The stock market recently faced challenges, ending the week with its worst losses in over a month, marking its worst week as rising Treasury yields and a strengthening U.S. dollar exerted downward pressure on stocks. Major indices dropped on Wednesday:

• S&P 500 (SPX): Fell by 0.92% to 5,797.42.

• Dow Jones Industrial Average (DJI): Decreased by 0.96% to 42,514.95.

• Nasdaq Composite (COMP): Declined by 1.60% to 18,276.65.

Mega-cap stocks, which had previously supported the market, faced their worst week, with tech leaders Nvidia (NVDA) and Apple (AAPL) each dropping over 2% amid a broader tech sell-off. This sector weakness, driven by defensive trading in response to rising yields, significantly contributed to the market’s downturn.

The market adopted a “risk-off” sentiment, favoring safer sectors, with only real estate and utilities gaining ground. In contrast, growth sectors like consumer discretionary, technology, and communication services underperformed under the pressure of rising yields.

Rising yields, a stronger dollar, and Federal Reserve uncertainty drive market concerns

Rising Treasury yields are now a central focus, with the 10-year yield reaching 4.24%, its highest in three months, contributing to the market’s worst week.

This increase is expected to challenge corporate earnings by raising borrowing costs and pressuring valuations. Meanwhile, the stronger U.S. dollar reflects confidence in the economy but also poses challenges for American companies with significant overseas operations, as unfavorable exchange rates may hurt profits.

Despite the Federal Reserve’s 50-basis-point rate cut in September, yields continue to rise due to better-than-expected economic data, creating uncertainty among investors concerned about the impact of future rate adjustments on growth and inflation.

Economic Indicator to Watch

- Purchasing Managers’ Index (PMI): Preliminary PMI data, set to release soon, will provide insights into manufacturing and services. Analysts anticipate contraction in U.S. manufacturing, indicating potential challenges ahead, while the services sector is expected to remain strong.

- Housing Market: Existing home sales in September were weaker than expected, marking a 14-year low, though median prices continue to rise due to limited inventory. New home sales data will be crucial to gauge the sector’s trajectory.

- Job Market: Weekly initial jobless claims data remains a focus, especially with recent fluctuations influenced by labour strikes and natural disasters.

GLOBAL CONCERNS

Geopolitical Tensions Increase, Boosting Gold Demand

Rising geopolitical risks have affected market sentiment, especially regarding safe-haven investments. Conflicts in the Middle East and uncertainties around the U.S. presidential election have driven gold prices to historic highs, indicating increased demand for stable assets during turbulent times.

Higher Pressure from U.S. dollar

The stronger U.S. dollar, influenced by a moderate Federal Reserve stance and expectations for economic stability, has put pressure on foreign currencies like the yen. This shift in currency dynamics can affect multinational corporations’ earnings, especially those with significant international exposure.

Source: U.S. News & World Report

However, the appreciation of the U.S. dollar is also a double-edged sword—while it reflects confidence in the U.S. economy, it can negatively impact U.S. companies with significant overseas operations due to unfavourable exchange rates.

