On 2nd September 2020, the S&P 500 printed a new all time high before experiencing a maximum drawdown of 10.6% for the month of September. At the month end close, the S&P 500 was down -4.6% at 3363. Is this selldown merely a healthy correction? Or perhaps this recent selloff could be the start of a new bear market with more downside?

Prior to the US stock market peaking late August early September, the market sentiment was very bullish. Many had questioned whether earnings expectations especially for the strong tech companies were too elevated. Thus when a selected group of stocks have rallied so high, it is normal and to be expected for at least some correction to occur. To some extent, such corrections are healthy, if not welcomed for the stock market.

TAKEAWAY

- Increasing market uncertainty is the main theme for September 2020. Markets have corrected at least -10% and continue to show weakness heading into October 2020.

- In part, it could have been due to the upcoming US presidential elections in November 2020, which has resulted in significant investment outflow from the equities market.

- There has not been a major reallocation towards typical safe haven assets like US Treasuries and Gold, despite the concerning pullback.

- This could possibly indicate most fund managers and professional traders are taking a wait and see approach to the current political and macroeconomic conditions which are increasingly uncertain.

- Active traders currently vested in the market should continue to cautiously monitor the evolution of the political and macroeconomic landscape, which may present good trading opportunities in the month ahead.

Bird Eye View

Towards the end of August, and into early September 2020, the equities market was extremely bullish, especially technology stocks. However, many market observers were sounding concerns over increasing volatility (as measured by the VIX index), despite the markets rally hard. It came with little surprise when the stock markets sold down hard after the 2nd September peak.

Following the selldown that lasted a week before a short consolidation period occurred, news emerged that the famous Japan’s SoftBank bought billions of dollars in individual big tech stock options like Amazon and Microsoft in August 2020, driving up trading volumes and contributing to the exuberance. Apparently Softbank fully exited their options trade in early September which contributed to the overall market weakness.

Between 10th to 17th September, the US stock market traded in a temporary consolidated range in preparation for the infamous quadruple witching day. Quadruple witching refers to the third Friday of every March, June, September and December. On these days, market index futures, market index options, stock options and stock futures expire, usually resulting in increased volatility. Furthermore, it was also an opportunity for institutions, funds and professional traders to rebalance their portfolio. The equities market showed further weakness on the quadruple witching day, with many big funds taking profits off the table from the bullish run up since March 2020.

What was interesting was the fact that these fund managers did not, in a significant way, reallocate their profits into typical safe haven assets like gold and US treasuries, despite the pullback. In most bearish cases, due to fundamental concerns over deteriorating market conditions, a flock to safe haven assets have been a norm. However this was not the case in September 2020. Will this continue to be the trend in October, especially with the upcoming November US presidential elections, which will be a market moving event?

Let’s review the latest market data that will help shape the market outlook going forward.

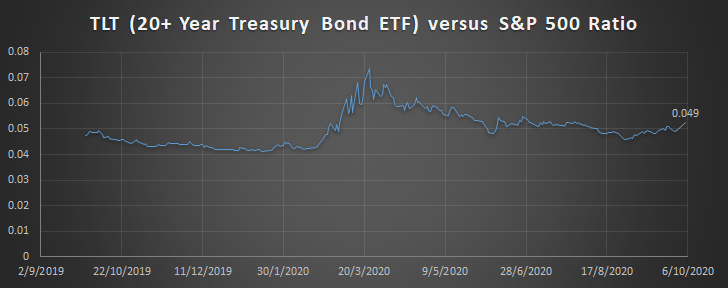

TLT (20+ Year Treasury Bond ETF) versus S&P 500 ratio

The TLT/S&P 500 ratio provides a relative gauge on whether investors are shifting their investment positions toward safe haven assets like US Treasuries, or prefer to take on market returns/risk via equities.

An increasing ratio can be perceived as investors having more concerns over the stock market, and therefore allocating more towards US Treasuries relative to equities. A decreasing ratio is indicative of investors being pro-growth and more willing to take on market volatility by allocating more of their funds toward equities.

The TLT/S&P 500 ratio reached a peak at 0.073 on 23rd March 2020 at the peak of the Covid-19 pandemic market selldown, before settling at a recent low of 0.046 on 31st August 2020.

Since the August low of 0.046, this ratio has been increasing again to close at 0.049 on 30th September 2020.

