February 2021 was a roller coaster month.

Beginning February started strong with the S&P 500 opening at 3731, and continued its unbelievable climb to another all-time high at 3,950 within two weeks. At the pinnacle of that joy ride, the markets sold off for the remaining two weeks, only for the S&P 500 to close at 3,811 for the month of February 2021.

Most of the gains made in February 2021 were given back to the market. It certainly took many investors and traders alike on a roller coaster ride!

The central theme for markets in February can be summarised mainly as ‘Inflation Fears’, and is a market risk AlgoMerchant has been highlighting since the beginning of this year.

To find out how and why we have been tracking this market risk, please check out our previous articles:

- My Market – Investment Themes for 2021

- My Market – Classic Post Election Rally, Unexpected Disruption Led Selldown

What was most interesting was how markets treated the Fed’s Powell recent reassurances that inflation was still soft and that the Fed was still committed to the current accommodative policies as an example of the “Boy Cried Wolf’. Powell’s inflation comments were made on 23 February 2021, but the sell-off continued all the way to month close on 26th February 2021.

What this is demonstrating to us is that the Fed’s actions and forward guidance may be starting to lose credibility with financial markets.

Let’s look at some of the key data insight.

TAKEAWAY

- The central theme for markets in February can be summarised mainly as ‘Inflation Fears’, and is a market risk AlgoMerchant has been highlighting since the beginning of this year.

- The Fed’s Powell recent reassurances that inflation was still soft and that they were still committed to the current accommodative policies did not abate the bond selling and equities sell-off.

- What this is demonstrating to us is that the Fed’s actions and forward guidance may be starting to lose credibility with financial markets.

- That said, for markets to settle purely based on the perspective of inflation fears, treasury yields need to stop increasing and start to stabilise. For this to occur a few scenarios are possible:

- Financial markets need to continue to sell-off, to a point where flight to safety occurs, and that naturally materialises in more fund flows into safe haven assets like US treasuries and Gold.

- The recent sell-off in treasury bonds that resulted in higher yields relatively to S&P 500 dividend yields will start to drive demand back into treasuries. When this materialises, treasury yields may start to stabilise and even drop.

- Alternatively, all the profit-taking from treasuries and bonds will result in bond investors and funds sitting on a huge pile of cash. If they chose to deploy these proceeds into riskier assets like equities, we may see a continuation of an equities run up, coupled with continuing bond treasuries sell-off.

