What Happened in August ?

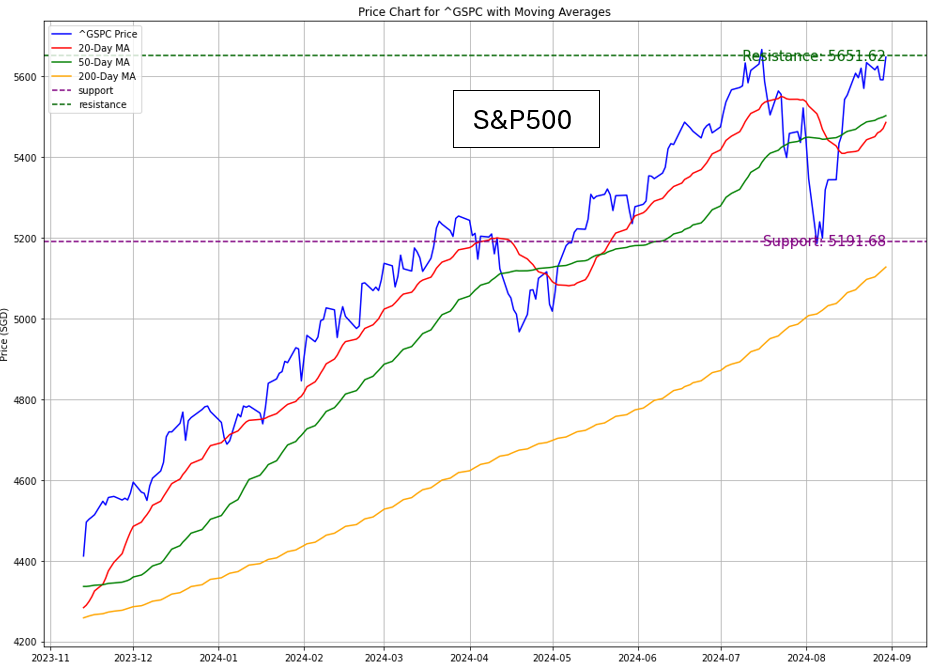

The U.S. stock market experienced a remarkable turnaround in August 2024. The S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all posted gains after a volatile start to the month. The S&P 500 hit three-month lows on August 5, driven by recession fears linked to a weak labor market. However, as economic indicators improved and the Federal Reserve hinted at possible rate cuts, the market rebounded strongly.

The Dow Jones Industrial Average (DJI) reached a series of new all-time highs, bolstered by a broadening rally that extended beyond the technology and mega-cap sectors. Notably, the Dow recorded its fourth consecutive record close by the end of the month.

Investor sentiment was further soothed by the PCE Price Index for July, which reported a 0.2% month-over-month increase, in line with expectations. The data reinforced the narrative of a gradual cooling of inflation, strengthening the case for a moderate Fed rate cut in September. As of late August, futures markets were pricing in a 69.5% chance of a 25-basis point cut and a 30.5% chance of a larger 50-basis point reduction.

However, market participants remain cautious, particularly as September is historically one of the weaker months for stocks. Although the rally towards the end of August was encouraging, signs of consolidation suggest that the market’s momentum might be waning. Investors are weighing whether the positive sentiment from earnings and expected Fed rate cuts has already been priced into current valuations.

Shifting focus toward the labor market

The economic landscape in the U.S. continues to be shaped by the interplay between inflation trends and labour market dynamics. The latest data reveals a steady but moderate inflationary environment, which has significant implications for Federal Reserve policy.

Last week, Fed Chair Jerome Powell indicated he was getting more worried about a weakening job market than about inflation. Source: Bloomberg.

In July 2024, the Federal Reserve’s preferred inflation gauge, the Personal Consumption Expenditures (PCE) index, rose by 2.5% year-over-year, aligning with economists’ expectations. The core PCE, which strips out volatile food and energy prices, also met forecasts by increasing 2.6%. Importantly, these figures did not show any acceleration from the previous month, suggesting that inflation is stabilizing at manageable levels.

Fed Chair Jerome Powell has recently signalled a shift in focus towards the labour market, expressing concerns about potential weakening. This marks a subtle change from the Fed’s earlier emphasis on inflation control. The market is now split on the extent of the rate cuts expected in the upcoming Federal Reserve meeting. A significant portion of investors anticipate a 25-basis point cut in September, which aligns with a “soft landing” scenario. However, some investors are pricing in a larger, 50-basis point cut, driven by fears of a more substantial slowdown in the labor market.

