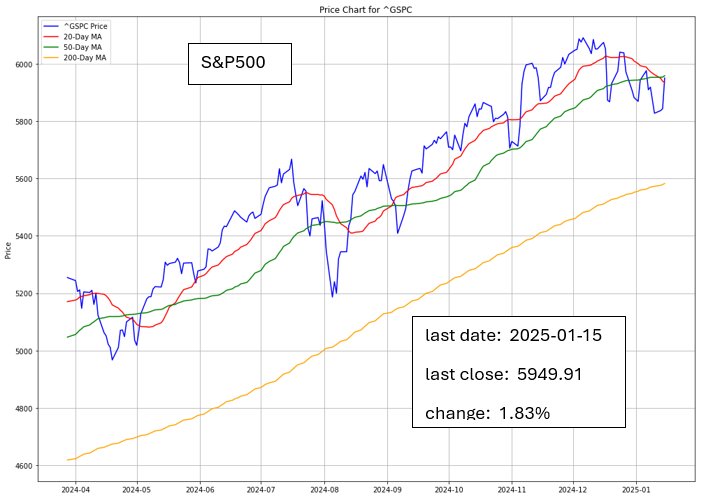

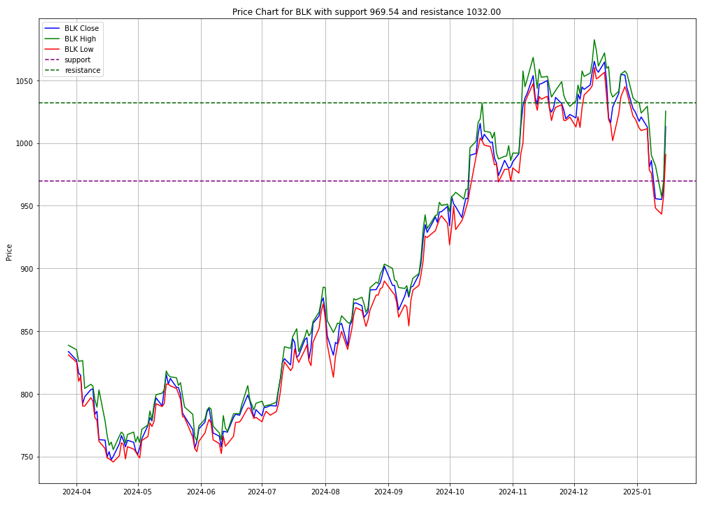

New York, NY – Stock market surges as U.S. equities posted their largest daily gains since November 6 on Thursday, driven by easing core inflation and robust corporate earnings. The S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all rallied significantly, bolstered by strong quarterly results from financial giants JPMorgan, BlackRock (NYSE: BLK), and Goldman Sachs.

Stock Market soars after cool CPI reading

The latest U.S. Consumer Price Index (CPI) report showed headline inflation rising 2.9% year-over-year in December, aligning with expectations. However, core inflation, which excludes volatile food and energy prices, increased by 3.2%, slightly below the forecasted 3.3%. This moderation in price pressures has reinforced market expectations that the Federal Reserve may consider rate cuts later this year.

Kyle Chapman, FX markets analyst at Ballinger Group, noted, “The inflation data suggests that the market’s aggressive pricing out of rate cuts may have been overdone. As economic data softens, the possibility of additional monetary easing could re-emerge.” Traders are now pricing in nearly even odds of two rate cuts by the Fed by year-end, a shift that has weighed on the U.S. dollar. The dollar index, which measures the greenback against a basket of six major currencies, dipped to 109.03.

Positive Earnings Reports Drove A Positive Market Sentiment

The rally on Wall Street was further supported by a wave of positive earnings reports. JPMorgan, BlackRock, and Goldman Sachs all delivered stronger-than-expected results, underscoring resilience in the financial sector. This earnings momentum, combined with the softer inflation reading, has bolstered confidence in the U.S. economic outlook.

Source: www.sc.com

Eric Robertsen, Global Head of Research and Chief Strategist at Standard Chartered (OTC: SCBFF), commented, “While we anticipate a shallow easing cycle from the Fed, short-term hawkishness appears overdone. The U.S. dollar is likely to remain strong, albeit with a volatile trajectory, as the theme of U.S. economic exceptionalism continues to play out.”

Treasuries Surge as Easing Inflation Boosts Fed Rate-Cut Bets

U.S. Treasury yields fell sharply in response to the inflation data, with the yield on the benchmark 10-year note dropping 13.5 basis points to 4.653%. The decline reflects growing investor confidence that the Fed may adopt a more accommodative stance in the coming months.

