The S&P 500 (SPX), Dow Jones Industrial Average (DJIA), and Nasdaq Composite experienced declines ahead of Thanksgiving. A rotation out of mega-cap tech stocks weighed on indexes, even as broader market breadth improved in other sectors. The SPX closed at 5,998.74, reflecting a 0.38% daily decline. The U.S. economy is navigating a complex landscape characterized by sticky inflation, persistent inflationary pressures, cautious monetary policy adjustments, and shifting trade dynamics. The Federal Reserve’s preferred inflation gauge, the core Personal Consumption Expenditures (PCE) index, recorded a 2.8% year-over-year increase as of October. This rate exceeds the Fed’s 2% target, highlighting how sticky inflation continues to challenge efforts to stimulate economic activity despite recent interest rate cuts.

Bond Markets Bet on December Rate Cut

Despite the persistent sticky inflation, bond markets appear optimistic about another potential rate cut in the Federal Open Market Committee (FOMC) meeting scheduled for December. Futures trading suggests a 66% probability of a cut, bolstered by the bond market’s reaction to inflation reports showing ongoing inflationary pressures.

Risks and Rewards of Trump’s Re-Election on

Trade Tensions

Source: PBS News

Donald Trump’s re-election as U.S. President introduces a mix of policy uncertainties and market opportunities. His aggressive stance on trade, including proposed steep tariffs on Canada, Mexico, and an additional 10% on China, could escalate trade tensions, leading to higher costs for businesses reliant on international supply chains. Such measures, if implemented, could lead to price increases across consumer goods and critical sectors like automotive manufacturing, as businesses pass on higher input costs to consumers.Sectors like technology, manufacturing, and agriculture might face headwinds from retaliatory tariffs or supply disruptions.

Conversely, Trump’s emphasis on deregulation and tax cuts could provide a boost to domestic industries, particularly energy, finance, and construction. The stock market may experience heightened volatility as businesses and investors adjust to his potentially disruptive but business-friendly policies.

