U.S. equities closed higher on Friday, supported by strong performances in the Telecoms, Utilities, and Oil & Gas sectors. The positive momentum across these industries helped lift the broader market, reflecting investor optimism.

Source: CNBC

At the close of trading on the New York Stock Exchange, the Dow Jones Industrial Average rose 0.52%, while the S&P 500 Index climbed 0.55%, and the NASDAQ Composite Index gained 0.70%.

Market breadth was positive, with advancing stocks outnumbering decliners on the NYSE, 1,584 stocks rose against 1,168 decliners, while 91 remained unchanged. Similarly, on the NASDAQ, 1,794 stocks advanced, 1,493 declined, and 140 ended flat.

The CBOE Volatility Index, which measures market expectations of near-term volatility, dropped 6.03% to 23.37. This decline signalled reduced investor uncertainty and improved market confidence.

Gold Slips While Oil Prices Climb Amid Market Fluctuations

In the commodities market, Gold Futures for April delivery dipped 0.25%, or 7.30 to settle at 2,919.30 per troy ounce. Meanwhile, Crude oil prices rose, with the April delivery contract climbing 1.07% or 0.71to 67.07 per barrel. The May Brent oil contract also gained 1.30% or 0.90 reaching 70.36 per barrel.

Source: Forbes

Euro Gains as U.S. Dollar Weakens Slightly in Forex Market

In currency trading, the EUR/USD pair increased 0.50% to 1.08, while the USD/JPY pair edged down 0.03% to 147.99. The U.S. Dollar Index Futures declined 0.21% to 103.81, indicating a slight weakening of the dollar against a basket of major currencies.

Source: Yahoo Finance

Tariffs Squeeze Homebuilders as Costs Rise, Fed Stays Cautious

The U.S. housing market is under pressure as tariffs drive up construction costs, adding as much as $10,000 to the price of building a typical home. With rising costs for materials like lumber and appliances—particularly due to tariffs on imports from Canada and Mexico—homebuilders are facing tighter margins, worsening affordability issues. In January, new home sales dropped 10.5% compared to December, highlighting the strain on the market amid high home prices and mortgage rates.

Beyond housing, tariffs are also influencing Federal Reserve policy. Fed Chair Jerome Powell acknowledged that while the economy remains strong, ongoing trade uncertainty is preventing the Fed from making immediate interest rate adjustments. Inflation is showing signs of slowing, but prolonged or expanded tariffs could reignite price pressures, affecting consumer spending and construction costs. The Fed is taking a cautious approach, waiting for more economic clarity before adjusting rates.

With builders hesitant due to rising costs and economic uncertainty, the housing market faces additional challenges. New housing starts declined 10% in January, reflecting builder caution at a time when increased housing supply is critical for affordability. While mortgage rates have slightly eased, persistent construction cost increases could tighten housing supply further, driving up rents and making homeownership even less accessible. If tariffs continue to escalate, both homebuilders and consumers may struggle with long-term affordability and economic stability.

February Jobs Report Shows Steady Growth Amid Uncertainty

The U.S. labor market remained strong in February, adding a seasonally adjusted 151,000 jobs—slightly below the expected 170,000 but an improvement over January’s 125,000. Despite steady job growth, the unemployment rate edged up to 4.1% from 4.0%. Healthcare and transportation led hiring, with healthcare adding 52,000 jobs and transportation and warehousing contributing 18,000. However, retail and food services saw declines, shedding 6,000 and 27,500 jobs, respectively, likely reflecting immigration-related labor shortages. The government sector also lost 10,000 jobs, primarily due to federal employment cuts, potentially linked to President Trump’s hiring freeze.

Source: Bloomberg

Looking ahead, economists remain cautious as tariffs and immigration policies introduce uncertainty. However, the February report suggests a resilient labor market, keeping the Federal Reserve on track to maintain interest rates in the near term.

