Every Friday, Alex Mashinsky, the CEO of Celsius Network LLC, would sit in front of a video camera, live-streaming a sales pitch for his bank-like crypto investment platform:

“The beauty of what we as Celsius accomplished is that we delivered higher returns. We paid it to the people who would never be able to do it themselves. We made them rich because we beat the index year in and year out.”

Sounds fantastic, doesn’t it?

Send money to us, and we’ll make you rich by paying you interest of as much as 18% a year, and all you have to do is “unbank yourself!”

Now, this is fishy!

And as expected, the Celsius token dropped 70% in a matter of minutes, with investors frantically trying to withdraw their frozen assets after it paused all withdrawals, swaps, and transfers, citing “extreme market conditions.”

Being one of the leading Crypto lenders, let’s see what exactly happened with them, how it is squeezing the entire crypto industry, and what we can learn from it…

But before getting into the Celsius fiasco, let's take a quick glimpse of what's going on in the Cryptosphere over the last two months:

In May 2022, we witnessed the stunning fall of cryptocurrency’s crown jewel, Terra Luna, which virtually lost 100% of its value in less than 5 days. And since then, there has been no turning back for the other cryptos as well.

Bitcoin subsequently dropped below $20,000, losing over one-third of its all-time high of almost $71,000!

Amid the selloff, Binance halted Bitcoin withdrawals owing to a “stuck transaction causing a backlog.”

Ethereum, the world’s second most valuable cryptocurrency by market cap, saw its value crater by more than 80%, dropping below the $900 mark.

And now, there’s Celsius, which slumped more than 70% in less than an hour after pausing its withdrawals and then virtually lost 97% of its value at one point.

What exactly happened with Celsius?

Before getting our hands dirty, let’s understand what Celsius is in simple terms and what it does to make money…

Celsius or $CEL is a DeFi lending platform that allows trading in cryptocurrencies, delivers high-yield deposits on users’ stable coins and cryptos, and also has a crypto-backed lending feature.

In essence, it positioned itself much more like a bank for crypto assets.

The way it works is simple — you deposit your crypto in Celsius, and you’re promised a “guaranteed” yearly return, which may vary but is publicly advertised as “up to 18.63% APY.“

Also, users can borrow funds and use their crypto as collateral. For instance, if you need USDT or USDC but don’t want to sell your BTC, you can use BTC as collateral and receive a loan from Celsius at a specific interest rate.

Celsius further deposits users’ crypto assets on higher interest protocols and earns the difference as profit. Simple!

Then what went wrong?

As the adage goes, “anything that goes up must come down,” and this was especially the case with Celsius. Currently, Celsius Network appears to be insolvent and is unable to pay the debts it owes.

Despite achieving so much so quickly, Celsius could not live up to its expectations. But, you might wonder, how?

So, here’s the deal: Promising a sky-high return on inherently volatile cryptos was more likely to backfire as the model was not sustainable.

And that’s what actually happened.

Celsius fell prey to its anti-bank ‘marketing techniques’:

Withdraw your crypto at any time – (Which Celsius is still not allowing)

Keep your cryptos private & secure – (They hold the main keys)

Next-level transparency – (Fail to explain why they halted withdrawals)

Why trust Celsius – (The trust is now eroded).

And what wasn’t advertised was: How it made risky bets that eventually brought about its collapse…

Let’s unpack.

#1. The use of On-chain leverage:

Celsius used unregulated money markets like @MakerDAO to access leverage to offer users low-rate borrowing. Celsius would accept user deposits in assets like Bitcoin or Ether and use those funds to deposit them with @MakerDAO to borrow its stablecoin, $DAI.

And as @MakerDAO is a platform for collateralized lending, Celsius would need to provide $1.50 in volatile collateral (such as $BTC) to borrow only $1 of stablecoin, $DAI.

And, having a 9-figure loan of @MakerDAO is a bit troubling, especially when you have staked 50% more value of $BTC and $ETH as collateral.

With $BTC and $ETH down more than 75% from their all-time highs, Celsius now has far less collateral to hold onto its loan to repay @MakerDAO. |

But this is just one part of the story.

