The U.S. stock market ended the week on a positive note, with major indexes reflecting a mixed but overall upward trajectory. The S&P 500 rose 0.24%, closing at a record high for the second straight day, while the NASDAQ Composite edged up 0.07%. The Dow Jones Industrial Average saw gains in sectors like healthcare and telecoms, though retail and technology lagged. Investors largely shrugged off signals from the Federal Reserve about pausing rate cuts, as minutes from the Fed’s January meeting revealed most officials favored maintaining restrictive policy amid persistent inflation concerns.

Source: The Economic Times

Healthcare, telecom, and consumer goods sectors led the market, contributing to notable gains. On the other hand, retail and tech companies faced challenges, with many posting declines. Within the S&P 500, certain tech and semiconductor firms saw substantial increases, while some in the materials and tech sectors experienced sharp falls. In the NASDAQ, biotech and tech stocks showed considerable progress, though the healthcare and energy sectors were weaker. Notably, the CBOE Volatility Index (VIX) dropped by 0.52% to 15.27, signaling lower volatility expectations.

Gold and Oil Tick Higher as US Dollar Strengthens Slightly

Gold prices for April delivery saw a slight uptick, rising by 0.02% to $2,949.72 per troy ounce. Crude oil prices also saw minor increases. In the currency markets, the EUR/USD exchange rate remained stable, while the USD/JPY rate dropped by 0.34% to 151.50. The US Dollar Index Futures edged up by 0.10% to 107.06, reflecting a slight strengthening of the US dollar.

Source: Ahead of Herd

Trump's 25% Auto Tariff Shakes Industry, Tesla Gains

President Trump’s announcement of a potential 25% tariff on imported vehicles has stirred concern across the automotive industry, particularly for foreign automakers. Brands like Volkswagen, BMW, and Mercedes-Benz, which heavily rely on imports into the US, face significant exposure to this policy. On the contrary, US-based Ford, which imports a lower percentage of its vehicles, may be less impacted.

Source: Pune.news

Nevertheless, the overall sentiment in the auto sector remains cautious, with investors bracing for potential price hikes of 4% to 10% on new vehicles due to these tariffs. Tesla, however, has managed to show a positive market performance, largely due to its local production base and close ties with the Trump administration, which investors believe may help it navigate regulatory challenges and speed up the deployment of self-driving cars.

Fed Minutes Signal Caution on Rate Cuts Amid Inflation Concerns

The latest Federal Reserve meeting minutes, published February 19, revealed a cautious approach towards rate cuts in the near term. While inflation pressures remain a concern, with the consumer-price index showing unexpected spikes in January, the Fed remains focused on the balance of consumer demand and external factors like trade policies. Fed officials are prioritizing stable inflation and a healthy labor market, with a majority of participants agreeing that the current high level of uncertainty requires a careful approach before making any further adjustments to the federal funds rate.

Source: WSJ

The Fed’s decision to maintain rates at around 4.3% after a series of cuts in 2024 reflects the central bank’s commitment to carefully assess economic conditions, especially with ongoing trade tensions. The potential for tariffs, including the new 25% levy on steel and aluminum, adds to inflationary pressures, potentially hindering progress in reducing costs across industries. The Fed’s next meeting in March will be pivotal, with analysts expecting the rates to stay steady through the first half of the year.

Investment Opportunity & Risk

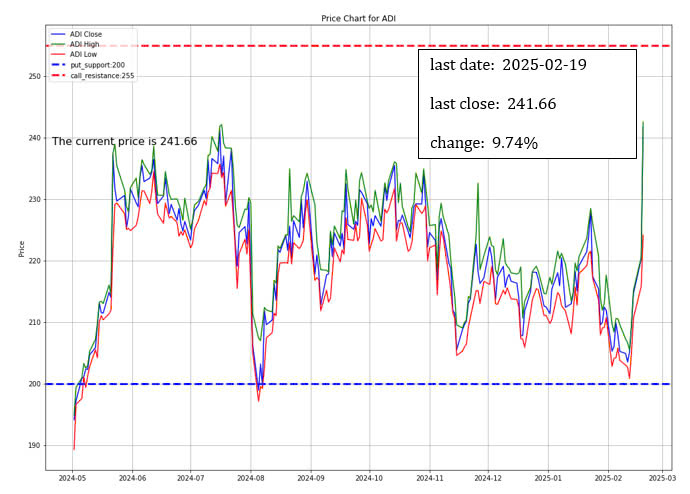

Analog Devices (NASDAQ: ADI)