WATCHOUT

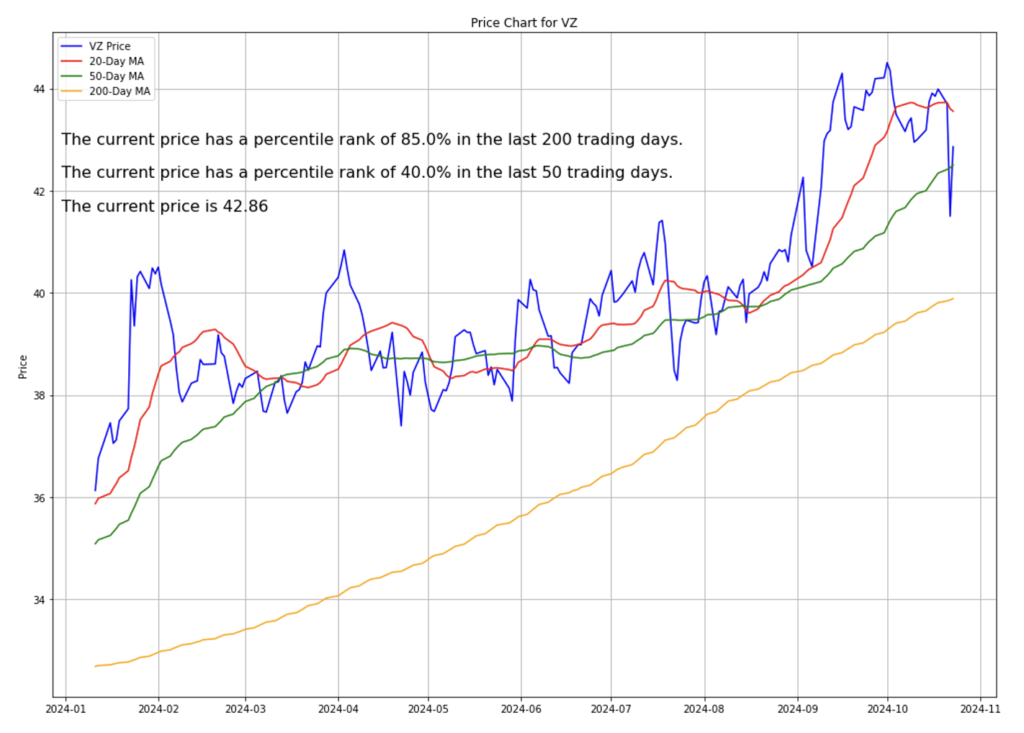

Verizon's Q3 Earnings Victory Dimmed by Declining Stock and Equipment Sales

Verizon exceeded earnings expectations in the third quarter but experienced a decline in its stock due to weaker-than-expected wireless equipment sales. This was largely due to slower customer upgrades, particularly concerning the new iPhone 16. Nonetheless, Verizon is progressing with strategic investments, including network expansions and acquisitions in the telecommunications space.

