As we approach the end of the year and look into 2025, market uncertainty looms, with key factors shaping the direction of the markets. The Federal Reserve’s hawkish interest rate policy has already created ripples through risk assets, including stocks and cryptocurrencies.

Source: Bloomberg

Rising Treasury yields and concerns over inflation are likely to stay at the forefront of investor sentiment, especially with the ongoing uncertainty surrounding fiscal policies in Washington. Market sensitivity to these macroeconomic factors will likely continue, offering both challenges and opportunities for cautious investors. Volatility is expected to remain in the short term as investors adjust to the evolving landscape.

Tech Pullback Drags Wall Street Stocks lower

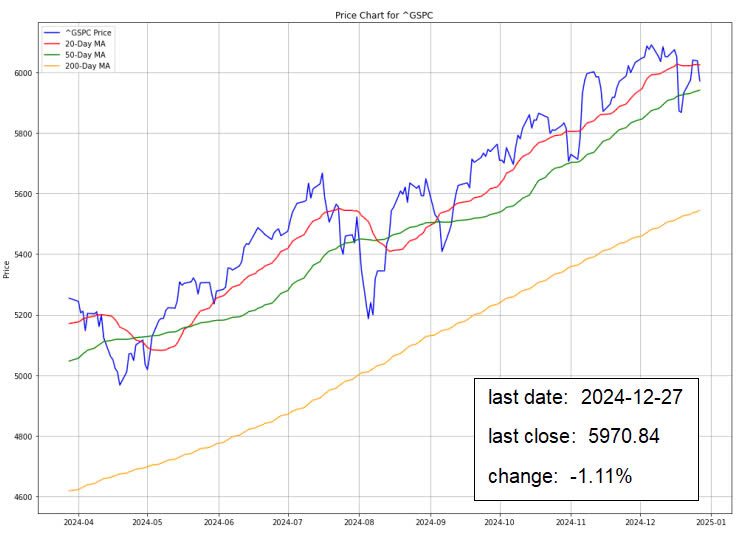

The stock market ended on a downbeat note on Friday, capping off a holiday-shortened week that saw the reversal of some progress from this year’s Santa Claus rally. Traditionally spanning the final days of the year and ending on the second trading day of the new year, the rally began on Tuesday with initial optimism but has been lackluster for major indices. Despite early-week gains, the Dow Jones Industrial Average dropped 334 points (0.8%), the S&P 500 slipped 1.1%, and the tech-heavy Nasdaq Composite fell 1.5% on Friday, underscoring a lack of sustained momentum.

Tech Sector Struggles Amid Market Uncertainty, While Energy Stocks Show Resilience

The tech sector, in particular, has faced significant pressure amidst market uncertainty. Semiconductor stocks and other high-growth names suffered notable losses, with the iShares Semiconductor ETF down 1.3% and the Roundhill Magnificent Seven ETF, which tracks major tech giants, falling 2.5%. This sharp decline contrasts with earlier in the month when these stocks were market favorites. Stretched valuations, the rise in Treasury yields, especially on the longer end of the curve, and broader market uncertainty appear to be weighing on sentiment. Higher yields often prompt investors to reassess riskier assets, particularly in high-growth sectors where valuations are closely tied to future earnings expectations.

In contrast, the energy sector displayed resilience amidst the market weakness. With crude oil prices rising 0.9% to surpass $70 per barrel, energy stocks offered a bright spot. This stability may reflect investors’ gravitation toward defensive sectors amid broader volatility. Higher demand for crude oil and a relatively stable global economic environment have provided tailwinds for energy stocks, which often serve as a gauge of economic activity. As the energy sector benefits from these trends, it offers a glimmer of hope in an otherwise challenging market landscape.

Source: Asia Times

Holiday Lull Fuels Market Volatility Amid Profit-Taking

Friday’s struggles can also be partly attributed to thin trading volumes, typical during the holiday period, which has contributed to market uncertainty. With many traders away for the holidays, the market has become more susceptible to larger-than-usual fluctuations. The lack of liquidity has amplified market movements, particularly during sell-offs in specific sectors.