WATCHOUT

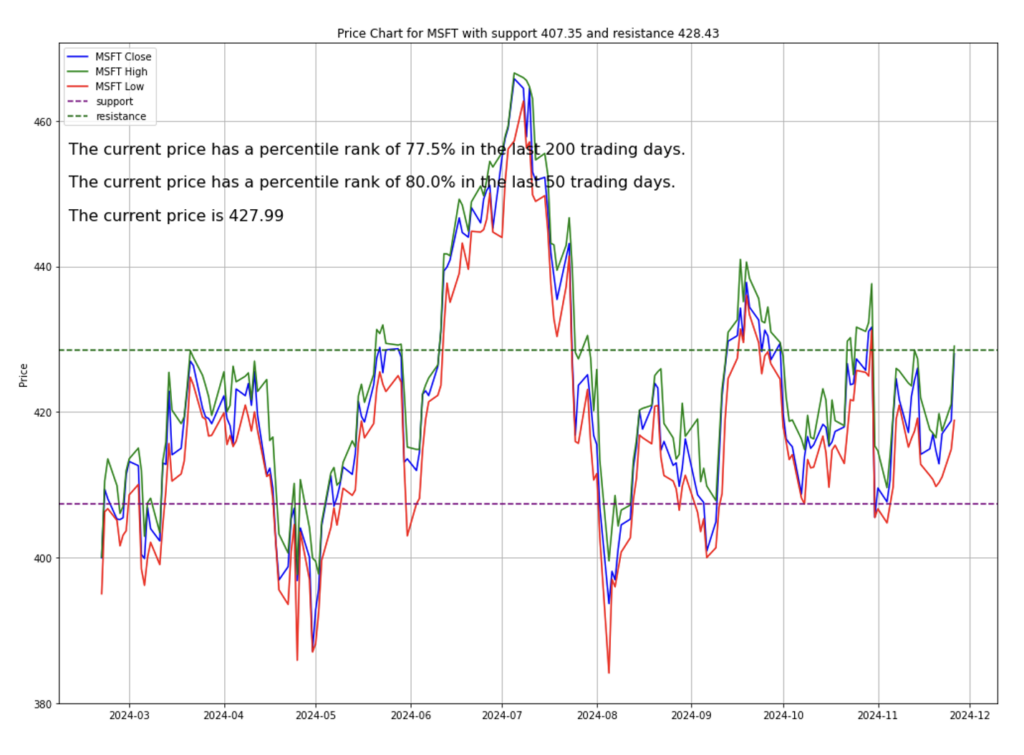

FTC Scrutiny Clouds Microsoft’s Future Plans

Microsoft faces heightened scrutiny from the Federal Trade Commission (FTC) over alleged anti-competitive practices in its Azure cloud services and productivity software segments. These allegations, compounded by recent complaints from rivals like Google, have created uncertainty surrounding the company’s strategic direction.

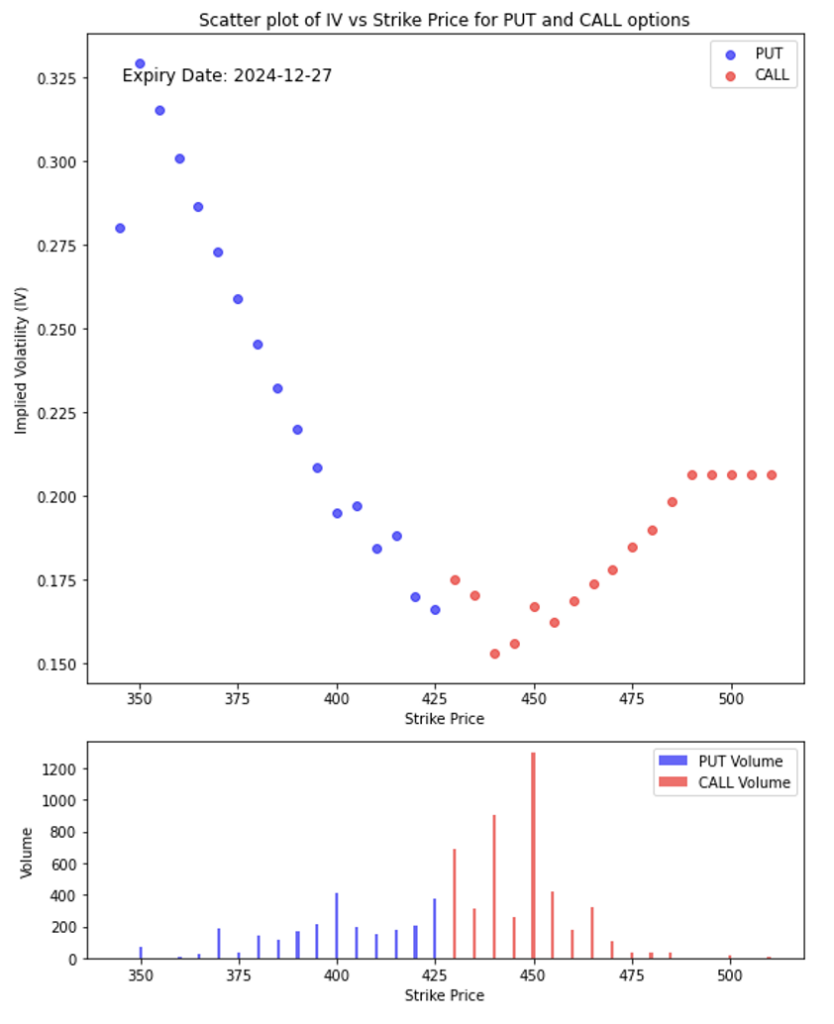

Slightly Bullish Near Term:

