16 Sep 2024 – The US economy is navigating a mix of challenges and opportunities amid higher interest rates, inflationary pressures, and changing consumer behavior. Recent alarm on Wall Street stems from rising delinquencies in credit card and auto loans, especially among lower-income consumers, signaling potential economic stress. These worries, combined with varying expectations for Federal Reserve rate cuts, have left investors unsettled.

Despite this, US stocks have stayed buoyant, bolstered by strength in the tech sector and optimism that the Federal Reserve’s actions will prevent a recession.

Rising Delinquencies turn Wall Street Skittish

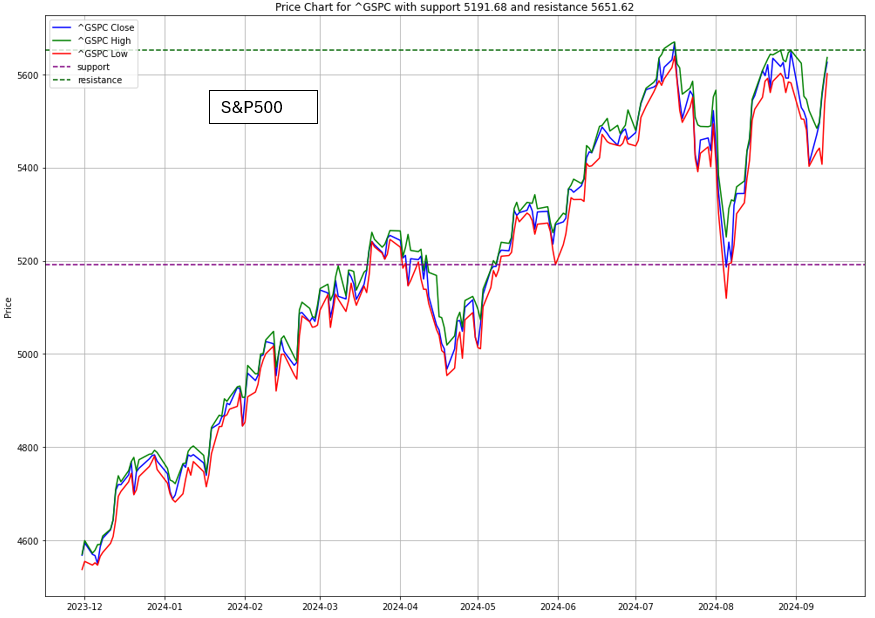

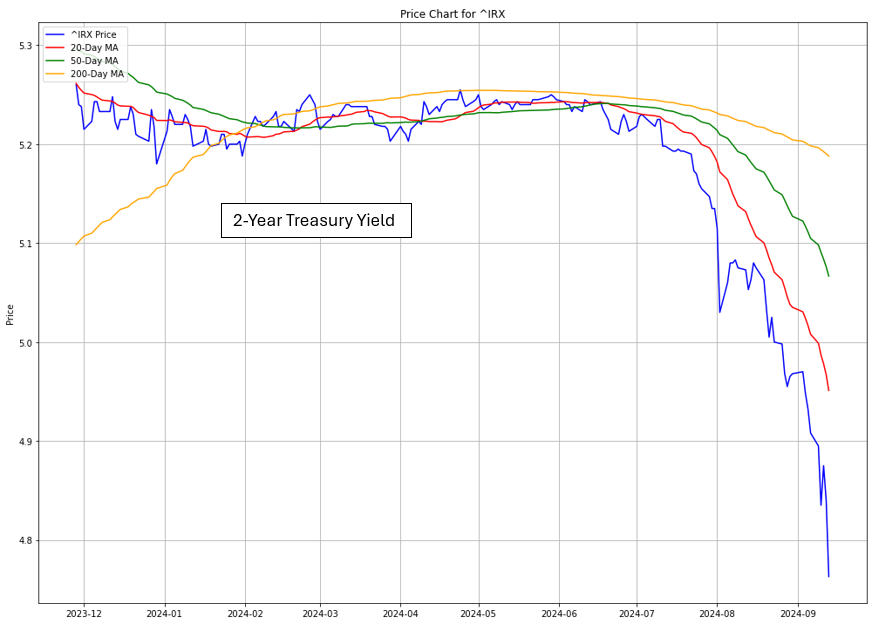

The broader S&P 500 Index remains near its all-time highs, with cyclical sectors such as information technology and communication services performing particularly well. However, rising delinquencies have emerged as a new threat in the market. At the same time, Treasury yields have declined, signaling bond market concerns about a possible economic downturn.

