The general theme of our August 2020 edition market outlook remains the same since the last two quarters.

There remains much uncertainty concerning when and whether the Covid-19 spread can be contained. Society, businesses and human lives are still being disrupted in many countries. Most governments and central banks remain very concerned over the broader impact of how a medical crisis has also evolved into a financial crisis, and have implemented unprecedented fiscal and monetary measures to safeguard businesses and livelihoods.

TAKEAWAY

Global economic recovery is indeed on the way. However, due to the persistent nature of the Covid-19 situation, with signs of a second wave emerging in many matured economies, the economic recovery rate will not be as fast as originally assumed.

Since March 2020, the stock market has rallied in tandem with expectations of an economic recovery and hopes for the successful vaccine(s), and therapeutics to be available. However, the slowdown in the economic recovery rate due to the re-emergent of the second wave may very well slow the bullish momentum of the stock market.

More market consolidation, sideway trading, and in the worst case, a market pullback or selldown, maybe on the cards depending on future news events.

Bird Eye View

Globally the number of Covid-19 cases is still increasing daily, with no signs of tapering off. In the USA, death rates in some states are showing evidence of rising. Some states have decided to curb opening, and it appears the long resistance to wearing masks in public, is wearing off due to conclusive scientific evidence in support of masks. Also, the White House has changed tack to encourage the population to use masks in public and insist on social distancing to curb the rate of infection.

However, the slow reaction by the federal government has resulted in much damage being done, as the economic recovery continues to slow. Businesses have delayed openings, and school reopening is still being hotly debated and in doubt.

Separately the news on vaccine developments, therapeutics, and testing remains positive. In part, test results have shown faster turnaround, and several drug companies have announced vaccines might be available by year-end, in addition to having more therapeutics.

