The U.S. economy continues to demonstrate mixed economic signals, with both growth and challenges across various sectors. Key economic indicators and events provide insight into these movements:

1. Factory Orders Decline: In August 2024, factory orders dropped 0.2%, marking the third decline in the past four months. While defence goods orders provided some resilience, the broader manufacturing sector has shown weakness, particularly in non-defence capital goods.

2. Growth in Services Sector: Despite manufacturing’s struggles, the services sector has been a bright spot. The ISM service index rose to 54.9% in September 2024, its highest level in 1.5 years, fuelled by growth in banking, retail, and hospitality. This reinforces the service economy’s pivotal role in U.S. economic growth despite headwinds from inflation.

3. Rising Inflation Concerns: Inflation fears have resurfaced due to a combination of dockworker strikes, rising oil prices, and global geopolitical tensions. Rates on CPI-linked swaps have surged, reflecting market concerns about inflationary pressures intensifying. These developments come shortly after the Federal Reserve’s interest rate cuts, adding complexity to the inflation outlook.

Source: Cox AutoMotive

4. Strong Jobs Market: The September 2024 jobs report surpassed expectations, with 254,000 jobs added. The unemployment rate dipped to 4.1%. This robust performance in the labour market has eased fears of an imminent economic slowdown, though it has reduced the likelihood of a larger interest rate cut in November.

GLOBAL INFLUENCE

China’s Green Energy Investments

Chinese firms have accelerated investments in green energy, contributing over $100 billion in outbound foreign direct investment since 2023. The country’s dominance in solar manufacturing and battery production is reshaping the global green energy landscape, but it also raises geopolitical concerns for Western countries reliant on Chinese supply chains.

China’s Economic Stimulus

China’s fiscal stimulus has bolstered both its domestic economy and international stocks exposed to China. Companies like Wynn Resorts and Las Vegas Sands, which rely heavily on the Chinese market, have seen improved prospects due to the reopening of Macau and the surge in tourism.

Investment Opportunity & Risk

The U.S. stock market has been buoyed by a strong labor market, with the Dow Jones hitting record highs following the better-than-expected jobs report in September 2024. However, mixed economic signals, inflationary pressures, geopolitical tensions, and the upcoming U.S. presidential election present significant risks. While the Federal Reserve is expected to continue cutting rates, inflationary concerns and volatility could dampen the broader market outlook.

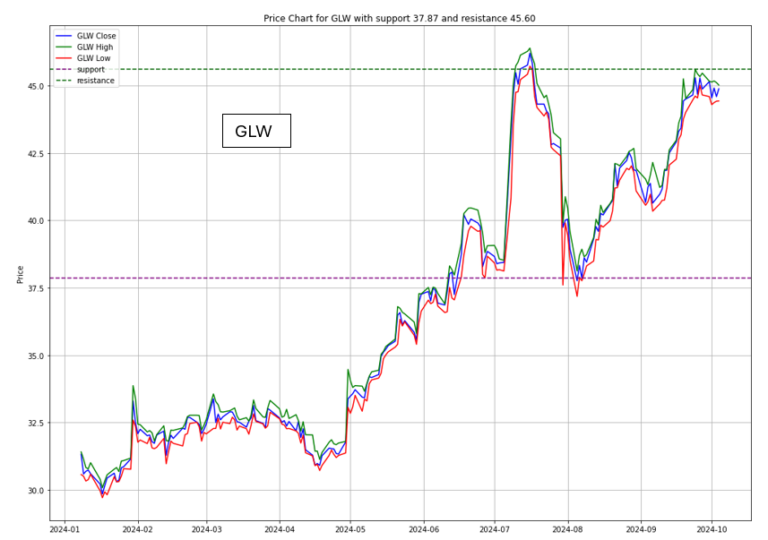

Corning (GLW)

- Corning continues to make waves in the AI data centre and communications spaces, with its optical communications segment growing 20% in Q2 2024. Corning has capitalized on demand for faster connectivity between AI data centres, and its future outlook remains strong, particularly with its focus on broadband and clean energy technologies.