This is possibly an early indication of more fund managers and institutional investors allocating more of their assets towards safe haven TLTs.

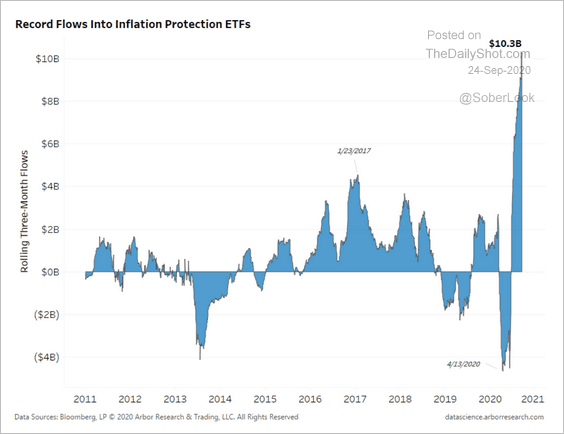

Inflation Protection ETFs

An increasing investment flow into Inflation Protection ETFs can be perceived as market participants being concerned over inflation growing too excessively, which is bearish for the economy.

It is bearish for the economy because the US Fed and Federal government will have to tighten liquidity and increase interest rates to control inflation. Less accommodative monetary and fiscal policies are generally bad for the equities market.

Investment flow into Inflation Protection ETFs have reached unprecedented levels since 2011. The rolling 3 month flow peaked at $10.3B as of 24th September 2020, following an all time investment outflow low of -$4.5B occurring on 13th April 2020.

The previous peak was only at $4.5B on 23 Jan 2017.

This shift from an all time investment outflow low, to an all time investment inflow high within a span of 6 months, is a possible indication that the US Fed and Federal government loose and accommodative monetary and fiscal policies risk overheating the US economy.