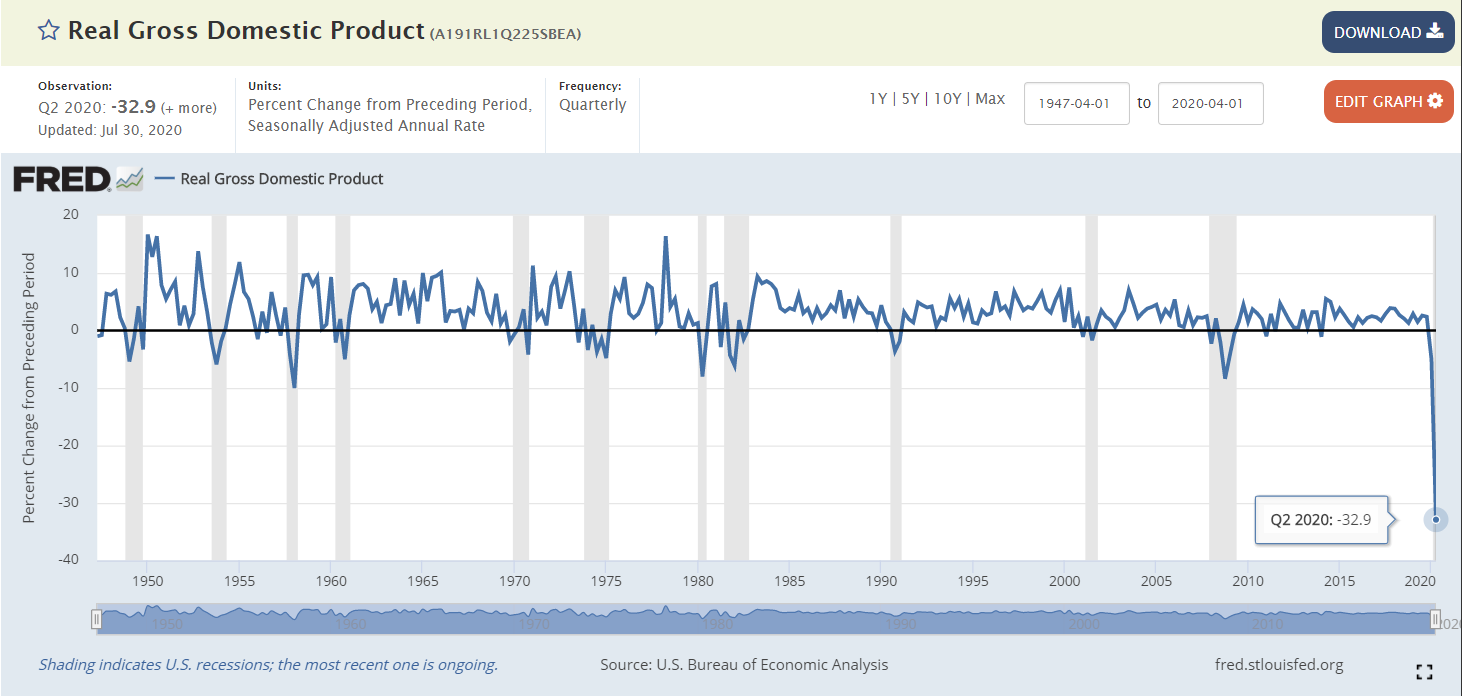

US Gross Domestic Product (GDP)

Gross Domestic Product (GDP) measures the annual change in the inflation-adjusted value of all goods and services produced by the economy. It is the broadest measure of economic activity and the primary indicator of the economy’s health.

GDP — the broadest measure of economic activity — decreased by an annual rate of 32.9% in the second quarter as restaurants and retailers shut their doors in a desperate bid to slow the virus spread, which has killed more than 150,000 people in the U.S.

Never in the past 70 years had the US GDP decreased as much as it did in 2020 (-32.9%)!

In general, the weaker the GDP the more bearish it is for financial markets.

