The U.S. economy is showing mixed signals, reflecting the complex interplay of various macroeconomic factors. Despite the Federal Reserve’s efforts to stimulate the economy through rate cuts, signs of a Market Recession persists. The Fed’s recent 50-basis-point rate cut highlights its focus on sustaining economic growth amid rising concerns about the labor market’s health and inflationary pressures. The market’s reaction to these cuts has been ambivalent, with short-term rallies often followed by pullbacks as investors reassess the long-term implications.

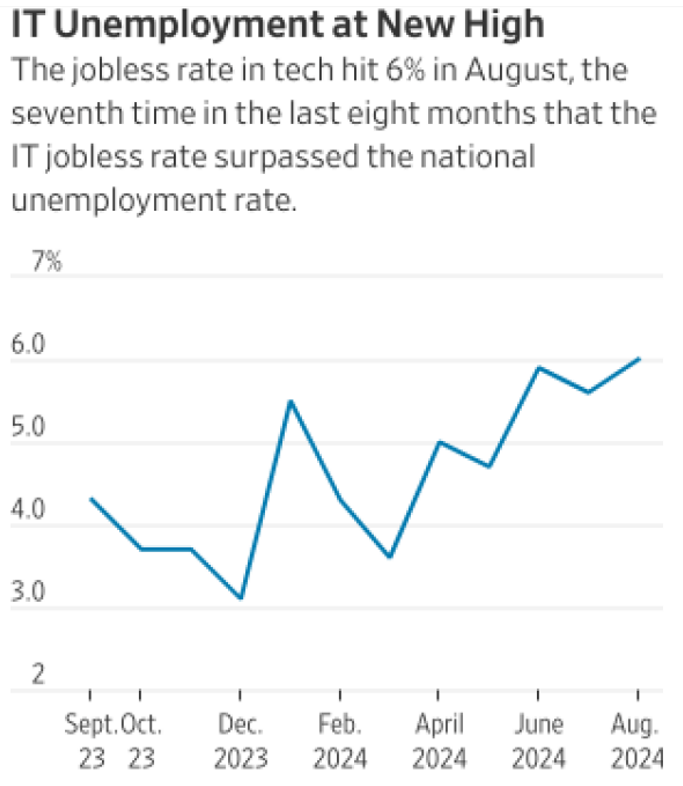

IT Unemployment Hits 6%

one of the key signs of a market recession is growing concern about the labor market. While the national unemployment rate ticked down to 4.2% in August 2024, the IT sector is experiencing a disproportionately high unemployment rate of 6%, reflecting significant disruptions due to advancements in AI and streamlining efforts. This divergence highlights the uneven impact of technological change across different sectors.