Mizuho’s analyst, Daniel O’Regan, highlighted concerns over pension funds possibly taking profits as the year ends, which could lead to a multibillion-dollar selloff. Trading volumes have dropped around 35%, which has made it harder for the market to absorb large buy or sell orders, adding to volatility. The absence of participation from major institutional investors has created an environment prone to sharp market moves.

Federal Debt Ceiling Worries Add to Market Uncertainty

Adding another layer of complexity to Market uncertainty, Treasury Secretary Janet Yellen announced that the U.S. is approaching its borrowing limit, and “extraordinary measures” will be needed to avoid default in mid-January. These measures will buy Congress more time to act on raising the debt ceiling, which is scheduled to be re-set on January 2, 2025. The debate over the debt ceiling could add significant uncertainty to the market in the coming months, especially if Congress fails to agree on a plan.

Yellen’s warning underscores a critical issue facing U.S. fiscal policy and the broader financial markets. If the debt ceiling isn’t raised by summer, the U.S. could default on its debt, which would have serious implications for global financial markets and could contribute to heightened volatility. The potential for a standoff between Congress and the executive branch over the debt ceiling could create further uncertainty for investors in 2025.

Volatile Bond Market Reflects Inflation and Rate Concerns

The bond market also showed signs of volatility on Friday, adding to the overall uncertainty. The yield on the 2-year Treasury note fell to 4.325%, reflecting some investor preference for short-term safe-haven assets amid the market downturn. Meanwhile, the 10-year Treasury yield rose to 4.619%, reaching its highest closing point at 3 p.m. since May 29, 2024, according to Dow Jones Market Data. This uptick in long-term yields could indicate growing concerns about inflationary pressures and the future direction of interest rates, particularly following the Federal Reserve’s more hawkish stance last week.

Investment Opportunity & Risk

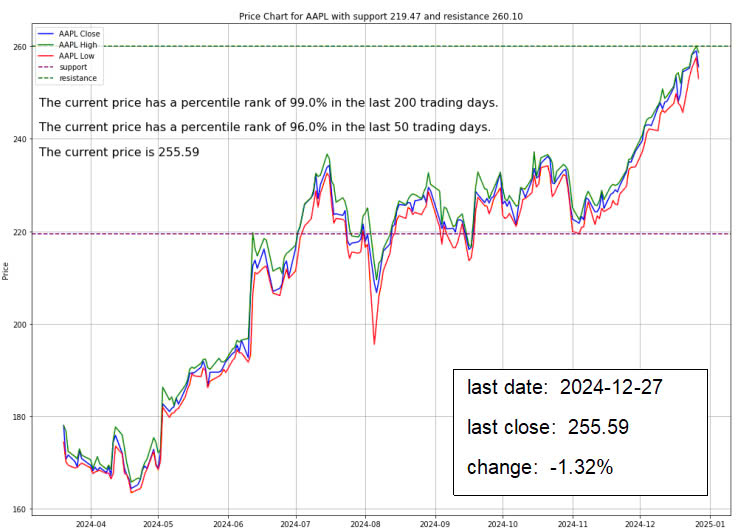

Apple (NASDAQ: AAPL)

Wedbush maintains an Outperform rating on Apple‘s stock, raising the price target to 300, highlighting a ‘golden era of growth’ driven by AI advancements. Apple is expected to benefit from a multi-year iPhone upgrade cycle as AI features, such as those related to Apple Intelligence, enhance consumer engagement and drive revenue growth in the services sector. With a strong financial position, including a gross profit margin of 46.2% and a P/E ratio of 42.1x, Apple is on track to potentially reach a $4 trillion market cap.

The company’s involvement in AI integration with Chinese tech giants and its termination of an iPhone hardware subscription service further underscore strategic shifts. Despite risks such as high valuation and competitive pressures in AI, analysts like JPMorgan remain optimistic about Apple’s growth prospects, with AI set to play a pivotal role in future developments.