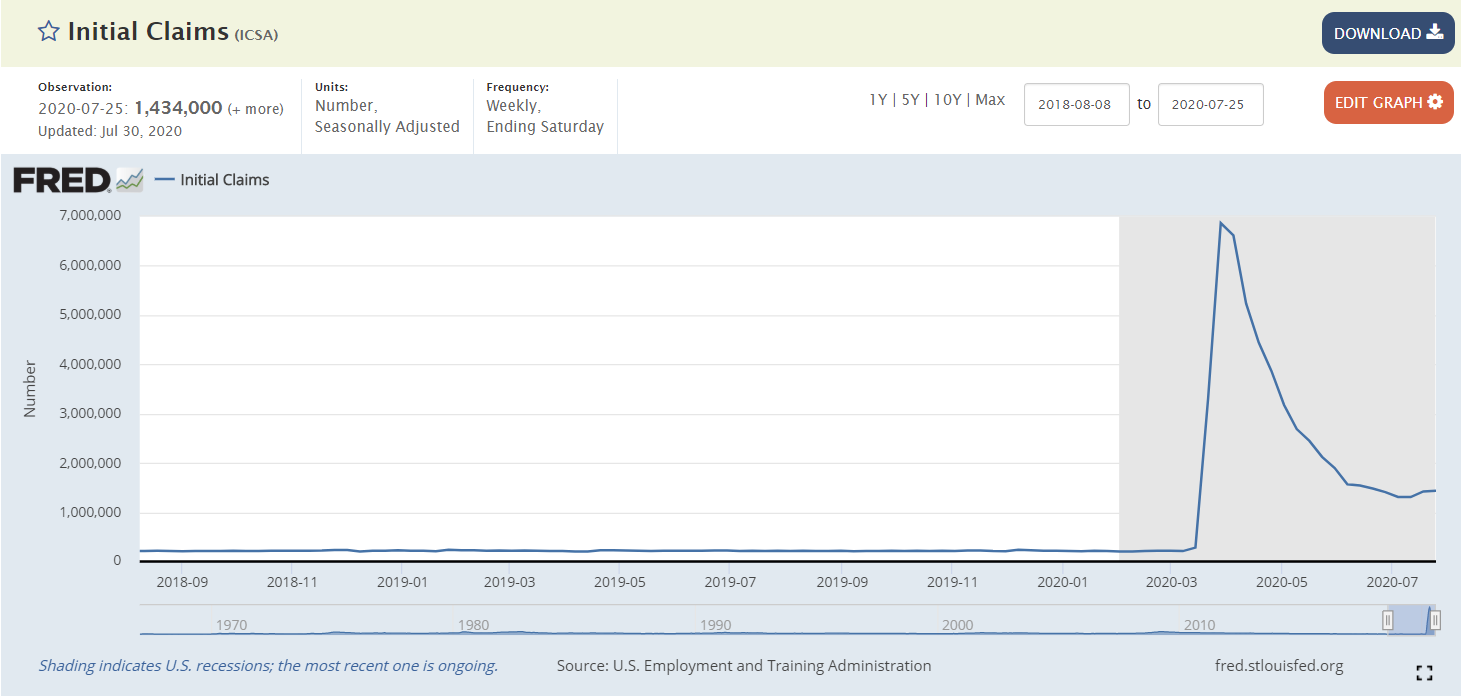

US Initial Jobless Claims

Initial Jobless Claims measures the number of individuals who filed for unemployment insurance for the first time during the past week. This is the earliest U.S. economic data and is a leading indicator.

Since the start of the Covid-19 pandemic, the U.S. initial jobless claims bottomed at 1,307K on 16 Jul 2020. However, since then, this indicator has been trending up again, with the latest print being 1,434K.

Increasing initial jobless claims should be viewed as bearish for the financial markets.

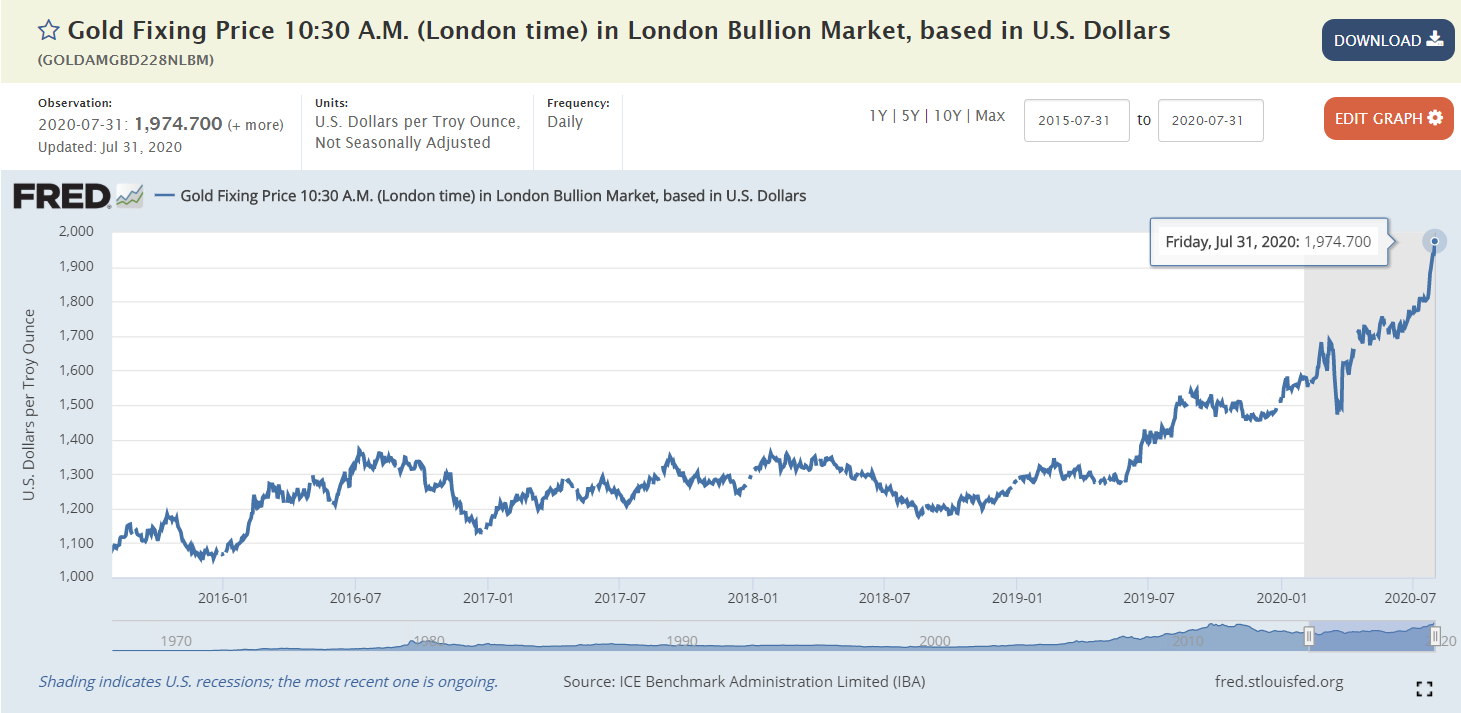

Gold Prices

The gold (US$1,974) rose an astonishing 11% monthly return in July 2020, continuing the previous trend and at the same time, the U.S. dollar index continues to decline.

