The U.S. economy continues to exhibit resilience, with the stock market experiencing a market surge, pushing to new highs as mega-cap technology stocks lead a powerful rally. However, the broader market shows signs of uneven growth, as multiple sectors struggle to keep pace with the tech-heavy indices.

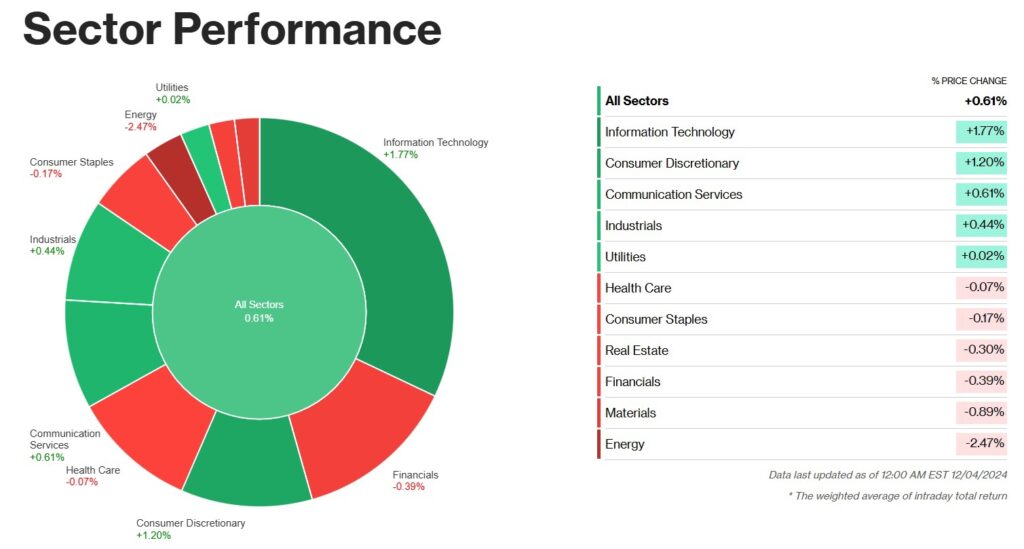

The S&P 500, Nasdaq Composite, and Dow Jones Industrial Average posted gains on December 4, 2024, supported by a market surge fueled by bullish sentiment in technology stocks. The S&P 500 rose by 0.61%, while the Nasdaq surged 1.30%, driven by all-time highs in mega-cap names like Apple (AAPL), Meta Platforms (META), and Amazon (AMZN).

Despite this, Federal Reserve Chairman Jerome Powell tempered enthusiasm by reiterating that rate cuts are unlikely in the near term. Powell’s remarks coincided with softer-than-expected economic data, including the ISM Services PMI and private-sector job growth, which helped push Treasury yields lower.

Slowing Job Growth and Services PMI Fuel Fed Pivot Speculation

The U.S. labor market and economic growth remain central to the Fed’s policy outlook. Amid a broader market surge, November’s ADP National Employment Report showed private-sector job growth of 146,000, falling short of expectations. Similarly, ISM Services PMI fell to 52.1% in November, signaling a slowdown in business activity.

Treasury yields declined, with the 10-year yield dipping to 4.18%. This drop, along with Powell’s cautious stance, hints at investors’ hopes for a pivot in monetary policy. Futures markets are pricing in a 77% probability of a 25-basis-point rate cut at the Fed’s December meeting, though Powell emphasized the need for a cautious approach.

GLOBAL IMPACT

China's Uneven Recovery Challenges U.S. Companies Amid Tech Tensions

The Chinese economy’s recovery remains uneven, impacting U.S. companies reliant on Chinese demand, such as Apple and Tesla. Amid a broader market surge, geopolitical tensions surrounding U.S.-China technology competition also pose risks to supply chains and export markets.