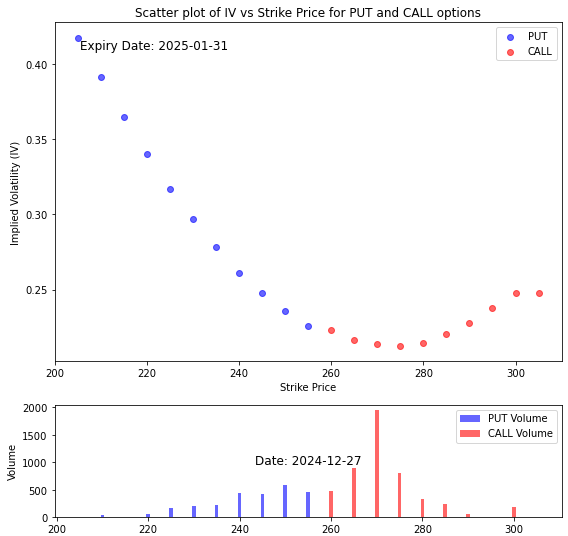

- Given the significant volumes in call options at higher strike prices (265 and 270), there is a strong indication that traders are optimistic about the stock’s potential to rise. The stable implied volatility for call options further supports this bullish sentiment.

- Considering the slight upward trend in the stock price and the overall market sentiment reflected in the options data, it is reasonable to predict that the stock price may continue to rise in the near term, potentially approaching the 265-270 range. However, the presence of put options indicates that there could be some volatility and potential pullbacks.

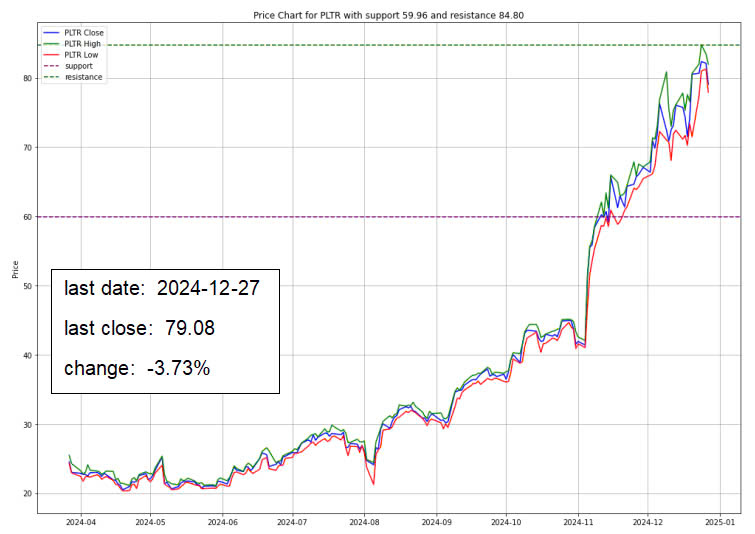

Pelantir (NASDAQ: PLTR)

Wedbush maintains a bullish stance on Palantir Technologies Inc. (NASDAQ:PLTR), reiterating an Outperform rating and a $75.00 price target, citing its strong positioning in the rapidly growing AI market and its role as a central player in the AI Revolution. With an impressive YTD return of ~380%, Palantir is trading near its 52-week high of $84.80, though some valuation metrics suggest premium pricing. The company’s robust operational efficiency, highlighted by an 81.1% gross profit margin and 24.5% revenue growth over the last twelve months, along with its expanding pipeline and deal flow, are expected to drive growth in its US Commercial business over the next 12 to 18 months.

Recent developments include a $400.7 million extended partnership with the U.S. Army, the launch of its Warp Speed initiative with key partners, and a collaboration with Pray.com to enhance language translation capabilities. Despite skepticism from some analysts, Wedbush is confident in Palantir’s potential to evolve into a company comparable to Oracle, driven by its AI Platform (AIP).

