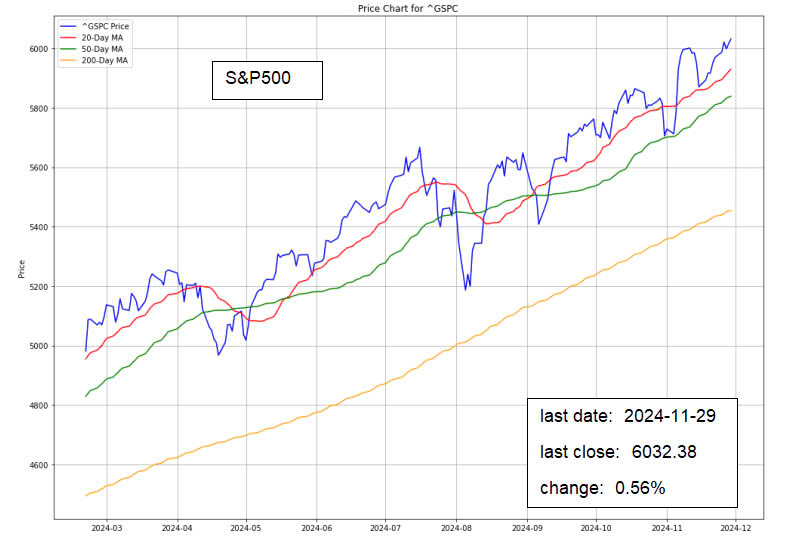

Stocks surged as Wall Street capped off one of its best months of the year. November closed with strong gains across major indices, fueled by optimistic consumer sentiment and a resilient labor market. Looking ahead, key reports, including the November jobs data and ISM manufacturing and services data, will be crucial in assessing the economy’s strength. A stronger-than-expected performance could reduce the likelihood of Federal Reserve rate cuts, impacting the dollar and treasury yields.

The energy sector, bolstered by AI-driven data center demand, and the entertainment industry, exemplified by Disney’s record-breaking Thanksgiving box office, reflect diverse avenues of economic growth. However, geopolitical uncertainties and inflation trends in other major economies remain critical variables.

INTERNATIONAL AFFAIR

China's Manufacturing Rebounds

Manufacturing activity, as measured by the Caixin PMI, showed significant improvement in November, signaling that stimulus measures are beginning to yield results. Yet, lingering deflation concerns and potential tariff increases from the U.S. pose challenges. Chinese electric vehicle (EV) makers, including NIO, XPeng, and Li Auto, reported record deliveries, underscoring strong consumer demand despite pricing pressures.

GLOBAL IMPACT

Global Forces Shaping U.S. Market Trends

U.S. market conditions are closely tied to global economic developments. For example, China’s economic rebound, driven by strong manufacturing and export growth, could positively impact U.S. businesses dependent on global trade. However, rising trade tensions, likely between the U.S. and China, and deflationary pressures in China (indicating weaker demand) present risks that could disrupt supply chains or decrease global profitability. Similarly, Europe’s inflation challenges and the European Central Bank’s policy responses influence global financial stability. Higher inflation could lead to interest rate hikes, slowing economic growth and affecting demand for U.S. goods.

Source: Reuters

Japan’s cautious adjustments to monetary policy also play a significant role. As a major global investor and lender, sudden changes in Japan’s policies could introduce financial volatility, impacting U.S. markets. These interconnected dynamics shape trade, investments, and investor sentiment globally, underscoring the importance of international developments in determining the trajectory of the U.S. economy.

