In the month of September 2021, the S&P 500 showed some weakness by closing negative for the month -223.46 points (-4.93%) from 4531.04 to 4307.54.

This is only the second time in 2021 where the S&P 500 experienced a losing month. The first time occurred in January 2021.

September 2021 experienced some volatility throughout the month. For a consecutive 3 weeks, we saw a temporary maximum drawdown (peak to trough) move from 4545.85 to 4305.91 (-5.27%) due to seasonal weakness and more importantly the contagion risks associated with Evergrande’s financial troubles (we will cover this further in this article).

Subsequently, increasing bond yields started to weigh on the stock market. This pressured the big tech and popular growth stocks which are highly sensitive to bond yields. For example, Apple and the Nasdaq 100 fell 1.1% and 0.8% respectively. Even Microsoft fell 1.7% and Amazon was down 0.6%.

Going forward, if there are no major catalysts that will change the ongoing market narrative, we can expect the S&P 500 to trade within the turquoise trend channel below. The S&P 500 will likely be constrained at the 4741 resistance level, with 4233 acting as key support.

In terms of managing downside risks, if the critical 4373 support level fails to hold, this likely means that the stock market will be faced with unexpected market concern(s) that have the potential to trigger further downside below 4058.

TAKEAWAY

- The market posture ending September 2021 has softened and weakened slightly.

- This is only the second time in 2021 where the S&P 500 experienced a losing month. The first time occurred in January 2021.

- Economic and inflation data suggests the US economy is still strong with clear stagflation risks not present.

- The Evergrande saga in China appears to be contained by the Chinese government – for now.

Recap of what we said in our September 21 Outlook

In our September 2021 Market Outlook piece, we suggested our community readers pay close attention to economic growth indicators and also inflation data as key factors to determining whether the US stock market will continue to show strength, or experience a pullback/correction.

