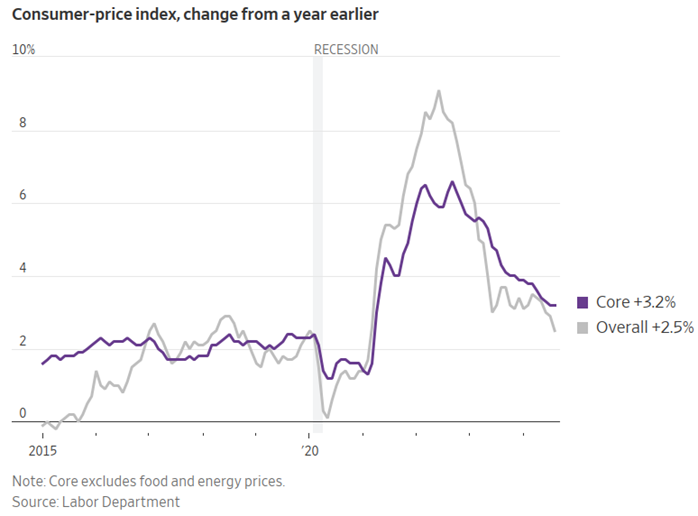

A recession is approaching – The U.S. economy in 2024 has been marked by a steady, if uneven, recovery from the pandemic years, with inflation finally showing consistent signs of cooling. Inflation dropped to 2.5% in August, marking a new three-year low, down from a July rate of 2.9%.

Source: Labor Department

This significant deceleration in inflation has paved the way for the Federal Reserve to consider rate cuts starting in September 2024. However, concerns over the labour market persist as hiring has slowed, though consumer spending has remained resilient.

Be Cautious 'Recession is Coming'

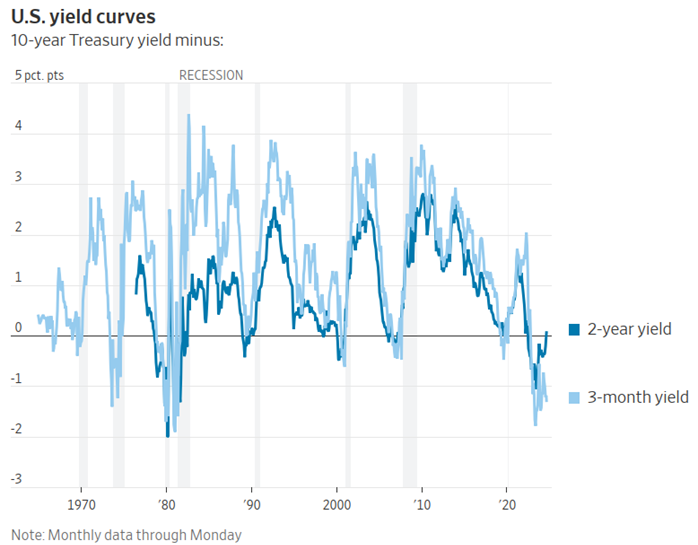

Concerns over a potential recession have intensified as the yield curve has reverted to normal. Traditionally, this serves as an indicator of economic downturns. Historically, such shifts have signaled an impending recession, though there is hope that the Fed’s anticipated rate cuts could lead to a “soft landing” for the economy. Similar scenarios seen in the mid-1990s. However, significant risks remain.

Source: LSEG

The Market seems to be anticipating a recession to come

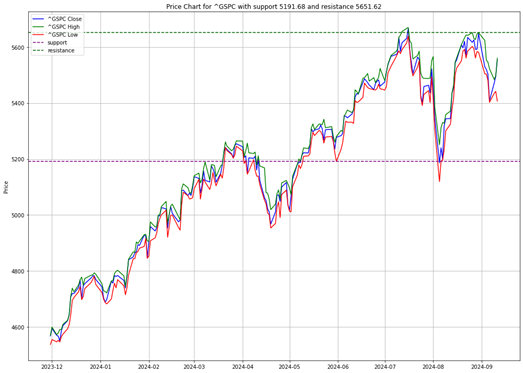

The U.S. stock market in 2024 has been characterized by high volatility, with major indexes fluctuating in response to a combination of economic data and investor sentiment. Inflation data has been one of the primary drivers of market movement, with the cooling inflation rates sparking optimism among traders. The S&P 500, for instance, swung between gains and losses in September, reflecting investor uncertainty over inflation and potential Federal Reserve rate cuts.