Investment Opportunity & Risk

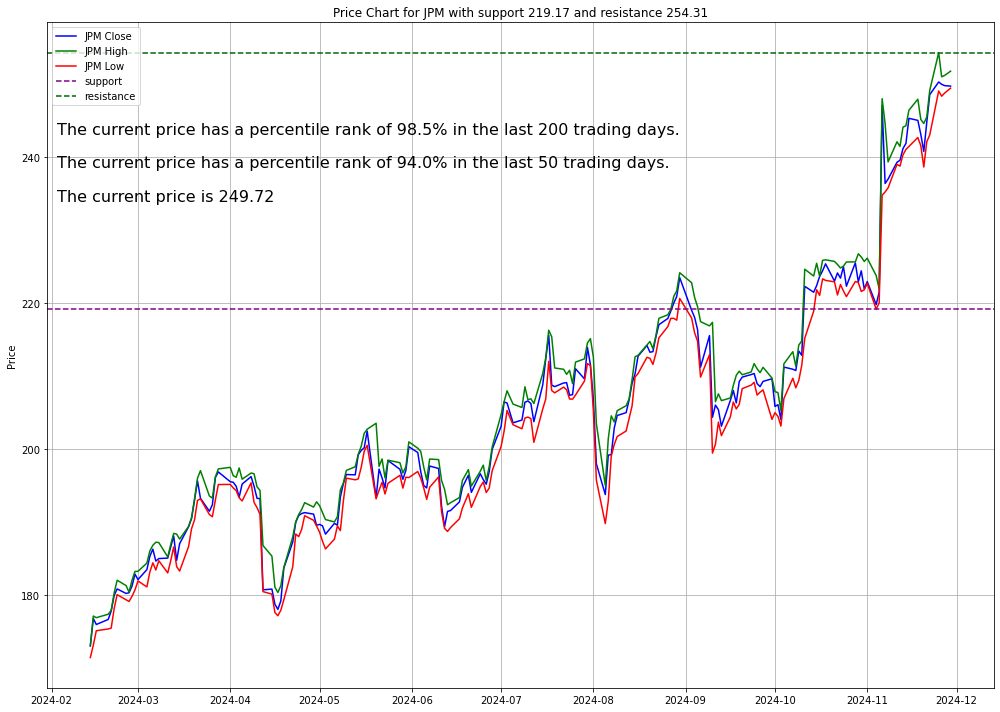

JPMorgan Chase (JPM)

As the largest bank in the world by market capitalization, JPMorgan Chase represents financial stability and consistent growth. The bank boasts a robust CET1 ratio of 15.3% and an extensive loan and deposit base, positioning it to weather economic uncertainties. In Q3 2024, JPM exceeded expectations with $43.3 billion in revenue and $4.37 earnings per share, supported by growth in both interest and non-interest income.

The company’s strategic expansion, including plans to open 500 new branches by 2027, aims to deepen its customer base in underserved areas. Analysts remain optimistic about JPM’s long-term prospects, with a strong “Moderate Buy” consensus.

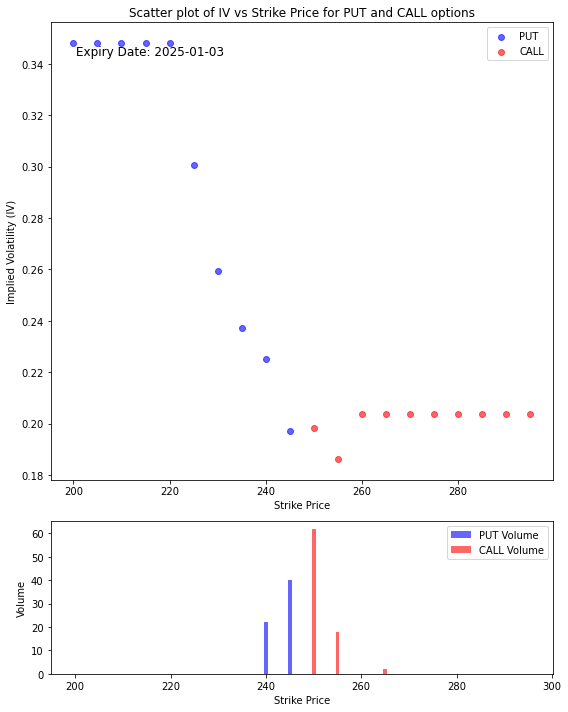

- The concentration of CALL option activity around 250 suggests that the market expects the stock to move closer to this level or slightly higher in the near term.

