Introduction

In this new day and age, there are certain industry sectors that are emerging and very likely to benefit from digitalisation acceleration and climate change drivers.

When it comes to investing, one strategy is to identify very promising sectors that are likely to benefit from structural tailwinds, which provide fundamental support for strong upside.

Then, once these promising sectors are identified, the next stage will be to identify key stocks within these promising sectors that are best set up to dominate the space they operate in.

Very often, if such a selection thesis plays out, these stocks will often compound exponentially for patient shareholders in the long run, and offer very rewarding returns!

Let’s go through several industries that are likely to experience mega trends!

Distributed Cloud

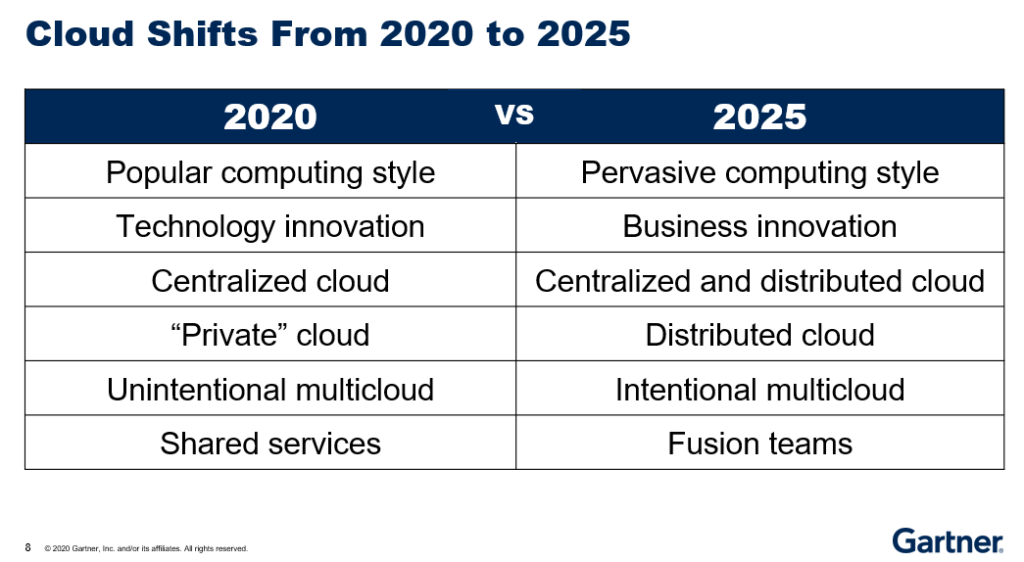

According to Gartner, merely investing in Cloud related stocks is probably already old news.

In fact, the niche trend that will likely play out for the Cloud Computing industry in the next 3 years is a shift towards ‘Distributed Intentional Cloud’.

What does that even mean?

Here’s a summary:

“To that end, by 2025, 50% of enterprises will adopt intentional multicloud where they use cloud services from multiple public cloud providers for the same purpose (up from fewer than 10% today). This approach offers several benefits to organizations, such as reducing risk of vendor lock-in, maximizing commercial leverage and addressing broader compliance requirements.

Distributed cloud, another future-looking computing mechanism, is the distribution of public cloud services to different physical locations while operation, governance and evolution of the services remain the responsibility of the public cloud provider.

The Gartner 2020 Cloud End-User Behavior study shows more than three-quarters of respondents prefer to have cloud computing in a location of their choice. That’s why Gartner anticipates half of organizations will use distributed cloud by 2025, a substantial increase from today.”

Stocks with potential to benefit from Distributed Cloud

Pick #1 – Digital Ocean (DOCN)

DigitalOcean simplifies cloud computing so developers and businesses can spend more time building software that changes the world. With its mission-critical infrastructure and fully managed offerings, DigitalOcean helps developers, startups and small and medium-sized businesses (SMBs) rapidly build, deploy and scale applications to accelerate innovation and increase productivity and agility. DigitalOcean combines the power of simplicity, community, open source, and customer support so customers can spend less time managing their infrastructure and more time building innovative applications that drive business growth.