Source: Bureau of Labor Statistics

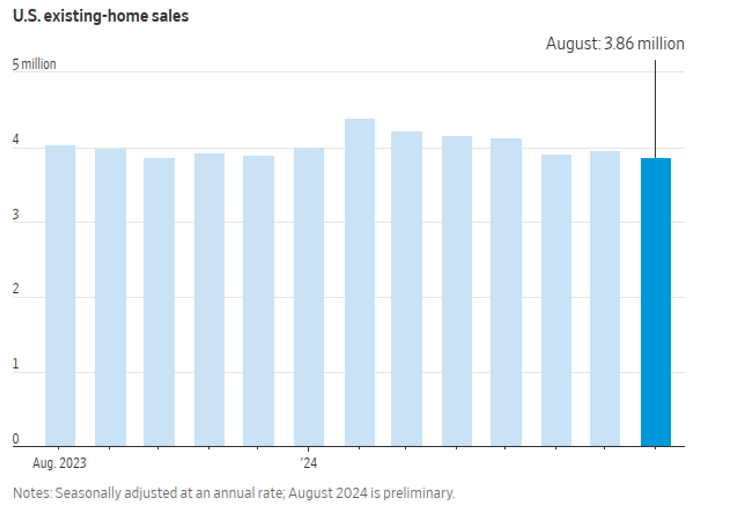

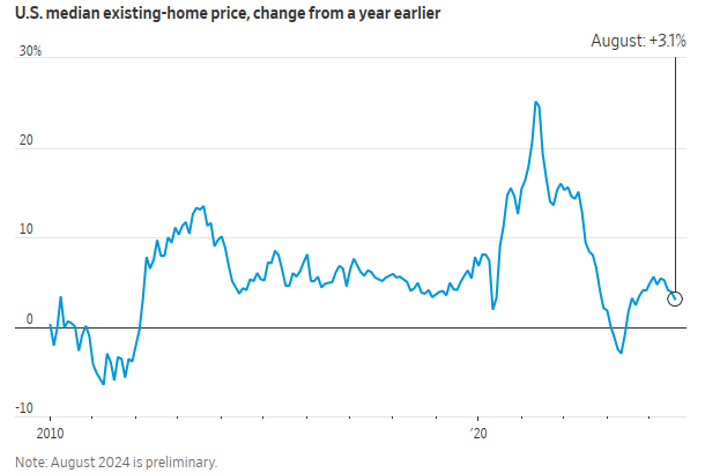

US Existing-Home Sales Slip 2.5%

In the housing market, sales of previously owned homes declined by 2.5% in August, despite a decrease in mortgage rates. This decline marks the fifth drop in six months, underscoring the ongoing affordability crisis. High home prices and limited inventory continue to sideline potential buyers, despite the slight relief in mortgage rates. The persistent high cost of housing remains a barrier for many would-be buyers, further complicating the economic landscape. And this is another key signs of a recession.

Source: National Association of Realtors

Source: National Association of Realtors

WATCHOUT

The U.S. stock market has been volatile, reflecting signs of a recession, as it has been influenced by both macroeconomic uncertainties and company-specific factors. The initial optimism from the Fed’s rate cut was dampened by worries over corporate earnings and an economic slowdown.

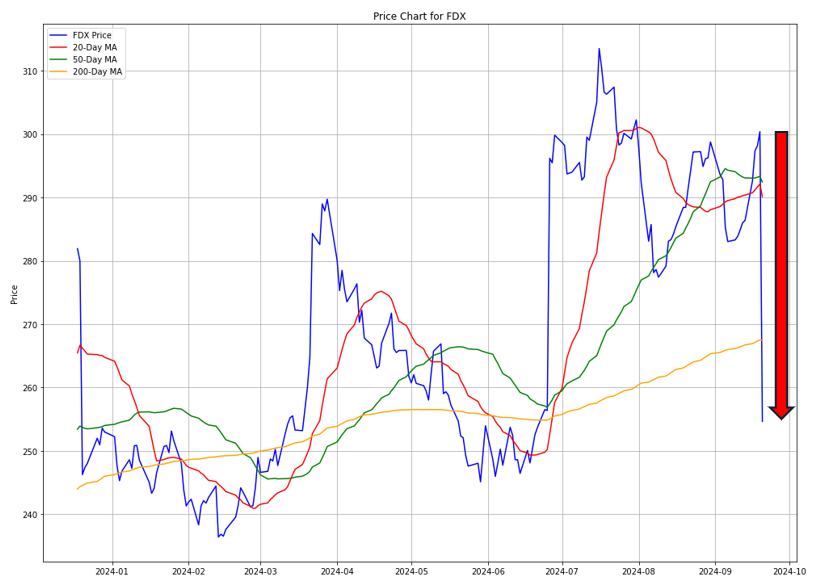

FedEx (FDX)

FedEx is facing significant headwinds, with its latest quarterly results reflecting weaker-than-expected demand and rising operational costs. The company reported a decline in both profit and revenue, leading to a downward revision of its full-year outlook. The challenges in the U.S. domestic package market, coupled with higher costs, have hurt its financial performance. Despite efforts to streamline operations by merging its Ground and Services divisions, the company has struggled to offset these challenges. As a result, FedEx’s stock has seen significant volatility, dropping nearly 10% following its earnings report.

