The US stock market ended the week on a downward note Friday, as investors reacted to a combination of weaker-than-expected jobs data, rising inflation expectations, renewed trade tensions sparked by President Donald Trump’s announcement of impending tariff measures, and growing concerns about the impact of artificial intelligence (AI) on the tech labor market. The Dow Jones Industrial Average dropped 443 points, or 1%, while the S&P 500 declined 0.9%, and the Nasdaq Composite fell 1.4%.

Source: AP News

Trump’s Tariff Threat Raises Trade War Fears, EU Responds

President Trump warned Friday of plans to impose reciprocal tariffs on goods imported into the U.S., matching the rates that trading partners levy on American exports. Although specific countries were not named, the announcement reignited fears of a potential global trade war, further dampening investor sentiment. In response, the European Union has reportedly offered concessions, including a proposal to reduce its 10% import tax on cars to align more closely with the U.S.’s 2.5% levy, according to Bernd Lange, head of the European Parliament’s trade committee.

Source: The New Indian Express

Consumer Sentiment Drops as Inflation Fears Rise Amid Tariff Concerns

A key gauge of consumer sentiment from the University of Michigan unexpectedly declined in February, but one-year inflation expectations surged to 4.3%, up from 3.3% in the previous month—marking the highest level since 2023. Analysts at Capital Economics suggested that consumers are growing increasingly concerned that Trump’s tariff policies could reignite inflationary pressures and hinder broader economic growth.

Source: Financial Times

The inflation data coincided with the release of January’s nonfarm payrolls report, which showed job growth of 143,000, falling short of the forecasted 169,000 and down significantly from December’s upwardly revised figure of 307,000. Additionally, average hourly earnings rose by 0.5% in January, exceeding expectations of a 0.3% increase and adding to worries about persistent inflation.

Tech Unemployment Surges as AI Reshapes the IT Job Market

The unemployment rate in the information technology (IT) sector rose sharply from 3.9% in December to 5.7% in January, well above the overall jobless rate of 4%. This increase reflects the growing impact of automation and AI on the tech labor market. According to a report from consulting firm Janco Associates, the number of unemployed IT workers rose from 98,000 in December to 152,000 in January.

Victor Janulaitis, CEO of Janco Associates, noted that the emergence of generative AI has led to significant investments in AI infrastructure by tech giants, but these investments have not translated into new IT jobs. Instead, routine and mundane IT roles, such as reporting and clerical administration, are being eliminated as companies look to AI for cost savings and efficiency gains.

Indeed, job postings for software developers declined by 8.5% in January compared to a year earlier, reflecting a broader trend of reduced demand for white-collar knowledge workers. Cory Stahle, an economist at Indeed, highlighted a growing bifurcation in the job market, with in-person skilled labor jobs seeing stronger demand compared to tech roles.

Fed Signals No Rate Cuts as Wage Growth and Inflation Persist

The combination of rising wage growth, heightened inflation expectations, and a cooling labor market has reinforced the view that the Federal Reserve is unlikely to cut interest rates in the near term. Jefferies noted in a Friday report that recent comments from Fed officials indicate they are in “no hurry” to reduce rates further, following a cumulative 100 basis points of cuts since September. The latest economic data, they argued, provides no compelling reason for the Fed to accelerate its timeline.

Source: City Journal

Investment Opportunity & Risk

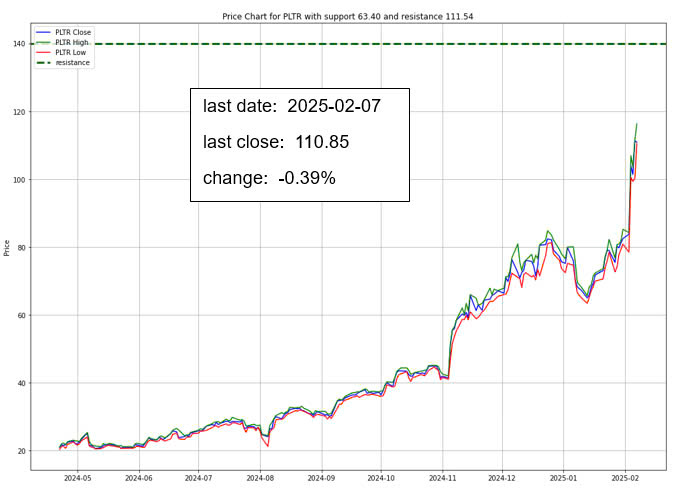

Palantir Technologies Inc. (NYSE: PLTR)