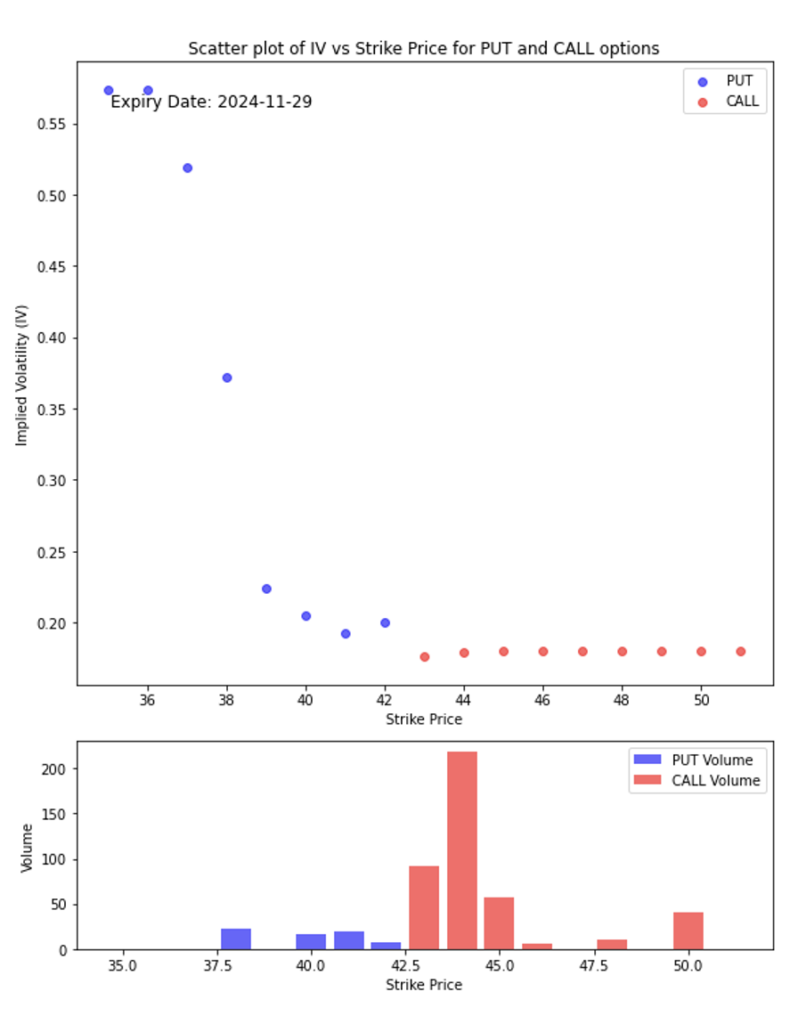

- Implied volatility for PUT options shows a clear downward trend as the strike price increases. It starts relatively high for lower strike prices (around 35-38) and decreases as the strike prices approach the 42-45 range.

- CALL options exhibit a much lower and more consistent implied volatility across the strike prices, indicating a relatively stable expectation for future volatility within the current market conditions.

- The high implied volatility at lower strike prices for PUTs suggests greater concern about downside risk, implying traders are buying protection or hedging against a potential price decline below 38.

- The highest volume for CALL options is concentrated at the 45 strike price, indicating a significant interest at this level, possibly reflecting market expectations of Verizon’s share price hovering around or above this level by the expiration date.

- For PUT options, there is a moderate but spread-out volume across lower strike prices, with notable activity around the 42.5 and 40 strike levels, indicating caution around potential price drops in this range.

- The CALL volume spike at 45 suggests traders may view this as a key resistance level or a potential target for the stock, while PUT volumes at lower strike prices reflect hedging or protection strategies against price declines.

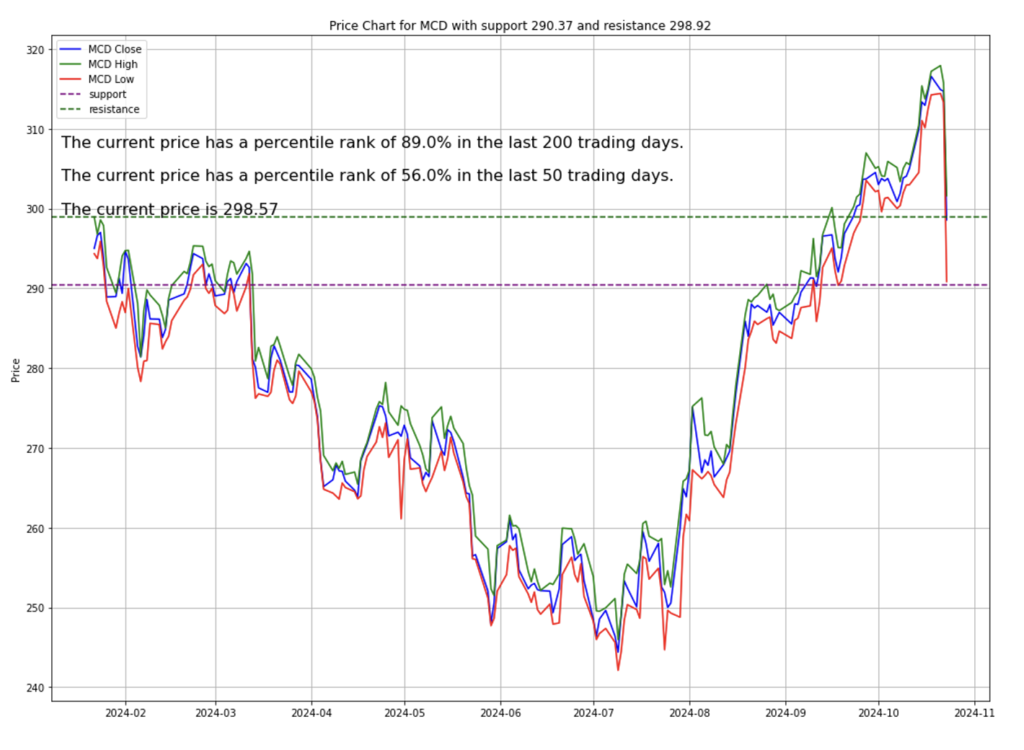

McDonald's hit by E. Coli Outbreak, Impacting Sales

McDonald’s has recently been impacted by a serious E. coli outbreak linked to its Quarter Pounder hamburgers. The incident has led to temporary product removals in multiple states, affecting sales and consumer confidence. This comes at a time when McDonald’s is already facing challenges in maintaining domestic growth. The company is reinforcing its commitment to food safety and aiming to attract inflation-wary customers with value-oriented deals.