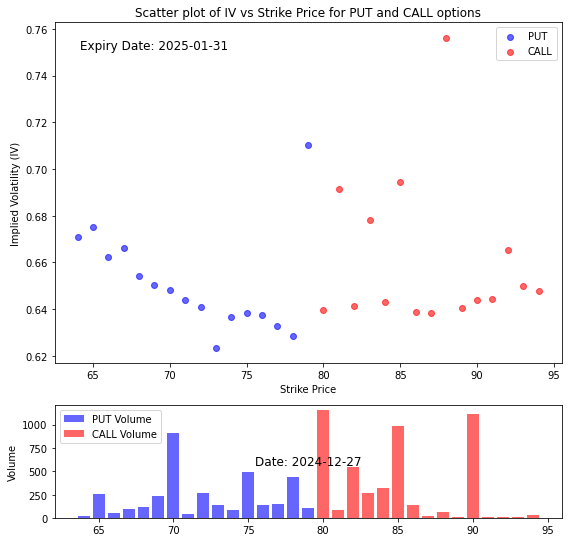

- Given the significant volumes in call options at higher strike prices (85 and 90), there is a strong indication that traders are optimistic about the stock’s potential to rise. The stable implied volatility for call options further supports this bullish sentiment.

- However, the notable volumes in put options at lower strike prices (75 and 80) suggest that there is also a cautious outlook, with some traders hedging against potential declines.

- Considering the volatility in the stock price and the overall market sentiment reflected in the options data, it is reasonable to predict that the stock price may experience upward movement, potentially approaching the 85-90 range. However, the presence of put options indicates that there could be some volatility and potential pullbacks.

The stock is likely to experience upward movement, with a potential target in the 85-90 range. However, investors should be cautious of potential volatility and consider the hedging activities.

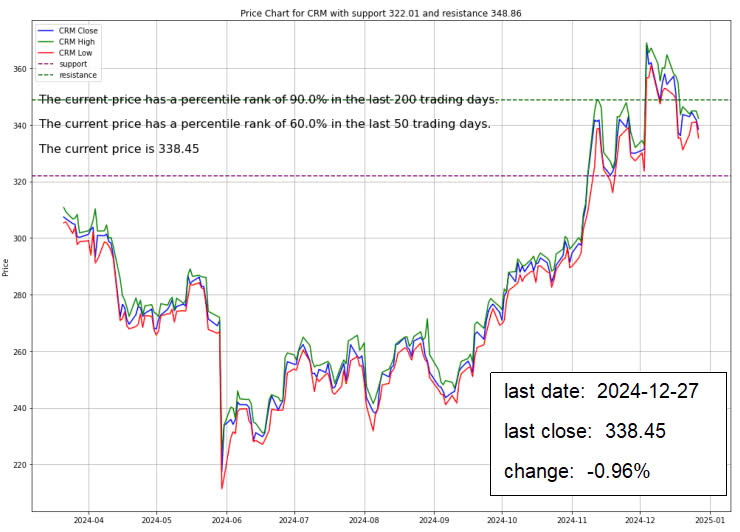

Salesforce.com (NYSE: CRM)

Wedbush Securities maintains a bullish stance on Salesforce.com (NYSE:CRM), reiterating an Outperform rating and a $425.00 price target, citing its strategic positioning in the AI revolution and potential to capitalize on a projected $7 trillion digital labor market. Trading at $344.43, the stock is slightly undervalued according to InvestingPro Fair Value estimates, with Salesforce boasting a 76.94% gross profit margin and a perfect Piotroski Score of 9. The company’s Agentforce 2.0 initiative aims to develop next-generation AI agents, enhancing automation and trust layers, which could add approximately $80 per share to its valuation. Analysts believe Salesforce is well-equipped to monetize AI advancements, driving growth over the next 12 to 18 months.