Investment Opportunity & Risk

Apple (NASDAQ: AAPL)

Apple has announced a delay in the rollout of AI-powered enhancements to its Siri voice assistant, which were initially expected to improve personalization and cross-app functionality. The company cited the need for more time to refine these features and now anticipates their launch within the coming year. This delay follows recent efforts to make Siri more conversational, including integration with OpenAI’s ChatGPT. The company has been focusing on AI to boost its product appeal amid slumping iPhone sales, which were down nearly 1% in the key December quarter. These AI improvements, part of Apple’s broader “Apple Intelligence” initiative, were expected to include new voice assistant capabilities, text-generation, and photo-editing tools.

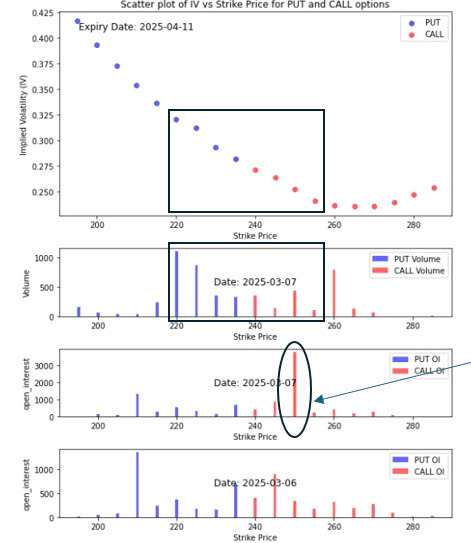

Option Smile Chart for AAPL

- Our in-house system assigns a bullish index score of 0.683 on a scale where 0 represents completely bearish and 1 represents completely bullish.

- Near the stock price (ATM), the average implied volatility of the call option is less than that of the put option. That’s an indication that the fear of a stock price fall is greater than the expectation of a price rise.

- Near the stock price (ATM), the volume of the call option is considerably less than that of the put option. That shows that traders on the exchange are betting more on the stock price to fall than to rise. However it is important to note that there was a massive purchase of the call option at the price level 250 which didn’t go through of the exchange (dark pool). That changes the overall sentiment to the bullish side.

- We can observe that there is a strong resistance level at the strike price 250 and this also appears to be a target level.

JD.com (NASDAQ: JD)

On Friday, Bernstein analysts at SocGen Group raised their price target for JD.com, Inc. (NASDAQ:JD) to 54.00 from 46.00, maintaining an Outperform rating, following the company’s strong fourth-quarter earnings, which exceeded both Bernstein’s and consensus estimates. JD.com reported a 13.4% year-over-year revenue increase to RMB 347 billion, driven by robust performance in electronics, appliances, and general merchandise, with Bernstein projecting double-digit growth into the first half of 2025. Analyst Robin Zhu highlighted JD.com’s accelerated user growth and strong cash flow, noting its undervaluation at a P/E ratio of 11.8x and a total return of 88% over the past year.

Despite concerns about cyclical demand, Zhu expressed confidence in JD.com’s ability to sustain growth, supported by strategic initiatives and a solid financial health score of 3.26. The updated outlook reflects optimism about JD.com’s potential for continued success, with the company well-positioned for a soft landing amid anticipated market challenges.