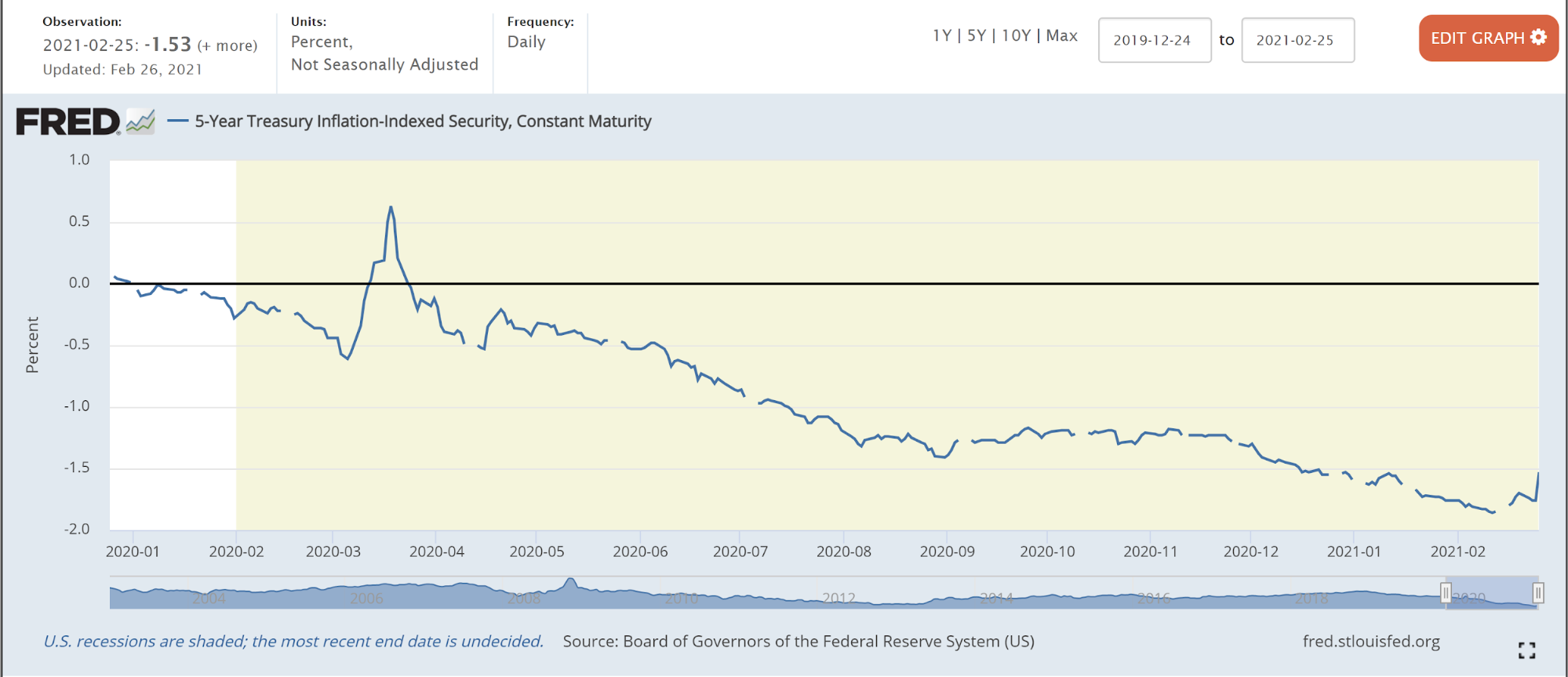

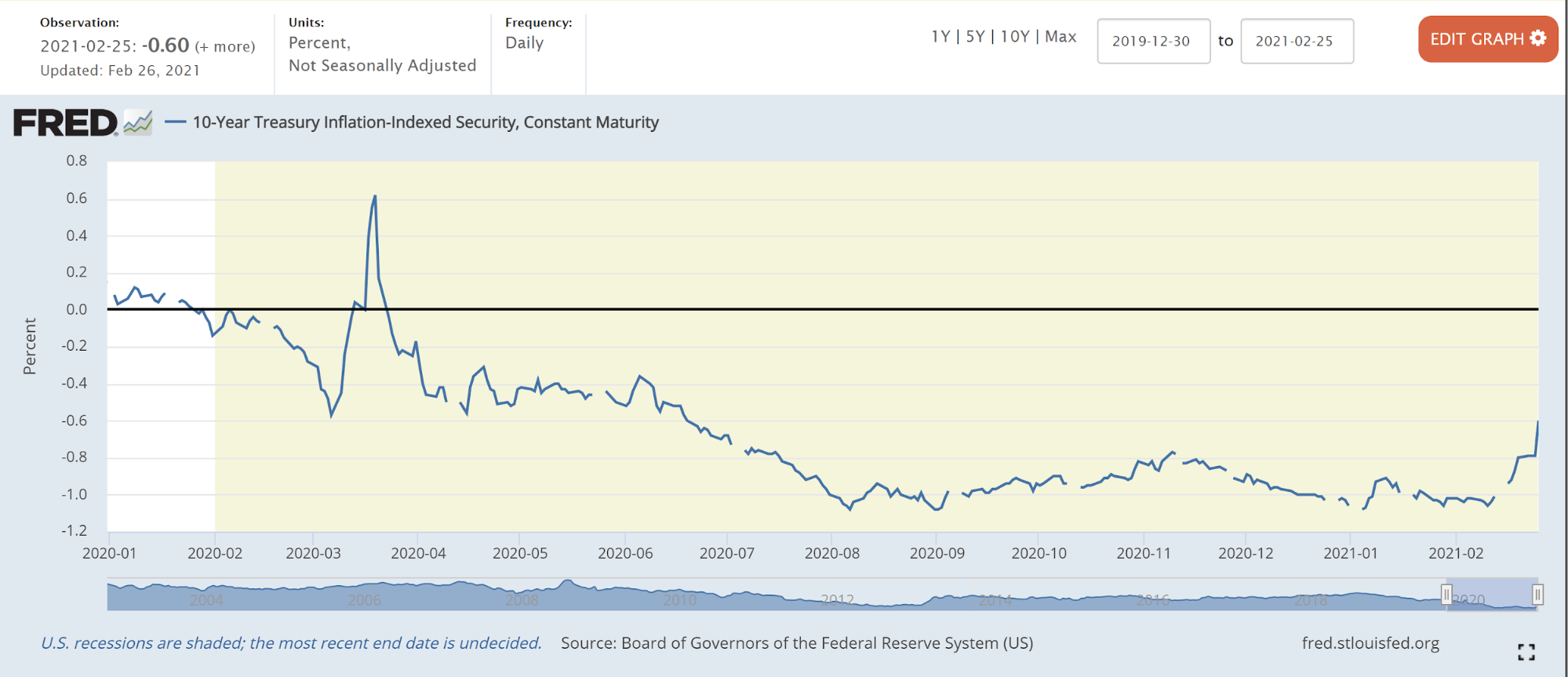

Treasury Inflation Protected Securities Yields (TIPS)

Treasury Inflation-Protected Security (TIPS) is a Treasury bond that is indexed to an inflationary gauge to protect investors from the decline in the purchasing power of their money.

An increasing TIPS is generally bearish for equities markets as it may suggest tightened financial conditions to rein in inflation. A decreasing TIPS, on the other hand, can be viewed as bullish for financial markets.

Both 5 year and 10 year TIPS peaked at 0.7% in March 2020 at the peak of the Covid-19 market selldown. Since then, the 5 year TIPS dropped to as low as -2% in January 2020 and the 10 year TIPS around -1.2%

The big news in markets end-February 2020 was the surge in real interest rates, with the 5-year TIPS yield jumping by 25 basis points and the 10-year by 20 basis points.