S&P 500 Index Chart

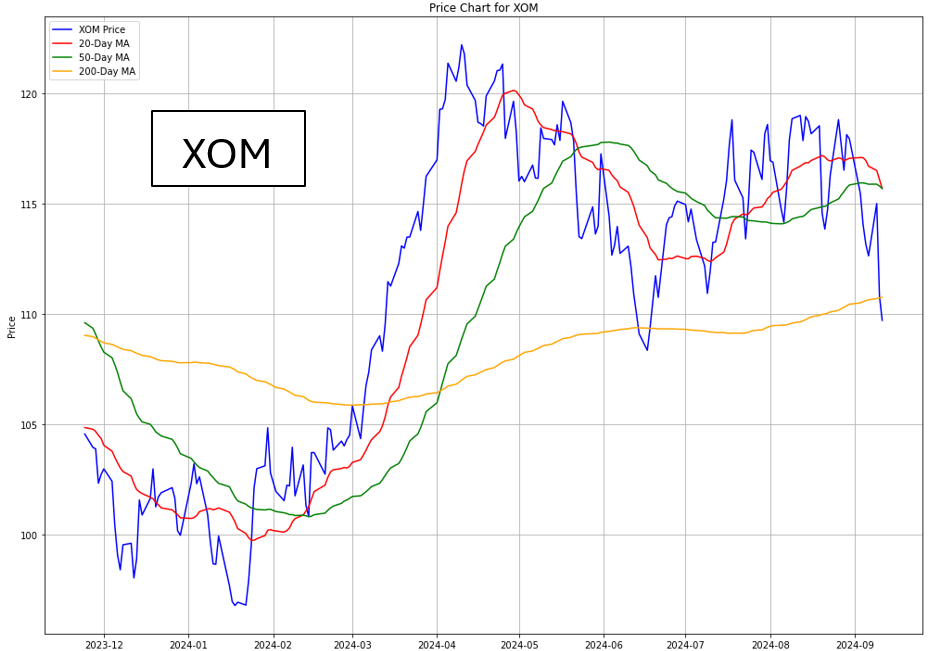

One of the major stories in the stock market has been Berkshire Hathaway’s significant bet on Occidental Petroleum (OXY). Despite Warren Buffett’s substantial investment, Occidental has underperformed in 2024, with its stock down 15% year-to-date. This decline is mainly due to falling oil prices and concerns about the company’s high debt levels, which contrast with the more conservative balance sheets of competitors like Exxon Mobil (XOM) and Chevron (CVX). With oil prices around $68 a barrel, Occidental’s future remains uncertain, especially since Berkshire has not made any new purchases since mid-June.

Occidental Petroleum Stock Chart

Exxon Mobil Stock Chart

Investment Opportunity & Risk

Several stocks have made notable moves in recent weeks.

