The stock market has shown resilience, with stock market highs as the S&P 500 and Nasdaq recently reached record levels. Positive economic indicators, such as higher-than-expected payroll numbers and rising consumer sentiment, have buoyed investor confidence. However, market gains were tempered by mixed signals from the Federal Reserve. Fed officials expressed cautious hawkishness, suggesting a slower pace of rate cuts to balance inflation and economic growth.

Source: INFINOX

Cautious Optimism Amid Mixed Signals in Jobs and Inflation

The US economy remains a mixed bag, marked by cautious optimism. Consumer confidence has reached its highest levels in seven months, driven by better assessments of the economy despite partisan divides. Stock market highs have mirrored this optimism. Inflation expectations have risen slightly, with consumers anticipating a 2.9% average for the year ahead.

Source: Hindustan Times

On the labour front, the November jobs report presented an apparent rebound with 227,000 payroll additions. However, this was largely attributed to temporary factors such as returning workers from strikes and hurricane-related disruptions. The unemployment rate ticked up to 4.2%, reflecting a cooling labour market, which aligns with the Federal Reserve’s ongoing consideration for a rate cut at its upcoming meeting, amid stock market highs.

GLOBAL IMPACT

Global Forces Shaping US Markets Amid Energy and Trade Shifts

International issues continue to influence the US economy:

- Energy Markets: Falling oil prices have put pressure on energy stocks, highlighting the global interconnectedness of energy supply and demand.

- Geopolitical Tensions: Tariff discussions and trade policy changes have kept inflation concerns alive, with differing expectations among political groups.

- Global Growth Trends: Mixed performances in global markets, such as China’s steady economic indicators and Europe’s industrial contraction, also weigh on US investor sentiment.

Investment Opportunity & Risk

Stock market highs, and these are opportunities you want to look at.

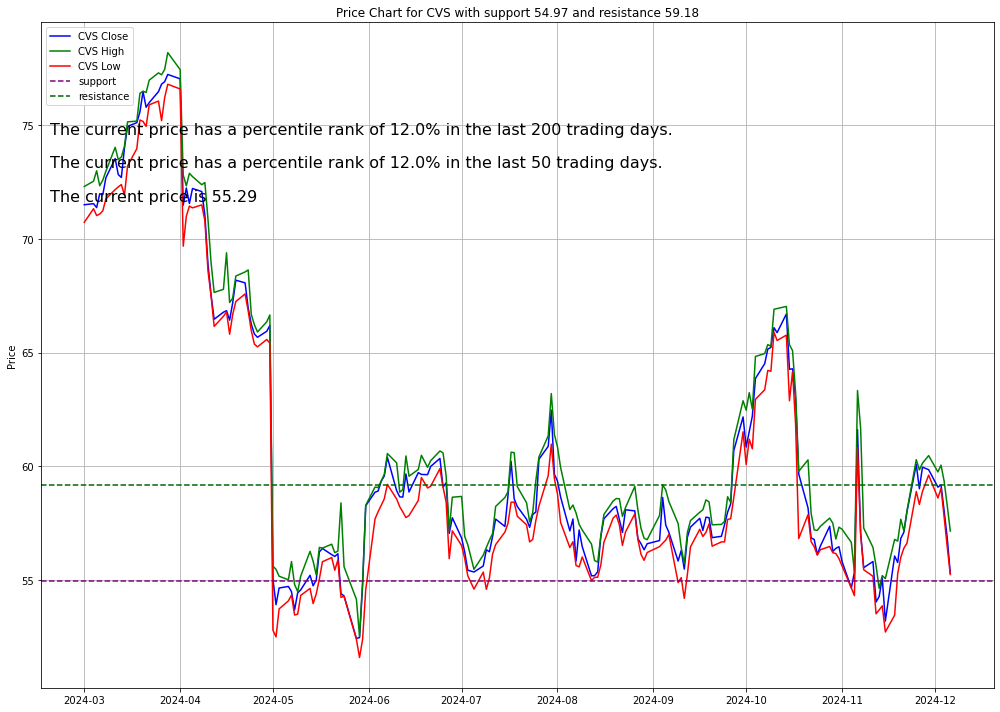

CVS Health Corporation (CVS)

Over the past three days, CVS Health Corporation has been the subject of various reports focusing on its strategic moves and financial performance. One of the most notable developments was the announcement of its partnership with a leading telehealth provider, aimed at expanding its virtual care services. This move is expected to enhance CVS’s position in the rapidly growing telehealth market, offering more accessible healthcare solutions to its customers.