Pick #2 – Cloudfare (NET)

Cloudflare, Inc. is on a mission to help build a better Internet. Cloudflare is a global cloud services provider that delivers a broad range of services to businesses of all sizes and in all geographies—making them more secure, enhancing the performance of their business-critical applications, and eliminating the cost and complexity of managing individual network hardware.

Pick #3 – Twilio (TWLO)

Twilio’s mission is to fuel the future of communications and is very likely to benefit even further from distributed cloud.

Millions of developers around the world have used Twilio to unlock the magic of communications to improve any human experience. Twilio has democratized communications channels like voice, text, chat, video, and email by virtualizing the world’s communications infrastructure through APIs that are simple enough for any developer to use, yet robust enough to power the world’s most demanding applications. By making communications a part of every software developer’s toolkit, Twilio is enabling innovators across every industry — from emerging leaders to the world’s largest organizations — to reinvent how companies engage with their customers.

Genomics

BOLD PREDICTIONS FOR HUMAN GENOMICS BY 2030

1

2

3

4

5

6

7

8

9

Individuals from ancestrally diverse backgrounds will benefit equitably from advances in human genomics.

10

Stocks with potential to benefit from Genomics

Pick #1 – Illumina (ILMN)

A global leader in DNA sequencing and array-based technologies, Illumina is fueling advancements in life sciences, oncology, reproductive health, genetic disease, agriculture, microbiology, and other emerging segments. They are dedicated to improving human health by unlocking the power of the genome. That mission is behind everything they do, from enabling breakthroughs that move them closer to the realization of precision medicine to delivering value to investors.

Pick #2 – Intellia Therapeutics (NTLA)

Intellia Therapeutics employs a modular genome editing platform to create diverse in vivo and ex vivo pipelines, spanning a range of therapeutic indications. Guided by this full-spectrum approach, they are committed to making CRISPR/Cas9-based medicines a reality for patients suffering from genetic diseases and to creating novel engineered cell therapies for various cancers and autoimmune diseases.

Pick #3 – CRISPR Therapeutics (CRISPR)

Leading gene editing company focused on translating revolutionary CRISPR/Cas9 technology into transformative therapies:- Achieving functional cures

- Next generation immuno-oncology platform

- Enabling regenerative medicine 2.0

- Advancing in vivo applications

Trends in Digital Wallets

The report projects that by 2024, digital wallet payments will account for more than a third (33 percent) of all in-store payments (16 percent in the U.S. currently).

“Our new research shows that the world is entering a new phase of adoption of digital payment methods,” said Jim Johnson, Head of Merchant Solutions at FIS. “The global pandemic has brought a cashless future closer on the horizon. The implications for merchants are profound. They must be building technology-centric strategies to meet the diverse preferences of consumers’ rapidly changing habits and do so in a way that drives financial inclusion for underserved communities around the world.

“For those businesses that are savvy enough to embrace smarter commerce and invest, the growth opportunities will be huge and potentially game-changing.”

Stocks with potential to benefit from Digital Wallets

Pick #1 – Square (SQ)

Square helps sellers more easily run and grow their businesses with its integrated ecosystem of commerce solutions, business software, and banking services. Cash App is focused on redefining the world’s relationship with money by making it more relatable, instantly available, and universally accessible. Spiral (formerly Square Crypto) builds and funds free, open-source projects that advance the use of Bitcoin as a tool for economic empowerment. TIDAL is a global platform for musicians and their fans that uses unique content, experiences, and services to bring fans closer to the artists they love and give artists the tools to succeed as entrepreneurs. TBD54566975 is building an open developer platform to make it easier to access Bitcoin and other blockchain technologies without having to go through an institution.

Together, they’re working to help their diverse audiences — sellers, individuals, artists, fans, developers, and all the people in between — overcome barriers to access the economy.

Pick #2 – Grab (AGC)

Grab is a leading superapp in Southeast Asia, providing everyday services such as mobility, deliveries and digital financial services to millions of Southeast Asians.