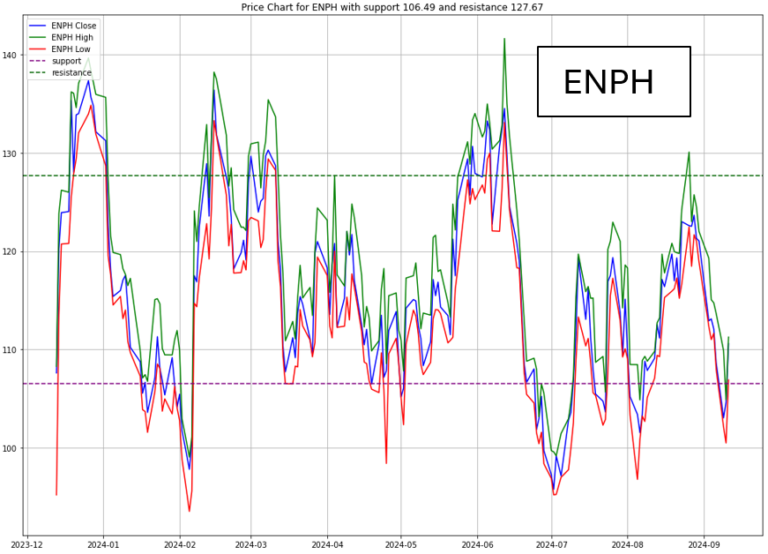

Renewable Energy Sector -e.g., First Solar, Enphase Energy, etc.

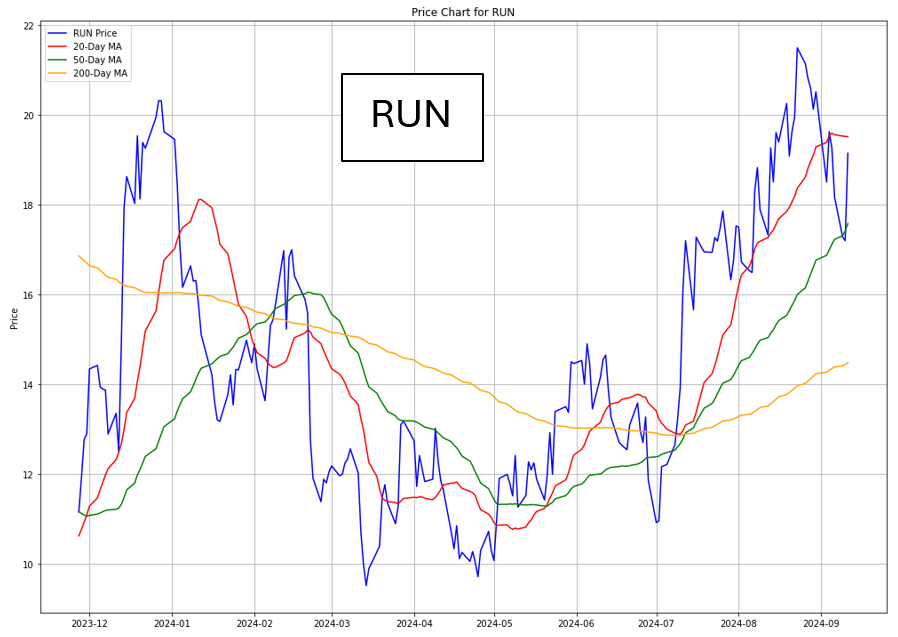

- First Solar (FSLR), Enphase Energy (ENPH), and Sunrun (RUN) saw significant gains after Kamala Harris’s perceived debate victory. Investors view her green energy policies favorably. These gains occur as more investors increasingly view the renewable energy sector as a growth opportunity, especially with global shifts toward decarbonization.

