Investment Opportunity & Risk

Cisco(CSCO)

Cisco reported a 5.6% drop in first-quarter revenue, primarily driven by a downturn in its core networking and collaboration segments. However, robust AI-related investments have elevated Cisco’s outlook, with the company forecasting revenue growth in its fiscal second quarter and for the full fiscal year of 2025. Cisco’s AI-driven infrastructure orders exceeded $300 million, and the company remains on track to meet its ambitious AI sales goals. This pivot toward AI, alongside restructuring efforts including a 7% reduction in workforce, reflects Cisco’s adaptation to a shifting tech landscape.

- There might be some volatility as traders position for both upside and downside moves. However, the significant CALL volume around the 65 strike could mean there’s a bias towards a potential moderate upside. The stock may experience slight upward pressure but is likely to encounter resistance near the 65 level due to option-related interest.

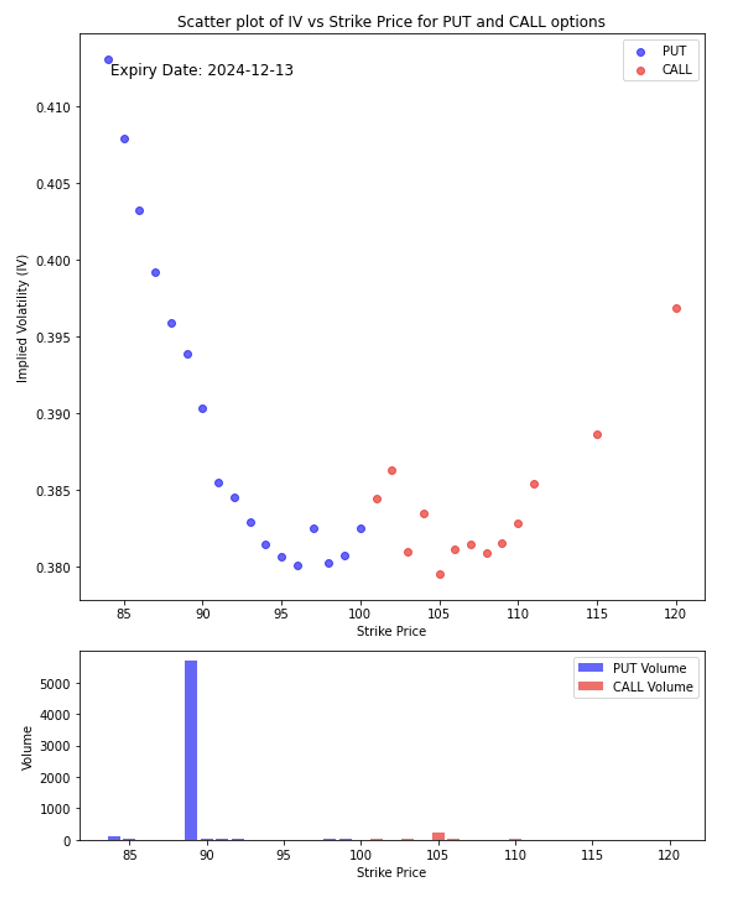

Walt Disney (DIS)

Disney is set to report its earnings, with investor attention centered on its streaming services, which turned profitable in the previous quarter. However, weaker performance in Disney’s parks and experiences division, attributed to moderated demand, may weigh on its results. Additionally, questions surrounding Disney’s leadership and CEO succession plans remain under scrutiny, potentially impacting long-term investor sentiment.

- The options data implies a cautious outlook, leaning slightly bearish due to the high PUT volume at the 90 strike, which indicates hedging or downside protection strategies. However, the low IV around the 95–100 range suggests limited immediate downside pressure. This could indicate that the stock is expected to remain relatively stable in the near term, with some investors preparing for a potential downturn.