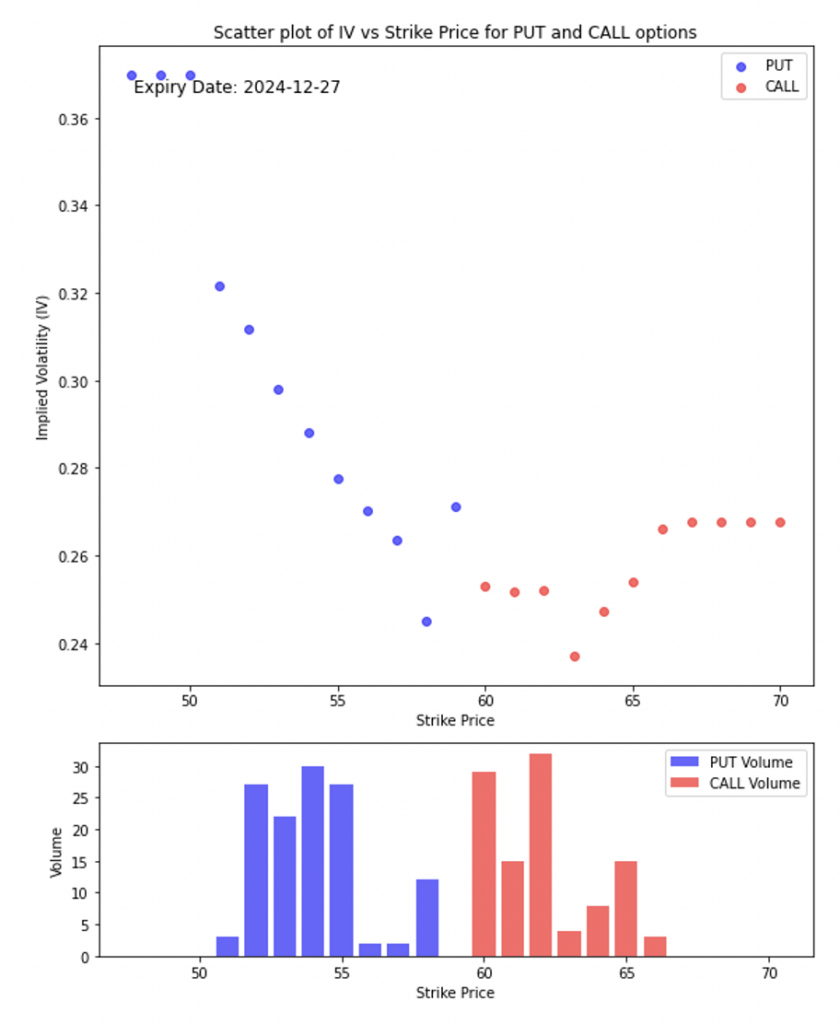

The high call option volume near the at-the-money (ATM) and slightly higher strikes combined with moderate IV levels for calls suggests cautious optimism. This could mean the stock is expected to move slightly upward in the near future.

Downside Risks Persist:

The elevated IV for deep out-of-the-money (OTM) puts indicates underlying concerns about potential downside risks.

Investment Opportunity & Risk

Palantir Technologies (PLTR)

This AI-driven software firm continues its upward trajectory, posting a remarkable 280% return year-to-date. Palantir’s Q3 performance surpassed expectations, driven by robust demand from U.S. government contracts. However, weaker international sales, particularly in Europe and the Middle East, pose challenges for sustained growth.