Additionally, CVS released its quarterly earnings report, which showed a better-than-expected performance driven by increased pharmacy sales and a robust retail segment. The company reported a slight uptick in its stock price, reflecting investor confidence in its growth strategies and operational efficiency.

- The market sentiment seems cautiously balanced, with downside hedging activity indicating some concern about potential drops while call interest in the $60 range suggests moderate bullishness.

- Given these dynamics, the stock might experience a period of range-bound movement between $50 (support) and $60 (resistance). However, if a breakout occurs, the volume and IV data suggest a higher likelihood of downward pressure rather than an aggressive rally.

- The stock could trade sideways or slightly downward in the short term, given the heavier focus on put activity and hedging. Watch for any fundamental news or catalysts that could break this range and influence sentiment further. Let me know if you’d like me to integrate more market data or specifics to refine the outlook!

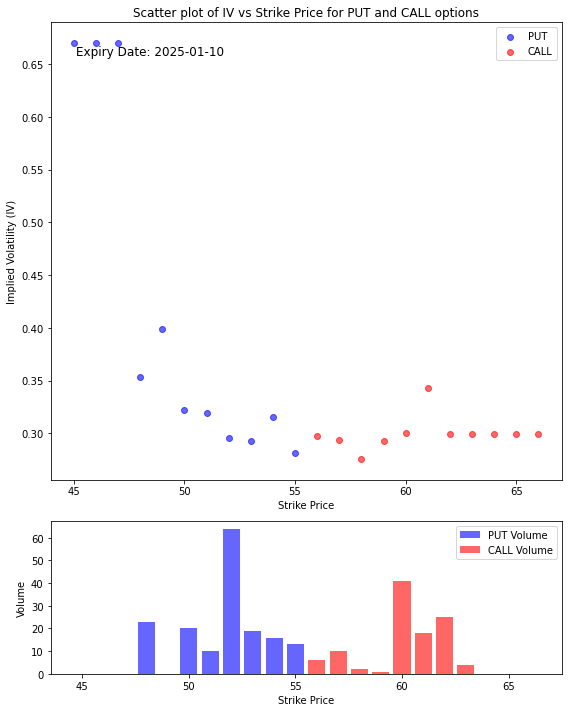

Schlumberger Limited (SLB)

Schlumberger, a leading oilfield services company, has been garnering attention due to recent developments in the energy sector. The company announced several new contracts with major oil and gas producers, signalling a positive outlook for its future growth. These contracts are expected to drive revenue and enhance its market position in the global energy industry.Moreover, Schlumberger’s stock has seen an upward trend as oil prices continue to recover, boosting investor sentiment. The company’s focus on innovation and sustainability, including investments in clean energy technologies, has also contributed to its positive performance in the stock market.

- The high concentration of put volume and elevated IV for lower strike prices imply market participants are hedging against or speculating on potential downside risks.

- The low call activity and stable IV suggest limited enthusiasm for a significant upward movement, pointing to a more cautious or bearish sentiment overall.

- This stock might be facing downward pressure or could experience a sideways movement in the short term. The $40 strike appears to be a critical pivot point; if the stock price breaks below this level, it could lead to further declines. Conversely, if the stock remains above $40, it might consolidate within the $40-$45 range.

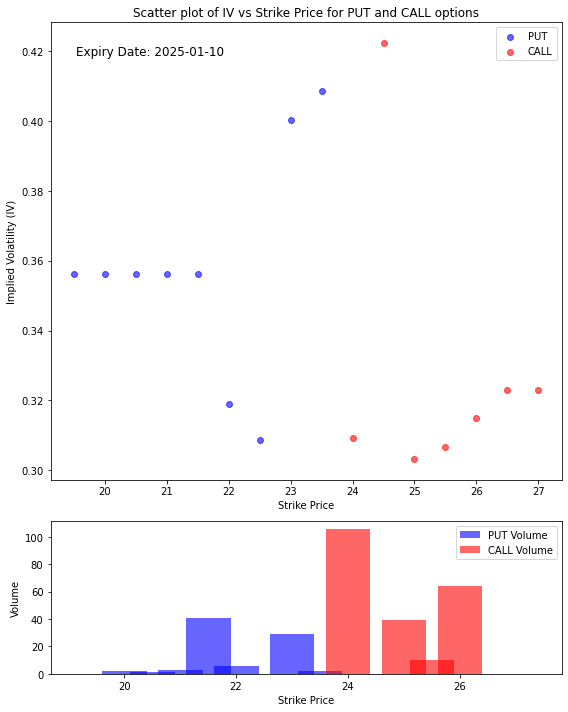

Lululemon Athletica (LULU)

Lululemon has delivered robust earnings growth, fueled by strong demand for athletic and leisurewear. Its expansion into new international markets and diversification of product offerings further solidify its market position.