Source: EurAsian Times

Energy Prices Swing Amid OPEC+ Moves and Geopolitical Risks

Fluctuations in global oil prices, driven by OPEC+ production decisions and geopolitical risks in the Middle East, continue to influence energy stocks and broader inflation trends

Source: Orient Energy Review

Eurozone Weakness Threatens U.S. Exports

The Eurozone’s economic stagnation, coupled with rising energy costs, could limit U.S. export growth to the region, particularly in sectors like industrial goods and consumer products

Source: Euro News

WATCH OUT

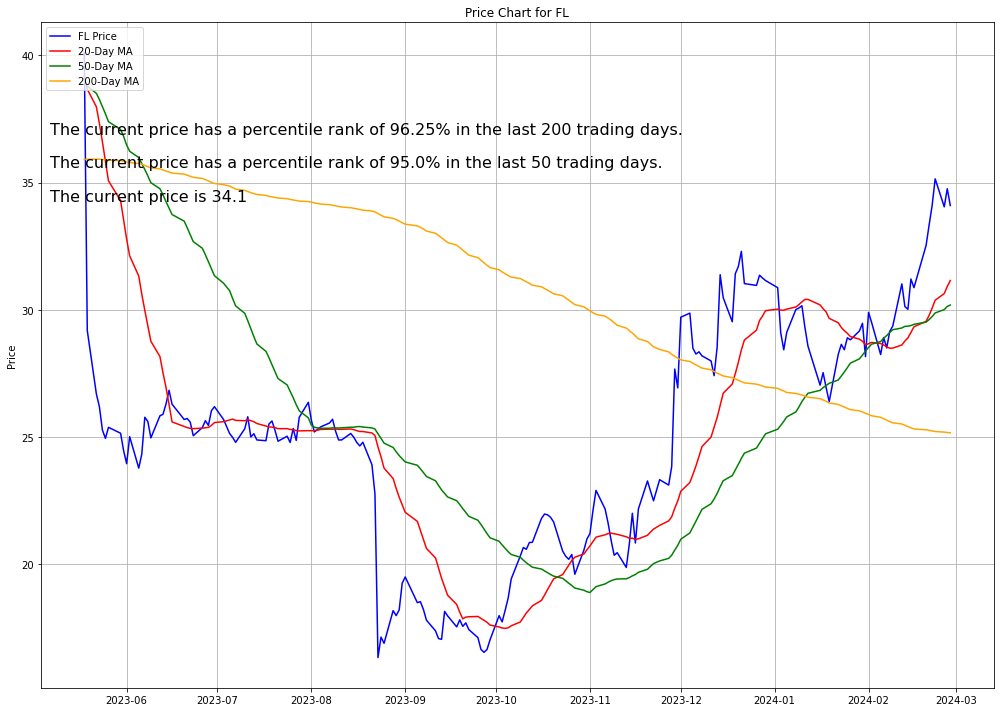

Foot Locker Drops 9% on Weak Earnings

Foot Locker tumbled nearly 9% after disappointing earnings and a downgraded outlook due to weak consumer spending.

Nike Slips Amid Retail Sector Challenges

Nike declined slightly, reflecting broader challenges in the retail sector.