Source: Wall Street Journal

Markets Watch U.S. Trade Policies as Yen Rises on BOJ Rate Hike Speculation

Investor attention remains firmly fixed on U.S. policy developments, particularly as President-elect Donald Trump prepares to return to the White House. Recent reports suggesting a gradual implementation of tariffs by the new administration have alleviated some concerns, though analysts caution that Trump’s policies could simultaneously boost growth and exacerbate inflationary pressures.

Meanwhile, the Japanese yen strengthened to a one-month high against the dollar, driven by speculation that the Bank of Japan (BOJ) may raise interest rates as early as next week. Joseph Capurso, Head of International Economics at Commonwealth Bank of Australia (OTC: CMWAY), noted, “While BOJ Governor Kazuo Ueda is typically cautious, there is a growing possibility of a rate hike, particularly if U.S. trade policy clarity and strong wage growth data emerge.”

GLOBAL INFLUENCES

China's Central Bank Pumps Near-Historic Level of Cash Into Financial System

While the U.S. market took center stage, developments in China also captured investor attention. The People’s Bank of China (PBOC) injected a near record-high amount of liquidity into the banking system, pumping 959.5 billion yuan (approximately $130.9 billion) via seven-day reverse repurchase agreements. This move, the second-largest such injection on record, aimed to offset the impact of expiring medium-term lending facility loans, tax payments, and increased cash demand ahead of the Lunar New Year holiday.

The PBOC’s actions come amid efforts to support the yuan, which has faced downward pressure due to broad dollar strength and concerns over potential U.S. trade tariffs. Economists expect further monetary easing from the PBOC this year, including possible cuts to the reserve requirement ratio (RRR) to replenish liquidity in the financial system. However, policymakers have refrained from rate cuts or RRR adjustments since September 2023, balancing the need for economic support with the risk of exacerbating currency weakness.

Wei He, an analyst at Gavekal Dragonomics, highlighted PBOC Governor Pan Gongsheng’s proactive approach, stating, “With a mandate for greater monetary easing, there is a growing chance that the PBOC could take extraordinary steps, such as a major one-off interest rate cut, to boost market sentiment in 2025.”

Asian Markets Rally as U.S. Optimism Fuels Gains Across Equities and Commodities

The positive sentiment in the U.S. spilled over into global markets, with Asian equities rising in tandem. MSCI’s broadest index of Asia-Pacific shares outside Japan gained 1.4%, while Hong Kong’s Hang Seng Index surged 1.5%. In Taiwan, tech-heavy stocks climbed 2% as investors awaited earnings from Taiwan Semiconductor Manufacturing Co (TSMC), the region’s most valuable company.

Source: Strait Times

In commodities, oil prices edged higher following a larger-than-expected drawdown in U.S. crude inventories, which heightened concerns over potential supply disruptions due to new U.S. sanctions on Russian energy exports. U.S. crude rose 0.29% to 80.27 a barrel, while Brent crude gained 0.17% 80.27 a barrel, while Brent crude gained 0.17% higher at $82.17. Gold also benefited from shifting rate expectations, with spot prices hitting a one-month high of $2,702.09 per ounce during Asian trading hours.

Investment Opportunity & Risk

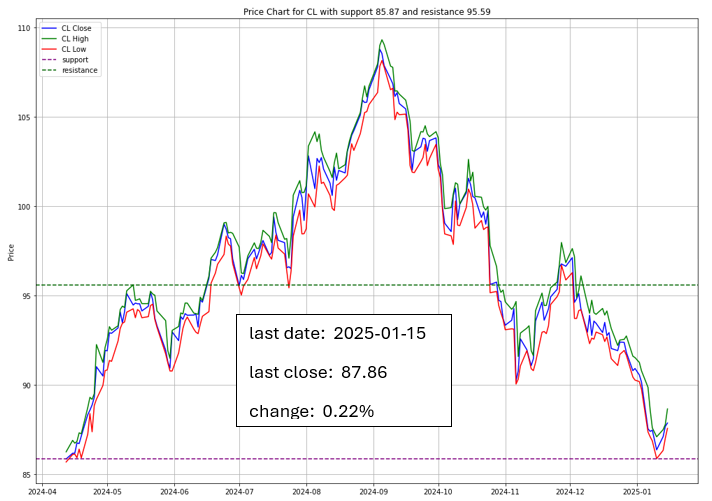

Colgate-Palmolive (NYSE: CL)