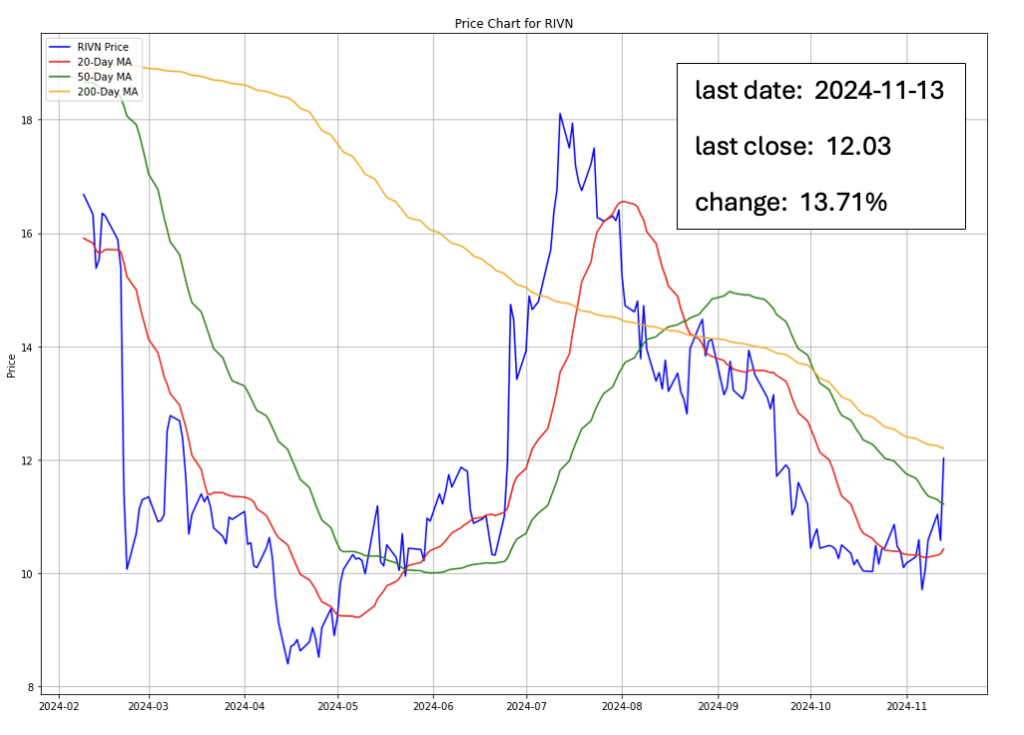

Rivian (RIVN)

Electric vehicle manufacturer Rivian saw significant gains, up 13.7%, driven by an expanded joint venture with Volkswagen, now valued at $5.8 billion. This bolstered confidence in Rivian’s growth trajectory and its potential to capitalize on global EV market expansion.