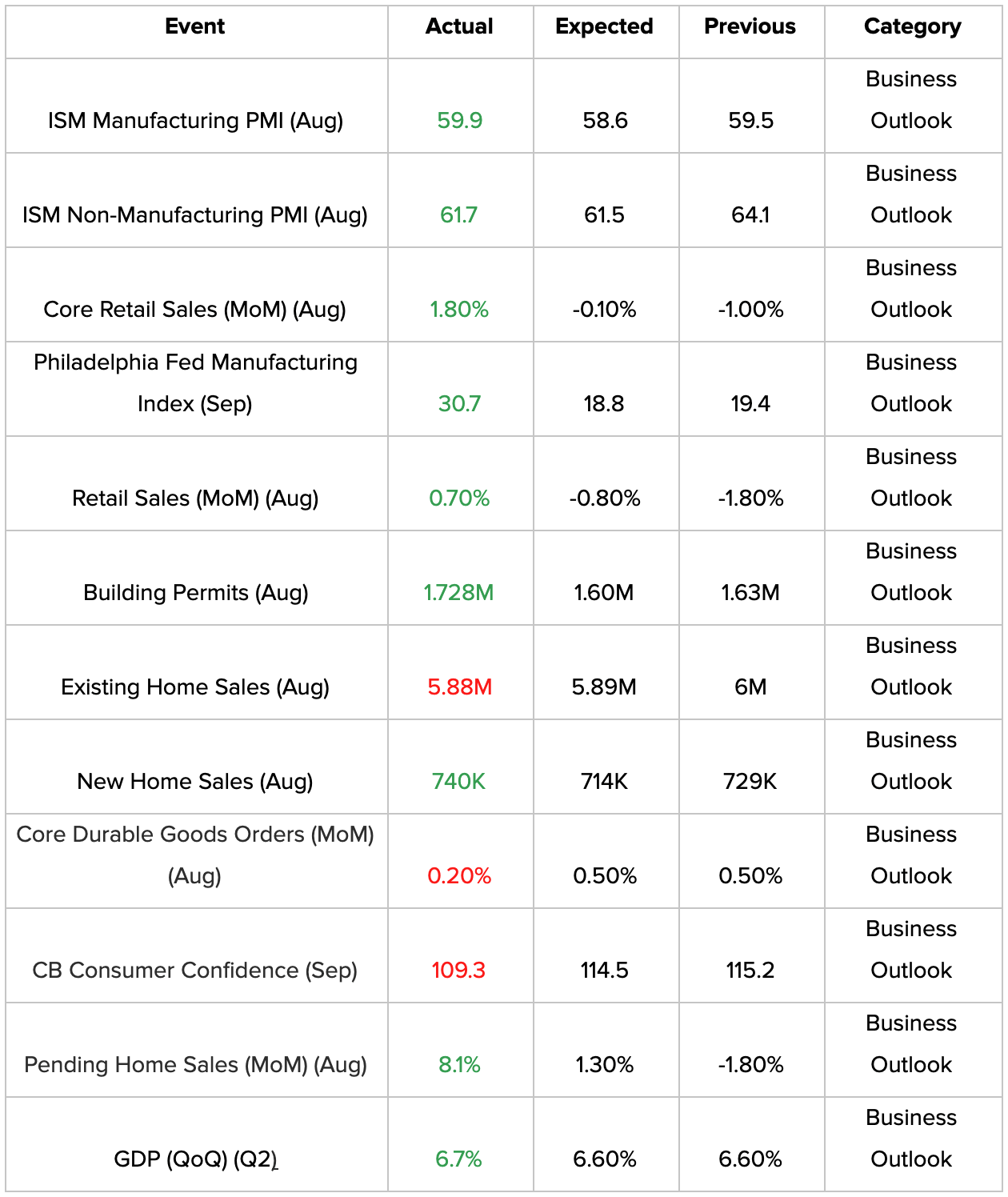

Let’s first revisit how several business outlook economic data panned out, before looking at inflation data and employment data.

Results in Red are less than ideal for the economy, and Green is ideal for the economy.

Business Outlook Economic Data

When it comes to the economy’s business outlook, there are several focus areas. First, Purchasing Managers (PMI) are often interviewed in the manufacturing and non manufacturing sectors to determine if businesses are bullish, neutral or bearish in their business sentiment.

Second, consumer spending activities make up the bulk of GDP contribution, and core retail sales directly track consumer spending behaviours.

Third, we also have building permits and home sales data that are tracked to determine the level of construction activities and also home transactions.

Fourth, local states often track the level of manufacturing conducted by companies which provide indication on the robustness of goods produced.

Lastly, core durable goods orders measure the change in the total value of new orders for long lasting manufactured goods.

In summary, the economic outlook indicators are showing more positive results than negative ones.

On the most part, manufacturing businesses appear to be robust, along with consumer retail sales increasing more than forecasted. Furthermore the higher than expected GDP growth supports the growth case rather than the feared stagnant growth scenario.

There are, of concern, certain aspects of the economic data by way of lowered existing home sales, core durable goods orders and consumer confidence that appear to be on the softer side. This needs to be monitored and tracked going forward.

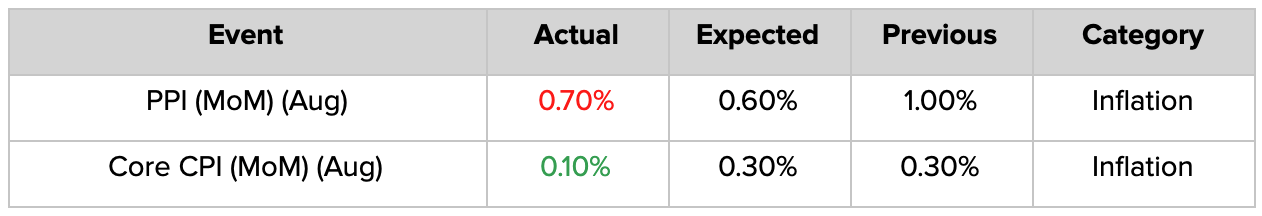

Inflation Data

The Consumer Price Index (CPI) measures the change in the price of goods and services from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation.

A persistently high CPI reading can be taken as being bearish for the equities market. A sustainable 2% (YoY) and below CPI reading is bullish for the equities market as that represents the Fed’s long term inflation target range.

Inflation drops lower than expected in August as the price index decreases to 0.1%, below the expected forecast of 0.3%, and also above the previous month’s 0.3% increase.

Energy prices accounted for much of the inflation increase for the month, with the broad index up 2% and gasoline prices rising 2.8%. Food prices were up 0.4%.