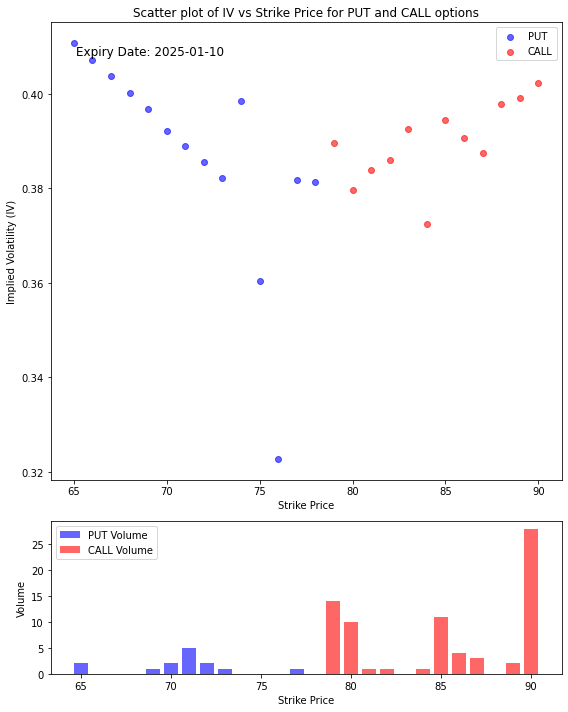

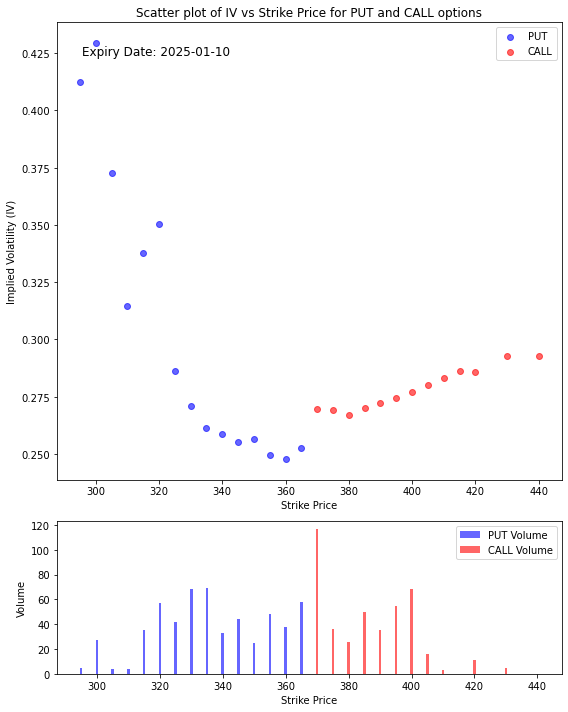

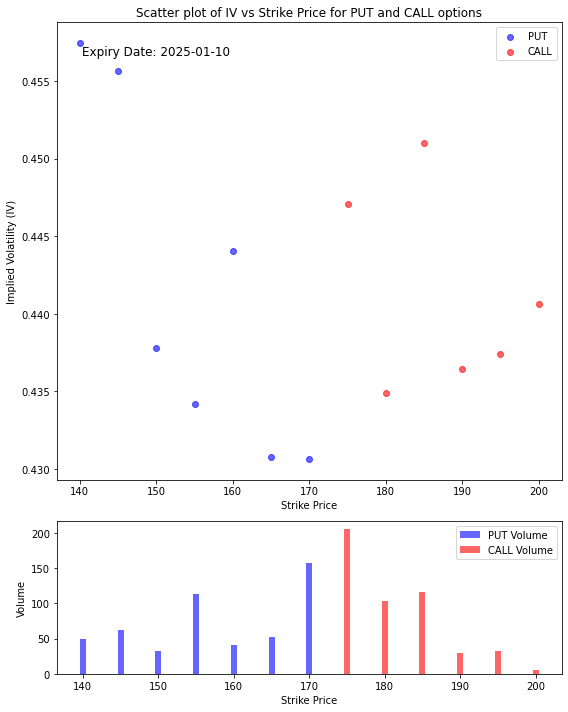

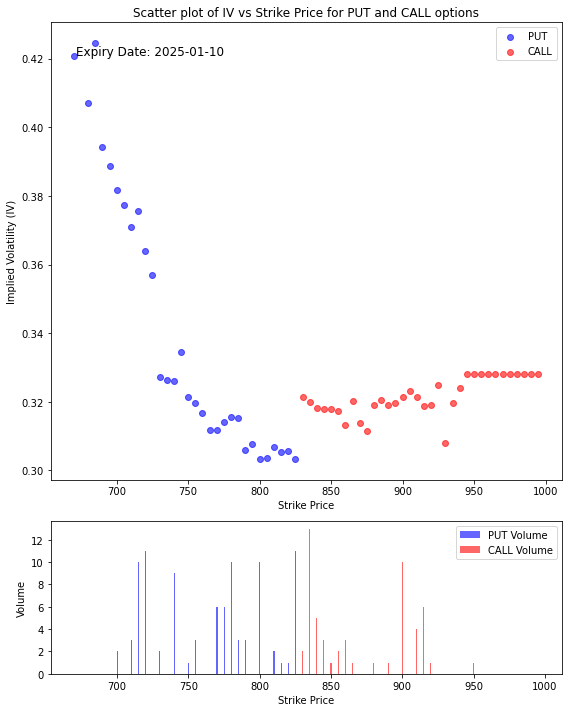

This stock exhibits a bullish bias, with strong call volume and elevated IV at higher strike prices. The market appears to anticipate potential upward movement, possibly driven by positive news or strong fundamentals. However, the presence of some put activity highlights residual caution about downside risks.

Investors Shift to Risk as Optimism for 2025

Utilities and staples underperformed, despite a favourable interest rate environment. The defensive retreat underscores investors’ renewed appetite for risk, fuelled by bullish technical and optimism for 2025 economic growth.

