Introduction

Technology stocks have been taking a beating in recent sessions, having been in favour due to digital acceleration since Covid 19 occurred.

Hence it is extremely rare for technology stocks to be making new highs coming into 2022.

Are you interested to know which technology stocks listed on the NASDAQ have made new all time highs in 2022 and why?

More importantly, what further upside narratives might they have?

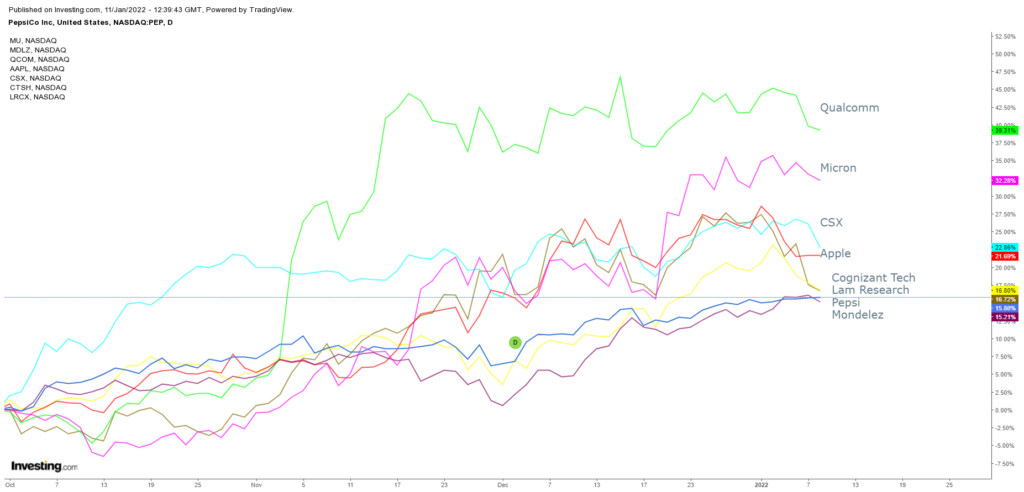

8 Nasdaq stocks making new highs in 2022

There are currently only 8 stocks listed on the NASDAQ 100 index that have made a new all time high in 2022.

Stock | 1 Year Return |

PepsiCo Inc | +20.8% |

Micron Technology | +21.27% |

Mondelez International Inc | +15.19% |

Qualcomm Inc | +14.71% |

Apple Inc | +30.4% |

CSX Corp | +14.38% |

Lam Research Corp | +32.43% |

Cognizant Technology Solutions Corp | +5.77% |

Upside Narrative

For stocks to constantly make new highs, there must be upside narratives supporting the strong price trend.

Here’s a summary of what’s moving these 8 stocks.

Pepsi Co

- With inflation reaching levels not seen in nearly 30 years, PepsiCo is uniquely positioned to combat this headwind.

- PepsiCo’s well-established and diversified product lineups allow the company to capitalize on opportunities around the globe.

- PepsiCo’s impressive dividend history, including 49 years of consecutive growth, should also provide cash flows that are well insulated from inflation.

Micron Technology

- Calling semiconductors the “new oil” of the global economy, Bank of America analyst Vivek Arya on Monday listed Nvidia (NASDAQ:NVDA) and Micron Technology (NASDAQ:MU) among his top chip stocks for the year.

- In a research note, Arya said that despite a “bumpy” ride at the present time, semiconductors should have a strong year due to factors such as expanding cloud services, automobiles and increases in corporate capital spending. Arya estimates that global semiconductor sales should reach $619 billion this year, or a 13% increase over 2021’s sales.

- “Rising [interest] rates are the biggest risk to semiconductor industry valuation,” in 2022, Arya said. “However, we assume a return to fundamentals once [a] new rate regime is baked in.”

- Arya said Micron Technology (MU) is his top pick among memory chips due to the potential for DRAM chip prices to pick up in the second half of the year. Like Nvidia (NVDA) Arya also has a buy rating on Micron (MU), and he raised his price target on the company’s stock to $118 a share from $100.

