TAKEAWAY

In a weak global economy with numerous outstanding concerns and uncertainty, history has proven the broad market sentiment will remain weak, with a selected few stocks and sectors primed to do well. In the early months following the March Covid selloff, that Sector has exclusively been TECH.

However, market sentiment appears to have changed significantly from the first, second and third quarters of 2020. Significant capital has flown into speculative alternative asset classes like Cryptocurrency, long beaten down sectors like the Airlines and Energy, and also riskier small cap companies.

On the other spectrum, interest in safe haven assets like Gold and US treasuries have been receiving lukewarm treatment and in the case of Gold, significant capital withdrawals.

Most importantly, we will like to highlight that while it seems a broad based rally is taking place, there are also signs of increasing speculations and volatility, especially in riskier asset classes.

BIRD EYE VIEW

What a difference one month makes.

In last month’s October 2020 Market Outlook, we highlighted several deteriorating economic and market indicators, and advised our community of readers to exercise caution in their trading and investments.

A quick recap – in October which really isn’t very long ago we had President Trump come down with Covid-19, an alarming rise of Covid-19 cases in Europe and USA, and also heightened uncertainty relating to the US Presidential elections.

Moving forward 1 month, it appears all these previous concerns and uncertainty have been mitigated by what many investors view as the most favourable election outcome results, whereby the Democrat President-Elect Joe Biden will have to work with a Senate still largely in control by Republican and the House’s Democrat influence curtailed.

Most importantly, a series of highly promising vaccine news by leading medical drug companies seem to take priority over the fact the global count of Covid-19 cases are increasing more than it did in March-April 2020 (experienced the fastest market selldown of -38% not seen in history).

IS THE NOVEMBER RALLY TO BE BELIEVED?

It is a fact that money and capital has flooded back into the stock market in a big way. More often that not, these are signs of increasing market confidence that the worst is behind us.

In this month’s Market Outlook piece, we plan to break down the money flow in various market sectors and products, for the month of November. This will illustrate to our readers whether the recent rally has further legs, and exactly where most investors’ and traders’ money have gone.

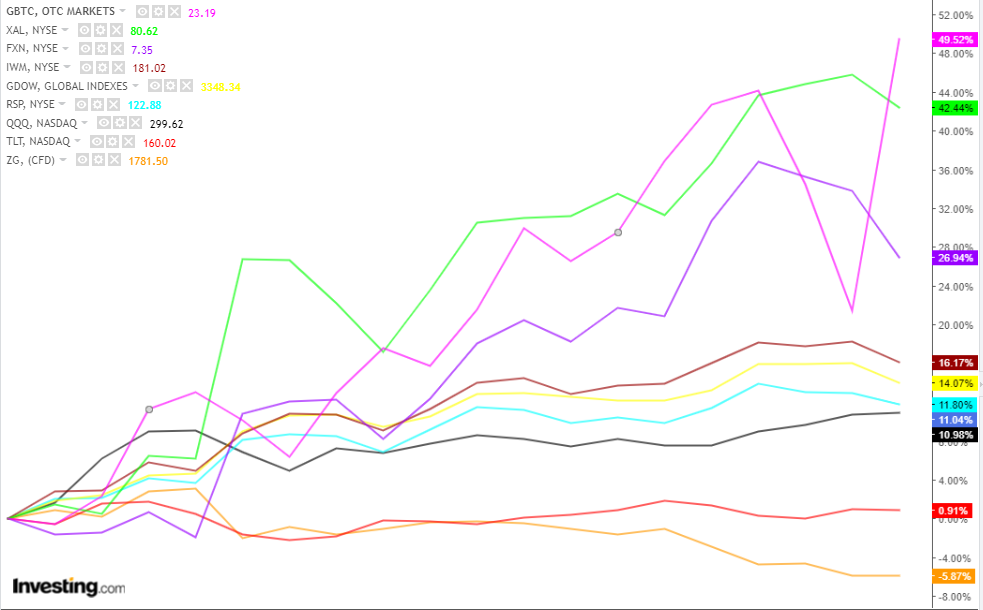

More importantly, you may have read in the news this had been a ‘broad’ based rally. What exactly does that mean? The chart below will illustrate the concept.

In the chart below, the relative performance of various asset classes by returns % is compared for the month of November 2020.

In the section below, we will explain in detail the various asset classes and what their underlying performance for the month of November means.