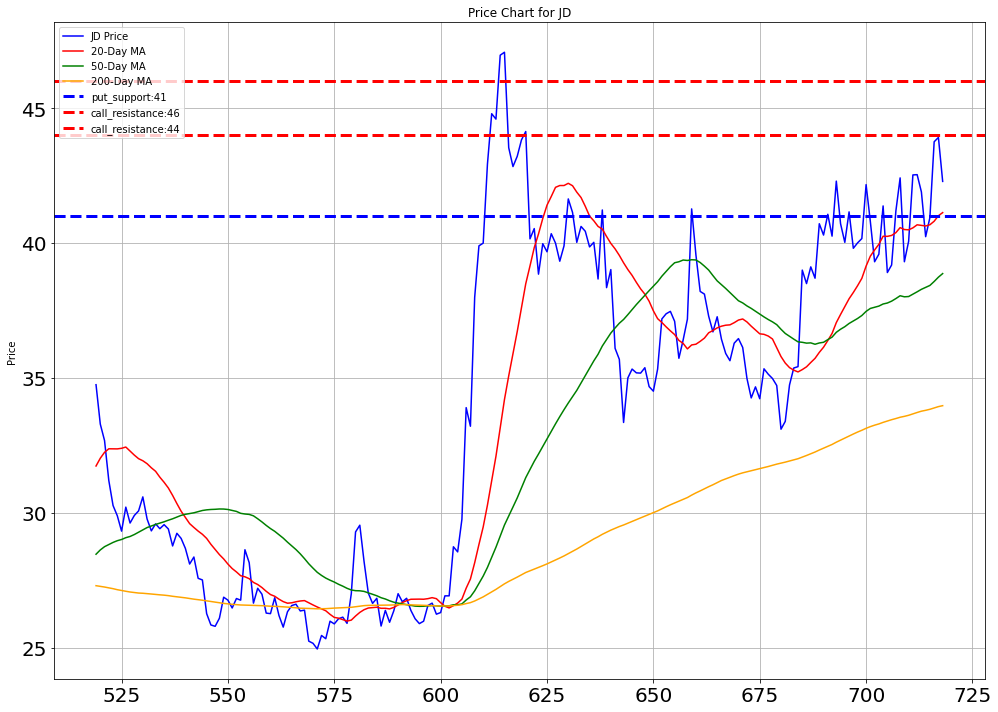

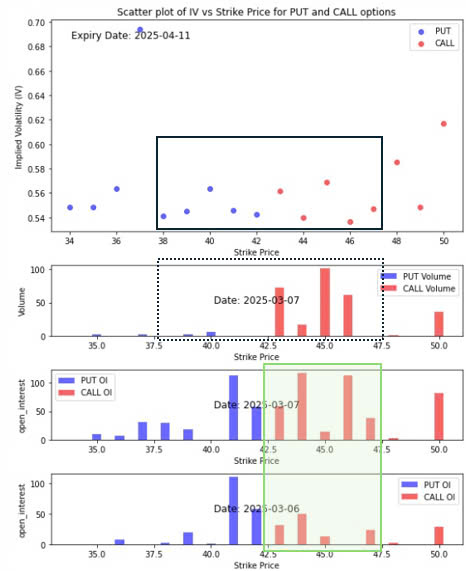

Option Smile Chart for JD

- Our in-house system assigns a bullish index score of 0.91 on a scale where 0 represents completely bearish and 1 represents completely bullish.

- Near the stock price (ATM), the average implied volatility of the call option is roughly equal with that of the put option. That’s an indication that the fear of a stock price fall is roughly equal with the expectation of a price rise.

- Near the stock price (ATM), the average volume of the call option far exceeds that of the put option. That shows that traders on the exchange are betting much more on the stock price to rise, apparently aiming to climb to 45 and beyond.

- The open interest also appears to agree with that with the considerable increase in the open interest in the region of 43 to 47.

- It can be observed that there is a strong put induced support level at 41 and put induced call resistance at 44 and 46.

CONCLUSION

- Telecoms, Utilities, and Oil & Gas sectors led the rally, boosting major indices like the Dow Jones, S&P 500, and NASDAQ.

- Advancing stocks outnumbered decliners, and volatility eased, signaling improved sentiment.

- Gold dipped slightly, while crude oil prices rose.

- The U.S. dollar weakened against major currencies.

- Tariffs are driving up construction costs, worsening affordability issues and reducing new home sales.

- No immediate interest rate changes amid trade policy uncertainties.

- 151,000 jobs were added, but unemployment ticked up to 4.1%.

- Healthcare and transportation saw job growth, while retail and food services declined, possibly due to immigration policies.

- The Fed remains watchful of inflation and trade impacts, maintaining a steady approach to interest rates.

Please note that all information in this newsletter is for illustration and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any investment products or services.

About the Author

Rein Chua is the co-founder and Head of Training at AlgoMerchant. He has over 15 years of experience in cross-asset trading, portfolio management, and entrepreneurship. Major media outlets like Business Times, Yahoo News, and TechInAsia have featured him. Rein has spoken at financial institutions such as SGX, IDX, and ShareInvestor, sharing insights on the future of investing influenced by Artificial Intelligence and finance. He also founded the InvestPro Channel to educate traders and investors.

Rein Chua

Quant Trader, Investor, Financial Analyst, Vlogger, & Writer.