Investment Opportunity & Risk

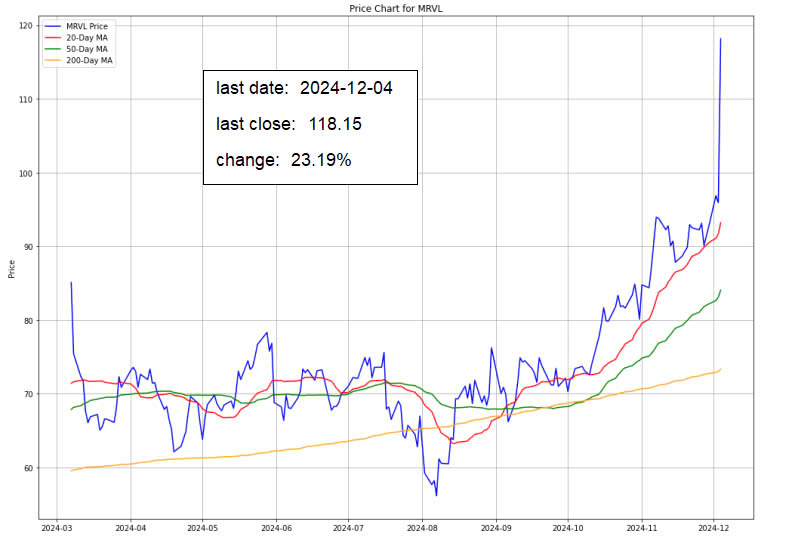

Earnings results from Salesforce (CRM) and Marvell Technology (MRVL) underscored strong demand for artificial intelligence (AI) and cloud-based technologies, further fueling optimism in the tech sector. Salesforce’s revenue exceeded expectations, while Marvell’s sequential revenue growth guidance of 19% highlighted the burgeoning demand for custom AI silicon solutions.

Marvell Technology (MRVL)

Marvell Technology surged over 23% after announcing strong revenue growth driven by AI silicon programs.

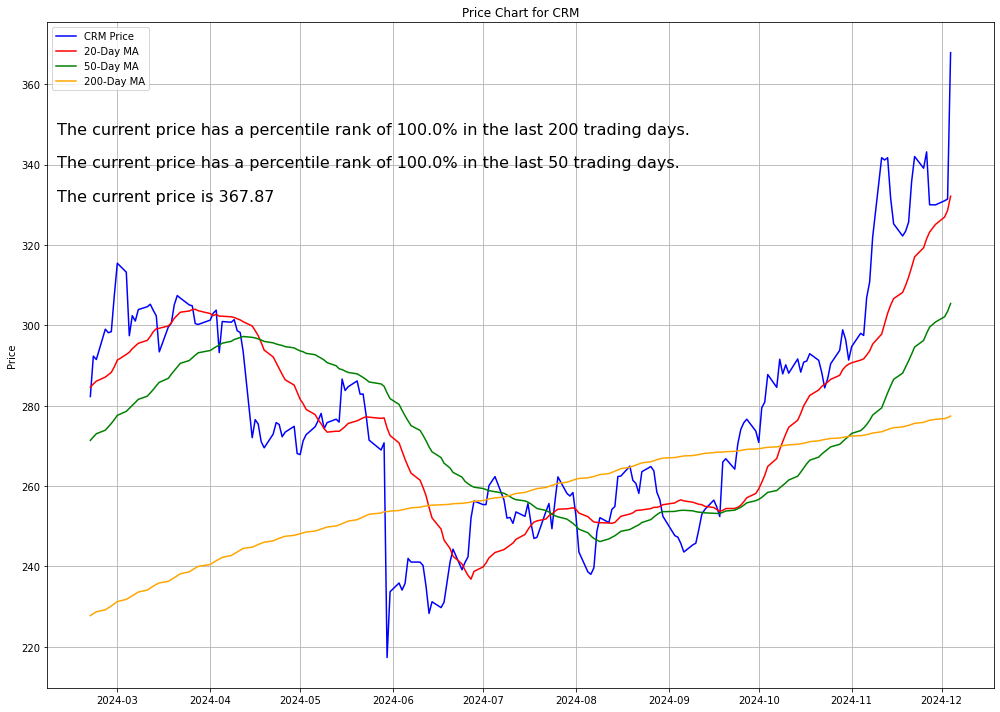

Salesforce (CRM)

Salesforce climbed nearly 11% on revenue growth and raised guidance, despite an earnings miss.