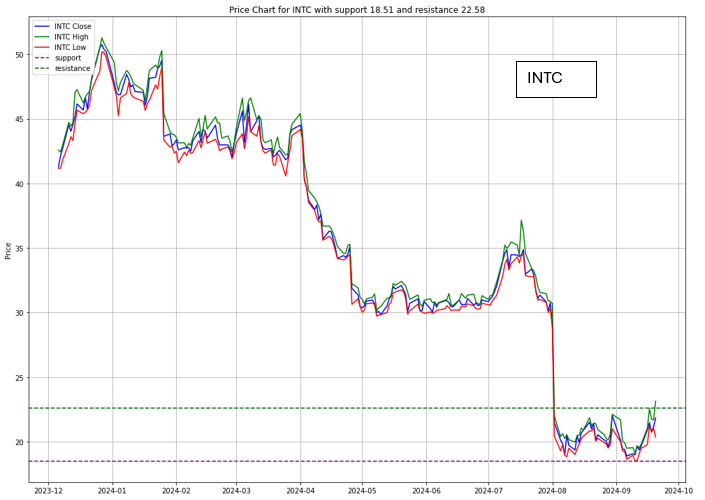

Intel (INTC)

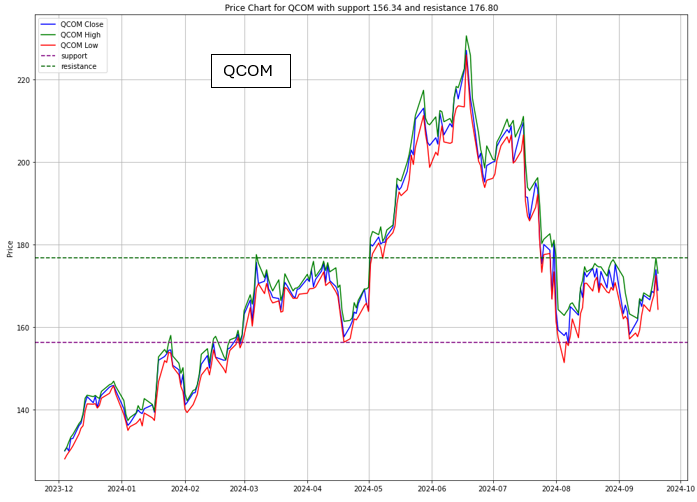

Intel’s situation is precarious, as it grapples with the fallout from missing key technological shifts, particularly in AI. The company’s core business in PC and server chips has been eroded by competitors like Nvidia, which have capitalized on the AI boom. Intel’s ambitious turnaround strategy, which includes expanding its manufacturing capabilities and entering the foundry business, has yet to yield the desired results. With its stock price down nearly 70% from its peak in early 2020, Intel is now viewed as a potential acquisition target, with Qualcomm reportedly exploring a takeover.

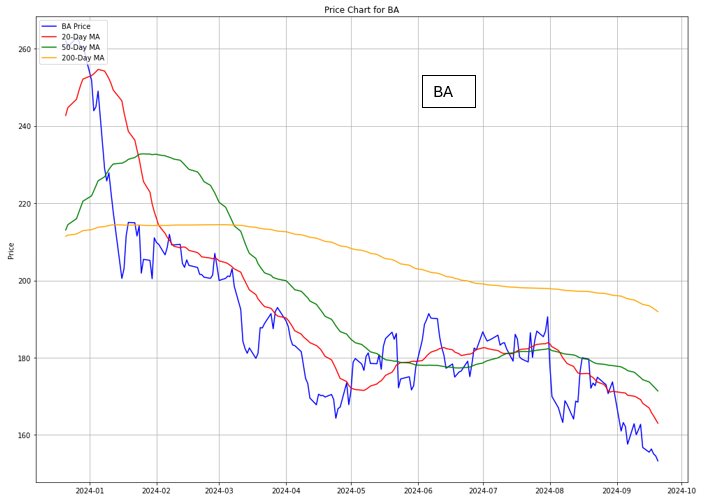

Boeing (BA)

Boeing’s defence and space division is undergoing significant upheaval, with the recent departure of its chief executive, Ted Colbert. The division has been plagued by losses, production delays, and high-profile failures such as the Starliner spacecraft’s issues, which have undermined customer confidence. Boeing’s broader challenges, including a strike that has halted 737 production, have further strained the company’s finances. These developments are part of the broader difficulties facing Boeing, as it struggles to regain its footing amid operational and financial challenges.