- However, the elevated implied volatility on PUT options at lower strikes (below 240) highlights traders’ concern about potential downside risks.

- The market seems to expect stability or a mild upward trend, as evidenced by the relatively flat IV curve for CALLs and the activity at 250.

- At the same time, the higher IV for lower PUT strikes reflects cautiousness, implying that while the stock may trend upward, there is a non-negligible chance of volatility on the downside.

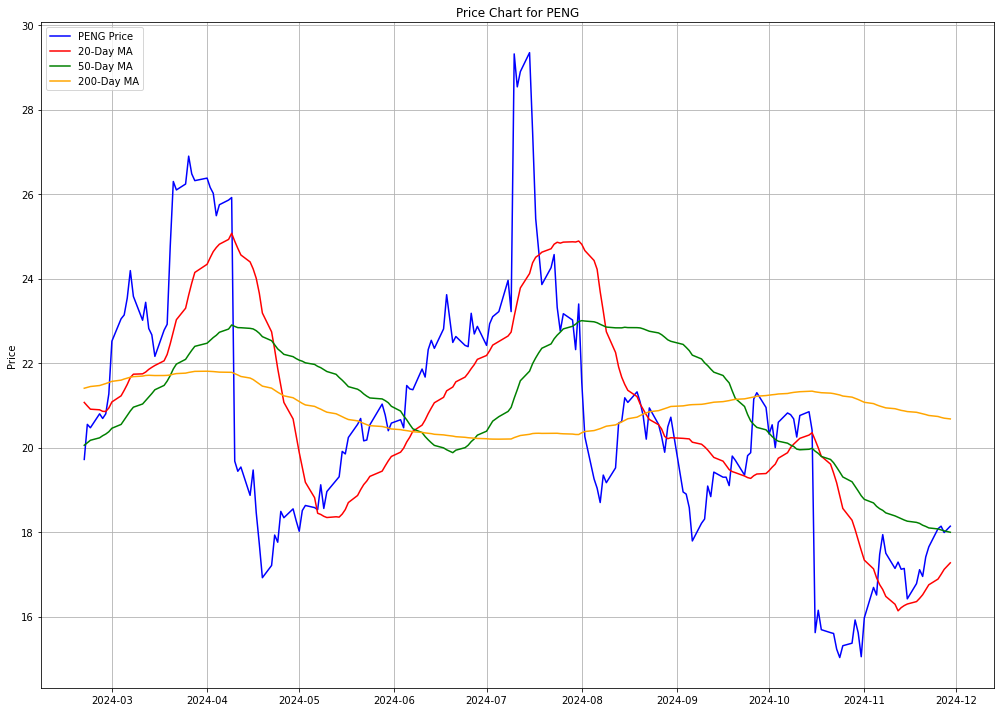

Penguin Solutions (PENG)

A lesser-known but impactful player in AI and high-performance computing. With strategic partnerships and scalable solutions, Penguin Solution‘s stock is gaining attention despite recent earnings misses.