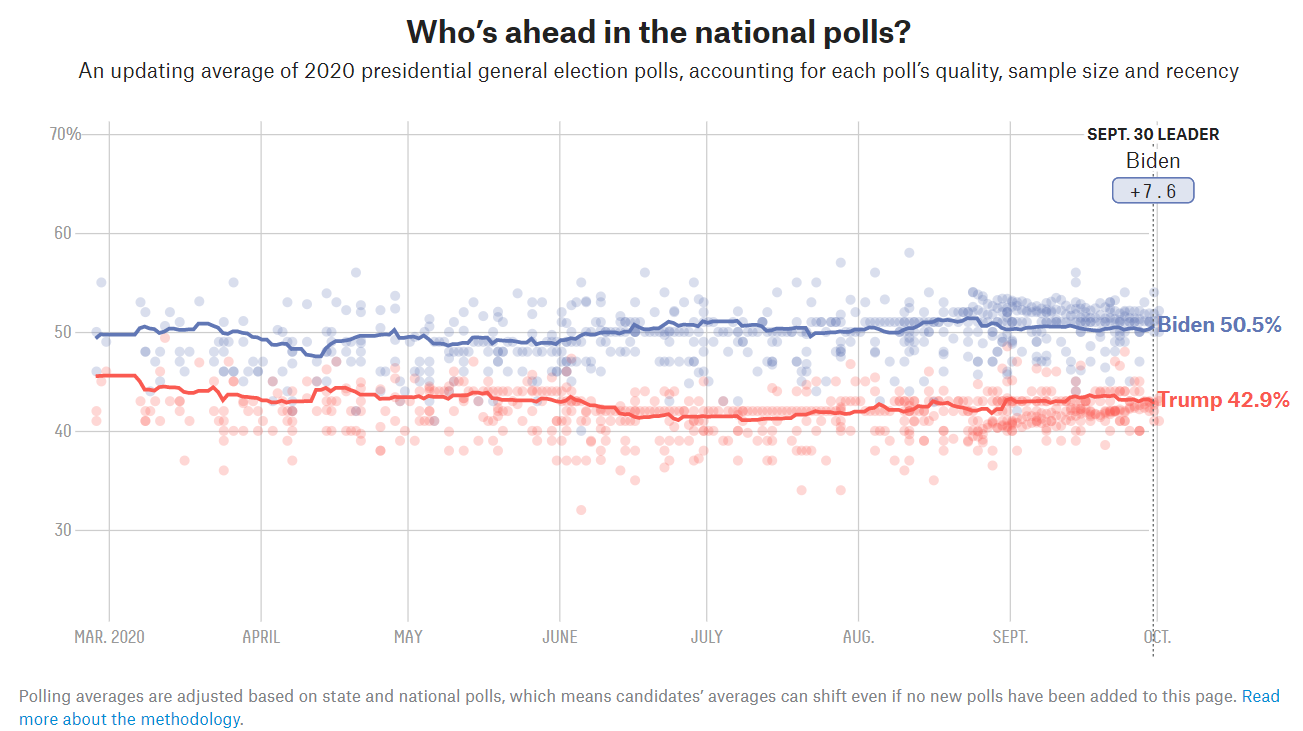

US 2020 Presidential National Poll average

If Joe Biden were to win the upcoming presidential elections, it may result in a bearish stock market due to his stance on corporate and individual taxes.

However, if Trump gets re-elected he will continue with his existing agenda, which appear to be bullish for the economy, but can also be extremely volatile with his off the cuff tweets and stand-off with current global powers like China.

In general the existing stock market had priced in the individual and corporation tax reduction plan that was introduced in 2017 by Trump, which had resulted in a bullish stock market.

Joe Biden has campaigned to increase the top individual tax rate for the wealthy back to 39.6% from 37%, as well as Raise top corporate income tax rate to 28% from 21%.

Part of the reason why the US stock market pulled back in September 2020, can be attributed to uncertainty over the upcoming US presidential elections due in November 2020.