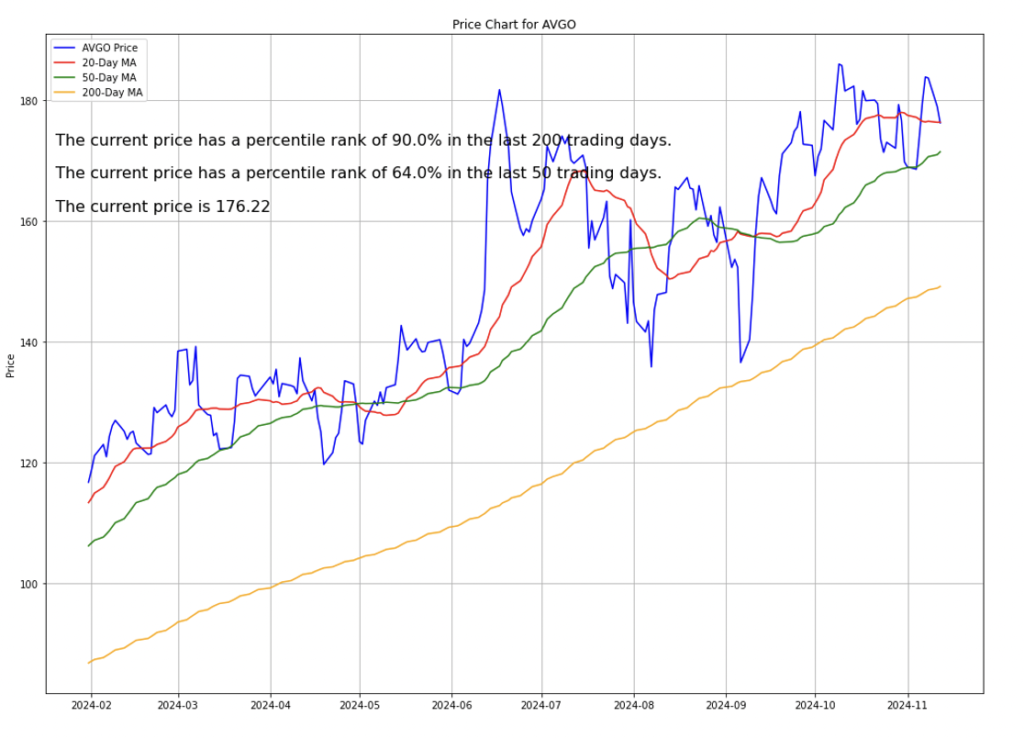

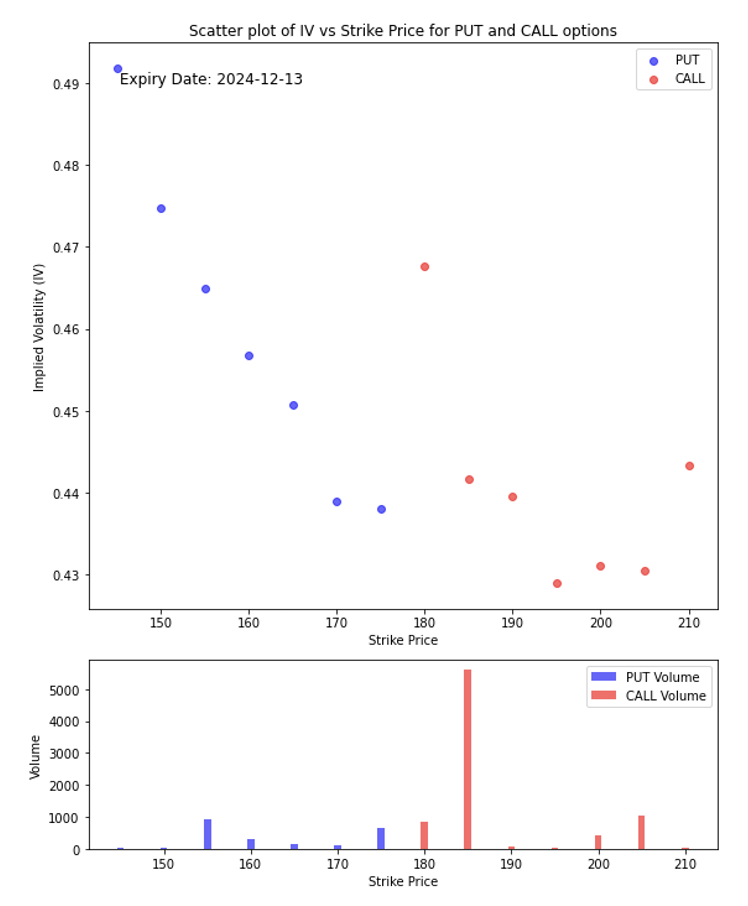

Broadcom (AVGO)

As one of the world’s top semiconductor firms, Broadcom is up 56.7% year-to-date and is rated a “Strong Buy” by analysts, who cite an 11.5% upside. Its extensive portfolio includes analog and digital ICs, with a stronghold in data center networking.

- Bullish Indicators: The high volume in CALL options, especially around the 180 strike, suggests bullish sentiment. Investors may anticipate an upward movement toward 180 or are positioning for gains if the stock appreciates.

- Mixed Risk Sentiment: Although there’s a downward slope in implied volatility, indicating potential downside risk perceived at lower strikes, the lack of high PUT volume suggests that investors aren’t strongly hedging for a sharp decline.