Increasing 5 and 10 year TIPS represent increasing inflation fears, as well as concerns the Fed might tighten monetary policies much earlier than expected have resulted in a minor pullback of the US equities market.

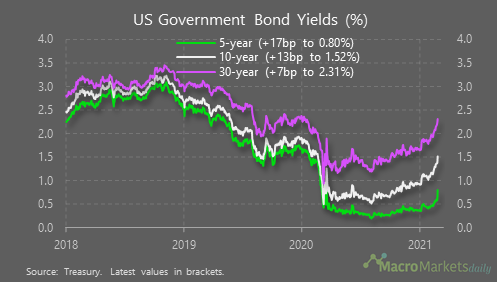

US Government Bond Yields

Government bond yield is the return on investment (%), based on the U.S. government’s debt obligations. Presented another way, the Treasury yield is the effective interest rate that the U.S. government pays to borrow money for various durations of time.

Most importantly, Treasury yields indicate investors’ sentiment towards the economy. The higher the yields on longer term US Treasuries, the higher the confidence investors have in the financial outlook. Also, high long term yields are also typically an indication of rising inflation in the future.

According to Macro Markets Daily:

“The surge in real yields push bond yields up, but the big surprise compared to the earlier rises in recent weeks was that the 5-year yield jumped by more than the 10-year or the 30-year. So the curve flattened.

That seems to suggest traders don’t believe the Fed’s commitment to keep policy rates low for many years.

The rise means the 10-year bond yield increased to above the dividend yield of the S&P 500. That will make many types of investors, such as pension funds, start looking at bonds again as a source of yield and could detract from equity demand.

The further rise in real yields was particularly bad for tech stocks, with the S&P 500 tech sector now down by 5.9% in the past week.”

US Dollar Index

The US Dollar Index represents the world’s reserve currency. The reserve currency status afforded to the US dollar represents the demand for USD as a preferred currency to conduct financial transactions globally.

An increasing USD can be viewed as bearish for the US equities market as it will cost non-US investors more money to purchase US investments.

The US Dollar Index hit a recent 3 year low at 89.32 on 7th January 2021, before rebounding to its current February 2021 close of 90.88.

The increasing US Dollar Index has been mentioned in mainstream financial news as being caused by increasing inflation fears, as well as concerns the Fed may tighten monetary policies much earlier than expected.

These fears have resulted in a minor pullback of the US equities market.

CBOE Volatility Index (VIX)

VIX is the implied volatility of the S&P 500 for the next 30 days. It typically ranges below 20 and has not exceeded 50 since the 2008 financial crisis.

The CBOE VIX escalated to a peak of 31.61 towards the end of February 2021, before closing at 27.95 for the month.

The surge in real yields push bond yields up, but the big surprise compared to the earlier rises in recent weeks was that the 5-year yield jumped by more than the 10-year or the 30-year. This resulted in the curve flattening which seems to suggest that traders do not believe the Fed’s commitment in keeping policy rates low for many years.

This resulted in a sell-off in equities resulting in a Vix surge.

GOLD

When money is shifting to gold and gold prices rise steadily, it often indicates that investors are looking for safe havens due to the uncertainty in the market.

Gold is also often viewed as an inflation hedge.

Gold hit an all-time high at 2089 in the month of August 2020. However, it experienced a sharp pullback to as low as 1729 at the close of February 2021.

The equities market has sold off for the month of February, in part due to inflation fears that may trigger the Fed to tighten their monetary policies.

However, despite the supposed inflation fear spreading across financial news, what is unexpected is that Gold has not spiked.

Instead, Gold continued to make new lows at 1729 from it’s all time high at 2089.

Conclusion

It definitely feels that markets were finding reasons to sell-off in February. In our previous January 2021 Market Outlook, we highlighted the over-extended market conditions, and cautioned our trading community to trade carefully moving forward into February and March 2021.

The sell-off did materialise, and thus far the narratives facilitating the sell-off were centred around the word ‘Fear’, and heavily related to inflation expectations.

Hence, the question most of our trading community is interested to find out is whether or not markets have bottomed, or we could possibly have more downside. In reality, financial markets are always uncertain and predictions are extremely hard, if not impossible.

That said, for markets to settle purely based on the perspective of inflation fears, treasury yields need to stop increasing and start to stabilise. For this to occur, a few scenarios are possible:

- Financial markets need to continue to sell-off, to a point where flight to safety occurs, and that naturally materialises in more fund flows into safe haven assets such as the US treasuries and Gold.

- The recent sell-off in treasury bonds that resulted in higher yields relatively to S&P 500 dividend yields will start to drive demand back into treasuries. When this materialises, treasury yields may start to stabilise and even drop.

- Alternatively, all the profit-taking from treasuries and bonds will result in bond investors and funds sitting on a huge pile of cash. If they chose to deploy these proceeds into riskier assets like equities, we may see a continuation of an equities run up, coupled with continuing bond treasuries sell-off.