- There is a notable concentration of PUT volume around the 280 strike price, highlighting significant interest in hedging at this level.

- CALL volume shows a peak around the 300 strike price, suggesting that traders see this as a key level for potential upside or a target price by expiration.

- The volume profile indicates a more cautious outlook, with higher PUT activity below the 300 strike, reflecting protective positioning. Meanwhile, the interest in CALL options indicates some expectation of upward movement, but with a clear focus on the 300 level as a possible cap.

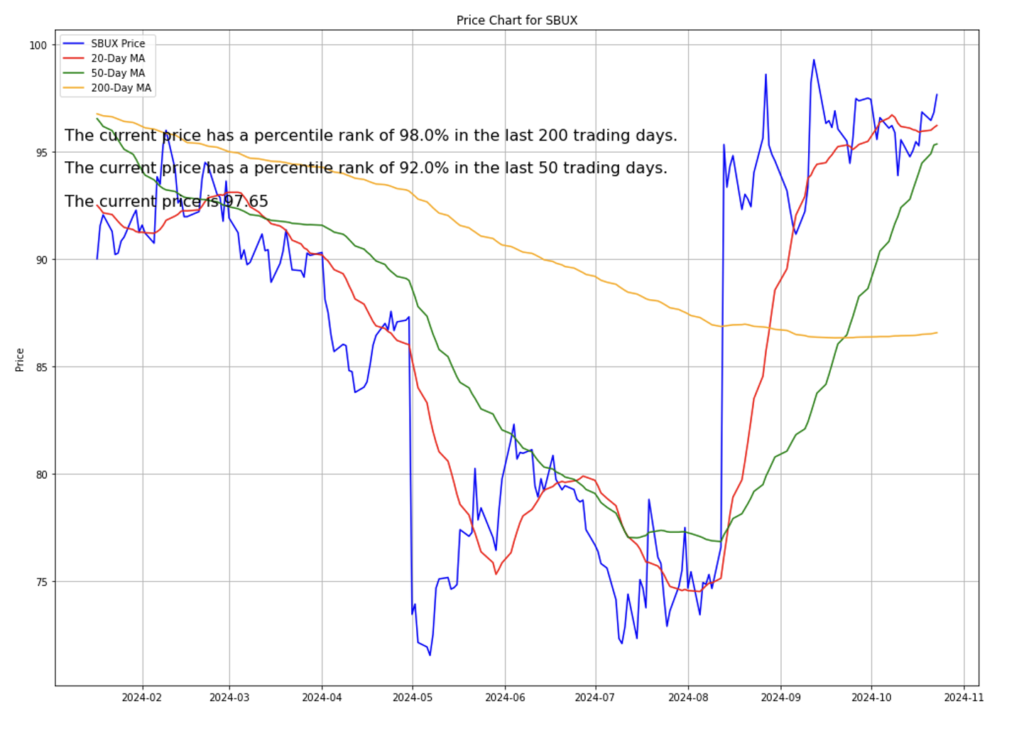

Starbucks' Sales Challenges Prompt Strategic Shift Under New CEO

Starbucks is currently facing challenges, with a notable decline in sales across its key markets. The coffee giant missed fourth-quarter earnings expectations and has suspended financial guidance for the upcoming fiscal year. The new CEO, Brian Niccol, has highlighted the need for a strategic overhaul, focusing on pricing, marketing, and customer experience to regain its market position.

- Implied volatility for CALL options is lower than for PUTs across most strike prices. However, there’s a slight upward trend starting from the 100 strike price and beyond, indicating a growing uncertainty as the strike price rises above this level.