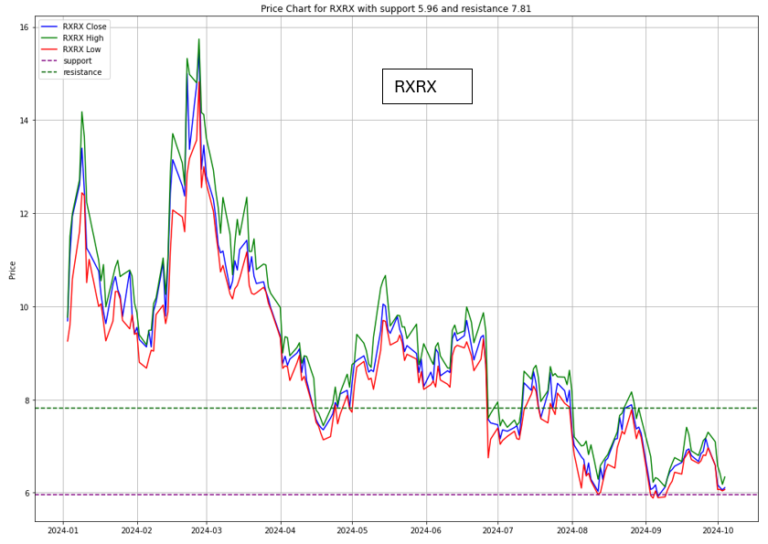

Recursion Pharmaceuticals (RXRX)

- Recursion is a clinical-stage biotech firm that uses AI to enhance drug discovery. It recently achieved a significant milestone with FDA approval for its cancer treatment, REC-1245. This development highlights the potential of AI to reduce costs and improve success rates in the biotech industry. As a result, Recursion is positioned as a company to watch in the AI-driven healthcare space.

Wynn Resorts (WYNN)

- Wynn Resorts, with its significant exposure to the Chinese market through its Macau operations, has benefited from China’s economic reopening and fiscal stimulus. The Macau gaming sector, the only region in China where casino gambling is legal, is rebounding from pandemic-related setbacks. Wynn has positioned itself to capture growing demand as Chinese tourism recovers.

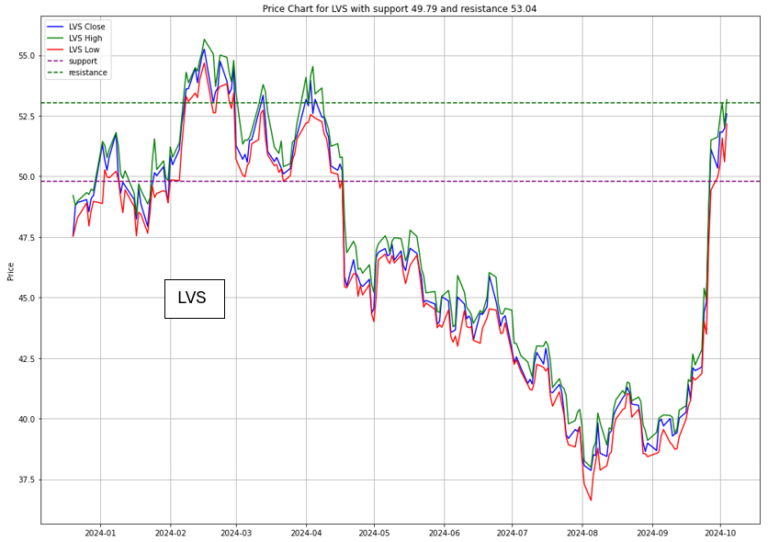

Las Vegas Sands (LVS)

- Like Wynn, Las Vegas Sands has also experienced a resurgence, driven by the reopening of Macau and China’s strong stimulus measures. LVS remains one of the largest casino operators in the region, and its recovery prospects are closely tied to China’s continued economic rebound. As Chinese visitors return to Macau, LVS stands to gain significantly from increased gaming and hospitality activity.

CONCLUSION

- The U.S. economy remains resilient, particularly in the services and labor markets, though though mixed economic signals, including inflation and global risks, loom large.

- Key stocks such as Corning (GLW) and Recursion Pharmaceuticals (RXRX) are poised for growth due to their strong positions in AI-driven industries, while Wynn Resorts (WYNN) and Las Vegas Sands (LVS) are set to benefit from China’s economic reopening and stimulus.

- The road ahead will depend on how inflation and global events shape both the U.S. economy and its key markets.

Please note that all information in this newsletter is for illustration and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any investment products or services.

About the Author

Rein Chua is the co-founder and Head of Training at AlgoMerchant. He has over 15 years of experience in cross-asset trading, portfolio management, and entrepreneurship. Major media outlets like Business Times, Yahoo News, and TechInAsia have featured him. Rein has spoken at financial institutions such as SGX, IDX, and ShareInvestor, sharing insights on the future of investing influenced by Artificial Intelligence and finance. He also founded the InvestPro Channel to educate traders and investors.

Rein Chua

Quant Trader, Investor, Financial Analyst, Vlogger, & Writer.