Morgan Stanley has raised its target price for Analog Devices (ADI) from $248 to $250, while maintaining an Overweight rating. Despite the company’s relatively high valuation compared to its peers, Morgan Stanley remains confident in ADI’s stability, particularly given its strong financial performance and market position. The semiconductor company reported solid Q1 results, surpassing earnings expectations with an EPS of $1.63 and revenue of $2.42 billion, alongside a robust 68.8% gross margin.

Additionally, ADI announced a $10 billion share repurchase program and provided optimistic guidance for Q2. The firm’s diversified market approach and strong focus on growth areas such as AI, data centers, and healthcare wearables are expected to drive future success.

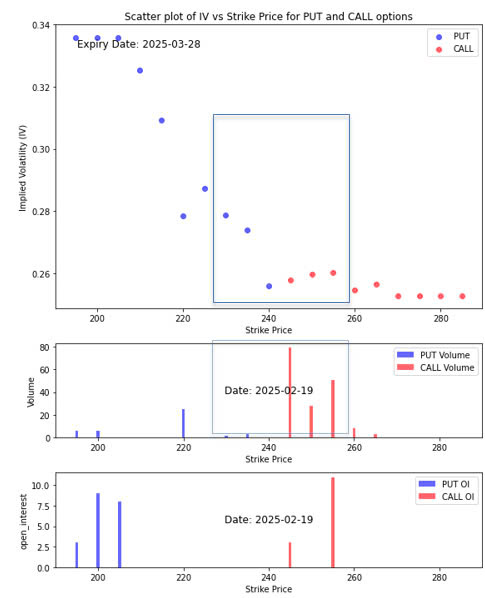

Option Smile Chart for ADI

- Our in-house system assigns a bullish index score of 0.901 on a scale where 0 represents completely bearish and 1 represents completely bullish.

- Near the current stock price level (ATM), the implied volatility of the put options are higher than the implied volatility of the call options. That is the indication that the traders fear of the fall in the stock price surpasses their greed for the rise in the stock.

- The volumes near the current stock price clearly shows a different story in that the traders are betting much more of their money on the prospect of a rise in price as indicated by the call options far greater volume than that of the put options. The traders appear to bet that the price will exceed 245 and may even surpass 255.

- In the open interest chart, we are seeing a strong support level at 200. As for the resistance level, we can see that there is a strong resistance at the 255 level.

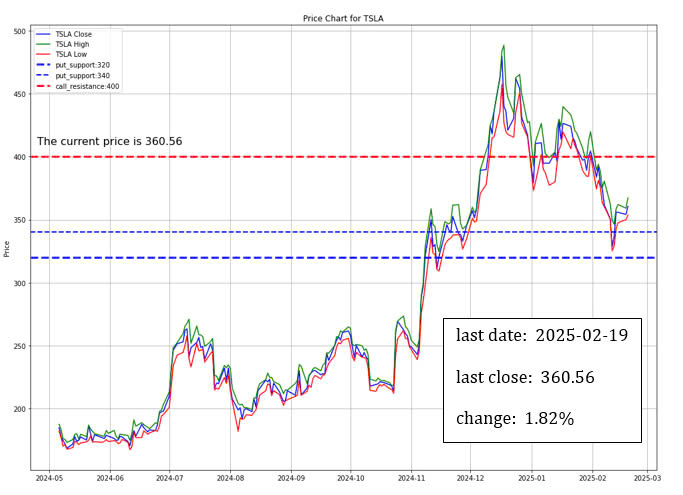

Tesla (NASDAQ: TSLA)

Tesla stock rose by 1.8% after CEO Elon Musk appeared alongside President Donald Trump in an interview with Sean Hannity, which discussed potential conflicts of interest arising from Musk’s political involvement. The interview, which also touched on Musk’s leadership in the Department of Government Efficiency (DOGE), aimed to reassure the public that the department’s focus was on eliminating fraud and waste.