On Wednesday, Deutsche Bank lowered its price target for Colgate-Palmolive (NYSE: CL) from $100 to $95 while maintaining a Hold rating. The revision follows expectations for the company’s fourth-quarter results to meet forecasts with a 6% increase in organic growth, though the analyst anticipates slightly lower-than-consensus results due to growing foreign exchange (FX) headwinds and a slowdown in certain global markets. Consequently, the EPS estimate for Q4 was reduced to $0.87, below the consensus of $0.89. Looking ahead to fiscal year 2025, the analyst forecasts a 5% organic growth target and expects low single-digit adjusted EPS growth, lowering the EPS estimate to $3.65 from $3.77, reflecting a more cautious outlook in light of FX challenges and planned business investments.

Option Smile Chart for CL

- The implied volatility of the put options are generally higher than that of the call options. That shows the public sentiment which is more fearful of a price drop than the greed of a price rise.

- Currently there is a big call volume at the call strike at 100, indicating that there is the expectation the stock price may reach 100.

- The sentiment index for the day is 0.781 where the value of less than 1 is bearish and more than 1 is bullish.

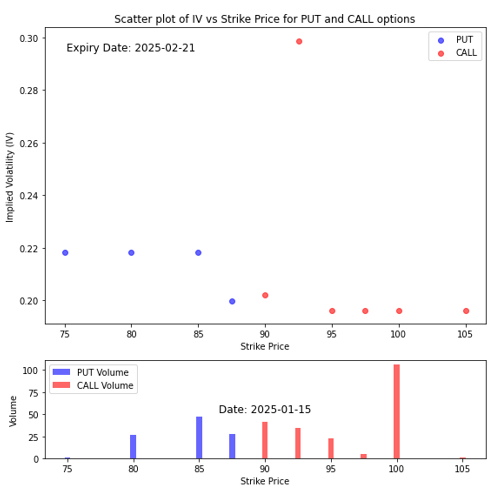

BlackRock (NYSE: BLK)

JPMorgan recently raised its price target for BlackRock (NYSE: BLK) to $1,053 from $971 while maintaining a Neutral rating, following the company’s strong fourth-quarter 2024 earnings report. BlackRock’s adjusted EPS of $11.93 exceeded expectations, driven by higher base and performance fees, particularly from equities and alternatives. Revenue grew by 10.2%, supported by $201 billion in long-term inflows. However, the earnings beat was partially driven by a lower-than-expected tax rate, which may not be sustainable. While BlackRock remains strong in cash management and organic growth, JPMorgan expressed caution about the maturation of its iShares business and slower growth in fixed income flows. The updated target reflects concerns about future growth, especially in fixed income and alternatives, though BlackRock’s solid financial health and positive analyst ratings continue to provide some upside potential.

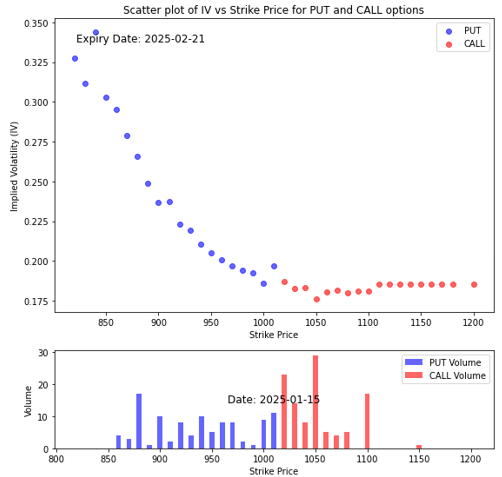

Option Smile Chart for BLK

- Please note the lower implied volatility of the call options, higher implied volatility of the put options and coupled with the significant bigger volume of the call option close to the ATM. Such combination points a sentiment which is considered as cautious optimism.

- Sizeable volume at 1000 strike is a strong support which further indicates that the stock is in a bullish mode.

- The sentiment index for the day is 1.751 where the value of less than 1 is bearish and more than 1 is bullish.