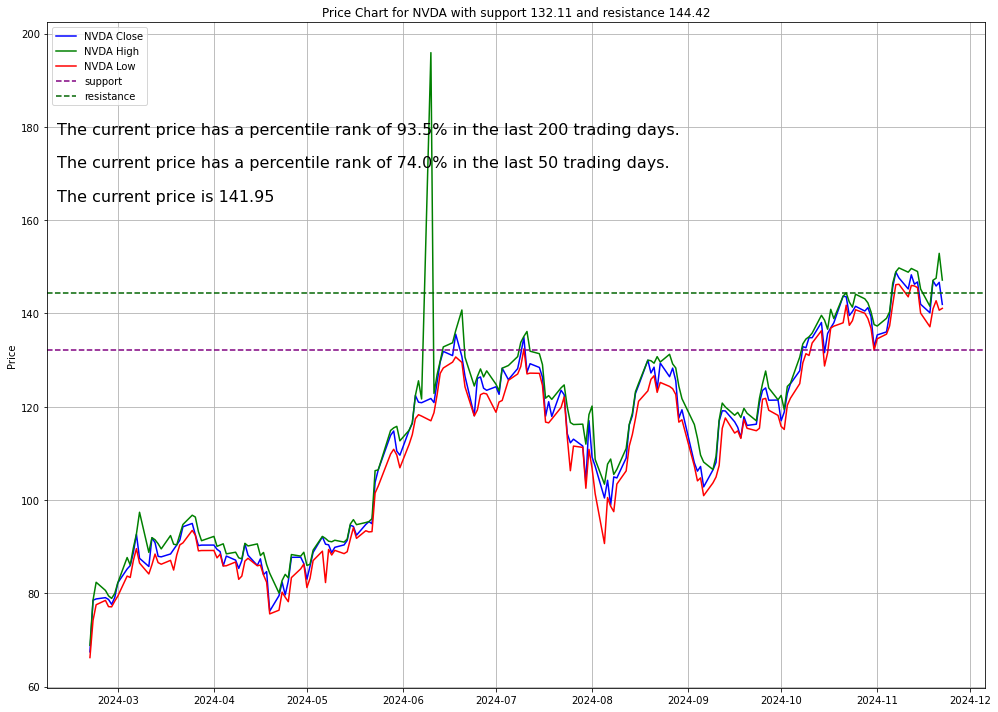

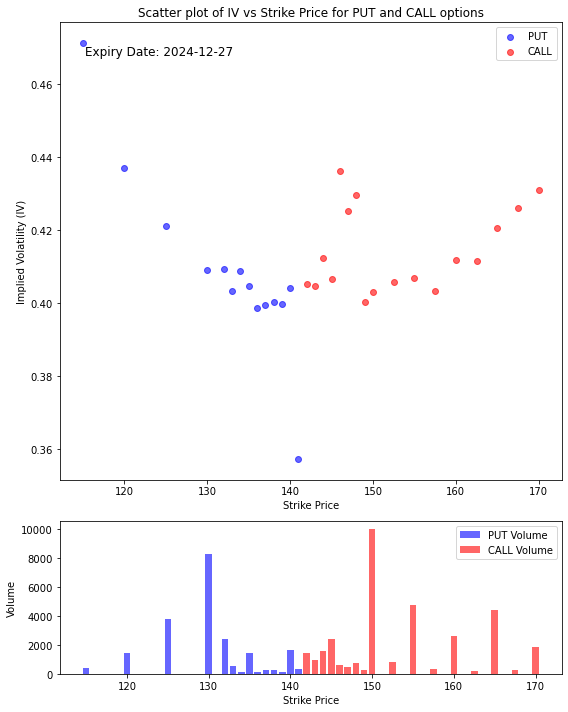

- It looks like the market is leaning slightly bullish based on this chart. The big cluster of CALL options around the 150 strike suggests that traders are optimistic and positioning for the stock to move higher. On the other hand, the noticeable PUT volume near the 130 strike means there are still some traders hedging against a potential drop, so the sentiment isn’t entirely one-sided.

- If the stock is currently trading somewhere around 140 to 145, it seems like the market expects it to stay in that range for now, but there’s potential to test the 150 level on the upside. At the same time, there’s a chance it could dip toward 130 if the overall market or company-specific news takes a turn.