Mondelez International Inc

- Mondelez (NASDAQ:MDLZ) is heavily supported as it is a key component of the S&P 500 Consumer Staples (NYSEARCA:XLP). Expected Positive interest rates in 2022 and GDP betas are expected to benefit MDLZ. Furthermore MDLZ ranks high in ESG ranking.

Qualcomm Inc

- Qualcomm CEO Cristiano Amon said Wednesday that the growth of digital components within vehicles has tightened the relationship between automakers and computer chip providers, a trend that will benefit QCOM over the long term.

- “Every car maker wants to have a direct relationship with a chip company,” the head of Qualcomm (NASDAQ:QCOM) told CNBC.

- Amon explained that a stronger digital platform will allow automakers to expand their revenue base, by allowing the manufacturers to provide additional services. He predicted that this service revenue will eventually eclipse the profit gained from the original vehicle sale.

- Meanwhile, the Qualcomm CEO sees a similar dynamic fueling growth in the PC space. He explained that consumers will demand added functionality as they expand the uses for products like laptops.

- Amon pointed to the recent pandemic experience as an example. He noted that work-at-home routines turned laptops into communication devices, a process he expects will continue over time.

- “There’s a lot of things are completely changing what the PC is,” he said. “Number one use case of a PC right now is for communication.”

- He added that functions like AI and gaming would also require more powerful chips in standard consumer PCs.

- Earlier this week, QCOM announced a deal with Microsoft to launch custom chips for use in future AR glasses.

Apple Inc

- Apple’s simplicity allows apps like Snapchat to utilize the camera whereas Android’s complexity has forced developers to use screengrabs.

- Sales of wearables, home and accessories have exploded from $12.8 billion in 2017 to $38.4 billion in 2021.

- Under CEO Cook’s leadership, Apple’s presence in China skyrocketed such that 2021 operating income was $28.5 billion on sales of $68.4 billion!

CSX Corp

- CSX Corporation (CSX +1.5%) is added to the BMO Capital list of top 15 U.S. large cap stock picks to replace Union Pacific (UNP +1.7%).

- The firm thinks CSX is executing better than peers on both operational and commercial fronts.

- Analyst Brian Belski: “We believe that CSX will experience well above historical average volume growth going forward, which should enable it to further improve margins without a significant increase in capex supporting expansion in ROIC and FCF.”

- Wall Street analysts are bullish on both CSX and UNP.

Lam Research

- Jefferies analyst Mark Lipacis initiated coverage on Lam Research (NASDAQ:LRCX) with buy ratings, noting that the chip equipment maker is a leader in the industry and should generate high free cash flow for the foreseeable future.

- Lam Research (LRCX) has higher exposure to the memory market than KLA Corp or Applied Materials, but it also has higher, more predictable services revenue than the other two companies.

Cognizant Technology Solutions Corp

- Reliq Health Technologies (OTCPK:RQHTF) announces an agreement with Cognizant (NASDAQ:CTSH) to leverage the latter’s Care Management resources for future deployments of Reliq’s iUGO Care software to large scale clients.

- Reliq’s remote patient monitoring platform, iUGO Care, is currently used by a diverse array of healthcare organizations in the U.S. These include primary care practices, specialist practices, home care agencies, skilled nursing facilities, HIV clinics and hospice care agencies.

- The agreement with Cognizant will expand Reliq’s capabilities and extend its reach, allowing Reliq to provide its iUGO Care solution to managed care organizations, large health systems, health insurance providers and reduce the cost to the healthcare system.

Conclusion

Technology stocks have been taking a beating in recent sessions, having been in favour due to digital acceleration since Covid 19 occurred.

Hence it is extremely rare for technology stocks to be making new highs coming into 2022.

For stocks to constantly make new highs, there must be upside narratives supporting the strong price trend.

Disclaimer: Please note that all the information contained in this content is intended for illustration and educational purposes only. It does not constitute any financial advice/recommendation to buy/sell any investment products or services.