Trends in Advertising Revenue

Advertising revenue in the United States is expected to increase by 22% to $279 billion in 2021, a sign that the industry has turned a corner following the uncertainty during the COVID-19 pandemic, according to GroupM’s mid-year forecast released Thursday.

Digital advertising revenue will grow even faster, by 33%, in 2021 – building on last year’s 10% rate of expansion – and account for 57% of all advertising in the United States.

Total ad revenue will increase to $388 billion by 2026.

Stocks with potential to benefit from Advertising Spend

Pick #1 – The Trade Desk (TTD)

The Trade Desk is a technology company that empowers buyers of advertising. Through its self-service, cloud-based platform, ad buyers can create, manage, and optimize more expressive data-driven digital advertising campaigns across ad formats, including display, video, audio, native and social, on a multitude of devices, including computers, mobile devices, and connected TV. Integrations with major data, inventory, and publisher partners ensure maximum reach and decisioning capabilities, and enterprise APIs enable custom development on top of the platform.

Pick #2 – Magnite (MGNI)

Magnite offers a platform that features applications and services for digital advertising inventory sellers, called publishers (websites, mobile applications and other digital media properties) in order to sell their advertising inventory to the buyers (advertisers, agencies, agency trading desks, and demand side platforms, or DSPs), creating a marketplace over which such transactions are executed. Together, these features power and enhance a comprehensive, transparent, independent advertising marketplace that brings buyers and sellers together and facilitates intelligent decision-making and automated transaction execution for the advertising inventory.

Pick #3 – PubMatic (PUBM)

PubMatic fuels the endless potential of Internet content creators. The company provides a specialized cloud infrastructure platform that enables real-time programmatic advertising transactions. They believe that their purpose-built technology and infrastructure provides superior outcomes for both Internet content creators (publishers) and advertisers (buyers). By harnessing their massive data asset and leveraging their sophisticated machine learning algorithms, they increase publisher revenue, advertiser return on investment (ROI), and marketplace liquidity, while improving the cost efficiency of their technology platform and their publishers’ and buyers’ businesses.

Trends in Space

According to prediction studies done by Morgan Stanley, they are projecting that

“The revenue generated by the global space industry may increase to more than $1 trillion by 2040.”

Currently, the global space industry generates about $350 billion.

Morgan Stanley estimates that satellite broadband will represent 50% of the projected growth of the global space economy by 2040—and as much as 70% in the most bullish scenario. Launching satellites that offer broadband Internet service will help to drive down the cost of data, just as demand for that data explodes.

Stocks with potential to benefit from Space

Pick #1 – Planet Labs (PL)

Planet is a leading provider of daily data and insights about Earth. Planet changed the earth observation industry with the highest frequency satellite data commercially available. Planet’s data is transforming the way companies and governments use satellite imagery data, delivering insights at the daily pace of change on earth. This differentiated data set powers decision-making in a myriad of industries including agriculture, forestry, mapping, and government. Their fleet of approximately 200 earth imaging satellites, the largest in history, images the whole Earth land mass daily.

Pick #2 – BlackSky Technology (BKSY)

BlackSky is Defining the Category of Real-time Global Intelligence. BlackSky is an AI-driven SaaS Platform Powered by their Proprietary Space and Terrestrial Sensor Network. They Deliver Real-time Information, Insights and Analytics about our Changing World.

Pick #3 – Astra (ASTR)

Astra’s mission is to Improve Life on Earth from Space™ by creating a healthier and more connected planet. Astra was the fastest privately-funded company in history to reach space, and the lowest cost dedicated access to space. With over 50 launches under contract, Astra will begin delivering customer payloads into orbit in Summer 2021, moving to monthly, biweekly, weekly, and daily launches by 2025.