When money is shifting to gold, and gold prices rise steadily, it often indicates that investors are looking for a safe haven due to the uncertainty in the market.

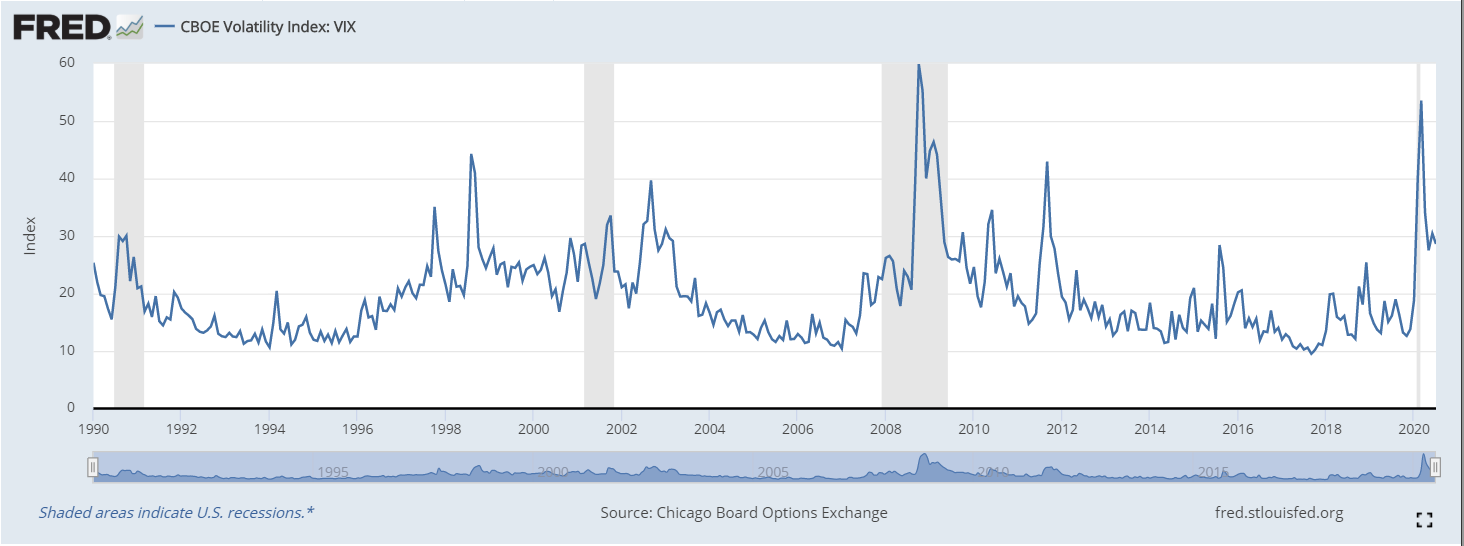

Volatility Index (Vix)

VIX is the implied volatility of the S&P 500 for the next 30 days. It typically ranges below 20 during bull markets and has not exceeded 50 since the 2008 financial crisis.

The CBOE VIX remains at elevated levels, although VIX dropped from 30.48 to close at 24.76 as of 31 Jul 2020. The perceived risk of the market remains elevated.