While Musk acknowledged some decline in Tesla sales in regions like California, Germany, and France, there was no clear evidence of a significant trend. Despite concerns about Musk’s political activities, including potential damage to Tesla’s brand, the stock has still increased by 41% since the November 5 election. However, it has dropped nearly 20% since the January 20 inauguration, reflecting investor sensitivity to political developments.

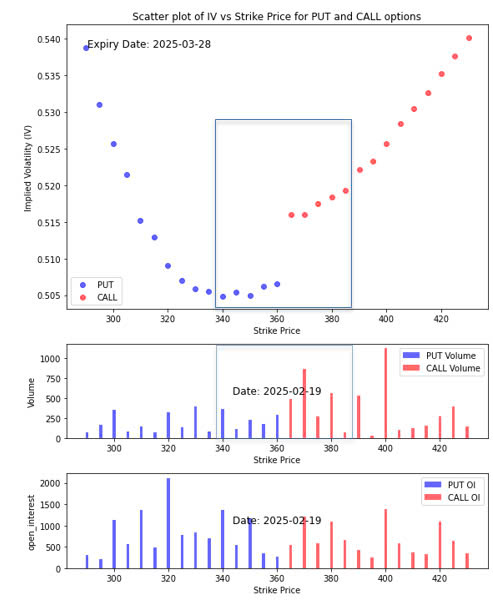

Option Smile Chart for TSLA

- Our in-house system assigns a bullish index score of 0.681 on a scale where 0 represents completely bearish and 1 represents completely bullish.

- Near the current stock price level (ATM), the implied volatility of the call options are higher than the implied volatility of the put options. That is the indication that the traders greed for the rise in the stock price is stronger than their fear of the fall in the stock price.

- The volumes near the current stock price clearly shows that the traders are betting more of their money on the prospect of a rise in price as indicated by the call options greater volume than that of the put options. There is even a big call volume at the strike price of 400, meaning that traders are seeing a real chance that the price will reach and surpass 400.

- In the open interest chart, we are seeing a strong support level at 320 and a lesser one at 340. This may indicate that if the price touches down to 340, there is a strong momentum that would push it further down to 320. As for the resistance level, we can see that there is an apparent sign of it at the 400 level.

CONCLUSION

- Stock Market Resilience: Key sectors like healthcare and telecom show strength, while tech and retail sectors face challenges.

- Automotive Industry Concerns: Potential tariffs on imported vehicles create uncertainty, though Tesla benefits from its strategic positioning.

- Federal Reserve Policy: A cautious stance on interest rate cuts highlights macroeconomic uncertainty.

- Tesla’s Market Sensitivity: The company’s stock performance reflects investor reactions to political developments.

- Analog Devices (ADI) Strength: Despite high valuation, ADI maintains strong financial health with bullish sentiment in the options market.

- Market Focus Areas: Inflation, trade policies, and corporate earnings remain key drivers of stock performance and broader market trends.

Please note that all information in this newsletter is for illustration and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any investment products or services.

About the Author

Rein Chua is the co-founder and Head of Training at AlgoMerchant. He has over 15 years of experience in cross-asset trading, portfolio management, and entrepreneurship. Major media outlets like Business Times, Yahoo News, and TechInAsia have featured him. Rein has spoken at financial institutions such as SGX, IDX, and ShareInvestor, sharing insights on the future of investing influenced by Artificial Intelligence and finance. He also founded the InvestPro Channel to educate traders and investors.

Rein Chua

Quant Trader, Investor, Financial Analyst, Vlogger, & Writer.