MOVE OVER TECH..

Technology stocks as a whole did very well since the March 2020 lows, as the Covid-19 lockdowns and restrictions have accelerated the adoption process of e-Commerce and online deliveries, remote learning and working via technology, and digital communications.

This resulted in the technology index (QQQ, Nasdaq 100) rallying approximately 55% off its March lows to end November 2020.

However, QQQ’s performance for the month of November 2020 has been relatively mediocre compared to other asset classes. While QQQ managed to gain 11% for this period, it pales in comparison to several other super movers..

WHICH ARE THE SUPER MOVERS?

With reference to the chart above, Bitcoin, as represented by the ticker GBTC gained an enormous 49.52% just in 1 month! Cryptocurrencies are currently considered as an speculative alternate asset class. The fact capital has flown back into such an asset class is indicative of recovering risk appetite.

However, it also highlights the very important point that high speculation is back at play, and something to be concerned about especially when speculative bullish sentiments reach extreme levels. In fact if you look at the GBTC chart, Bitcoin gains fell as much to 20+% before finally closing the monthly return at 49.52%. This is an example of how speculative plays are subject also to high volatility.

Next up we have the airlines sector as represented by ticker XAL, was another clear out-performer gaining a whooping 42.44% in just a month! It is clear these gains are mostly optimistic and forward thinking based on expectations of vaccine availability to the masses, which will bring air travel back in vogue.

A close second is the Energy sector as represented by ticker FXN, which made an enormous gain of 26.94% for the month of November 2020. There are two main stories circulating the investing world, that is driving Energy optimism. First, the next US president Joe Biden has campaigned as a climate change advocate, unlike his predecessor who had been very accommodative toward US oil shale development. President Elect Joe Biden is expected to be tough towards US oil development, which is welcomed by the rest of the oil economy as it will be suggestive of lower future supply and therefore higher oil prices. Secondly, if the rest of the world eventually becomes vaccinated, demand for oil and energy will increase which will be bullish oil stocks.

WHAT DOES 'BROAD BASE' ACTUALLY MEAN?

IWM is the ticker symbol for the Russell 2000 which comprises a basket of 2000 small market capitalisation US companies.The Russell 2000 sold down hard during the March Covid selldown, as confidence in small cap companies being able to survive the pandemic was shaken. The fact this index is currently up 16.17% for the month of November 2020, indicates significant buying interest in higher risks, smaller public listed US companies.

GDOW is the ticker symbol for the Global Dow index which is a 150-stock index of corporations from around the world, created by Dow Jones & Company. Only blue-chip stocks are included in the index. Thus in terms of analysing global recovery, GDOW is often looked at and its November 2020 performance of 14.07% has been nothing short of impressive. It seems the recovery is not exclusive to the US economy but also globally.

RSP is the ticker symbol for the equal weighted S&P 500 index. While there are 500 companies in the S&P 500 index, not all have equal weightage in the portfolio. What RSP does is it assumes all 500 companies are equally important and therefore have equal weightage contribution. When RSP is increasing, as it did by 11.8% in November 2020, is another indicator that investors and traders are buying all small, weak, big and strong component stocks of the S&P 500 index.

WHAT ABOUT SAFE HAVENS? HOW ARE THEY DOING?

Gold (Ticker ‘ZG’) and US Treasuries (Ticker ‘TLT’) are the go-to assets when there are flight to safety concerns in the market. These two assets have performed -5.87% and 0.91% respectively for the month of November 2020, which indicates that most market participants have allocated more money and capital towards riskier assets like stocks compared to safe haven assets.

Conclusion

In a weak global economy with numerous outstanding concerns and uncertainty, history has proven the broad market sentiment will remain weak, with a selected few stocks and sectors primed to do well. In the early months following the March Covid selloff, that Sector has exclusively been TECH.

However, market sentiment appears to have changed significantly from the first, second and third quarters of 2020. Significant capital has flown into speculative alternative asset classes like Cryptocurrency, long beaten down sectors like the Airlines and Energy, and also riskier small cap companies.

On the other spectrum, interest in safe haven assets like Gold and US treasuries have been receiving lukewarm treatment and in the case of Gold, significant capital withdrawals.

Most importantly, we will like to highlight that while it seems a broad based rally is taking place, there are also signs of increasing speculations and volatility, especially in riskier asset classes.