Recent developments, including positive reception at the Agentforce World Tour event and a staggered release schedule for Agentforce 2.0, have reinforced optimism among analysts, with firms like Truist Securities, Stifel, Mizuho, Goldman Sachs, and BMO Capital Markets maintaining Buy or Outperform ratings, highlighting Salesforce’s innovation and leadership in the CRM space.

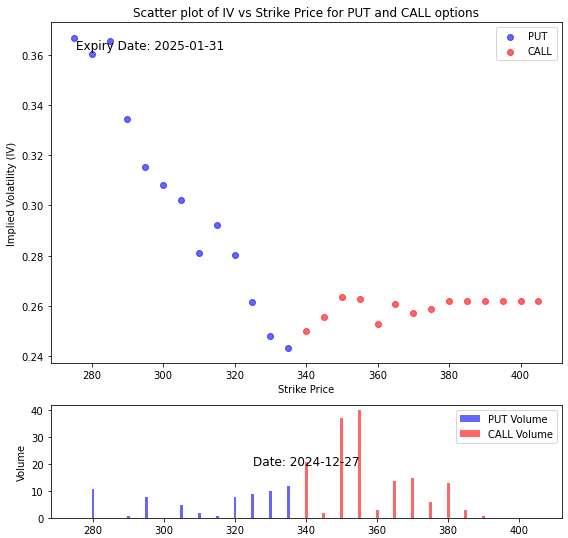

- Given the significant volumes in call options at higher strike prices (360 and 370), there is a strong indication that traders are optimistic about the stock’s potential to rise. The stable implied volatility for call options further supports this bullish sentiment.

- However, the notable volumes in put options at lower strike prices (around 320 and 330) suggest that there is also a cautious outlook, with some traders hedging against potential declines.

- Considering the volatility in the stock price and the overall market sentiment reflected in the options data, it is reasonable to predict that the stock price may experience upward movement, potentially approaching the 360-370 range. However, the presence of put options indicates that there could be some volatility and potential pullbacks.

The stock is likely to experience upward movement, with a potential target in the 85-90 range. However, investors should be cautious of potential volatility and consider the hedging activities.

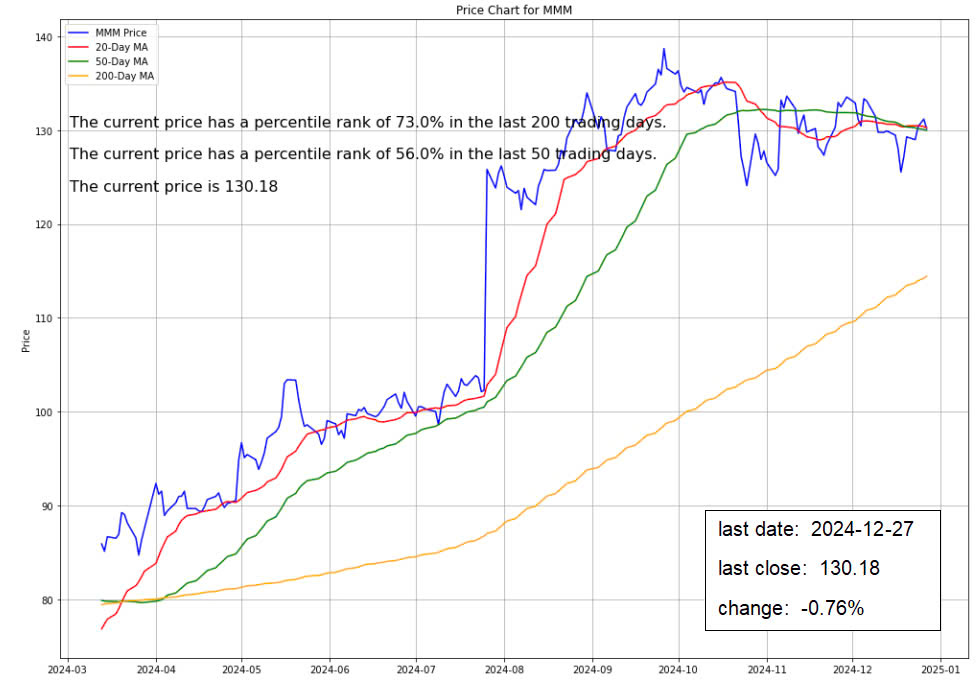

3M (NYSE: MMM)