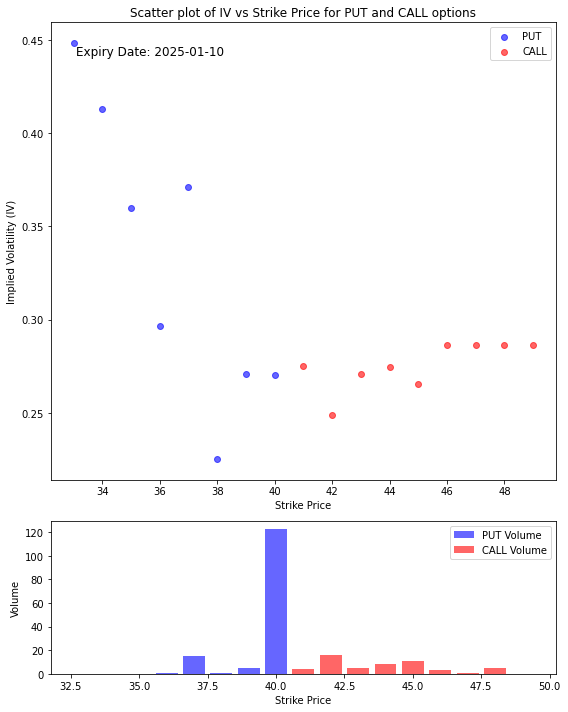

Hewlett Packard Enterprise (HPE)

Hewlett Packard Enterprise garnered attention after unveiling its latest advancements in cloud computing and edge-to-cloud solutions. The company has secured several new contracts with major enterprises, highlighting its growing influence in the technology sector. Furthermore, HPE’s strategic initiatives to enhance data security and improve infrastructure management have been well-received by industry analysts.

- The increased call volume and rising IV for higher strike prices suggest that market participants are leaning toward bullishness, anticipating a move to or beyond $24-$26 in the short term.

- The relatively flat IV for puts and lower put volume indicate that traders are not significantly worried about downside risk.

- This stock appears to have bullish momentum, with a likely price move toward the $24-$26 range in the near future. It may face resistance near $26 if no significant catalysts emerge to push it further. Monitor overall market conditions or news related to the stock for confirmation.

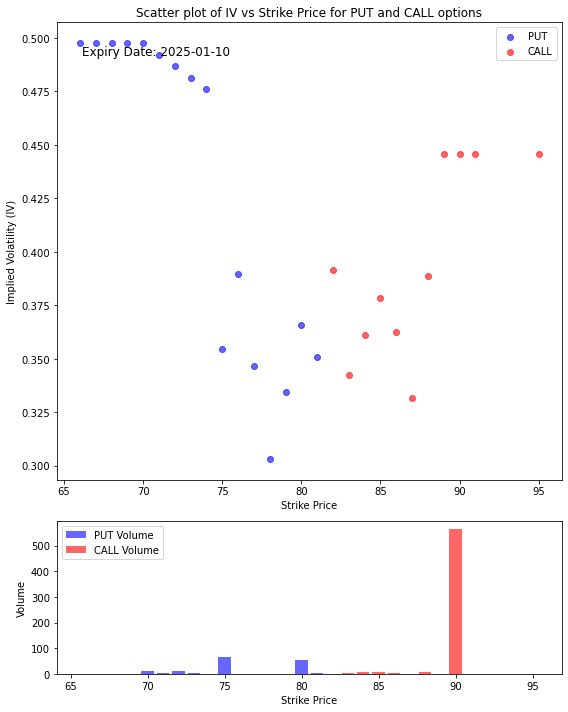

Dollar General (DG)

Dollar General made headlines with its announcement of a new store format aimed at increasing accessibility and convenience for customers in rural areas. This move is expected to bolster the company’s market reach and drive revenue growth. Additionally, Dollar General has been actively involved in community support initiatives, particularly in response to recent natural disasters.