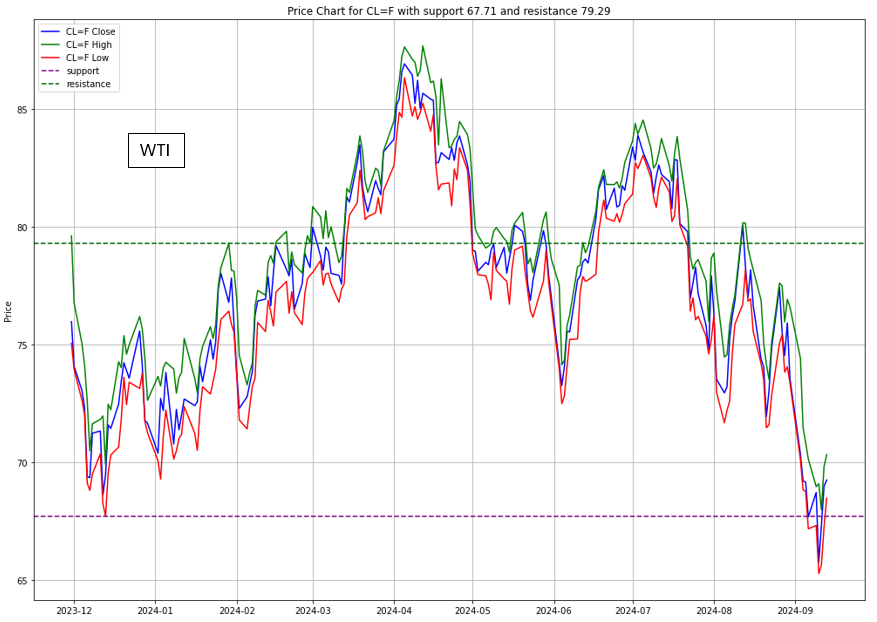

Meanwhile, gasoline prices have declined due to seasonal factors, including the transition to cheaper winter-blend fuels and decreased demand. However, crude oil prices have shown volatility, with production cuts from OPEC expected to impact future pricing.

KEY HIGHLIGHT

Class Action Lawsuit Against Walgreens Boots Alliance

Source: CAMPAIGNASIA

Amid rising delinquencies, Walgreens Boots Alliance is dealing with significant legal challenges. The company has agreed to pay $106.8 million to settle allegations of fraudulent healthcare billing from 2009 to 2020, where it violated the False Claims Act by billing for uncollected prescriptions.

The company attributed the issue to a software error and has since refunded $66.3 million to the government. In response, Walgreens has enhanced its pharmacy management software to prevent future issues. Two former employees who filed lawsuits under the whistleblower provision were awarded $14.9 million and $1.6 million, respectively.

While Walgreens self-reported the issue and took corrective actions, the settlement has raised concerns about compliance and reputational risks. These legal troubles could impact the company’s stock performance, as it works to regain investor and consumer trust in the highly regulated healthcare industry.

Sector-Specific Observations

The Energy Sector is sending mixed signals. Oil traders expect gasoline prices to drop as winter approaches, but crude oil prices remain volatile due to geopolitical uncertainties and OPEC’s production decisions.

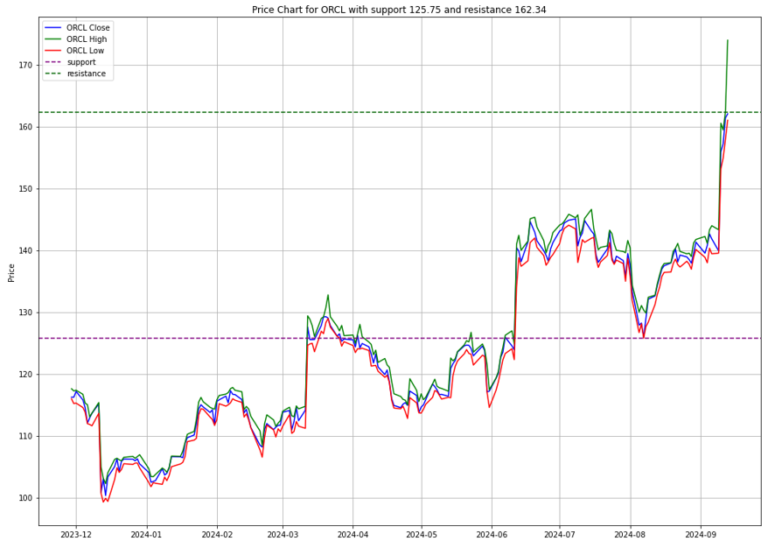

Meanwhile, the Technology Sector continues to lead the market, with strong performance from AI and cloud computing companies. Firms like Oracle and Nvidia have gained significantly, driven by rising demand for AI-powered cloud infrastructure solutions.