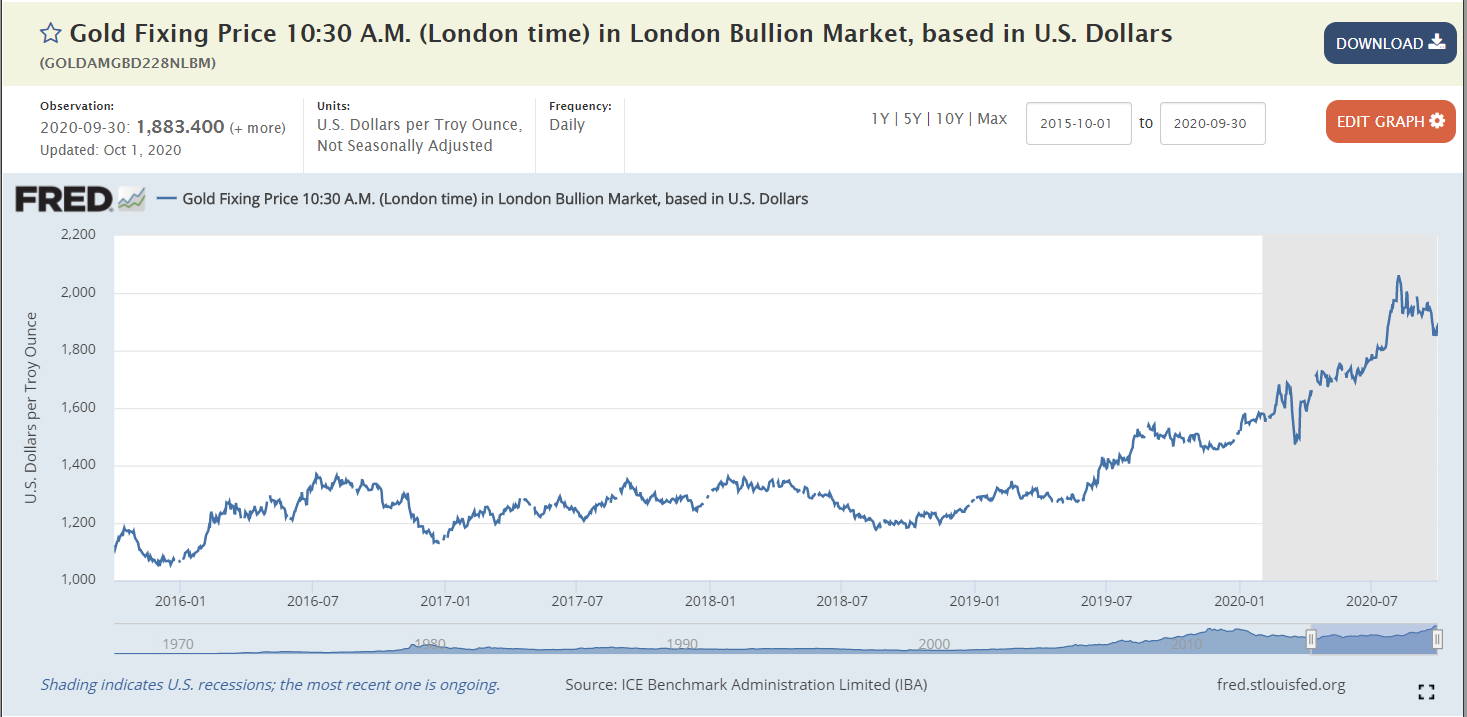

Gold

When money is shifting to gold and gold prices rise steadily, it often indicates that investors are looking for haven due to the uncertainty in the market.

Gold hit an all-time high at 2089 in the month of August 2020. However, it experienced a sharp pullback to as low as 1852 in September 2020, before closing at 1883.4 month end.

Gold is currently consolidation trading at the lower end of its trading range, after experiencing 2 months worth of pullbacks and consolidation.

The concurrent pullbacks of both the stock market and gold is indeed highlighting increasing market uncertainty.

Volatility Index (VIX)

VIX is the implied volatility of the S&P 500 for the next 30 days. It typically ranges below 20 during bull markets and has not exceeded 50 since the 2008 financial crisis.

The CBOE VIX escalated in the month of September 2020 to a peak of 38.38. This coincided with the pullback recently experienced.

As of the September 2020 close, the Vix remains stubbornly high at 26.37.

A stubborn VIX that refuses to break below the 20 threshold is a sign of significant market concerns and indecisiveness.

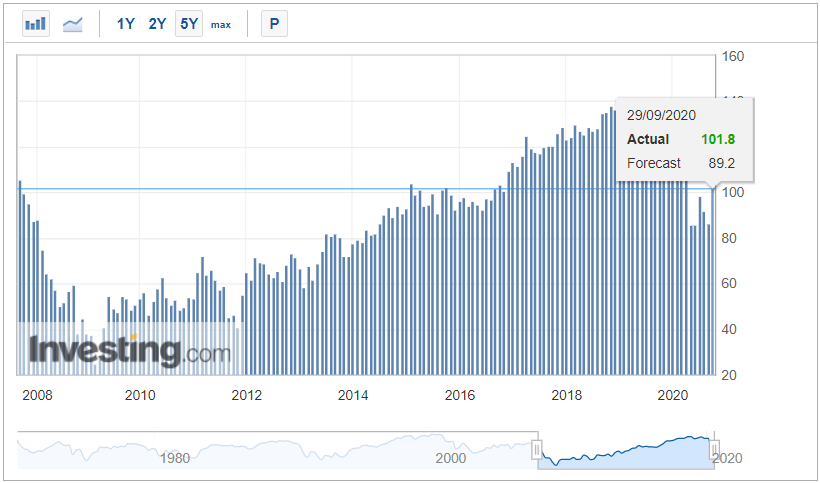

US Consumer Confidence

The consumer confidence index is closely watched as an indicator of economic health because consumer spending accounts for about 70% of economic activity.

An increasing US Consumer Spending trend is bullish for the economy, whereas a decreasing trend is generally bearish/concerning.

The US Consumer Confidence surges to its highest level since the start of the Covid-19 pandemic. It jumped to 101.8 in September from the previous print of 86.3. This represents the biggest 1 month jump seen in the past 17 years.

Consumer confidence is an economic indicator that measures the degree of optimism that consumers feel about the overall state of the economy and their personal financial situation.

Conclusion

- Increasing market uncertainty is the main theme for September 2020. Markets have corrected at least -10% and continue to show weakness heading into October 2020.

- In part, it could have been due to the upcoming US presidential elections in November 2020, which has resulted in significant investment outflow from the equities market.

- There has not been a major reallocation towards typical safe haven assets like US Treasuries and Gold, despite the concerning pullback.

- This could possibly indicate most fund managers and professional traders are taking a wait and see approach to the current political and macroeconomic conditions which are increasingly uncertain.

- Active traders currently vested in the market should continue to cautiously monitor the evolution of the political and macroeconomic landscape, which may present good trading opportunities in the month ahead.