- The large concentration of call volume at $90 hints at a speculative play or a potential resistance level where traders believe the stock might head if bullish catalysts emerge.

- The higher IV in puts for lower strikes suggests a cautious stance, likely from institutional or risk-averse participants, hedging against a potential decline below $70.

- The combination of these factors suggests a mixed sentiment, with a cautious-to-neutral outlook but a possibility of bullish movement if catalysts push the stock price higher.

The stock is likely in a consolidation phase. If the price moves toward $90, it could face significant resistance unless there’s strong positive momentum or news. Conversely, if it trends downward, the $65-$70 range appears to be a critical support zone.

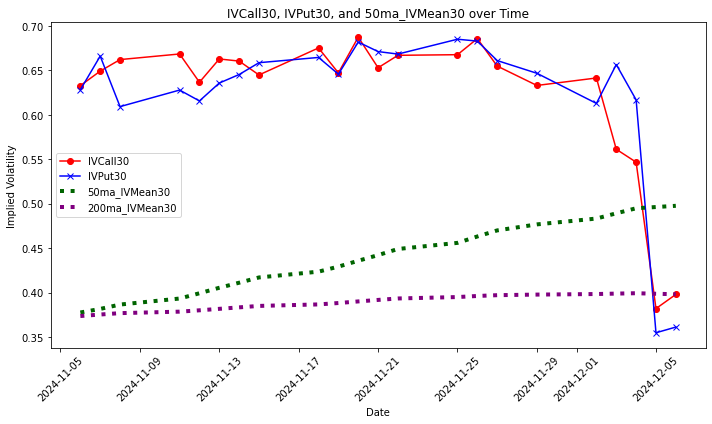

The anxiety surrounding the stock has pretty much subsided with the ATM call implied volatility being currently above that of the put implied volatility. The collapse in the implied volatilty is a bullish nuance.