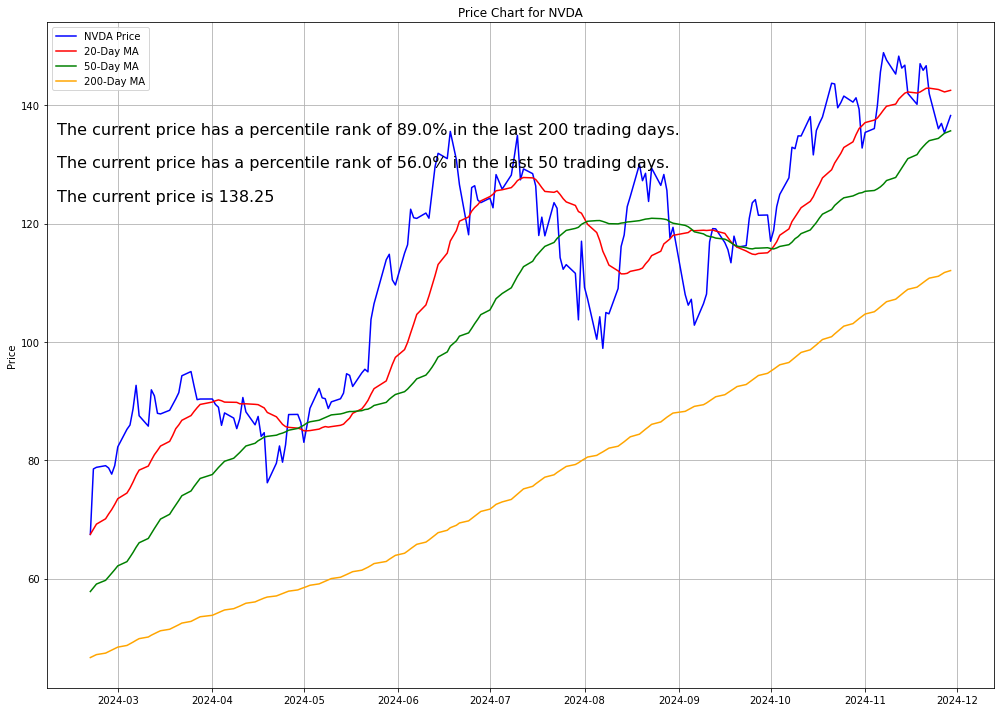

Nvidia (NVDA)

Although NVIDIA has retreated from recent highs, its robust free cash flow and margin performance indicate strong fundamentals. Analysts project significant upside, especially with attractive options premiums.

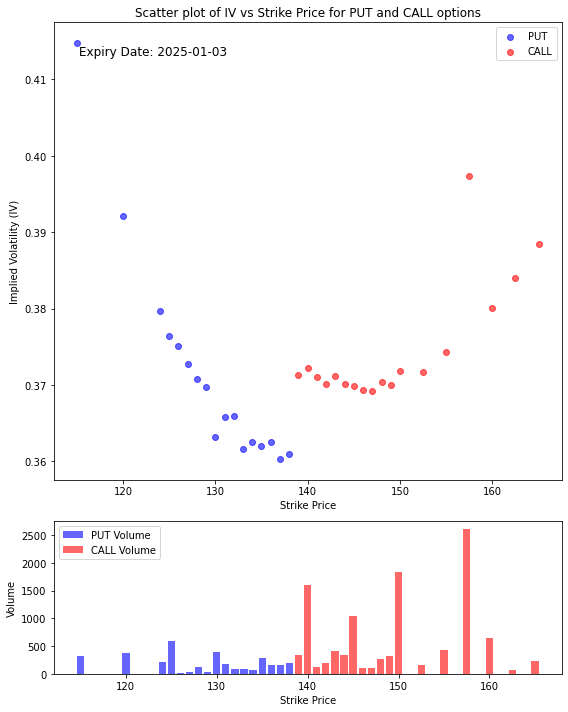

- The high CALL option volume near 150 suggests that the market expects the stock to gravitate toward this level in the short term.

- The increase in IV at higher strikes and substantial CALL interest at 160 points to some optimism for potential price gains.

- However, the PUT option volumes below 130 reflect caution and preparation for downside risks, especially in volatile markets.

The stock is likely to remain in the 140–160 range in the near term, with a mild upward bias. However, the elevated PUT volumes and IV on the downside suggest that market participants remain wary of potential dips, making it essential to monitor broader market conditions and any upcoming catalysts.