- The higher implied volatility for lower strike PUTs suggests that investors are hedging against potential price drops, with more concern focused on downside risks.

- There is a significant spike in PUT volume around the 85 strike price, indicating heightened activity and potential concern about the stock’s price falling to or below this level.

- CALL options have comparatively low volume, with only a few strikes showing minor activity, suggesting limited bullish sentiment or less interest in speculating on a substantial upward movement.

- The disparity between PUT and CALL volumes implies a more cautious or bearish outlook, with market participants possibly using PUTs to protect against a price decline.

Investment Opportunity & Risk

Despite the market facing its worst week, there are some stocks that may offer potential opportunities for investors willing to navigate the current volatility.

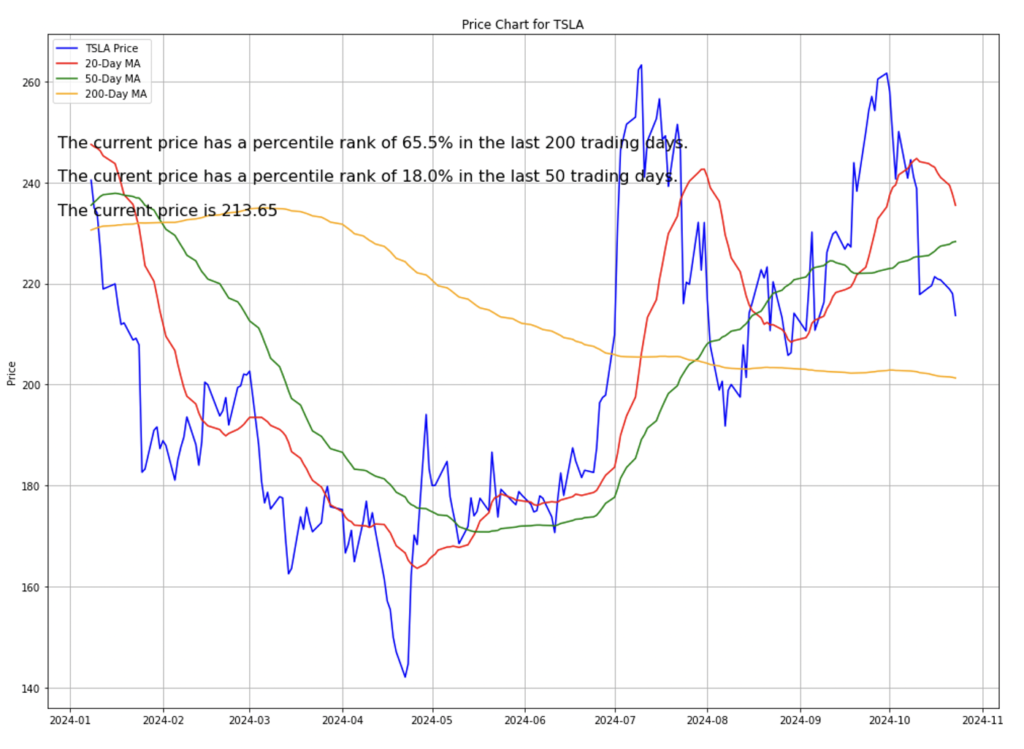

Tesla (TSLA)

Tesla’s third-quarter earnings surpassed expectations, driven by increased sales of regulatory credits and strong performance in its energy division. The company has also seen a boost in global deliveries, contributing to an 8% rise in revenue. Looking ahead, Tesla’s plans include the launch of affordable versions of existing models, focusing on technological advancements in autonomous driving.