Investment Opportunity & Risk

Although rising credit delinquencies may appear to be a market headwind, the U.S. stock market remains mixed, with various sectors and companies displaying diverse performance. Noteworthy stocks include:

Oracle (NYSE: ORCL)

- Oracle has become a key player in the cloud computing and AI space, following its successful fiscal Q1 2025 earnings report. The company is transitioning rapidly into the AI-driven cloud services market, with a strong 21% growth in cloud revenue and partnerships with Amazon Web Services (AWS). Despite its high valuation, Oracle’s stock price surged 14% in the past five days, and analysts remain bullish on its long-term growth prospects.

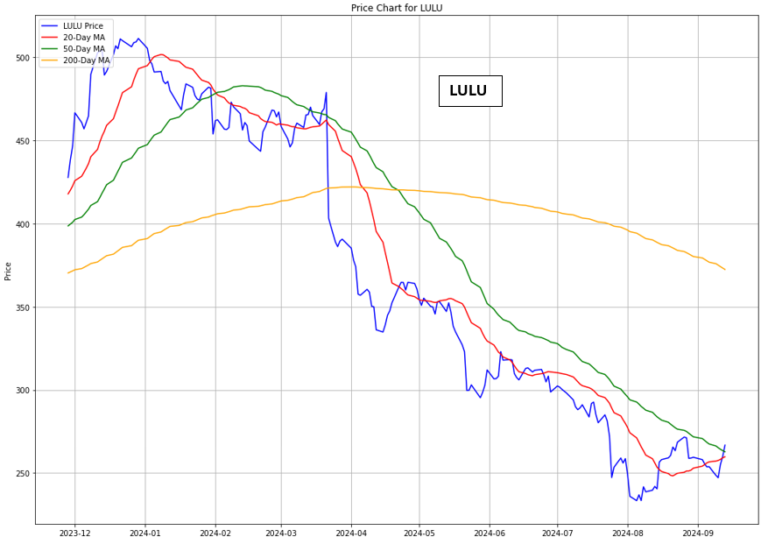

Lululemon (NASDAQ: LULU)

- Lululemon is experiencing a slowdown in its women’s apparel business, with only 6% growth that fell short of expectations. Executives attribute this to a lack of new colors, prints, and patterns, which diminished consumer appeal. Increased competition from brands like Alo and Vuori, along with inflation pushing customers toward cheaper alternatives or “dupes,” has also impacted the company. To address these issues, Lululemon has reorganized its leadership to better align product development and marketing. Despite these challenges, analysts are optimistic about the brand’s recovery potential with new collections, though concerns remain about whether it has reached its growth limit in key markets.

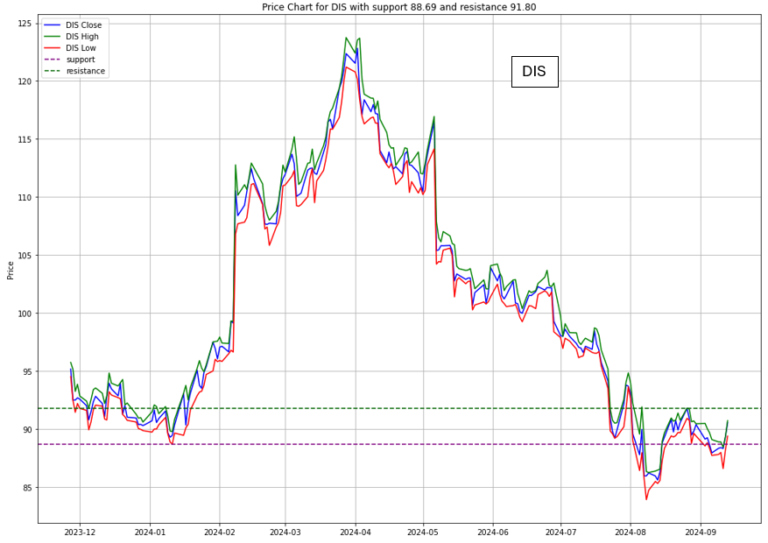

Disney (NYSE: DIS)

- Disney recently settled a major dispute with DirecTV, ending a two-week blackout and restoring ABC and ESPN to the broadcaster’s 11.3 million subscribers. The dispute revolved around fee increases for Disney’s channels and the flexibility of their distribution. The new deal allows DirecTV to bundle Disney’s streaming services, like Disney+ and ESPN+, into select packages and includes rights to Disney’s upcoming ESPN streaming service. As Disney adapts to the shift from traditional TV to streaming, it is focusing on expanding its digital presence and negotiating favorable terms with distribution partners to maintain broad content reach.