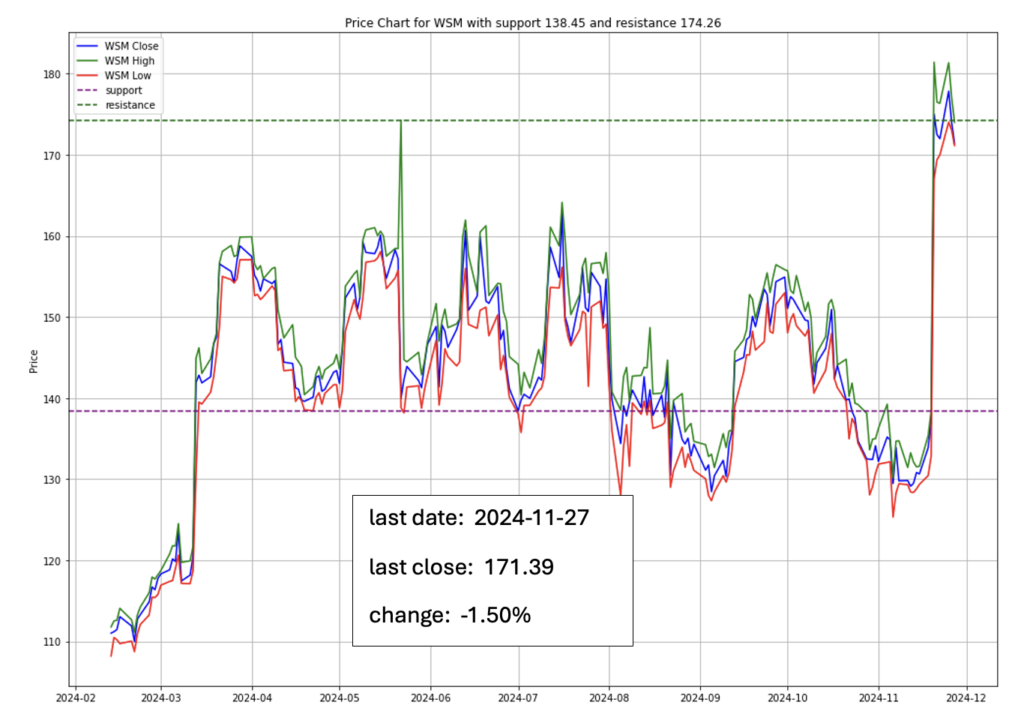

Williams-Sonoma (WSM)

Williams-Sonoma reported improved gross margins and announced a $1 billion stock buyback, triggering a significant stock rally. Its strong positioning in the premium consumer discretionary sector suggests potential resilience during the holiday shopping season.

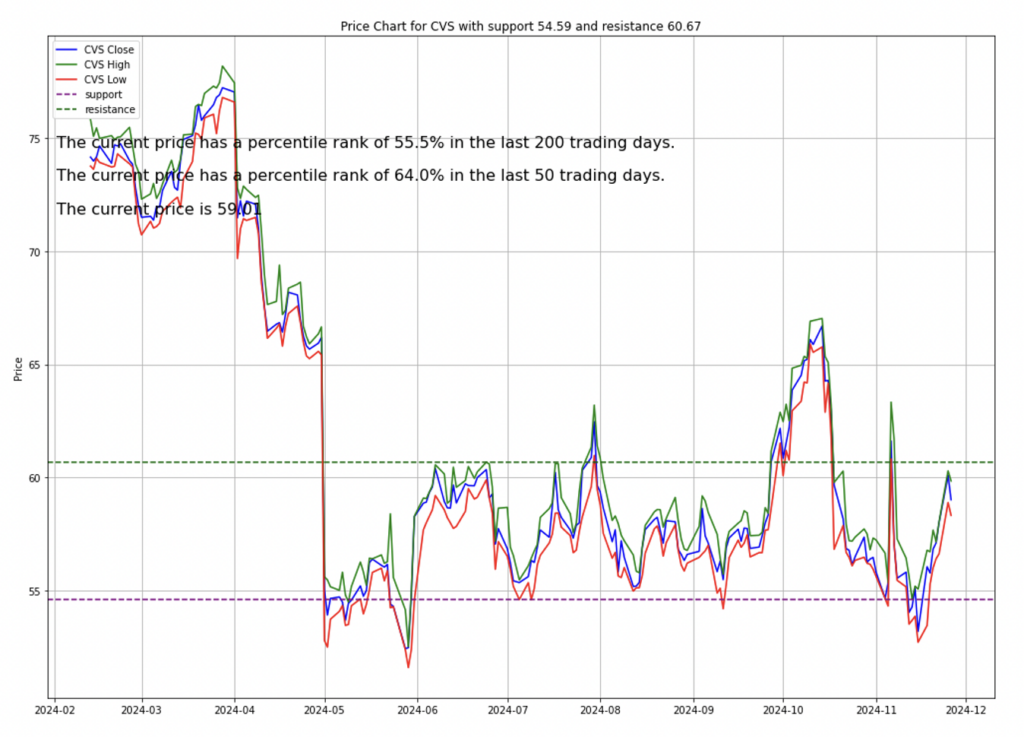

CVS Health Corp (CVS)

Analysts upgraded CVS to a “Buy” rating, citing the company’s ability to capture market share following store closures by competitors like Walgreens. With an impressive dividend yield of 4.6%, CVS offers both growth and income potential.

