The Federal Reserve’s recent decision to cut interest rates by half a percentage point has spurred varying reactions from small businesses across the US. While some entrepreneurs are eager to capitalize on the lower borrowing costs to fuel expansion, others remain hesitant, awaiting further cuts to truly benefit their operations. The overall sentiment indicates that although the rate cut may stimulate short-term business investments, many expect sustained improvements to materialize only after additional easing of monetary policy, leading to long-term uncertainty.

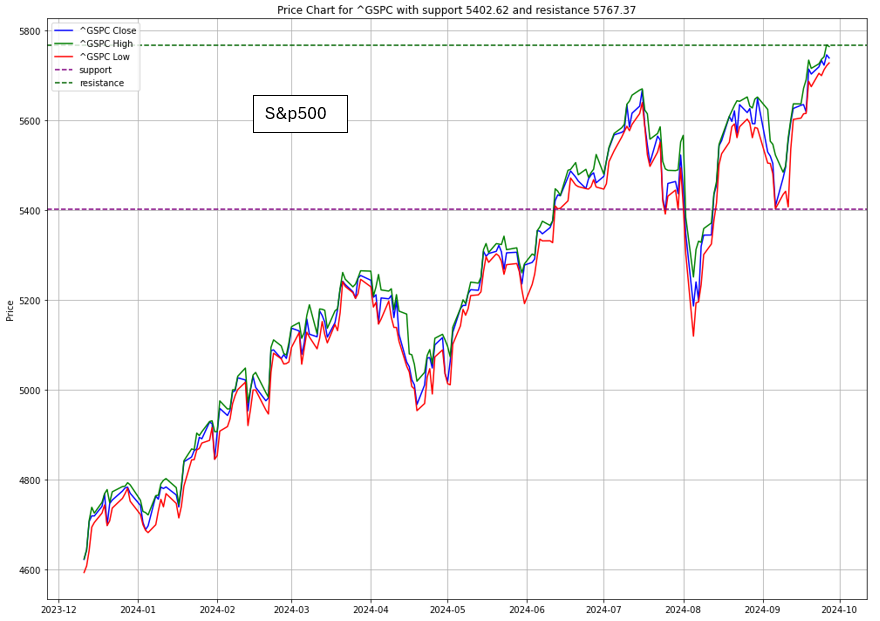

Meanwhile, major US economic indicators, including Manufacturing and Services PMIs, JOLTS Job Openings, and Non-Farm Payrolls, will offer further insights into the labour market and broader economic health. These data releases are being closely monitored to gauge the strength of the US economy, which could influence stock market trends and investor confidence moving forward.

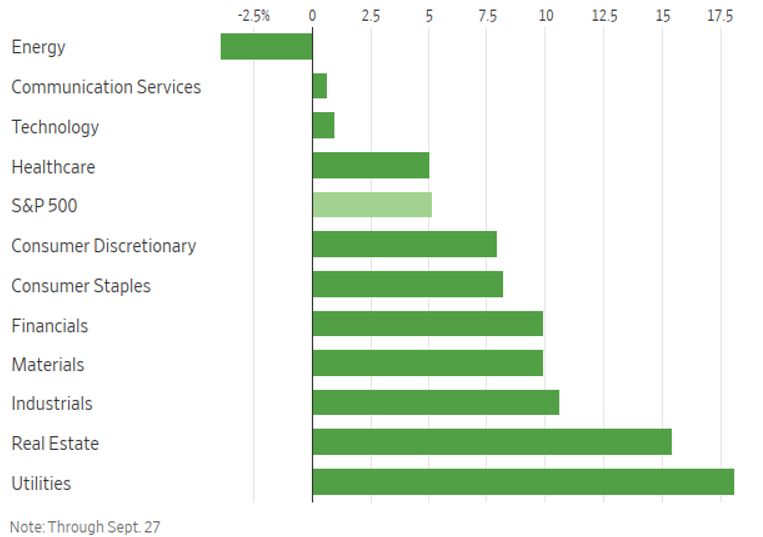

Sector And Index Performance, Third Quarter

Source: FactSet

MARKET CONCERNS

Oil Market and Inflationary Concerns

Oil prices have been under considerable pressure amid expectations of increased supply from OPEC+. Despite a previous delay in output hikes, OPEC+ could soon begin unwinding production cuts, contributing to an anticipated surplus in the oil market. This has raised concerns among investors and analysts that crude prices could weaken further, especially as global

demand remains uncertain. Adding to the long term uncertainty is the looming possibility of a longshoremen’s strike along the US East and Gulf coasts, prompting retailers and manufacturers to brace for supply chain disruptions that could fuel inflationary pressures. The strike threatens to shut down half of the country’s ports, potentially impacting the upcoming holiday shopping season. The administration’s response, or lack thereof, to these labour tensions will likely be scrutinized as businesses attempt to navigate yet another challenge to an already stressed supply chain.