- Based on this data, the stock appears poised for a possible upward movement, as implied by the higher call volumes and a focus on strikes above the ATM level. However, the higher put volumes at lower strikes reflect caution, suggesting that while a bullish sentiment exists, some traders are preparing for potential downside risk. A broader market or news catalyst may determine the actual direction.

- It’s apparent that at the current price, the net force still projects more on the bullish side.

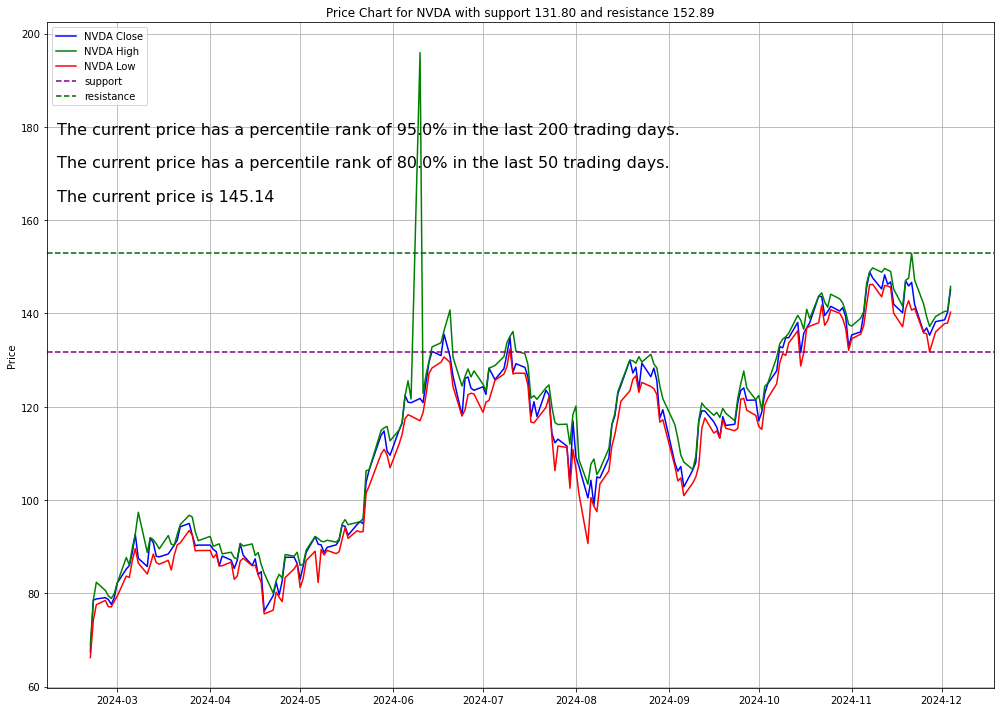

Nvidia (NVDA)

Nvidia advanced 3.48% as AI demand continues to underpin its leadership in AI-chip development.

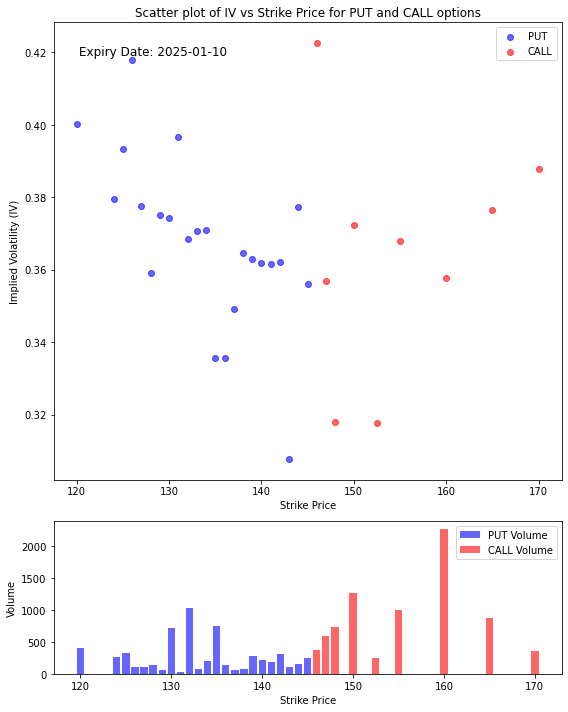

- This stock appears to have bullish momentum, as evidenced by the higher call volumes at out-of-the-money strikes and elevated IV at those levels. The market may anticipate positive catalysts or robust performance leading to a price increase. However, the relatively moderate activity on puts suggests a hedge against downside risks is still present, although not dominant.