The Fed's Dual Mandate

Fed’s new mandate—to maintain price stability and ensure maximum employment—is being tested as inflationary pressures ease while the labor market shows signs of faltering. The July labor data revealed that net job creation was lower than expected, and the unemployment rate rose to 4.3% from 4.1%. These indicators will be crucial in guiding the Fed’s decisions in the coming months.

Investment Opportunity & Risk

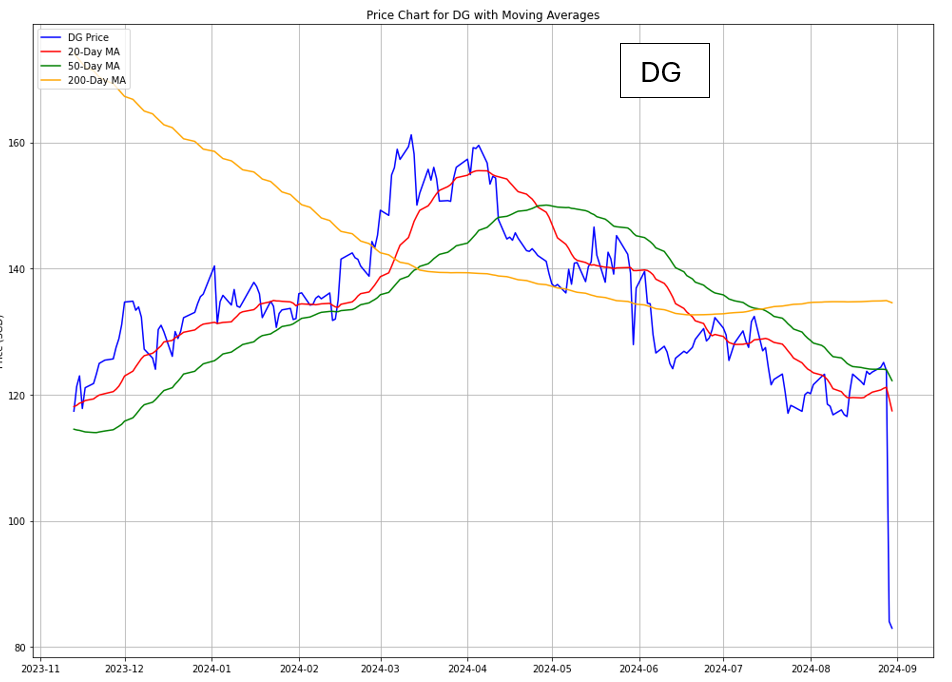

In addition to a weakening labor market, the U.S. retail sector is currently facing a tough environment marked by cautious consumer behavior and changing spending patterns.

A Weakening Labor Market is Directly Impacting on Low-Income Consumers

The most recent retail earnings reports highlight significant disparities in consumer spending across different income brackets. Low-income consumers, particularly those earning less than $35,000 annually, are under considerable financial strain. Dollar General(NYSE: DG), a prominent discount retailer, reported a sharp decline in sales, especially towards the end of each month, indicating that their core customer base is struggling to make ends meet. More than 60% of Dollar General’s customers surveyed admitted to sacrificing basic necessities due to rising prices.

Sectors and Stocks to Monitor Amid an Unfavorable Labor Market

1.Big-box retailers -e.g., Walmart and similar companies

- While low-income households are cutting back, middle- and high-income consumers are still spending but are increasingly seeking value. These consumers are gravitating towards big-box retailers like Walmart(NYSE: WMT) and Target, both of which have successfully attracted customers by cutting prices on essential items. Walmart, in particular, has noted an increase in market share among higher-income households, indicating that even wealthier consumers are becoming more price-conscious.

- Meanwhile, off-price retailers such as Burlington, T.J. Maxx, and Ross Stores are benefiting from this trend as consumers look for deals on discretionary purchases. These stores reported better-than-expected same-store sales growth in recent quarters. However, the overall retail landscape remains precarious, with many department stores like Macy’s and Kohl’s reporting declines in comparable sales as consumers trade down.