Market Rotation Away from AI

Investor enthusiasm for artificial intelligence (AI) stocks has cooled in recent months, with many broadening their focus beyond the tech sector. Throughout the third quarter, sectors such as utilities, industrials, and financials outperformed technology as concerns over inflation eased and the Federal Reserve began lowering interest rates. This shift reflects growing confidence in the resilience of the US economy and the possibility that the Fed may successfully engineer a soft landing without triggering a recession.

However, while some large tech stocks like Microsoft and Amazon faced pullbacks, others like Apple and Meta Platforms remained on track for gains. As market leadership broadens, many investors believe this could lead to a more sustainable rally across a variety of sectors.

WATCHOUT

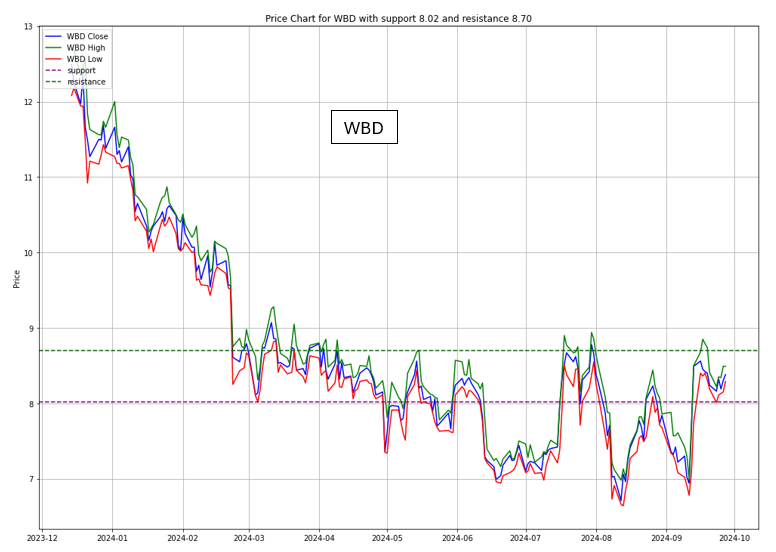

Comcast’s European pay-TV company, Sky, has filed a lawsuit against Warner Bros Discovery

Warner Bros Discovery has been accused of breaching a co-production agreement. The dispute focuses on the rights to produce and distribute major shows, including a new Harry Potter TV series. This legal battle highlights the increasing competitive pressures in the media industry, as companies compete for exclusive content to attract subscribers.

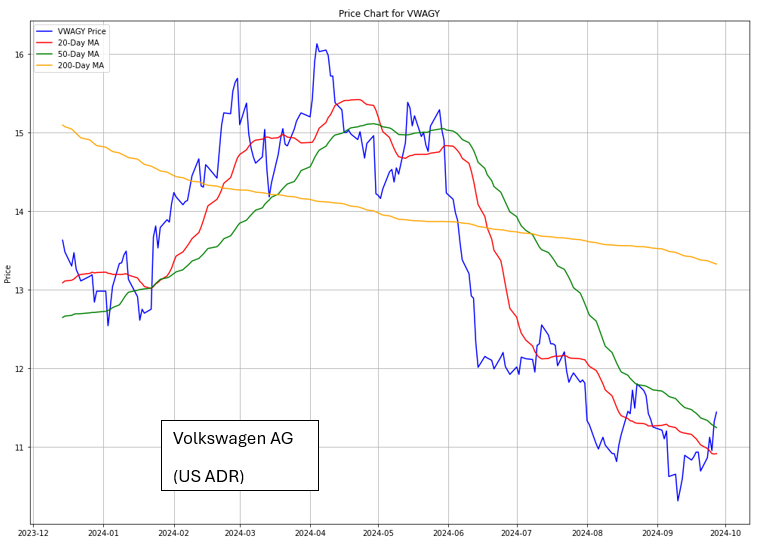

Volkswagen is facing significant challenges as it navigates the transition to electric vehicles.

