Introduction

If 2021 was the year where inflation escalated in a manner not seen in the past 30 years, the big story for 2022 may be that it is the year inflation decreased as swiftly as it escalated.

In fact, we’ve already covered this in our previous inflation article!

In this newsletter, do we have supporting data to suggest that inflation has peaked, and not only that it is likely to de-escalate?

The short answer is YES!

Source: www.macromarketdaily.com

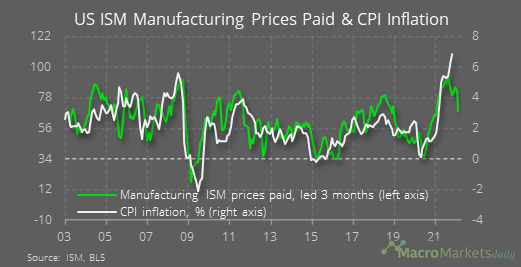

Looking at the chart above, the ISM manufacturing survey indicates that the prices paid by manufacturing companies fell much more in December than expected by economists.

If that data is to go by, it implies that inflation may fall to as low as 3% in the latter part of 2022.

Why is this Data Significant?

If Omicron and future variants do not result in further disruption to supply chains, it is unlikely there will be further upward pressure on inflation.

The implication is that the Fed will not need to increase the pace of tapering, and more importantly perform aggressive rate hikes.

If this were to occur, this may trigger the onset of another bull run in the stock market!

Please note that all the information contained in this content is intended for illustration and educational purposes only. It does not constitute any financial advice/recommendation to buy/sell any investment products or services.