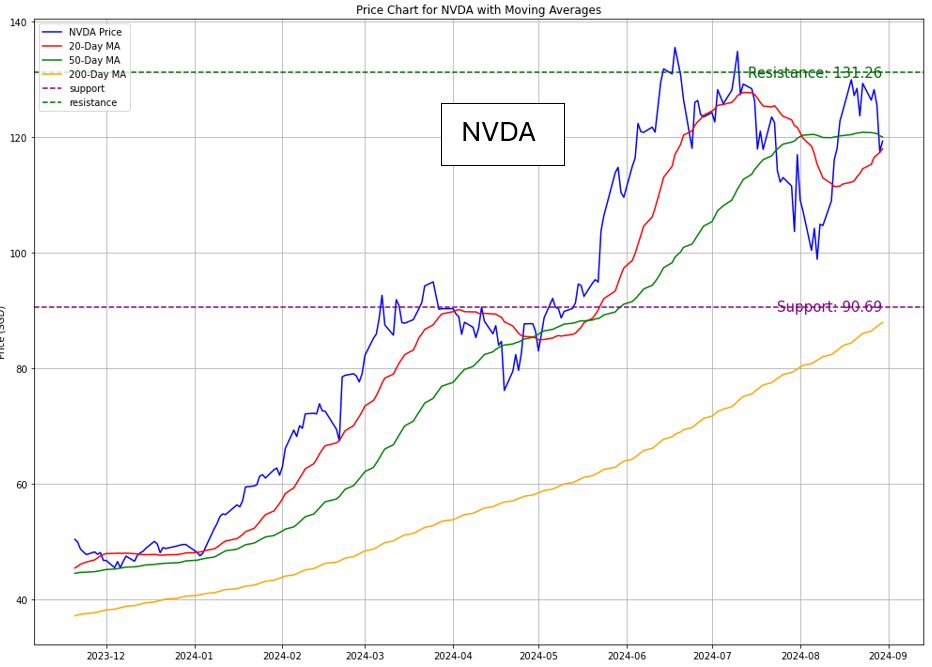

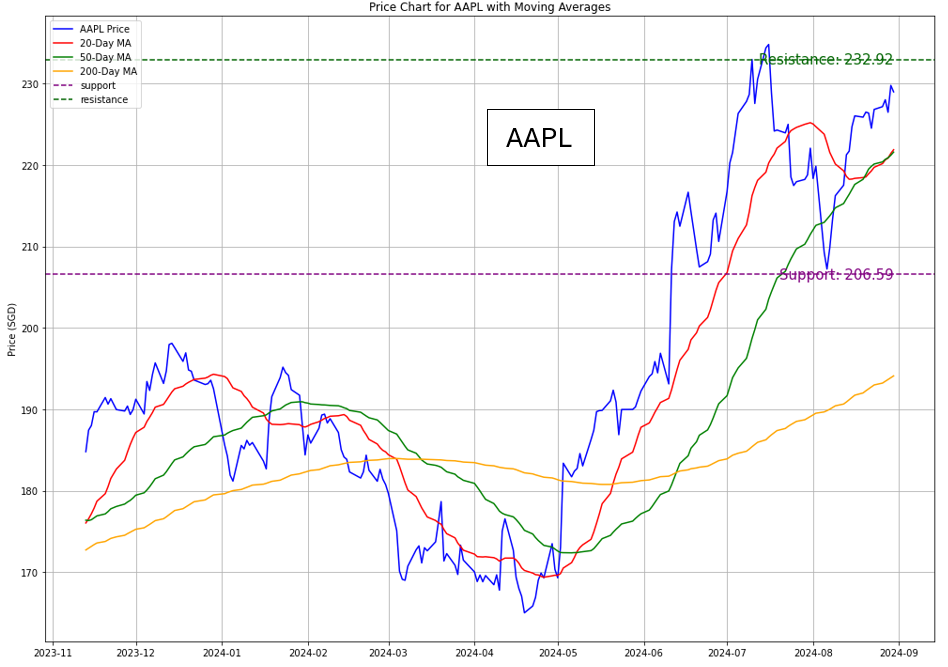

2.Technology and Artificial Intelligence -Apple & Nvidia

- The technology sector, particularly companies involved in artificial intelligence (AI), continues to attract significant investment and strategic interest.

- In a notable development, tech giants Apple and Nvidia(NASDAQ: NVDA) are in advanced talks to invest in OpenAI. This move would strengthen their ties with one of the most influential players in the AI space. OpenAI, which has already received substantial investments from Microsoft, is expected to be valued at over $100 billion in this new funding round.

- For Apple(NASDAQ: AAPL), this investment aligns with its broader strategy to integrate AI into its ecosystem. The company has already announced a partnership with OpenAI to incorporate ChatGPT into its new AI-powered features, including improvements to Siri and other services. Nvidia, as the leading supplier of AI chips, stands to benefit from closer collaboration with OpenAI, which relies heavily on Nvidia’s hardware to train its advanced AI models.

- This potential investment underscores the intensifying competition in the AI industry, where leading tech companies are vying for dominance. Apple’s involvement in OpenAI could complicate its relationships with other AI companies, but it also highlights the strategic importance of securing access to cutting-edge AI technologies.

