Happy Easter everyone, bring out all the bunny’s eggs and candies!

S&P is up another leg for the week amidst decent corporate earnings – congrats to Pinterest on the 12B IPO valuation. Markets are seemingly doing well with all good stories, but it has been a short trading week with lighter market activity anyway.

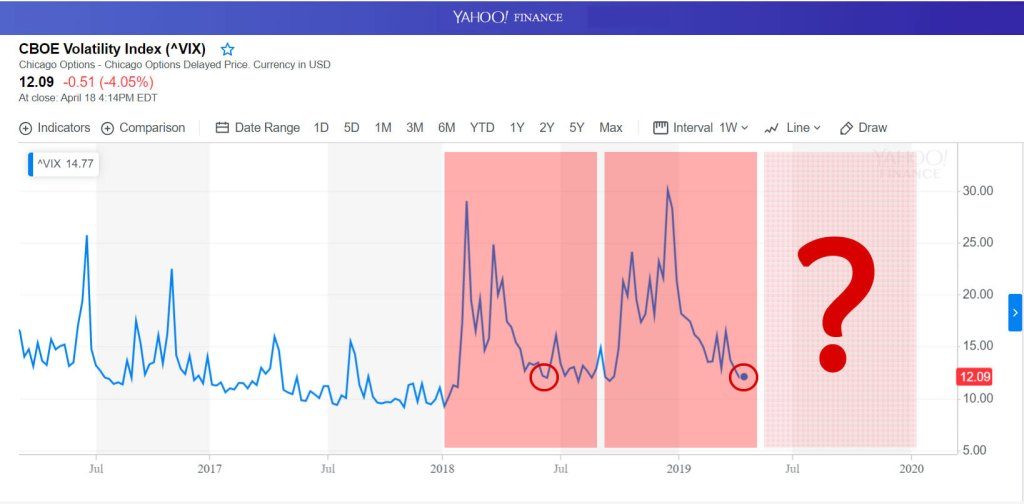

At this stage, the VIX harboring around low levels should give us a nudge and think if the stock market has been a tad too complacent – a small Deja vu in mid-June 2018 of similar setting with very low VIX and a slight uptick week price change will see a following small correction in the coming weeks (with 2815 being the S&P 500 technical support level).

In the Asian EM currencies world, the end of April-May usually comes with seasonal USD buying, which somewhat may cause some risk-off market move (mere correlated systematic trades can be significant these days!). Good Aussie employment data and Indonesian election outcomes have kept the macro sentiment uplifted during Asia hour last week, but worse than expected German PMI has started to throw some doubts on the other side of the world.

Next week, we will have Australia CPI, Canadian and Japan monetary policy releases to give us more color on what the Central Banks around the world think on the global outlook.

Macro-wise, we probably want to take profits from our long positions, and a small short is probably safe play from risk-reward perspective, but you don’t want to short technology stocks which are the drivers behind the S&P 500 these days!