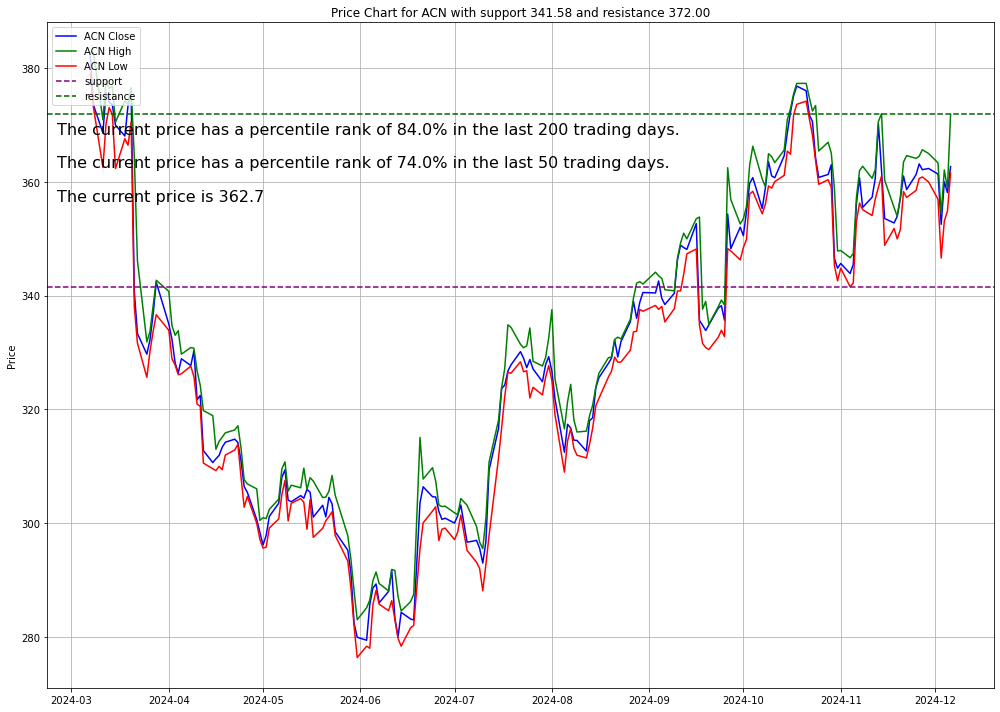

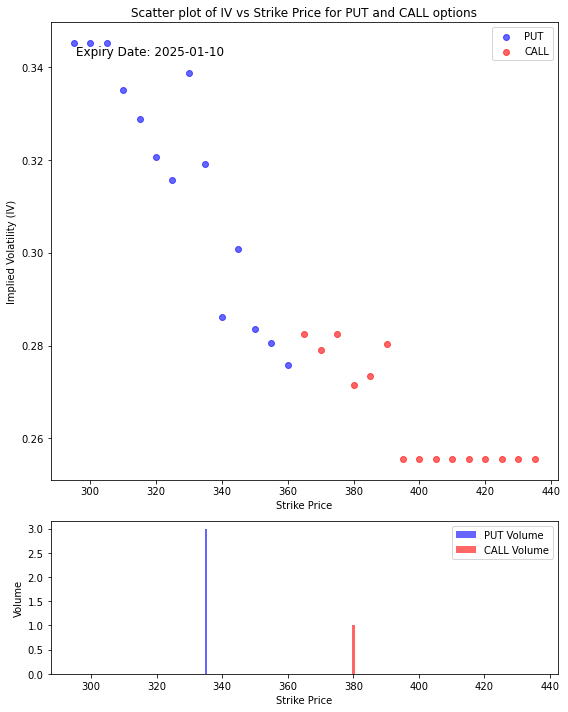

Accenture (ACN)

Accenture‘s recent acquisition of a leading digital consulting firm has been a major talking point. This strategic move will enhance Accenture’s capabilities in digital transformation and innovation services. The company also announced a partnership with a major global corporation to develop cutting-edge solutions in artificial intelligence and machine learning.

- The higher IV on the put side and concentrated volume at 340 suggest caution and hedging against downside risks. Traders might see 340 as a key support level, and if the price breaks below this level, it could lead to further declines.

- The relatively low call activity indicates a lack of strong bullish momentum, with resistance likely forming around the 380–400 range.

The stock appears to be in a bearish or neutral sentiment zone. It might consolidate near the 340–380 range, but if the price breaks below 340, it could trigger more selling pressure. Conversely, a sustained move above 380 could spark modest bullish interest, but the data suggests that scenario is less likely in the short term.