Investment Opportunity & Risk

NVIDIA Corporation (NVDA)

- NVIDIA has seen tremendous growth, driven by its leadership in AI and data center technologies. Despite the broader market fluctuations, NVIDIA has been resilient, supported by strong demand for its GPUs in AI and gaming.Analysts continue to be bullish on NVIDIA due to its dominant position in AI and its expanding role in autonomous machines, which includes robotics. The company’s forward-looking initiatives, including AI-driven robots and autonomous vehicles, position it well for long-term growth.

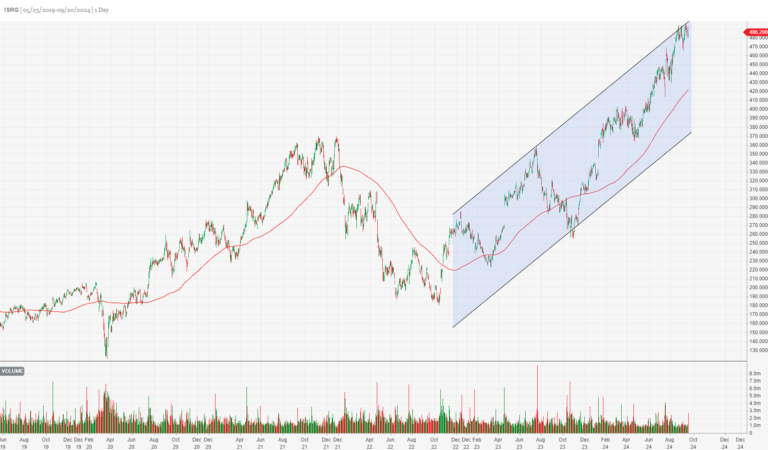

Intuitive Surgical, Inc. (ISRG)

- Intuitive Surgical has demonstrated steady growth, with a strong focus on expanding its installed base of da Vinci systems and increasing the number of procedures performed. The company’s recurring revenue from instruments, accessories, and service is a significant growth driver.The outlook for Intuitive Surgical remains strong, driven by the increasing adoption of robotic-assisted surgery worldwide. As healthcare continues to move toward minimally invasive procedures, ISRG is well-positioned to capitalize on this trend.

UiPath Inc. (PATH)

- UiPath has experienced rapid growth, with increasing adoption of its RPA solutions across various industries. However, the company has faced some volatility in its stock price, largely due to concerns about competition and the sustainability of its growth. Analysts remain optimistic about UiPath’s future, given the ongoing shift towards automation in business processes. The company’s ability to integrate AI into its RPA solutions and expand its customer base could lead to significant upside potential.

CONCLUSION

- The U.S. economy is facing a complex set of challenges, with high housing prices and limited inventory keeping potential buyers at bay, despite falling mortgage rates.

- The labor market, especially in the IT sector, is under pressure due to the rapid adoption of AI, leading to elevated unemployment rates.

- Corporate earnings, as seen with FedEx and Intel, reveal broader economic concerns.

- FedEx’s disappointing results highlight demand and cost challenges, while Intel’s strategic missteps and the AI boom have diminished its market position, making it a potential acquisition target.

- The stock market remains volatile, driven by mixed reactions to the Federal Reserve’s rate cuts and underlying economic uncertainties.

- As these trends unfold, careful monitoring of the labor market, corporate performance, and housing conditions will be essential.

- The Fed’s role will be crucial, but broader structural challenges require attention beyond monetary policy.

Please note that all information in this newsletter is for illustration and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any investment products or services.

About the Author

Rein Chua is the co-founder and Head of Training at AlgoMerchant. He has over 15 years of experience in cross-asset trading, portfolio management, and entrepreneurship. Major media outlets like Business Times, Yahoo News, and TechInAsia have featured him. Rein has spoken at financial institutions such as SGX, IDX, and ShareInvestor, sharing insights on the future of investing influenced by Artificial Intelligence and finance. He also founded the InvestPro Channel to educate traders and investors.

Rein Chua

Quant Trader, Investor, Financial Analyst, Vlogger, & Writer.