Looking at the data, it seems like there’s quite a bit of activity around the $55–$60 range for put options. This suggests that traders might be hedging against potential losses or betting on a slight downside for the stock. It’s a sign of caution—maybe they’re preparing for some negative news or just managing risk.

On the other hand, call options have strong volume in the $60–$65 range. This indicates some optimism, as traders are likely betting the stock could move slightly higher from where it is now. It shows a neutral to slightly bullish outlook, with expectations that the stock might hover around these levels or edge upward.

That said, there’s still a noticeable risk to the downside. The elevated implied volatility (IV) for puts, especially at lower strikes like $50–$55, reflects underlying concerns. Investors might be pricing in the possibility of a drop, whether due to uncertainty or potential negative developments.Overall, the sentiment seems mixed. There’s some cautious optimism for a modest rise in the near term, but the risk of a downturn isn’t off the table. It’s worth keeping an eye on any upcoming events or news that could swing the stock one way or the other!

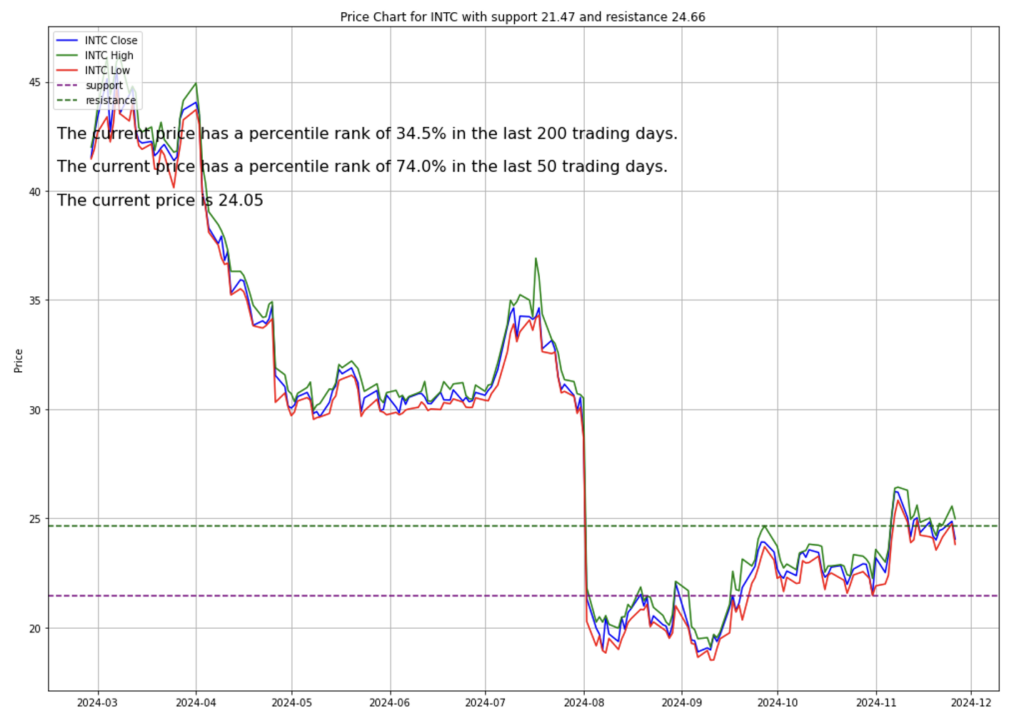

Intel (INTC)

Intel’s ambitious U.S. expansion plans hinge on adhering to government-imposed subsidy restrictions. The company’s efforts to spin off its foundry operations underscore its commitment to reviving domestic chip manufacturing capabilities.