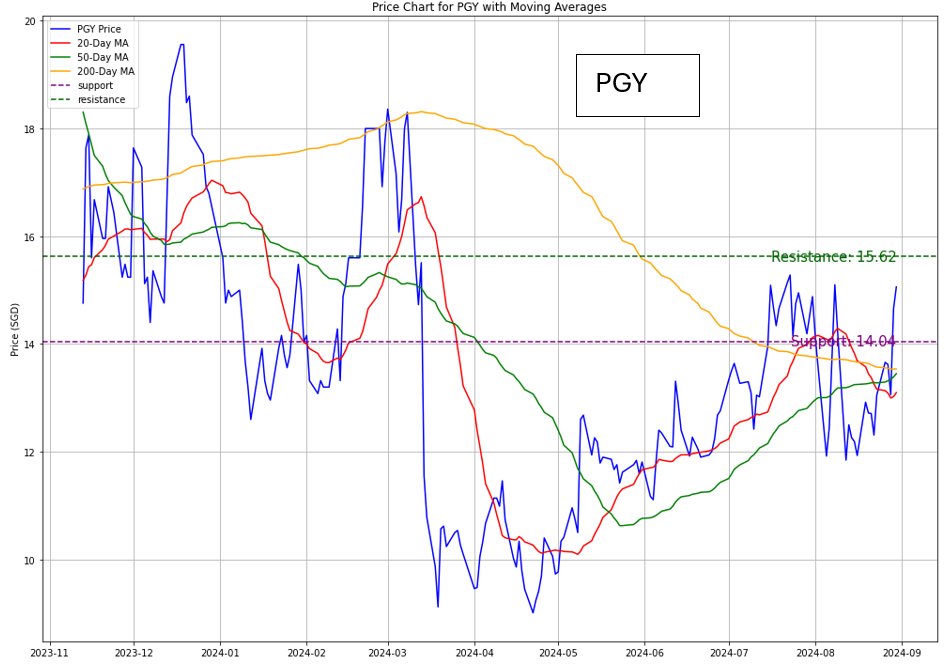

3. Small-Cap and Growth Stocks - Pagaya Technologies

- Pagaya Technologies Ltd.(NASDAQ: PGY) ,a small-cap fintech company specializing in AI-driven financial solutions, has experienced significant volatility over the past year. The company’s stock has lost 41.6% of its value in the last 52 weeks and is down 90% over the past two years. However, recent developments have sparked optimism among analysts.

- Pagaya reported mixed results for Q2 2024, with revenue exceeding expectations at $250.34 million, a 28% year-over-year increase. Despite this, the company’s adjusted profit fell short of analysts’ estimates. However, Pagaya’s adjusted EBITDA showed strong growth, rising 195% year-over-year to $50 million.

- Analysts are generally optimistic about Pagaya’s prospects, with a consensus “Moderate Buy” rating and a mean price target suggesting a 79% upside potential. The company’s focus on AI-powered financial solutions and its ability to self-fund growth positions it well for future profitability, despite the recent volatility.