Enphase Energy Stock Chart

Sunrun Stock Chart

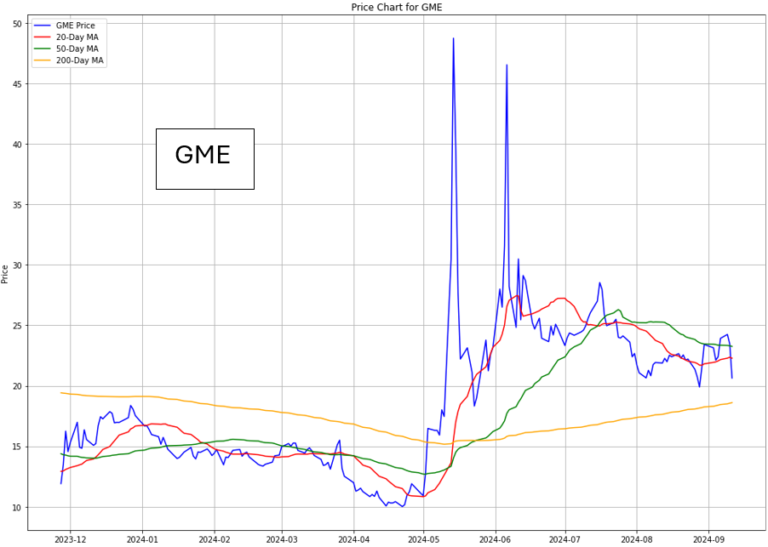

GameStop - (NYSE: GME)

- GameStop reported mixed earnings. Sales declined sharply, but cash reserves increased. The stock fell 12%, reflecting market concerns about the sustainability of its business model amid a changing retail landscape.

GameStop Stock Chart

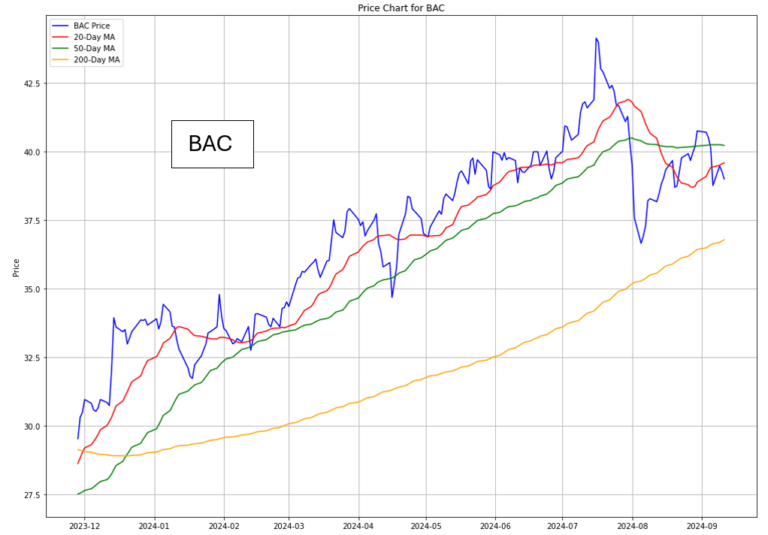

Bank of America - (NYSE: BAC)

- In the banking sector, Bank of America (BAC) saw its stock fall as Berkshire Hathaway continued to reduce its stake in the company. However, the financial sector has remained relatively stable. Investors are focusing on potential shifts in Federal Reserve policy that could benefit banks through more favourable interest rate spreads.

Bank of America Stock Chart

CONCLUSION

- The U.S. economy in 2024 is at a critical juncture.

- With inflation under control but growth slowing, the focus is now on the Federal Reserve and its rate-cutting decisions.

- The stock market remains volatile, with major sectors experiencing divergent trends based on both macroeconomic factors and individual company performances.

- Energy stocks like Occidental face significant headwinds, while the renewable energy and technology sectors are poised for potential growth as green policies and AI-driven innovations continue to attract investor attention.

- While the outlook remains uncertain, a measured approach by both policymakers and investors could help stabilize the economy and prevent a deeper downturn.

About the Author

Rein Chua is the co-founder and Head of Training at AlgoMerchant, with over 15 years of experience in cross-asset trading, portfolio management, and entrepreneurship. He has been featured in major media outlets such as Business Times, Yahoo News, and TechInAsia. Rein has also spoken at financial institutions like SGX, IDX, and ShareInvestor, sharing insights on the future of investing influenced by Artificial Intelligence and finance. Additionally, he founded the InvestPro Channel to educate traders and investors.

Rein Chua

Quant Trader, Investor, Financial Analyst, Vlogger, & Writer.