#2. The $stETH problem

Celsius offered some of the highest interest rates in the market for Ethereum ($ETH). And, Celsius was not backing up these loans with their own Ethereum. Instead, they relied on a derivative of Ethereum, known as Staked Ethereum/$stEth.

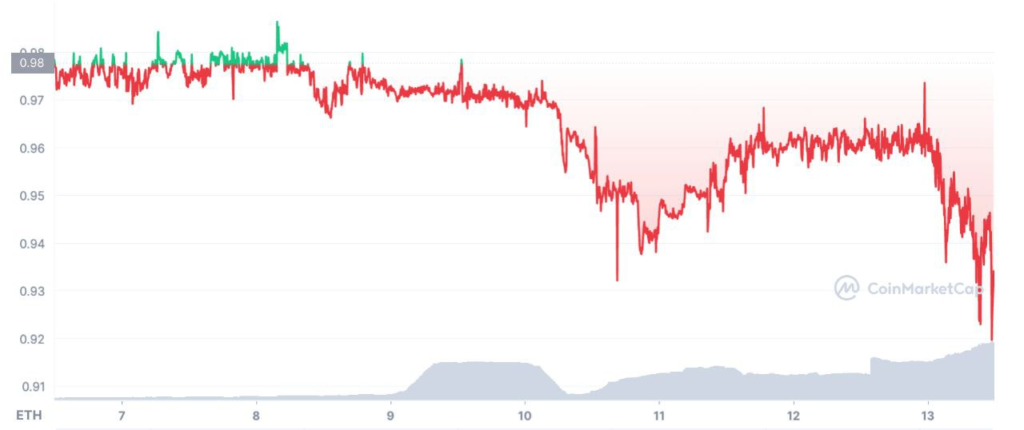

This derivative, called $stEth, represents Ethereum coins and is supposed to be worth the same as $ETH, trading in the ratio of 1:1. And Celsius was using $stEth to repay creditors whenever withdrawals were requested.

But now, $stETH is no longer trading 1:1 with $ETH, which is where the panic gripped up.

When they bought something for $1, that’s now worth $0.92. Worse yet, there isn’t enough liquidity for Celsius to swap out of $stETH for $ETH, even at a loss! |

$ETH-$stETH

Celsius has 445k ($565m!!) of $stETH, and there’s only 143k of $ETH liquidity in the $stETH-$ETH curve pool.

Since Celsius did not have sufficient funds, they effectively had to stop withdrawals since not all withdrawal requests could be honoured, resulting in the demise of the entire Celsius platform!

What does this say about the crypto-sphere?

There is no doubt that this is a great tragedy for 1.7 million ordinary individual investors that Celsius has prided itself in gaining their trust. These users have lost all access to their money, and it is not known which of them, if any, will get them back.

But Celsius’ story is only part of the overall picture. Celsius’ collapse occurred not only because of its business model but because it invested its assets which are prone to vanish in no time.

Most of such other DeFi projects are operated by artificially inflating the demand for their currencies, making them appear more successful than they actually are.

And who knows, this may just be the beginning of the end of other similar projects?

Final Words

- In contrast to stock markets, the crypto space lacks institutions such as central banks and regulatory authorities that can effectively protect lenders and investors.

-

And because of this, many crypto firms have been able to entice customers with the promises of guaranteed, sky-high returns, leaving ordinary investors holding the bag while insiders make off with their money.

-

“Nothing can be said to be certain in the world of investing,” Benjamin Franklin once said. Therefore in reality, what Celsius is offering to their clients is considered too good to be true for the following reasons:

Beating the market return is rare – Celsius is offering its investors 18% annualized returns, way above the S&P 500 historical average return of 10%.

Guaranteeing above market return is unrealistic – Our community readers should take note that Celsius ‘guarantees’ the 18% annualized returns. However, there has never been a guarantee by the S&P 500 (market return) for its 10% average historical return!

-

Our community members should always note that any investment company that “guarantees” an unrealistic rate of return higher than the market returns, which is often regarded as the S&P 500 index return, is too-good-to-be-true!

Please note that all the information contained in this newsletter is intended for illustration and educational purposes only. It does not constitute any financial advice/recommendation to buy/sell any investment products or services.