Used car and truck prices, which had been a major feeder of the headline inflation gains, fell 1.5% in August but are still up 31.9% year on year. New vehicle prices, though, rose 1.2%.

Transportation services declined 2.3% for the month.

However, the data does not conclusively show that inflation is abating. The Producer Price Index (PPI), which measures the change in the goods price sold by Producers, and is a leading indicator of consumer price inflation. The PPI has increased more than is expected by most economists although it has not exceeded the prior month’s value. This may suggest persistent inflation remains within the realm of reasonable possibilities.

The US CPI increase slowed in August, breathing sighs of relief as signs of inflation peaking may be present. However the PPI appears to suggest otherwise.

Should inflation results continue to increase in the subsequent months, this would increase concerns over persistent inflation occurring which may inadvertently result in the Fed raising interest rates early.

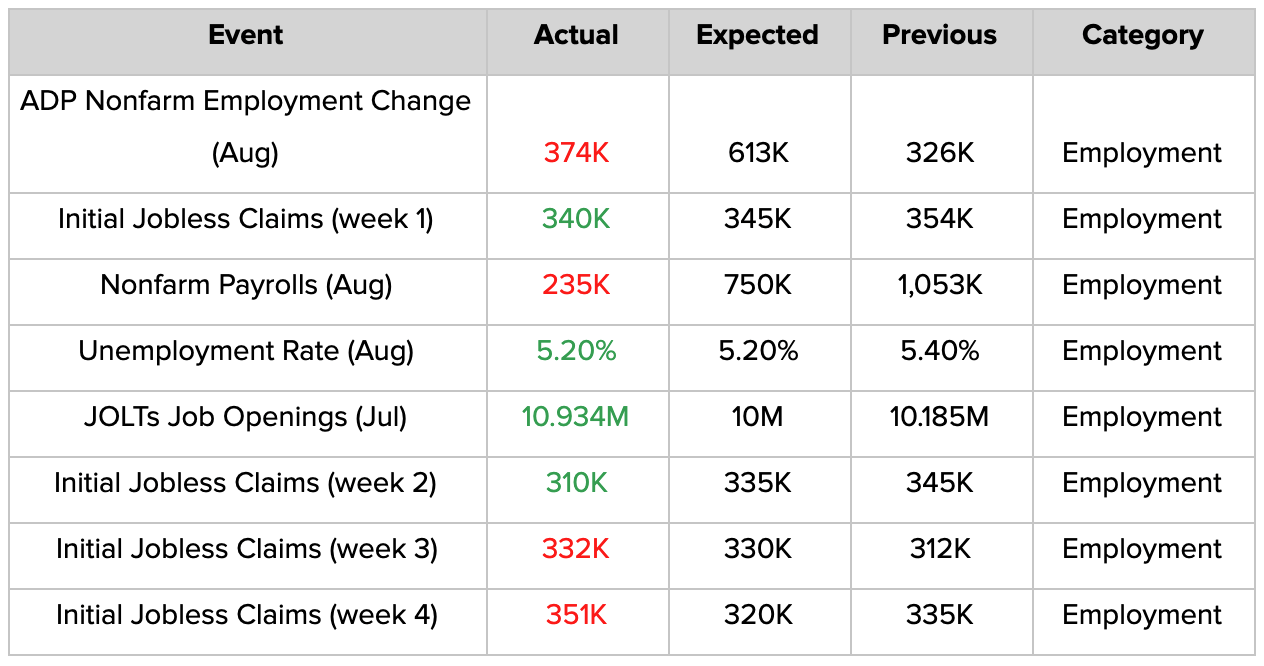

Employment Data

Since 1977, the Federal Reserve has operated under a mandate from Congress to “promote effectively the goals of maximum employment, stable prices, and moderate long term interest rates” — what is now commonly referred to as the Fed’s “dual mandate.”1

This clearly shows how important employment data is to the Fed’s monetary and interest rate decision making process.

When it comes to the employment data, there are several focus areas. First, the Fed has the ability to track payroll changes on a monthly basis in non farming industries (ADP Nonfarm Employment and Nonfarm payrolls).

Second, on a weekly basis, it also tracks the number of people that are filing for jobless claims.