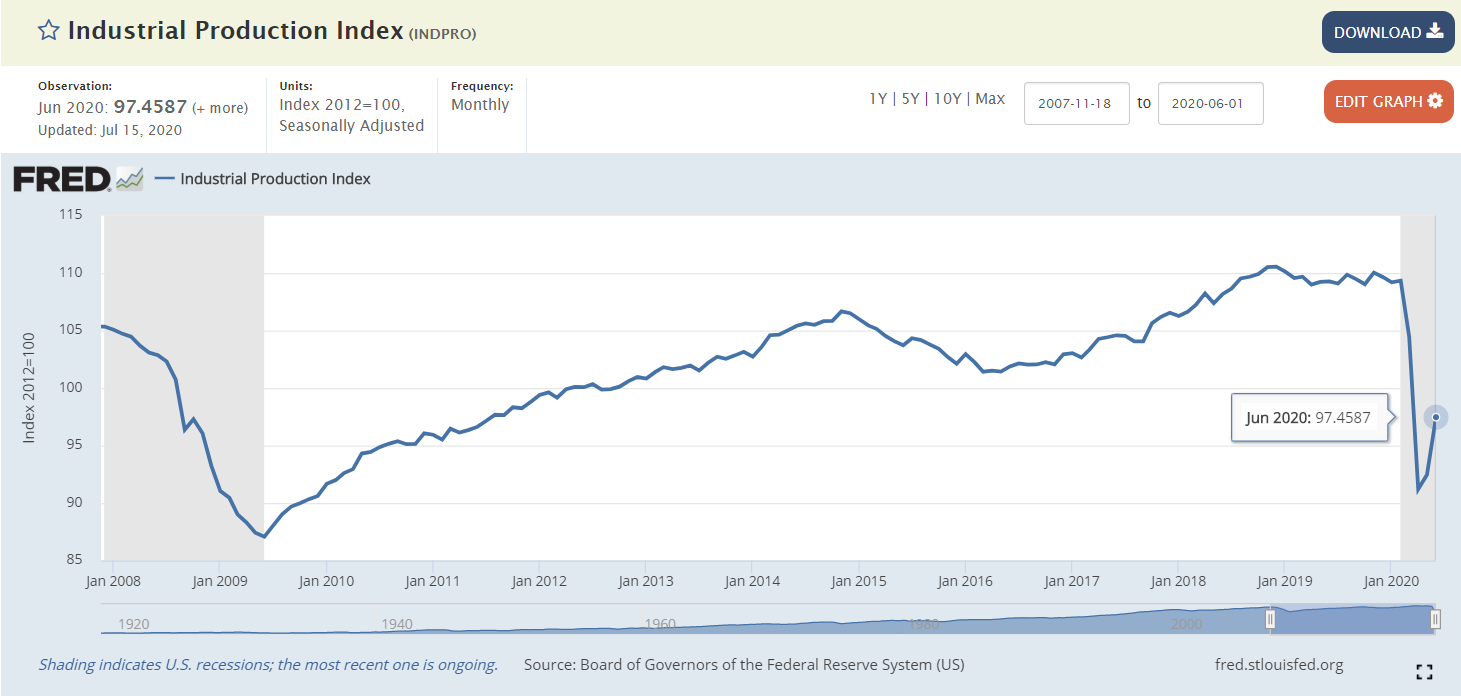

Industrial Production Index

The Industrial Production Index (INDPRO) is an economic indicator that measures real output for all facilities located in the United States manufacturing, mining, and electric, and gas utilities. It measures movements in production output and highlights structural developments in the economy.

INDPRO hit a low in Apr 2020 at 91.2 and has been trending up slightly in May and Jun 2020. The latest reading is 97.46. The previous time INDPRO decreased so much was during the 2008 financial crisis when it bottomed at 87.

Growth in the production index from month to month is an indicator of growth in the industry.

S&P 500 US Corporate Earnings

As of 31 Jul 2020, about half of the S&P 500 companies have reported earnings. About 80% of companies have beaten estimates, well above historical norms of approximately 70%.

More importantly, according to Refinitiv, the average earnings beat has been 13.2% above consensus, way above the historic norm of 3.3%.

When actual U.S. earnings exceed estimates, this tends to be bullish for the stock market. Since market expectations are initially based upon earnings estimates, any actual earnings beat tends to result in higher stock prices.

Conclusion

- Global economic recovery is indeed on the way.

- However, due to the persistent nature of the Covid-19 situation, with signs of a second wave emerging in many matured economies, the economic recovery rate will not be as fast as originally assumed.

- Since March 2020, the stock market has rallied in tandem with expectations of an economic recovery and hopes for the successful vaccine(s), and therapeutics to be available.

- However, the slowdown in the economic recovery rate due to the re-emergent of the second wave may very well slow the bullish momentum of the stock market.

- More market consolidation, sideway trading, and in the worst case, a market pullback or selldown, maybe on the cards depending on future news events.