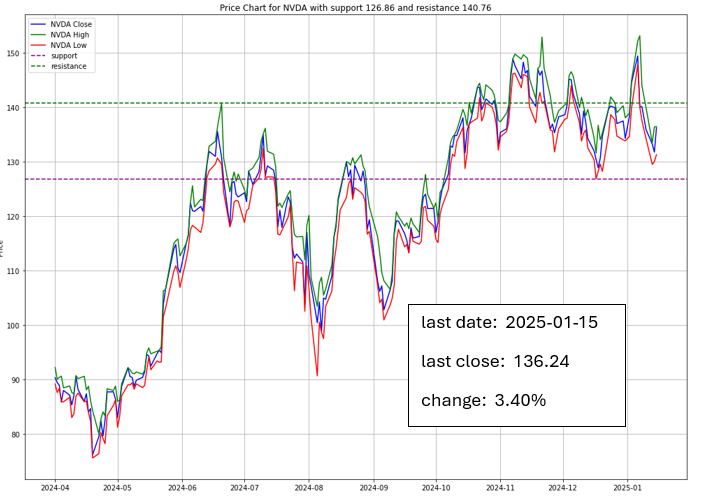

NVIDIA (NASDAQ: NVDA)

On Wednesday, DA Davidson reaffirmed a Neutral rating on NVIDIA (NASDAQ: NVDA) with a $135 price target, maintaining a cautious outlook despite the company’s strong performance, including a 140.9% return over the past year. The firm’s analyst, Gil Luria, noted that while NVIDIA has demonstrated impressive growth, including 152.44% revenue growth, their outlook for 2025 and beyond remains conservative, particularly regarding the company’s ability to meet expectations in 2026.

This caution is driven by supply-side disruptions, including issues with Blackwell chips and sales limitations to China. The firm’s target reflects a 35x multiple, suggesting a valuation aligned with their expectations for NVIDIA’s long-term demand-driven success. Recent developments also highlight challenges, including delays due to Blackwell chip issues affecting major clients like Microsoft, Amazon, Google, and Meta, as well as the introduction of AI regulations by the Biden administration. Analysts remain divided, with KeyBanc downgrading its outlook, Citi maintaining a Buy rating, and Fairlead Strategies predicting a bearish short-term trend if support at $134 breaks.

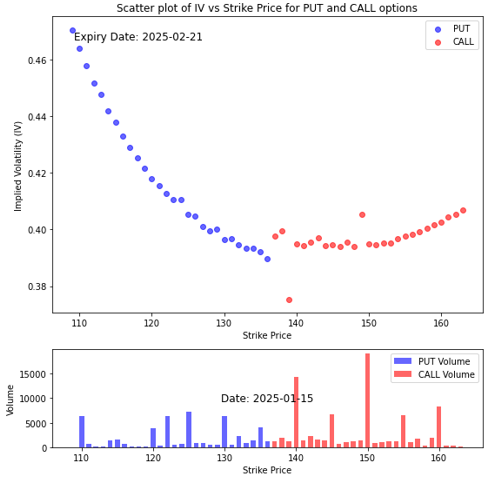

Option Smile Chart for NVDA

- The implied volatility of the call option is higher than the put option at the strikes near the price (ATM).

- Volume wise, the call strike at 140 and 150 demonstrates that many investors are expecting the stock price to cross 140 and reaches 150.

- The sentiment index for the day is 1.864 where the value of less than 1 is bearish and more than 1 is bullish.

CONCLUSION

- Stock market surges as investors digest the latest inflation data and corporate earnings, shifting focus to upcoming economic indicators and central bank policies.

- With the Fed’s rate trajectory in the spotlight, any signals on the timing and scale of potential rate cuts will be closely watched.

- In the near term, U.S. markets are set to sustain their upward momentum, driven by easing inflation, strong corporate performance, and optimism about monetary policy.

- However, geopolitical tensions in the Middle East and ongoing trade uncertainties remain critical factors that could influence market dynamics.

- Despite global challenges, the U.S. economy shows resilience, with the latest data supporting the possibility of a soft landing.

- Meanwhile, China’s monetary policy and ambitious growth target of around 5% for 2025 will significantly impact global trends and investor sentiment.

Please note that all information in this newsletter is for illustration and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any investment products or services.

About the Author

Rein Chua is the co-founder and Head of Training at AlgoMerchant. He has over 15 years of experience in cross-asset trading, portfolio management, and entrepreneurship. Major media outlets like Business Times, Yahoo News, and TechInAsia have featured him. Rein has spoken at financial institutions such as SGX, IDX, and ShareInvestor, sharing insights on the future of investing influenced by Artificial Intelligence and finance. He also founded the InvestPro Channel to educate traders and investors.

Rein Chua

Quant Trader, Investor, Financial Analyst, Vlogger, & Writer.