Third, it is also able to track the number of job openings generated by businesses at large.

Last and most important, it is able to measure on a monthly basis the level of unemployment in the US.

Positives

JOLT Jobs’ opening data, while a laggard (we only have data going back to July), continues to surprise to the upside with businesses generating 10.934M new jobs compared to 10M jobs expected. This indicates companies are hiring and opportunities exist for employment in the labour market.

Negatives

Nonfarm employment change data in August appears to be weaker than expected.

Additionally, unemployment claims remained about 50% the pre-pandemic average, despite record job openings and stepped-up attempts by many businesses to add staff.

The weekly initial jobless claims have been decreasing consistently for the past few months, but appear unable to break below 300K.

Looking ahead, economic growth is expected to slow in the third quarter amid a pullback in stimulus spending. The end of federal pandemic benefits has not yet led to an increase in job applications, according to employers across industries.

California saw claims rise by 24,221, and Virginia saw an increase of 12,879, by far the biggest increase last week. Louisiana saw the biggest decrease, as the state recovers from Hurricane Ida.

Federal pandemic unemployment benefits ended by Sept. 6 in all states. The White House has said it will not extend jobless aid further, but states can use pandemic relief funds to provide additional assistance to unemployed workers.

The Balanced View

The current unemployment rate of 5.2% is on a decreasing trend however it is clearly not back at pre-Covid levels indicating the economy is still not ideal.

A less than ideal unemployment rate provides reason for the Fed to keep monetary policy loose which is bullish for stocks, however what is unclear is at which point of the decreasing unemployment trend will the Fed take the cue to start the tapering process.

Market Outlook

In the last week of September, the Fed signalled that it is likely to announce its Quantitative Easing taper some time in November.

Almost half of the Fed voting members have voted for interest rates to be increased in 2022.

The 10-year Treasury yield has risen to as high as 1.54% after trading for as low as 1.17% in August 2021. This is due to the Fed’s expectation to soon taper (reduce its bond purchases) which could decrease demand for bonds. Inadvertently this lowers their prices, and increases their yields.

On the other hand, with economic growth still showing strength in recovery, the Fed’s taper is not currently expected to damage economic growth.

That’s allowing the 10-year yield to increase, reflecting higher expectations for future economic growth demand and transitory inflation.

This pressured the big tech and popular growth stocks which are highly sensitive to bond yields. For example, Apple and the Nasdaq 100 fell 1.1% and 0.8% respectively. Even Microsoft fell 1.7% and Amazon was down 0.6%.

On the other hand, increasing bond yields under strong economic recovery conditions favour financial stocks like bank stocks. This is because when the spread between long-dated yields and short-term interest rates increases, banks can lend at higher rates and still borrow at low rates, thereby boosting profitability. Furthermore, if economic growth is expected to remain robust, banks can make more loans.

Will Evergrande collapse the Stock Market?

Let’s begin the topic by stating that real estate activities account for approximately 30% of China’s GDP.

Given Evergrande’s status as the second largest property developer in China, and is also one of the most indebted. Therefore if it were to declare bankruptcy, there are legitimate concerns there will be domino effects of its failure felt throughout the Chinese economy, and possibly even internationally.

Why is Evergrande in trouble?

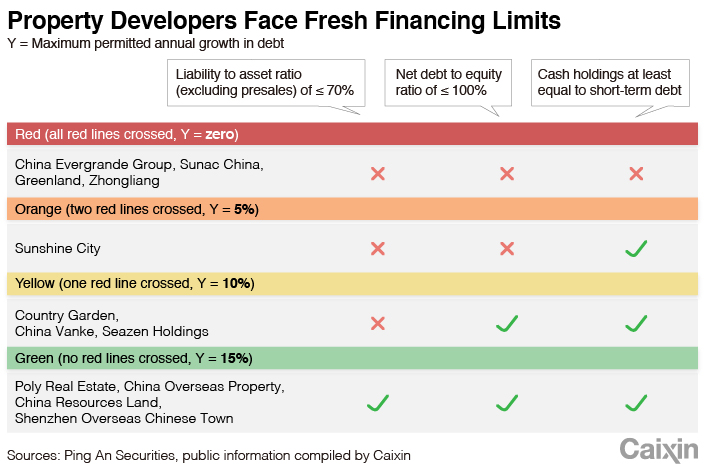

Evergrande started to encounter challenges in financing after the Chinese government stated to impose new financing controls on China’s property developers, more commonly referred to as the three red lines2, which are centred around how much interest bearing debt load property developers are now able to borrow based on 3 existing balance sheet ratios.