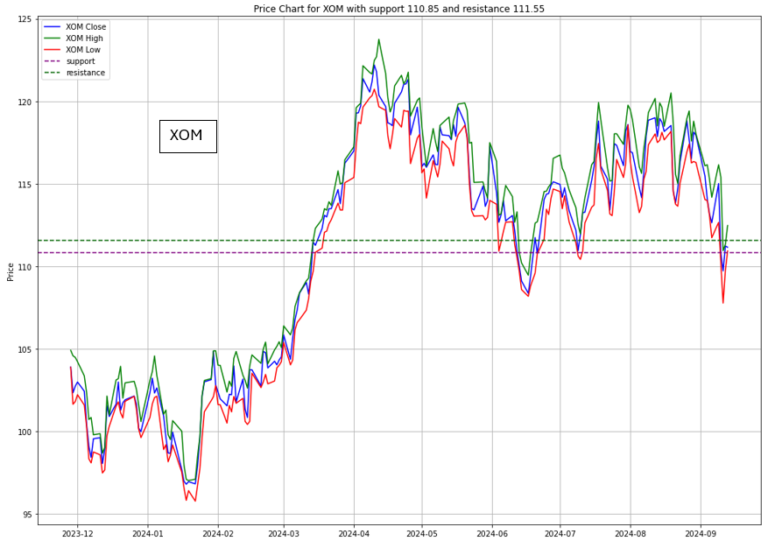

Exxon Mobil (NYSE: XOM)

- Exxon Mobil (XOM) is facing downward revisions in its earnings per share (EPS) forecasts due to economic challenges in the oil industry. Volatile crude oil prices and uncertain global demand have reduced the company’s earnings outlook. Instability in the oil market—driven by OPEC production cuts, geopolitical tensions, and shifting demand—has impacted Exxon. Despite its status as a major energy player, its growth is constrained by external factors like the shift to cleaner energy and fluctuating demand, leading to lower projected earnings.

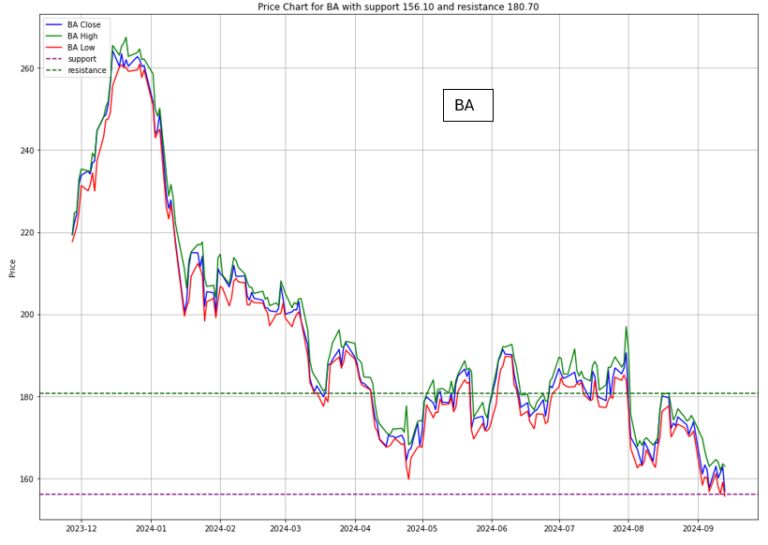

Boeing (NYSE: BA)

- Boeing is also facing earnings challenges amid broader market shifts. As a key player in the aerospace industry, the company has encountered its own difficulties. Its EPS estimates have been revised downward, driven in part by supply chain disruptions and production delays in the commercial aircraft division. Additionally, a recent strike by over 30,000 union employees has exacerbated the situation, significantly impacting commercial airplane production. This disruption comes at a pivotal moment for Boeing, which has been striving to recover from earlier production issues and safety concerns following the 737 MAX crisis.

CONCLUSION

- The US economy and stock market remain in a state of cautious optimism.

- While credit markets show signs of stress, especially for lower-income consumers, stock indexes remain robust, buoyed by the strength of tech and AI stocks.

- As rate cuts loom, both bond and equity investors remain split on the future trajectory of the economy, with hopes that the Fed’s actions can help prevent a recession while supporting stock market growth.

About the Author

Rein Chua is the co-founder and Head of Training at AlgoMerchant, with over 15 years of experience in cross-asset trading, portfolio management, and entrepreneurship. He has been featured in major media outlets such as Business Times, Yahoo News, and TechInAsia. Rein has also spoken at financial institutions like SGX, IDX, and ShareInvestor, sharing insights on the future of investing influenced by Artificial Intelligence and finance. Additionally, he founded the InvestPro Channel to educate traders and investors.

Rein Chua

Quant Trader, Investor, Financial Analyst, Vlogger, & Writer.