The German automaker recently slashed its sales and profitability guidance for the year, citing weak demand in key markets such as China. With deliveries expected to fall short of previous forecasts, Volkswagen has joined other European automakers in revising downward its earnings projections. Despite these challenges, the company remains committed to its restructuring efforts, which include potential cost-cutting measures to maintain competitiveness in an increasingly difficult market.

Investment Opportunity & Risk

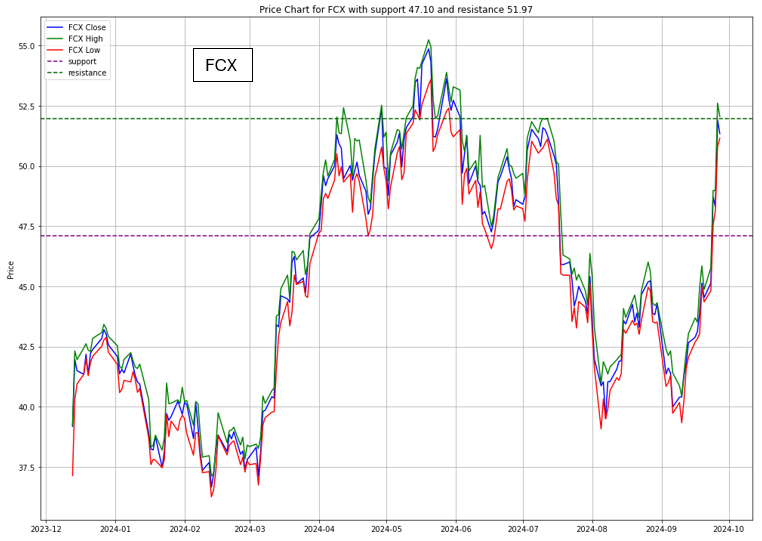

Freeport-McMoRan (FCX)

- Freeport-McMoRan (FCX), a leading global copper miner, continues to capture investor attention due to the bullish outlook on copper demand. This demand is being driven by various factors, including economic stimulus from China and the increasing use of copper in AI data centres and renewable energy technologies. With China’s recent economic policies aimed at boosting infrastructure and property markets, FCX is well-positioned to benefit from rising copper prices.

- FCX’s financial performance has also been strong, reporting impressive earnings in Q2 2024, supported by its large copper production volumes. The company has further enhanced its appeal to investors through regular dividend payments and its solid growth potential as the global transition to clean energy and AI technology accelerates.

CONCLUSION

- The US stock market and economy are at a pivotal moment, shaped by monetary policy adjustments, labor disputes, and sector-specific shifts, all contributing to long-term uncertainty.

- The Federal Reserve’s rate cuts have sparked cautious optimism among small businesses, yet many await further action before fully ramping up spending.

- Simultaneously, inflationary pressures remain a concern, particularly with potential supply chain disruptions due to labor strikes at major ports.

- Oil markets are also facing uncertainty, with OPEC+ poised to increase supply, potentially pushing prices lower as demand stagnates.

- This volatility, combined with shifts in investor focus away from AI-driven tech stocks toward a broader range of sectors, suggests that the market’s leadership is diversifying, which could foster a more balanced rally across industries.

- In this complex landscape, individual stocks like Freeport-McMoRan, Volkswagen, and major media players such as Comcast and Warner Bros Discovery are navigating their unique challenges and opportunities.

- As these companies face sector-specific pressures, investors should closely monitor both macroeconomic trends and company-specific developments to identify potential long-term opportunities amid ongoing volatility and uncertainty.

Please note that all information in this newsletter is for illustration and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any investment products or services.

About the Author

Rein Chua is the co-founder and Head of Training at AlgoMerchant. He has over 15 years of experience in cross-asset trading, portfolio management, and entrepreneurship. Major media outlets like Business Times, Yahoo News, and TechInAsia have featured him. Rein has spoken at financial institutions such as SGX, IDX, and ShareInvestor, sharing insights on the future of investing influenced by Artificial Intelligence and finance. He also founded the InvestPro Channel to educate traders and investors.

Rein Chua

Quant Trader, Investor, Financial Analyst, Vlogger, & Writer.