What happened to Evergrande after the 3 red lines announcement?

Size and Scope of Evergrande crisis

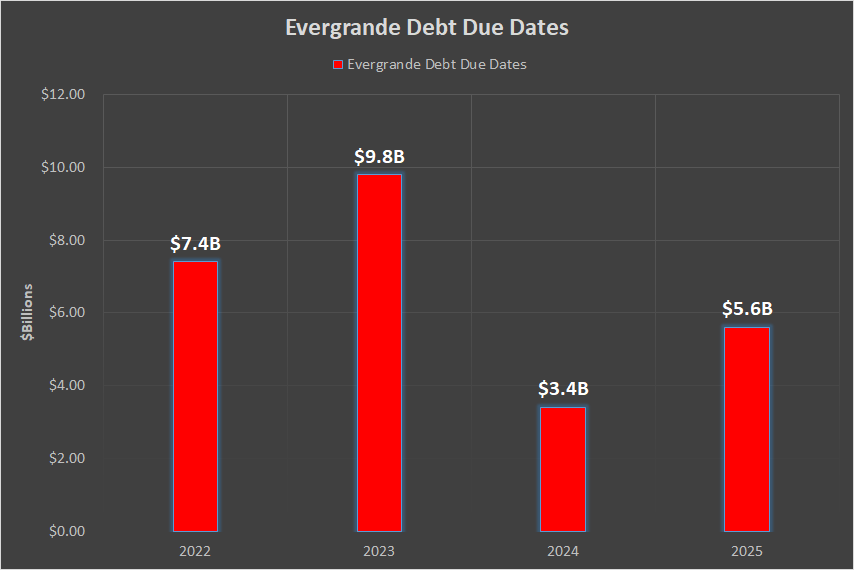

Evergrande Debt coming due

Evergrande Short Term Liabilities

While the current cash position of Evergrande is not known. There is certain evidence that strongly suggest Evergrande is unable to meet her short term liabilities:

- 22 September 2021 – Evergrande missed 2 interest payments due.

- 23 September 2021 – Evergrande’s Electric Vehicle (EV) unit has stopped paying staff salaries and suppliers.

Why is Evergrande termed Lehman 2.0?

Many of our readers would probably have read online or seen commentaries comparing Evergrande to the Lehman Brothers situation in 2008 that eventually caused the Great Financial Crisis.

Here’s a summary of why these comparisons exist:

- The 2008 Great Financial Crisis started because of property collapse in the USA. Evergrande is China’s 2nd largest property developer and the Chinese property market is currently heavily indebted.

- Real estate activities in China account for 30% of GDP.

- Banks and financial providers are very sensitive to bad and high risk loans. They tend to either starve funding to the beleaguering property China industry, or require property developers pay exorbitant interests on the loans.

- If the China property industry is starved of liquidity because of Evergrande, it could trigger a property induced financial crisis.

- Evergrande not only develops and sells property units, they also offer clients wealth management products (WMP), such as having the ability to redeem any financial losses with real estate owned by Evergrande.

- According to Bloomberg5 “Alarm bells are ringing as Chinese citizens keep pouring their savings into wealth-management products, a market that has tripled to more than $4 trillion in a little over three years… The outstanding value of off-balance sheet WMPs stood at 22 trillion yuan ($3.3 trillion)… equivalent to 24% of China’s GDP”

- Furthermore, Evergrande’s liabilities6 are equivalent to about 2% of China’s GDP and has more than 200,000 employees, who themselves and many of their families have invested billions of yuan in the company’s WMPs. There are more than 800 projects under construction, more than half of them halted due to the company’s cash crunch. In addition, thousands of upstream and downstream companies rely on Evergrande for business, creating more than 3.8 million jobs every year.

Will Evergrande affect the global economy?

Currently, the expected global impact of Evergrande is expected to be limited, UBS7 bank is currently estimating that $19 billion worth of Evergrande’s liabilities are offshore bonds owned by international investors outside of China.