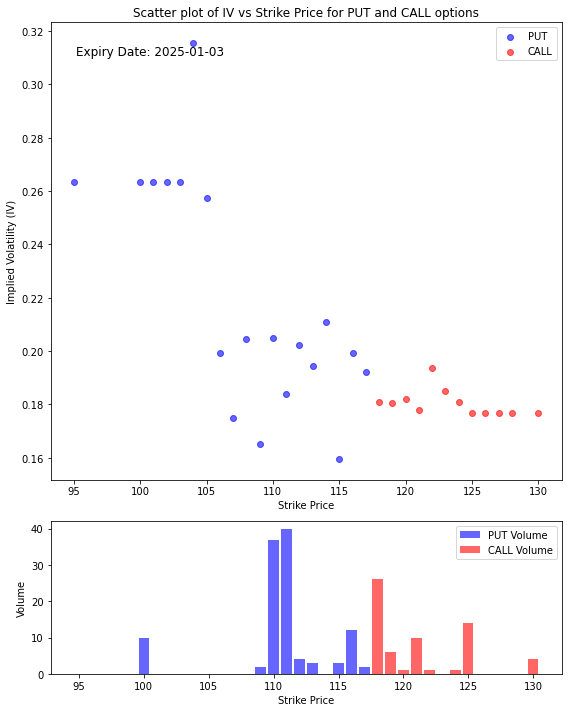

Disney (DIS)

Disney‘s new release of “Moana 2” led to a record-setting Thanksgiving weekend, emphasizing the resurgence of cinema-driven revenues. This performance also boosts related sectors like large-screen formats.

The activity suggests the market expects the stock to hover around 110–120 in the short term, with a possible upward bias. The concentration of CALL volumes near 115 and 120 hints at optimism, while the relatively high PUT volumes around 110 reflect caution about near-term downside risks.

The subdued IV for CALLs indicates limited expectations of significant upward surprises, while the PUT activity suggests some traders are hedging against potential dips.

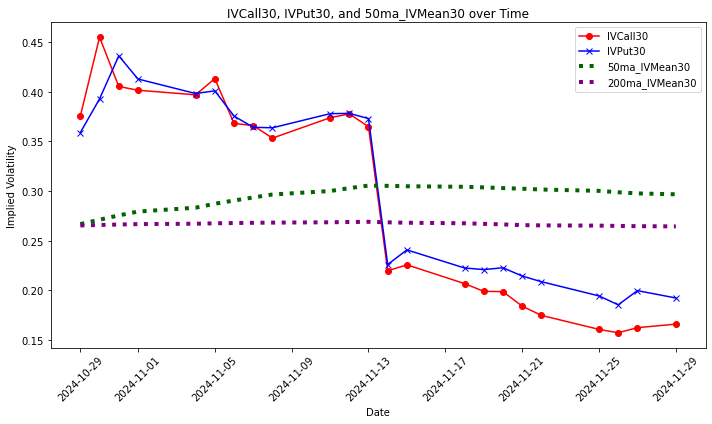

The IV trend chart indicates that the market sentiment is still leaning towards bearish expectations ever since the last dip in prices in November.

CONCLUSION

- November marked strong gains in U.S. markets, driven by positive consumer sentiment and a solid labor market.

- Upcoming economic data, especially on jobs and manufacturing, will play a pivotal role in shaping expectations for Federal Reserve policy.

- China’s manufacturing rebound suggests the effectiveness of stimulus measures, though concerns over deflation and trade tensions persist.

- Despite ongoing global uncertainties, markets continue to advance cautiously, maintaining a balance of optimism and caution.

Please note that all information in this newsletter is for illustration and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any investment products or services.

About the Author

Rein Chua is the co-founder and Head of Training at AlgoMerchant. He has over 15 years of experience in cross-asset trading, portfolio management, and entrepreneurship. Major media outlets like Business Times, Yahoo News, and TechInAsia have featured him. Rein has spoken at financial institutions such as SGX, IDX, and ShareInvestor, sharing insights on the future of investing influenced by Artificial Intelligence and finance. He also founded the InvestPro Channel to educate traders and investors.

Rein Chua

Quant Trader, Investor, Financial Analyst, Vlogger, & Writer.