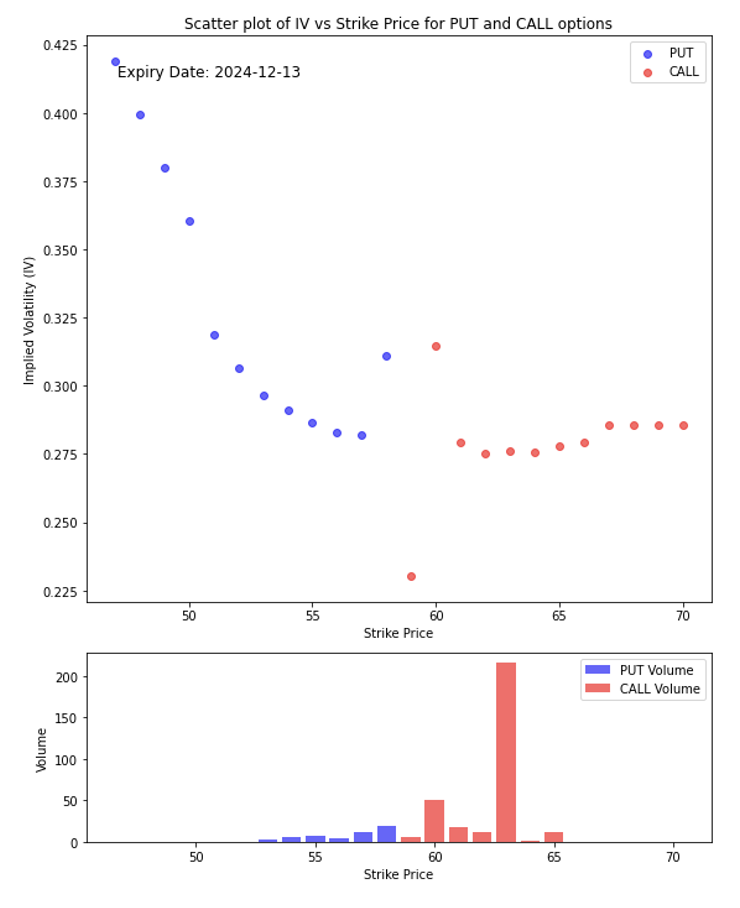

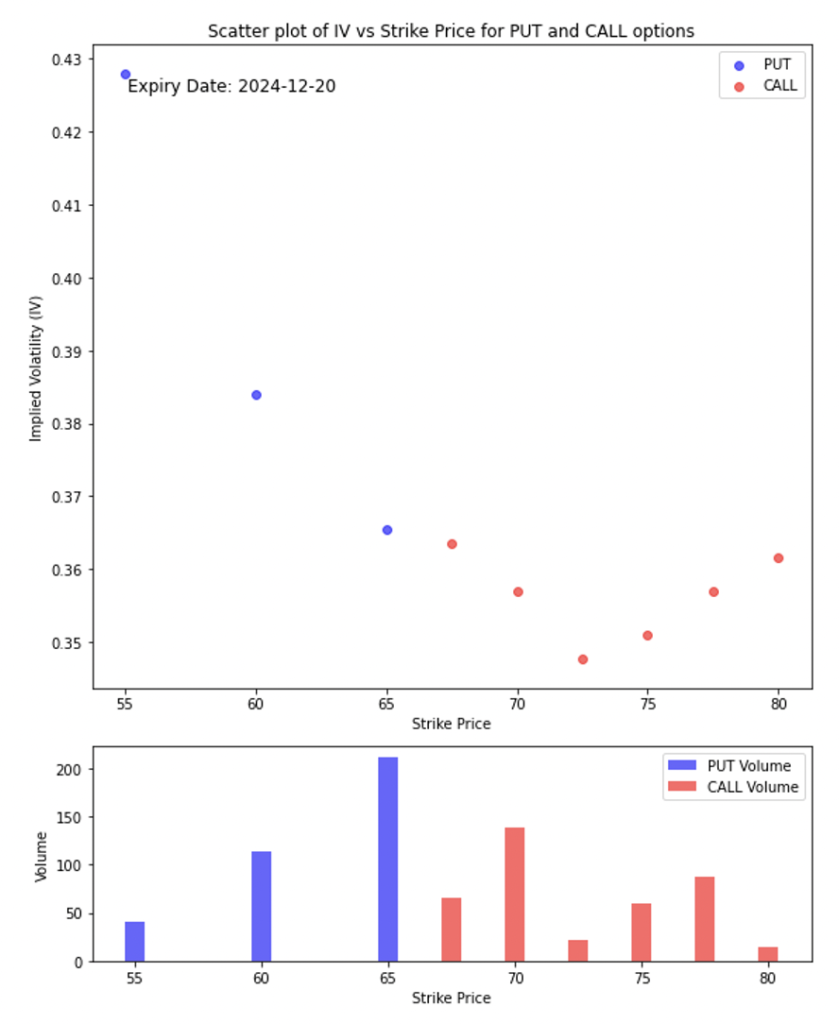

Microchip Technology (MCHP)

Known for embedded control solutions across multiple sectors, Microchip is appealing for its consistent dividends, high analyst ratings, and a projected 28.2% price increase.

- Bearish Sentiment: The high volume in PUT options, especially at the 65 strike, indicates caution and a possible hedge against downside risks, as investors prepare for the stock potentially dropping to or below this level.

- Moderate Upside Interest: The presence of CALL volume at the 70 and 75 strikes suggests some interest in potential upward movement, but the lower implied volatility and lack of concentrated CALL volume imply limited bullish sentiment.