- The market appears to be predicting that in the near future the price will stabilize at 160, possibly breaching the resistance level of 152.89 which we derive by aggregating the moving local extremity levels of the stock price.

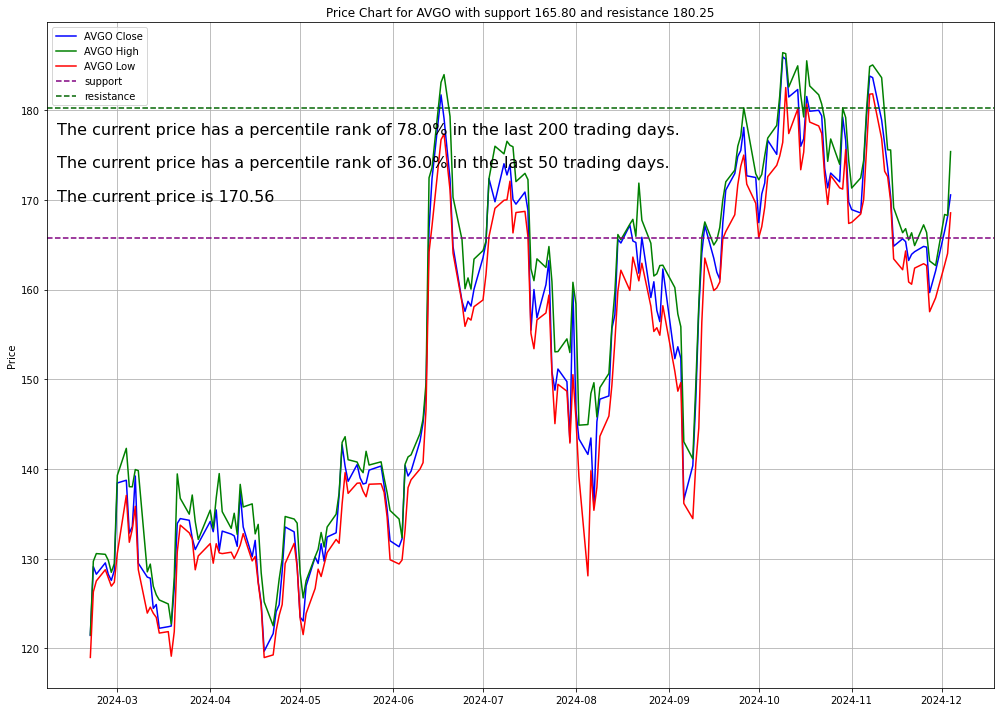

Broadcom (AVGO)

Broadcom set to release earnings next week, likely to serve as a key indicator for semiconductor demand.

This stock shows mixed sentiment. The large call volume at 180 and rising IV for out-of-the-money calls suggest expectations for a price increase. However, the high put volume at 170 indicates some market participants are hedging or preparing for downside risks.

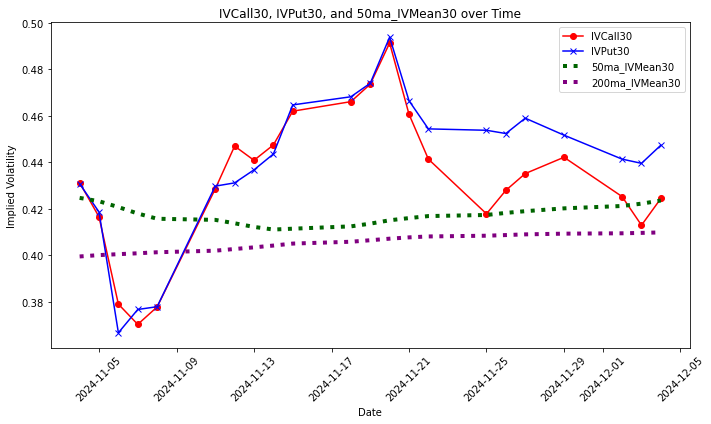

The IV trend chart shows that for some reasons, there is still a palpable fear of the stock price performance from the last 10 days till now.