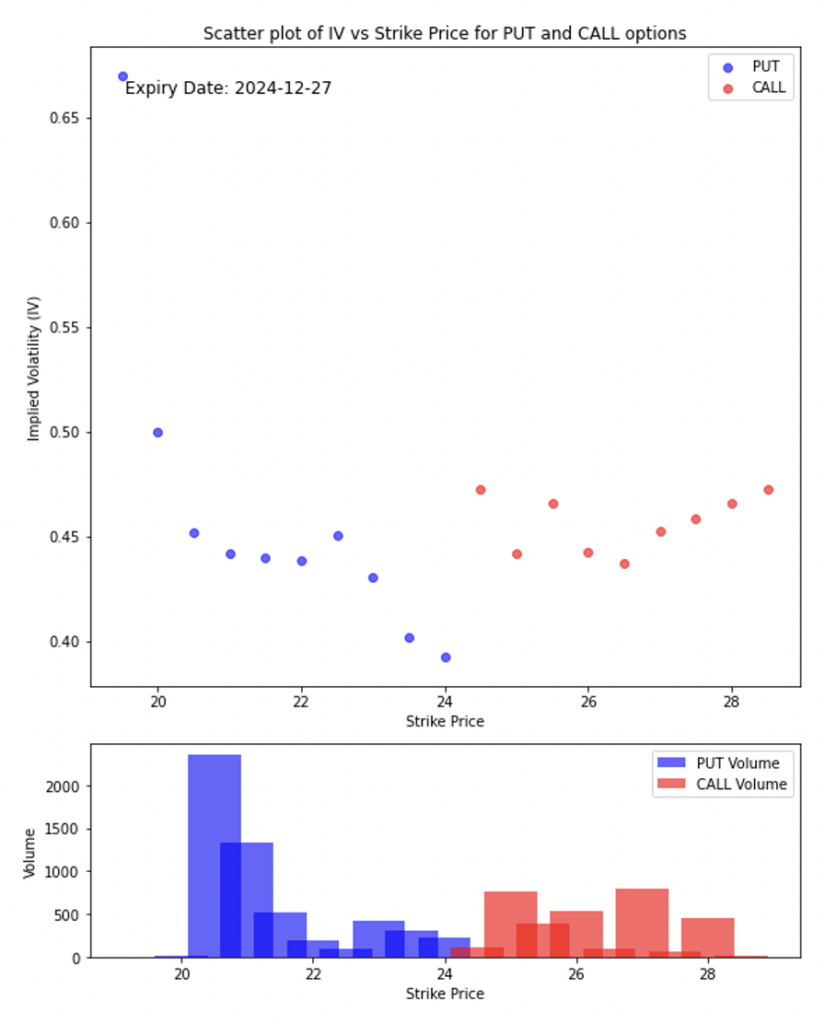

Put Options: There’s a lot of activity at the $20 strike with high implied volatility, which suggests traders are worried about a possible drop and are hedging against downside risks.

Call Options: On the other hand, the call volume between $26 and $28 points to some optimism that the stock could edge higher in the near term.

- Overall, the sentiment seems cautious but leaning slightly bullish. Traders expect the stock to hold steady or rise a bit, but they’re clearly keeping one eye on potential risks.

CONCLUSION

- The U.S. economy’s resilience in the face of sticky inflation, coupled with proactive fiscal and monetary policy measures, underscores cautious optimism.

- However, geopolitical uncertainties, such as potential trade wars and regulatory shifts, could act as headwinds.

- Stock-specific narratives reveal both opportunities and risks, with sectors like AI, healthcare, and retail poised to outperform under the current macroeconomic conditions shaped by sticky inflation.

Please note that all information in this newsletter is for illustration and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any investment products or services.

About the Author

Rein Chua is the co-founder and Head of Training at AlgoMerchant. He has over 15 years of experience in cross-asset trading, portfolio management, and entrepreneurship. Major media outlets like Business Times, Yahoo News, and TechInAsia have featured him. Rein has spoken at financial institutions such as SGX, IDX, and ShareInvestor, sharing insights on the future of investing influenced by Artificial Intelligence and finance. He also founded the InvestPro Channel to educate traders and investors.

Rein Chua

Quant Trader, Investor, Financial Analyst, Vlogger, & Writer.