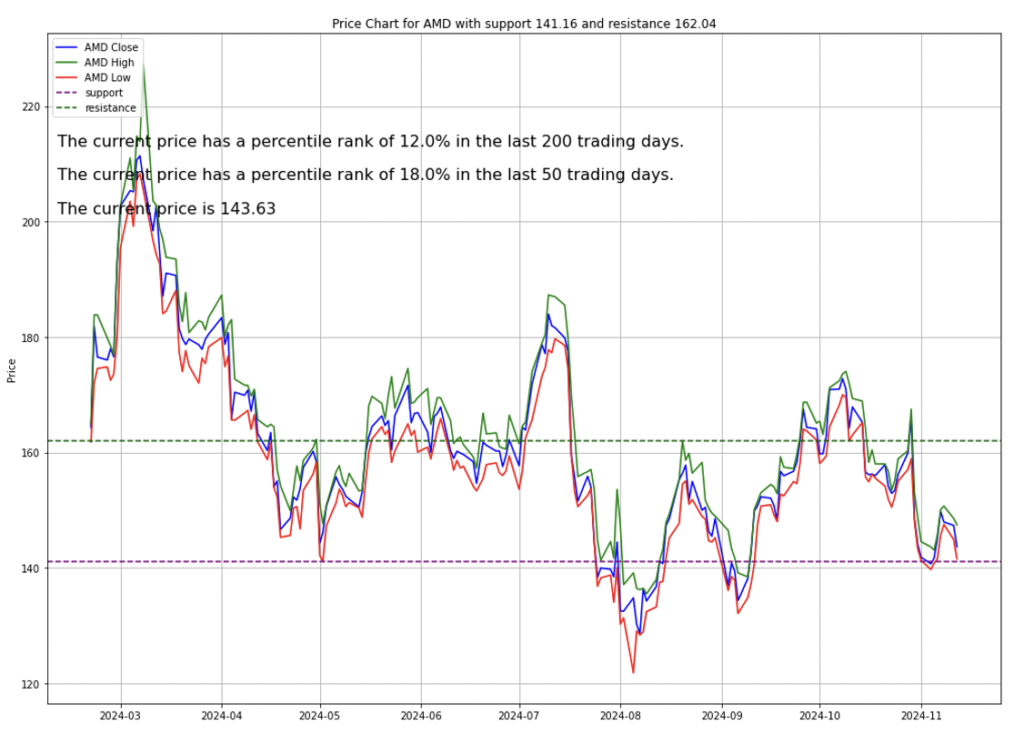

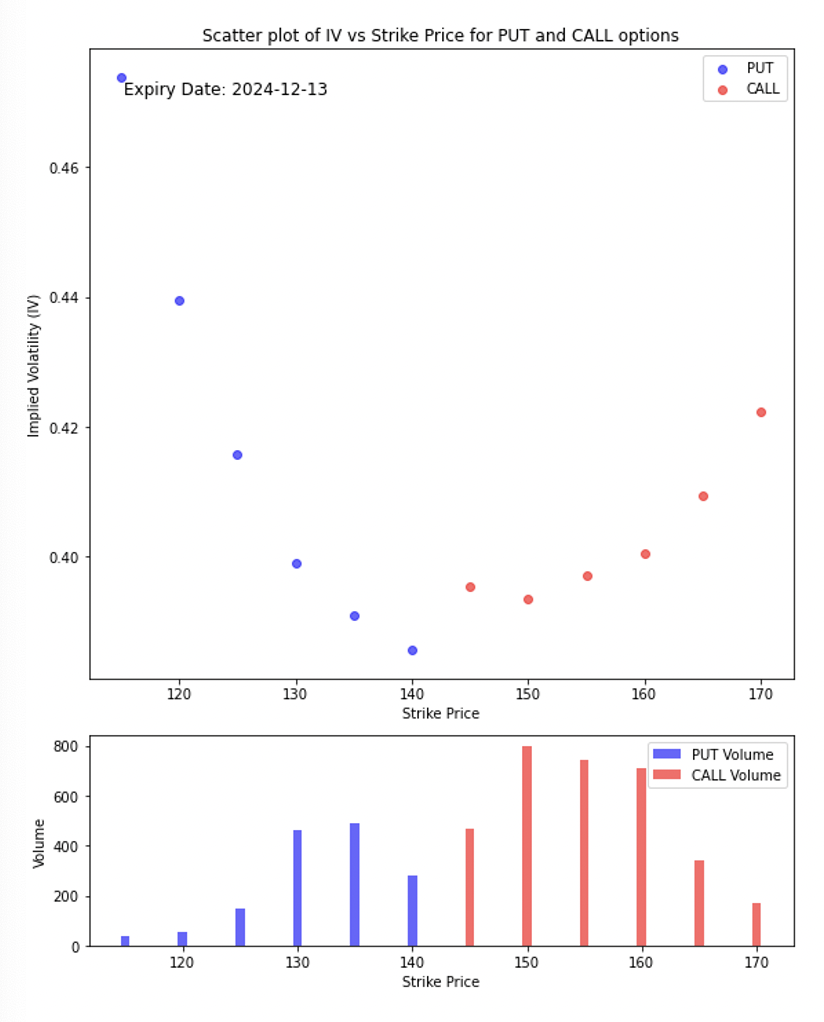

Advanced Micro Devices (AMD)

With a focus on AI and graphics processing, AMD offers a diverse revenue stream and an anticipated 36% upside potential, making it a high-conviction “Strong Buy” among analysts.

- This data reflects a cautiously bullish outlook. Investors are preparing for upside movement, especially around the 150-155 range, while still maintaining some downside protection. This setup suggests expectations of a moderate upward trend, with the possibility of pullbacks being managed through PUT options.

CONCLUSION

- The US economic and stock market landscape remains influenced by steady consumer demand and inflation pressures as inflation climbs.

- Internationally, the strength of the US dollar, anticipated US trade policy shifts, and potential interventions by global central banks present both challenges and opportunities for US companies, particularly those heavily reliant on exports and international markets.

Please note that all information in this newsletter is for illustration and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any investment products or services.

About the Author

Rein Chua is the co-founder and Head of Training at AlgoMerchant. He has over 15 years of experience in cross-asset trading, portfolio management, and entrepreneurship. Major media outlets like Business Times, Yahoo News, and TechInAsia have featured him. Rein has spoken at financial institutions such as SGX, IDX, and ShareInvestor, sharing insights on the future of investing influenced by Artificial Intelligence and finance. He also founded the InvestPro Channel to educate traders and investors.

Rein Chua

Quant Trader, Investor, Financial Analyst, Vlogger, & Writer.