CFRA upgraded 3M (NYSE: MMM) from a Buy to a Strong Buy, setting a $165 price target, driven by optimism around margin improvement from ongoing restructuring efforts and a strategic portfolio review. The company, trading at $130.70 with a $71.2 billion market cap, has shown impressive year-to-date performance, up 47.57%. CFRA’s analyst, Jonathan Sakraida, highlights 3M’s positive momentum under CEO Bill Brown, who is spearheading operational improvements and focusing on higher-growth sectors.

Despite challenges, such as a $3.6 billion legal settlement and PFAS-related liabilities, 3M’s financial health remains strong, with significant earnings and free cash flow growth. The upgrade signals confidence in the company’s future growth trajectory.

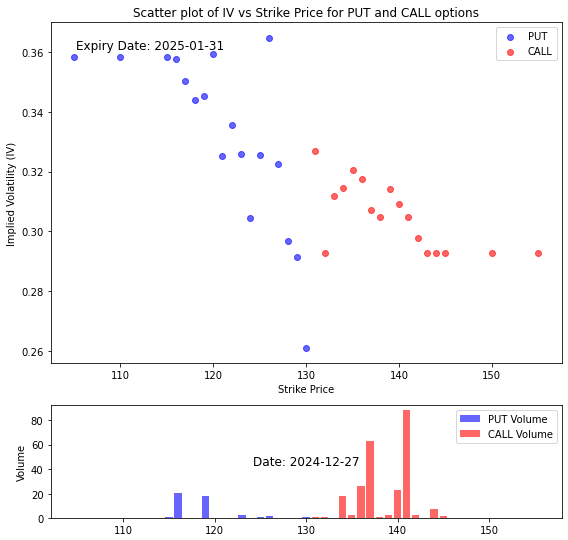

- Given the significant activities in call options at higher strike prices and the high implied volatility for both calls and puts, it suggests that the market is expecting a notable move in the stock price. The balance between call and put open interest indicates a mixed sentiment, but the higher concentration of call options suggests a slightly bullish bias.

- Therefore, it is reasonable to predict that the stock price may experience an upward movement in the near future, potentially testing the 134 and 140 levels. However, the presence of put open interest and high IV for puts indicates that there is still some risk of downward movement, so the upward trend may not be without volatility.

- The stock price is likely to move upward in the near future, but with potential volatility. Traders should be cautious and consider both bullish and bearish scenarios.

CONCLUSION

While the Santa Claus rally began with optimism, it has faced significant challenges, especially in the tech sector.

Market uncertainty, driven by ongoing volatility in Treasury yields, struggles within technology, and liquidity issues, has contributed to the mixed performance of the stock market during this holiday period.

As we approach 2025, the market will need to navigate a range of issues, including Fed policy, inflationary pressures, and the debt ceiling debate, all of which could impact price movements.

Investors must remain vigilant, adapting strategies as market conditions evolve.

The coming days and months could offer critical insights into how the market sets the tone for 2025, whether through a delayed rally or deeper sell-offs.

Please note that all information in this newsletter is for illustration and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any investment products or services.

About the Author

Rein Chua is the co-founder and Head of Training at AlgoMerchant. He has over 15 years of experience in cross-asset trading, portfolio management, and entrepreneurship. Major media outlets like Business Times, Yahoo News, and TechInAsia have featured him. Rein has spoken at financial institutions such as SGX, IDX, and ShareInvestor, sharing insights on the future of investing influenced by Artificial Intelligence and finance. He also founded the InvestPro Channel to educate traders and investors.

Rein Chua

Quant Trader, Investor, Financial Analyst, Vlogger, & Writer.