Palantir Technologies has seen a remarkable 40% surge in its stock price after reporting strong earnings, with its CEO asserting the company’s central role in the AI revolution. Despite its impressive growth, Palantir’s valuation remains high, with a price-to-sales ratio far above its peers like Nvidia and Microsoft. While the company anticipates significant revenue growth, some analysts caution that the stock’s valuation requires continued rapid expansion.

Meanwhile, MicroStrategy has introduced a Bitcoin-secured preferred stock offering, yielding 9.2%, making it an attractive option for those comfortable with its Bitcoin-centric strategy despite the company’s lack of traditional earnings and its junk-grade credit rating. Investors in this preferred stock also have the potential to convert it into common shares, adding an element of upside. Additionally, in the sports sector, MSG Sports and Atlanta Braves Holdings offer investment opportunities, with the latter expected to benefit from strong management and market demand, particularly in light of potential ownership changes.

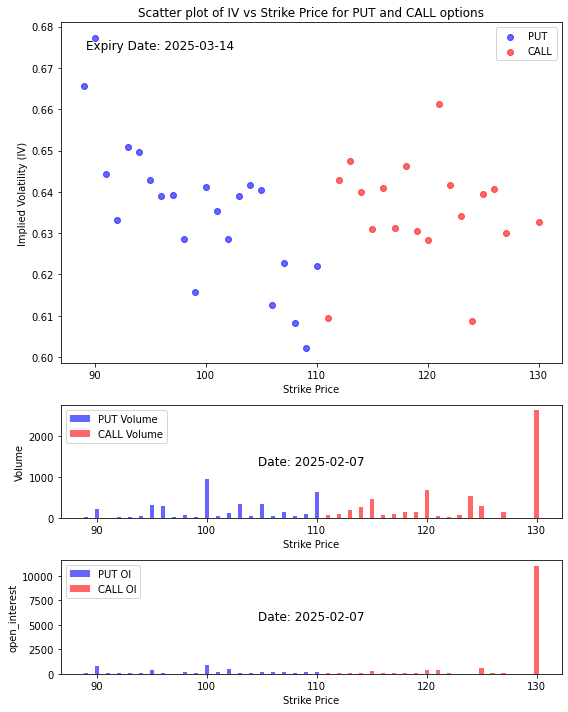

Option Smile Chart for PLTR

- Our in-house system assigns a bullish index score of 0.615 on a scale where 0 represents completely bearish and 1 represents completely bullish.

- The implied volatility throughout the span of strike prices close to the current stock price (ATM) indicates that the traders are more on the bullish side.

- The volume chart, on the other hand, shows that traders are betting slightly more on the protection provided by the put options than to profit from the call options bets.

- There is no apparent support level and there is a far off resistance level at 130.

CONCLUSION

- Trade uncertainties, inflation concerns, and the evolving impact of AI on the labor market are weighing on investor sentiment.

- Market participants are expected to remain cautious in the coming weeks.

- Escalating trade tensions may impact global economic growth.

- The tech sector continues to transform due to AI advancements.

- Inflation trends and the Federal Reserve’s policy stance will remain under close watch.

Please note that all information in this newsletter is for illustration and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any investment products or services.

About the Author

Rein Chua is the co-founder and Head of Training at AlgoMerchant. He has over 15 years of experience in cross-asset trading, portfolio management, and entrepreneurship. Major media outlets like Business Times, Yahoo News, and TechInAsia have featured him. Rein has spoken at financial institutions such as SGX, IDX, and ShareInvestor, sharing insights on the future of investing influenced by Artificial Intelligence and finance. He also founded the InvestPro Channel to educate traders and investors.

Rein Chua

Quant Trader, Investor, Financial Analyst, Vlogger, & Writer.