There is much to worry about these days – glaring challenges, huge in magnitude, and intertwined throughout the global economy in so many ways imaginable.

Yet the strength of the US stock market seems invincible and nothing is able to keep it down for long.

If Nassim Taleb’s book, ‘The Black Swan’, published in 2007 was made famous by the 2008 Great Financial Crisis, the Covid pandemic in early 2020 brought Black Swan back in vogue again.

Honestly speaking, the US stock market has been on a tear the past few years. It is so resilient that it had to take Covid to buckle the stock market -38%, but only temporarily.

What frightens the market these days are in fact known issues – big in scope but not out of the blue Black Swan events, and it is clear the stock market is taking them in stride.

These well known and heavily publicised problems are supply chain shortages, high inflation, tightening monetary policies, in a global economy that hadn’t even gone back to pre Covid levels – apart from the US stock market.

TAKEAWAY

The strength of financial markets is teaching all of us an important lesson.

As long as the issues are known, no matter how big the scale, there is no need to panic because humans will eventually solve them.

We have well known and heavily publicised problems such as supply chain shortages, high inflation, tightening monetary policies, in a global economy that hadn’t even gone back to pre Covid levels, apart from the US stock market.

It is really the black swan events – issues that no one is expecting but materialises that are going to cause a stock market collapse.

We currently have a stock market in a liquidity flushed sweet spot, staking on thin ice with burgeoning undercurrents and no known Black Swans.

Recap of 2021 Q3 Economic Performance

Q3 2021 performance was really a mixed bag. The good includes a strong labour market with clear evidence of unemployment falling. GDP is still growing positively, although the growth rate is increasing much slower than expected.

The bad includes strong credit availability yet real yields are negative. Inflation appears to be creeping up again and energy shortages are becoming persistent.

GDP Performance

GDP, the total of all goods and services produced in the economy, printed a growth rate that slowed to 2% for the 3rd quarter of the year.

This was its slowest increase since the end of the 2020 recession.

Furthermore, the actual GDP growth rate of 2% did not manage to beat the estimate of 2.7%.

Despite the poorer than expected GDP growth rate, the US stock market was cheering the fact that the GDP is officially now back above Pre-Covid levels.

Labour Performance

The US labour market continues to show signs of strong recovery, even as unemployment rates remain above pre-Covid levels.

In October, two data stood out:

- The good news is for the first time since May 2020 last year the unemployment rate dropped below 5%.

- Weekly jobless claims also fell below 300K since Covid occurred.

However, labor shortages continue with August’s JOLTs Job Openings coming in at 10.439M versus 10.925M.

Monetary Policy – Tapering is coming

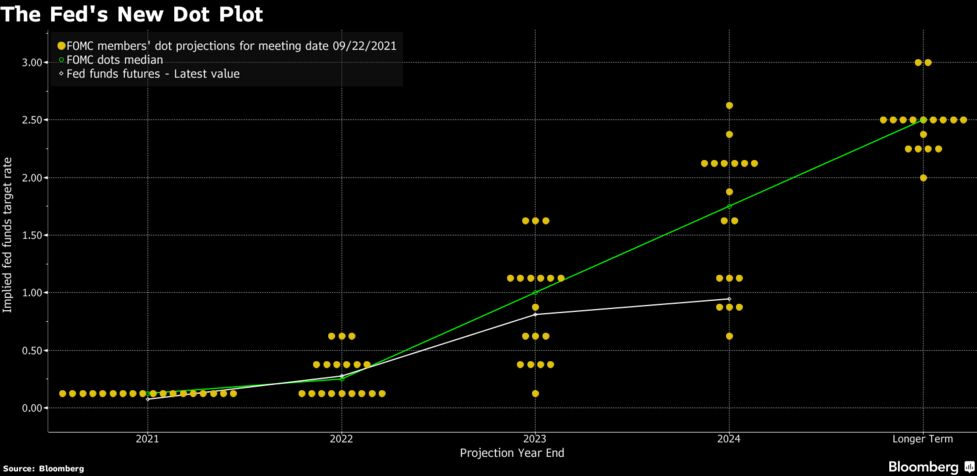

All US Fed members meet once every quarter during the FOMC meetings to discuss monetary policies for the US economy.