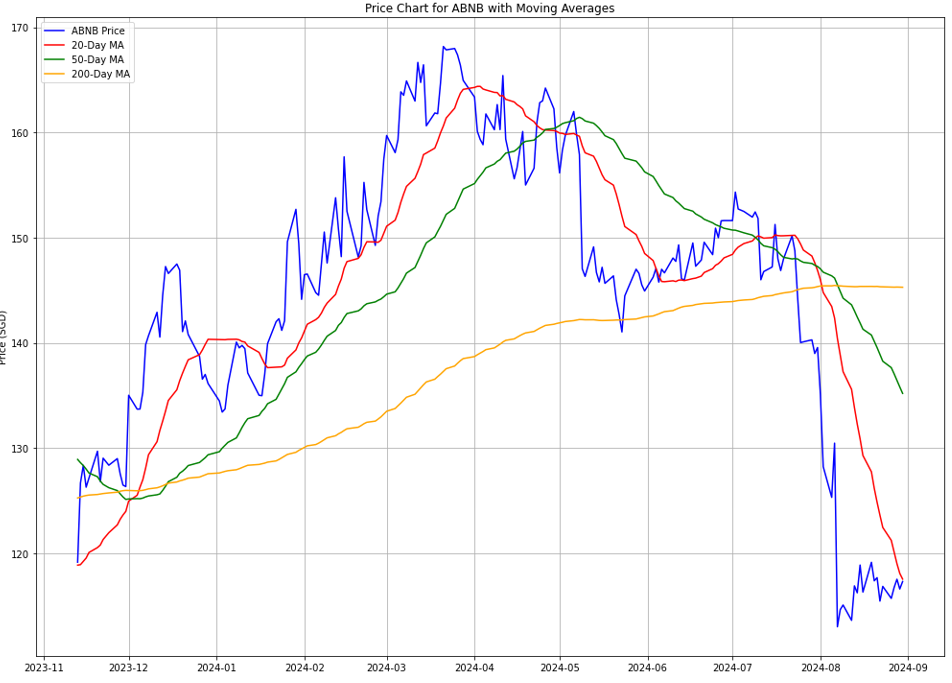

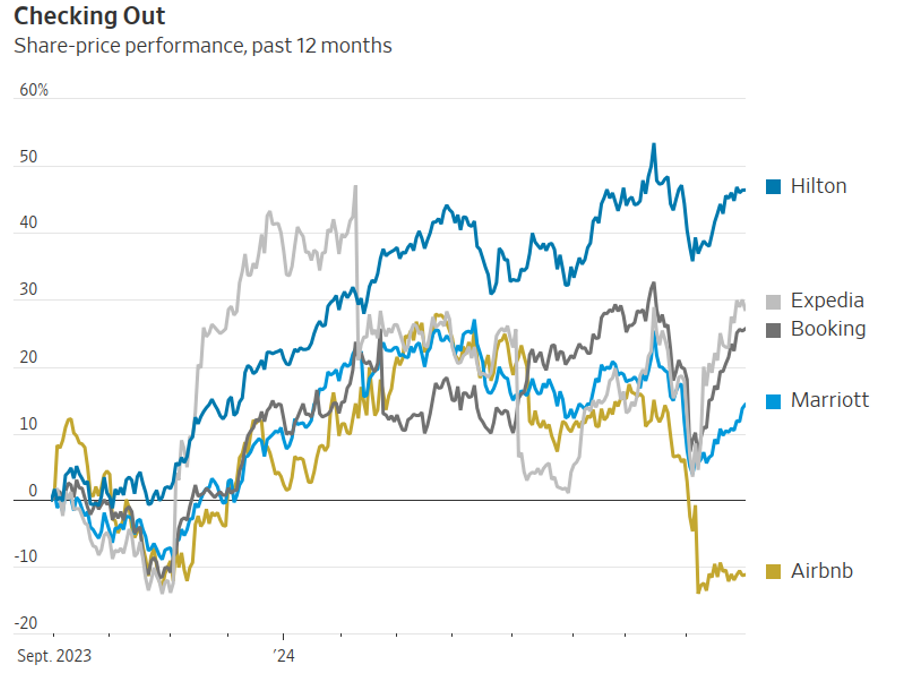

4. Hospitality Insights - Airbnb

- Airbnb(NASDAQ: ABNB) has faced a challenging period, with its stock losing 25% of its market value over the past six months, making it one of the worst performers among large-cap internet stocks. The company’s shares have also declined by 10% over the past year, an unusual performance given the broader recovery in the travel industry.

- Airbnb’s unique position at the intersection of travel, online commerce, and the gig economy has exposed it to the same economic headwinds affecting traditional lodging and entertainment companies. As post-COVID travel spending tapers off, consumers are becoming more cautious, impacting Airbnb’s growth. The company’s CEO, Brian Chesky, highlighted “shorter booking lead times globally and some signs of slowing demand from U.S. guests” during a recent earnings call.

- Despite these challenges, Airbnb is expected to outgrow its peers in the long run. Wall Street forecasts nearly 11% growth in gross bookings for Airbnb in 2024, compared to the 4%-6% range for competitors like Expedia and Booking.com. Furthermore, Airbnb is exploring new services and offerings, including a “winter release” in October that could diversify its revenue streams and enhance its competitive position.

Source: FactSet

CONCLUSION

- The U.S. economic outlook remains uncertain, with inflation stabilizing but labor market concerns rising. The Federal Reserve’s response to these dynamics will be critical in shaping market sentiment in the coming months. Investors are advised to monitor labor data closely, as it could significantly influence monetary policy and, consequently, market performance.

- The retail sector is under pressure, with low-income consumers particularly vulnerable. However, opportunities exist for investors in companies that can capitalize on shifting consumer behavior, such as discount and off-price retailers.

- In the technology sector, AI continues to be a focal point, with major investments signaling the strategic importance of this field. Companies like Apple and Nvidia are positioning themselves to be at the forefront of AI development, which could yield significant returns in the future.

- Small-cap stocks like Pagaya Technologies offer high-risk, high-reward opportunities, while established players in the hospitality sector like Airbnb are looking to innovate and adapt to changing market conditions.

- Overall, the current market environment calls for a balanced approach, with a focus on companies that are well-positioned to navigate economic uncertainties and capitalize on emerging trends.