However, there is always a small possibility that the domestic Evergrande troubles can send ripples to the international stage, if not waves.

According to Capital Economics, if all China property developers are pressured, property prices will drop leading to trouble in the housing market. Since the consumer is a significant contributor in the Chinese economy, a housing hit could inadvertently hurt consumption.

Chinese imports will start to weaken, as well as diminishing demand for raw commodities which will likely impact commodities countries like Australia and many Asia countries. Given China’s status as the world’s second largest economy, the growth of China is economically intertwined with the international economy.

Chinese Government to save the day?

Given how much control the Chinese government has over the population and economy, many would expect, in similar high handed fashion, the Chinese government’s intervention into Evergrande’s woes.

There is data in support of a financial crisis having reduced probabilities of occurring on the back of Evergrande.

Hence, Lehman 2.0 might not occur, as the China government has already stepped in.

Here’s what we know so far.

First, China has already asked state-backed property companies to acquire Evergrande’s assets8.

- Word has it, from people with knowledge of the matter, for China Vanke Co Ltd (000002.SZ), China Resources Land (1109.HK) and China Jinmao Holdings (0817.HK) to purchase some of embattled China Evergrande Group’s (3333.HK) assets.

- Several government owned companies have completed due diligence on Evergrande properties in Guangzhou.

- For example, Guangzhou City Construction Investment Group is close to acquiring Evergrande’s Guangzhou FC Soccer stadium and surrounding residential projects.

Second, the Chinese government is directly involved in restructuring Evergrande. For example, Evergrande would sell off $1.5 billion of its stake in Shengjing Bank to Shenyang Shengjing Finance Investment Group, an investment company that manages Chinese state assets9.

Third, China’s central bank (PBOC) vowed to protect consumers with exposure to the housing industry. Also, the PBOC has injected more cash into the banking system while the Shenzhen state government began an investigation into Evergrande’s Wealth Management Unit10.

Conclusion

In this month’s market outlook, perhaps the best expression to surmise the way forward is “Markets are starting to look soft”.

However, this is not to say a deep set correction is on the card and something that MUST happen. The stock market can be soft, and trade sideways without experiencing a significant correction.

One view is that despite the Evergrande saga, and Fed tapering news triggering a bond yield spike, these two negative market moving events have resulted in only a -5% pullback.

Furthermore, in view of receding inflation and continued economic growth data, stagflation risks are contained to date.

Hence for markets to drop further, perhaps more negative news is required.

Please note that all the information contained in this newsletter is intended for illustration and educational purposes only. It does not constitute any financial advice/recommendation to buy/sell any investment products or services.

Disclaimer: Please note that all the information contained in this newsletter is intended for illustration and educational purposes only. It does not constitute any financial advice/recommendation to buy/sell any investment products or services.

1https://www.richmondfed.org/publications/research/economic_brief/2011/eb_11-12#:~:text=Since%201977%2C%20the%20Federal%20Reserve,goals%20can%20be%20traced%20back

2https://www.bloomberg.com/news/articles/2020-10-08/what-china-s-three-red-lines-mean-for-property-firms-quicktake

3https://www.bbc.com/news/business-58579833#:~:text=Evergrande%20reportedly%20owes%20money%20to,be%20forced%20to%20lend%20less

4https://asia.nikkei.com/Spotlight/Caixin/How-Evergrande-could-turn-into-China-s-Lehman-Brothers

5https://www.bloomberg.com/news/articles/2019-04-14/don-t-say-you-weren-t-warned-about-china-s-wmps-quicktake-q-a

6https://asia.nikkei.com/Spotlight/Caixin/How-Evergrande-could-turn-into-China-s-Lehman-Brothers

7https://asia.nikkei.com/Spotlight/Caixin/How-Evergrande-could-turn-into-China-s-Lehman-Brothers

8https://www.reuters.com/world/china/china-asking-state-backed-firms-pick-up-evergrande-assets-sources-2021-09-28/

9https://www1.hkexnews.hk/listedco/listconews/sehk/2021/0929/2021092900039.pdf

10https://www.reuters.com/world/china/china-evergrandes-electric-car-units-shares-tumble-23-after-warning-2021-09-27/