One activity conducted is for all 18 senior policy makers to vote their expectations of Fed interest rates in the future, based on their interpretation of current economic data.

The latest Fed interest rate dot plot shows that the Fed could raise interest rates as soon as 2022, although it remains a coin flip at the moment, since 50% of Fed members voted against rate hikes and 50% were for the motion.

What is more important is that more Fed members started to vote for rate hikes compared to the Q2 FOMC meeting.

The financial market was pricing in a rate hike only in 2023 previously.

If more Fed members vote for a 2022 rate hike in the upcoming Q4 FOMC meeting, this might cause some jitters in the equities market.

Despite the possibility of earlier than expected Fed taper, the stock market is harping on the ever increasing Fed balance sheet, which added $500 million to hit $8.5 trillion last quarter.

This is in stark contrast to $2 trillion at the end of the 2008 Great Financial Crisis.

Global and US Stock Market Summary

Starting with the US stock market, contagion fears surrounding the Evergrande collapse in September, coupled with increasing treasury yields due to inflation fears did little to unsettle the US stock market.

Despite experiencing a -5.86% drawdown in September, the S&P 500 recovered strongly in October to gain 7.68% off the September lows.

On the other hand, the 2nd largest world economy China’s stock market is not faring as well.

Year to date the Shanghai Composite is up only 2.07%.

In part, it can be attributed to the heavy handed government clampdown on the entire economy which can be summarised as follows:

- Chinese tech companies are dealt with anti monopolistic practices and starved of capital market access

- Chinese Developers are no longer allowed to borrow more if their debt levels are too high

- Chinese educational companies are denied capital market access and are clamped down to make kids’ education more sustainable

- Restrictions on how long Chinese kids are allowed to play computer games daily

The European stock market has behaved very similarly to the S&P 500. Europe has benefited from abundant liquidity from their Central Bank, as well as aggressive reopening with high vaccination rates and reducing Covid cases.

YTD the STOXX Europe 50 is up 18.87%.

Back home in Singapore, the STI index had a strong start between March and May this year, but has been range bound since due to tension over Covid restrictions versus Reopening.

YTD the STI is up 11.85%.

Credit Markets – Higher Returns still favoured

If financial markets were truly concerned over inflation, we should be seeing the usual flight to safety towards US treasuries.

Instead investment grade bonds were range bound and mostly flat during the quarter. High yield bonds and leveraged loan markets are the only credit sectors that are positive year to date.

Loan defaults remain low.

The behaviour in the credit market tilts towards yield/return chasing, rather than caution towards persistent inflation fears.

Finale - Sweet Spot on Thin Ice

The strength of financial markets is teaching all of us an important lesson.

As long as the issues are known, no matter how big the scale, there is no need to panic because humans will eventually solve them.

It is really the black swan events – issues that no one is expecting but materialises that are going to cause a stock market collapse.

Why is the stock market on thin ice? We have real problems on hand with supply chain disruptions causing goods shortages. The energy market is also experiencing real shortages, and nations are hoarding hydrocarbons ahead of the upcoming winter season. Inflation is everywhere, real and growing.

Yet, and a big YET, all these problems are occurring at a time where employment is not where it needs to be. Bear in mind the Fed has a dual mandate, one of which is to optimise employment. It needs to see employment get back to pre Covid levels.

What happens when you have a vulnerable economy that still needs plenty of support, but with real challenges knocking on the door?

A stock market in a liquidity flushed sweet spot, staking on thin ice with burgeoning undercurrents.

Disclaimer: Please note that all the information contained in this newsletter is intended for illustration and educational purposes only. It does not constitute any financial advice/recommendation to buy/sell any investment products or services.