Electric Vehicle

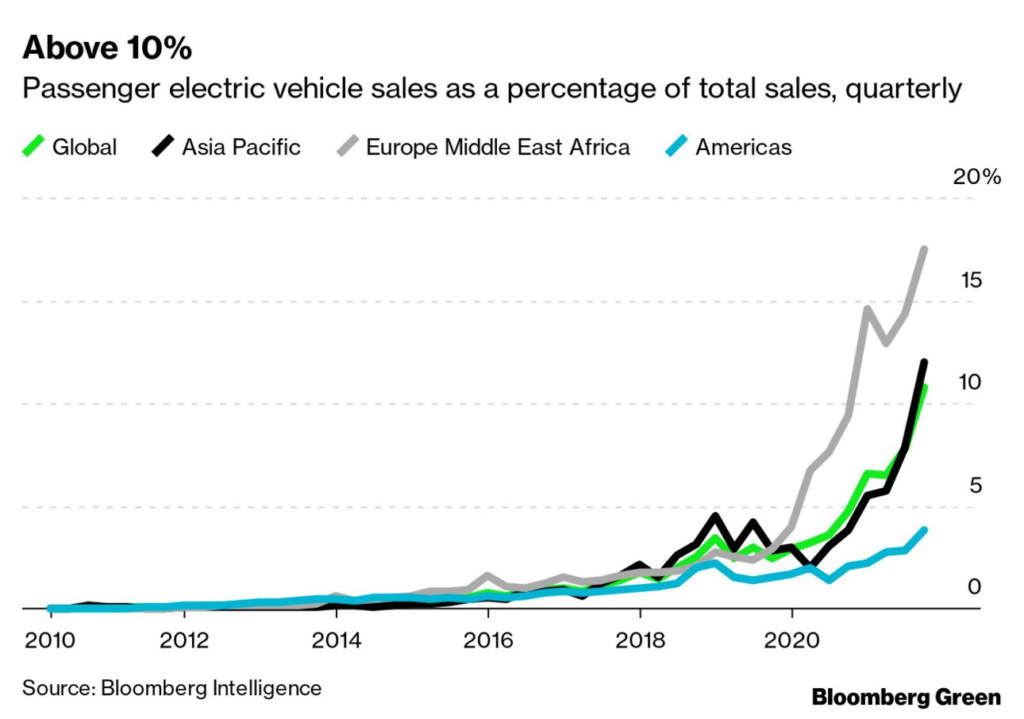

First and foremost, global vehicle sales are now 10% composed of Electric Vehicles, and 90% internal combustible engines (hydrocarbons).

This implies that investments in electric vehicles are still in the early innings.

In fact, according to this study by Deloitte, Total EV sales is expected to grow from 2.5 million in 2020 to 11.2 million in 2025, then reach 31.1 million by 2030.

Stocks with potential to benefit from Electric Vehicle

Pick #1 – Lucid Motors (CCIV)

Lucid Group, Inc. introduces luxury electric to the EV space. They are on a mission to inspire the adoption of sustainable transportation by creating the most captivating luxury electric vehicles in the world.

Pick #2 – Nio Inc (NIO)

NIO Inc. is a pioneer in China’s premium electric vehicle market. They design, jointly manufacture, and sell smart and connected premium electric vehicles, driving innovations in next generation technologies in connectivity, autonomous driving and artificial intelligence. Redefining user experience, they provide users with comprehensive, convenient and innovative charging solutions and other user-centric service offerings.

Pick #3 – XPeng (XPENG)

Founded in 2015, XPeng Inc. is a leading Chinese smart electric vehicle (“Smart EV”) company that designs, develops, manufactures and markets Smart EVs in China. Today, they have become a proven leader in the rapidly growing Smart EV market, producing popular and environmentally-friendly vehicles, namely an SUV (the G3) and a four-door sports sedan (the P7). Their Smart EVs offer attractive design and high performance, coupled with safety and reliability. Their Smart EVs appeal to the large and growing base of technology-savvy middle-class consumers in China. They primarily target the mid- to high-end segment in China’s passenger vehicle market.

There are many courses that teach traders how to predict the stock market to make consistent income. However the reality is, you don’t need them. And do you know that more traders lose than win, especially when they attempt to predict the market.

During our TradersGPS workshop, the trainer will teach you the ‘correct’ paradigm about stock trading and how to generate consistent income without predicting the market.

We will teach you ONLY one mechanical rule most professional traders apply to build their successful trading portfolios. Once you understand this rule, you can achieve success in the stock market!