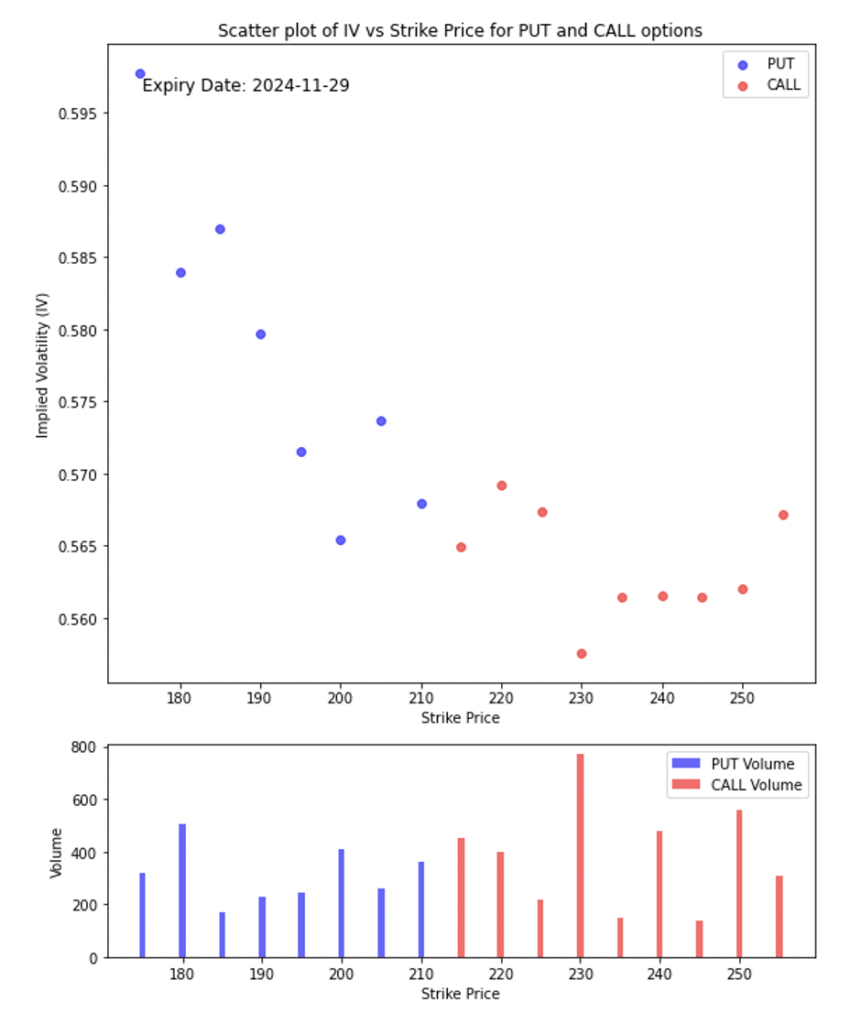

- The implied volatility for lower strike prices is higher, suggesting that the market anticipates greater volatility (risk) for options that are deep in the money for PUTs and out of the money for CALLs.

- This pattern indicates a slight IV skew, where investors are potentially more concerned about downside risks (protecting against price drops) than upside risks.

- Higher trading volume for CALL options is concentrated around the 230 strike price, indicating a focus on that price level, possibly due to market expectations of a price increase or key resistance level.

- PUT options have a relatively steady distribution of volume, with notable interest across a range of strike prices, particularly around lower strike prices, reflecting hedging activity or bearish sentiment at specific levels.

CONCLUSION

- The U.S. economy exhibits a mix of strength and caution as it adapts to changing domestic and global circumstances, having faced its worst week recently.

- With key sectors like housing showing signs of recovery and major companies adjusting strategies to align with current economic realities, the stock market remains in a state of watchful anticipation.

- Investors are keeping a close eye on international factors, particularly as they shape the trajectory of the U.S. dollar, commodities like gold, and the geopolitical landscape, which will undoubtedly play a critical role in future market movements.

Please note that all information in this newsletter is for illustration and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any investment products or services.

About the Author

Rein Chua is the co-founder and Head of Training at AlgoMerchant. He has over 15 years of experience in cross-asset trading, portfolio management, and entrepreneurship. Major media outlets like Business Times, Yahoo News, and TechInAsia have featured him. Rein has spoken at financial institutions such as SGX, IDX, and ShareInvestor, sharing insights on the future of investing influenced by Artificial Intelligence and finance. He also founded the InvestPro Channel to educate traders and investors.

Rein Chua

Quant Trader, Investor, Financial Analyst, Vlogger, & Writer.