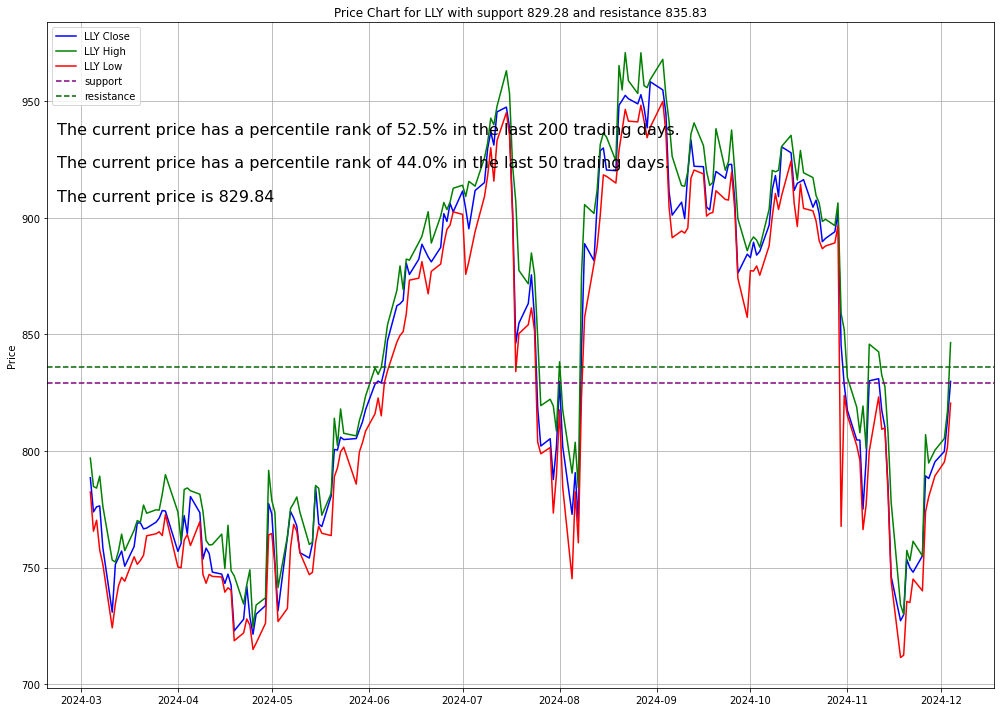

Eli Lilly (LLY)

Eli Lilly rose 2% after a study showed its obesity drug Zepbound outperformed Novo Nordisk’s Wegovy in clinical trials, reaffirming its dominance in the obesity treatment market.

This stock currently exhibits mixed sentiment with a cautious tone:

- The put option activity and higher IV at lower strikes imply significant concern about downside risks.

- Call options show lighter activity, reflecting limited bullish speculation.

If broader market conditions improve or company-specific catalysts emerge, this sentiment could shift. Further analysis of recent news, earnings, or macroeconomic factors could provide additional context. Let me know if you’d like me to investigate further.

CONCLUSION

- The U.S. stock market remains strong, supported by a market surge driven by the technology sector’s performance and a positive economic outlook for next year.

- Despite the optimism, challenges like labor market issues, slowing business activity, and international uncertainties suggest caution.

- Key upcoming data, including the November nonfarm payrolls report and the Fed’s December 18 Summary of Economic Projections, will provide important insights.

- The analysis combines stock-specific updates with broader economic trends, offering a comprehensive view of the market and economy.

Please note that all information in this newsletter is for illustration and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any investment products or services.

About the Author

Rein Chua is the co-founder and Head of Training at AlgoMerchant. He has over 15 years of experience in cross-asset trading, portfolio management, and entrepreneurship. Major media outlets like Business Times, Yahoo News, and TechInAsia have featured him. Rein has spoken at financial institutions such as SGX, IDX, and ShareInvestor, sharing insights on the future of investing influenced by Artificial Intelligence and finance. He also founded the InvestPro Channel to educate traders and investors.

Rein Chua

Quant Trader, Investor, Financial Analyst, Vlogger, & Writer.