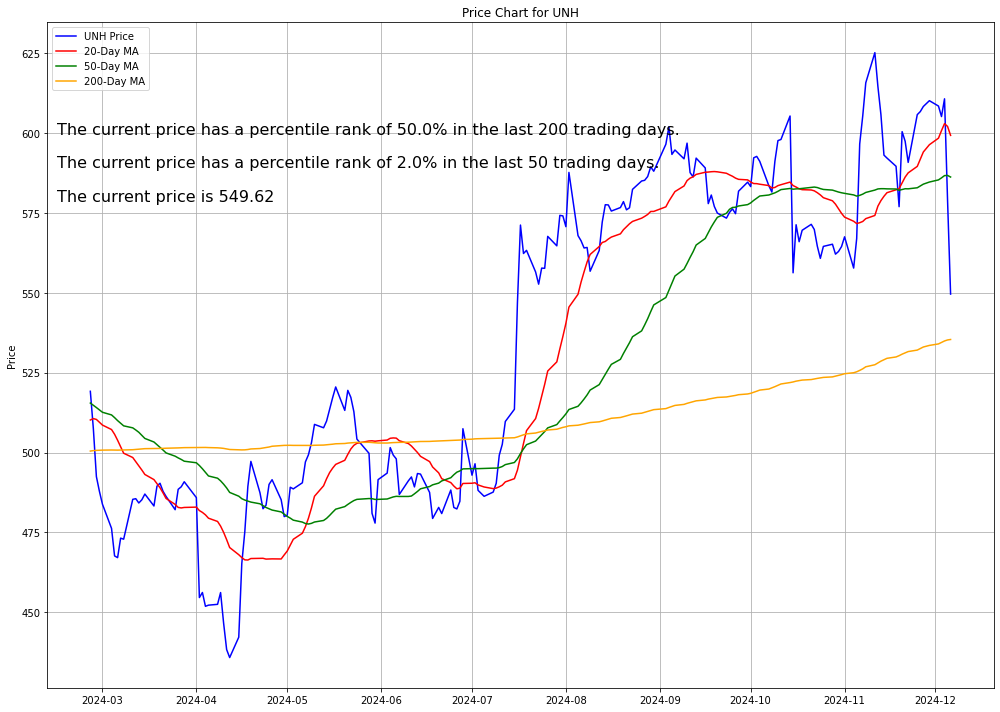

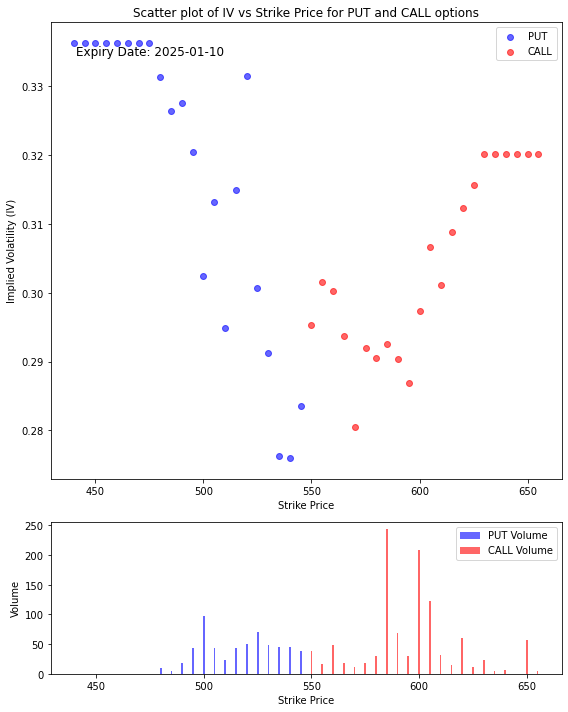

UnitedHealth Group (UNH)

UnitedHealth Group has been in the news following its strong financial performance in the healthcare sector. The company reported higher-than-expected earnings, driven by increased enrolment in its health insurance plans and growth in its healthcare services segment. Additionally, UnitedHealth Group has launched several new health initiatives aimed at improving patient care and reducing costs.

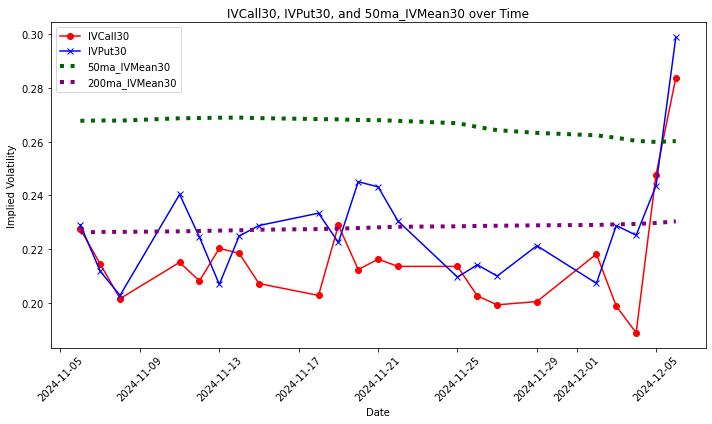

- The stock might experience a bullish bias, with a potential move toward the 600-650 range if momentum builds. However, the elevated put IV at lower strikes and steady put volume imply that traders are not discounting downside risks. This creates a scenario where the stock could trade between 500-650 depending on external catalysts.

- The 500-550 range likely acts as support, while 600-650 serves as a resistance zone.

The implied volatility trend however indicates that bearish nuance is creeping in. Suggestion: wait a few days more before entering a new position.

CONCLUSION

- The US economy and stock market exhibit resilience amid a complex interplay of domestic and international dynamics.

- While consumer confidence, stock market highs, and stock performance are encouraging, challenges such as a cooling labor market, geopolitical tensions, and global growth uncertainties persist.

- Key stocks, including CVS, Robinhood, and Lululemon, highlight sectoral strengths, while companies like Alphabet and Schlumberger navigate transformative challenges.

- Investors should remain vigilant, balancing optimism about growth opportunities with caution regarding broader economic and geopolitical risks.

- This evolving landscape presents a rich array of investment prospects for those who can adapt to changing dynamics.

Please note that all information in this newsletter is for illustration and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any investment products or services.

About the Author

Rein Chua is the co-founder and Head of Training at AlgoMerchant. He has over 15 years of experience in cross-asset trading, portfolio management, and entrepreneurship. Major media outlets like Business Times, Yahoo News, and TechInAsia have featured him. Rein has spoken at financial institutions such as SGX, IDX, and ShareInvestor, sharing insights on the future of investing influenced by Artificial Intelligence and finance. He also founded the InvestPro Channel to educate traders and investors.

Rein Chua

Quant Trader, Investor, Financial Analyst, Vlogger, & Writer.