U.S. stocks experienced a mixed performance as sector-specific movements led to contrasting outcomes across the major indices. The Technology, Consumer Goods, and Consumer Services sectors saw gains, which drove shares higher, while losses in the Healthcare, Basic Materials, and Oil & Gas sectors weighed down the market.

Source: Euromoney

At the close, the Dow Jones Industrial Average decreased by 0.21%, the S&P 500 gained 0.10%, and the NASDAQ Composite climbed 0.72%. Despite the mixed results, market volatility remained elevated, with the CBOE Volatility Index (VIX) rising 2.25% to 18.63.

Dow Movers: NVIDIA Surges, Merck Drops

In the Dow Jones Industrial Average, NVIDIA Corporation (NASDAQ: NVDA) led the index, rising 4.17%, gaining 5.42 points to close at 135.35. Walt Disney Company (NYSE: DIS) added 1.40%, up 1.56 points to 112.94, and Goldman Sachs Group Inc (NYSE: GS) increased by 1.32%, up 7.94 points to 611.75. On the downside, Merck & Company Inc (NYSE: MRK) fell 4.10%, losing 3.14 points to 73.49, Amgen Inc (NASDAQ: AMGN) dropped 3.02%, down 8.17 points to 262.28, and 3M Company (NYSE: MMM) declined 1.90%, losing 2.86 points to 147.88.

Source: Nasdaq

S&P 500 Movers: SMCI Jumps 15%, TECH Tumbles

In the S&P 500, Super Micro Computer Inc (NASDAQ: SMCI) saw an impressive rise of 15.66%, closing at 44.98, while Enphase Energy Inc (NASDAQ: ENPH) rose 5.81%, settling at 48.28, and International Paper (NYSE: IP) gained 4.85%, closing at 50.33. Conversely, Bio-Techne Corp (NASDAQ: TECH) fell 7.27%, closing at 47.86, IQVIA Holdings Inc (NYSE: IQV) declined 5.88%, settling at 141.82, and Revvity Inc (NYSE: RVTY) lost 5.88%, closing at 91.02.

Source: Yahoo Finance

NASDAQ Volatility: IXHL Skyrockets, HTCO Plunges

The NASDAQ Composite saw exceptional performance from Incannex Healthcare Ltd ADR (NASDAQ: IXHL), which surged 702.81%, closing at 0.69. Klotho Neuroscience Inc (NASDAQ: KLTO) rose 122.46%, reaching 0.29, and Primega Group Holdings Ltd (NASDAQ: PGHL) gained 95.64%, closing at 0.99. On the downside, High Trend International Group (NASDAQ: HTCO) plummeted 72.69%, closing at 0.39, Accelerate Diagnostics Inc (NASDAQ: AXDX) fell 61.36%, down to 0.03, and Basel Medical Group (NASDAQ: BMGL) dropped 57.45%, closing at 1.90.

Source: Bloomberg

Gold and Oil Slide as Dollar Inches Higher

In commodities, Gold Futures for June delivery fell 1.92%, closing at $3,185.40 per troy ounce. Crude oil prices also saw a decline, with West Texas Intermediate (WTI) crude falling 1.18%, closing at $62.92 per barrel. Brent crude dropped 1.20%, closing at $65.83 per barrel.

Currency markets saw modest movements, with the EUR/USD remaining largely unchanged, up 0.12% to 1.12. The USD/JPY decreased by 0.47%, settling at 146.79, and the US Dollar Index Futures rose slightly by 0.09%, to 100.92.

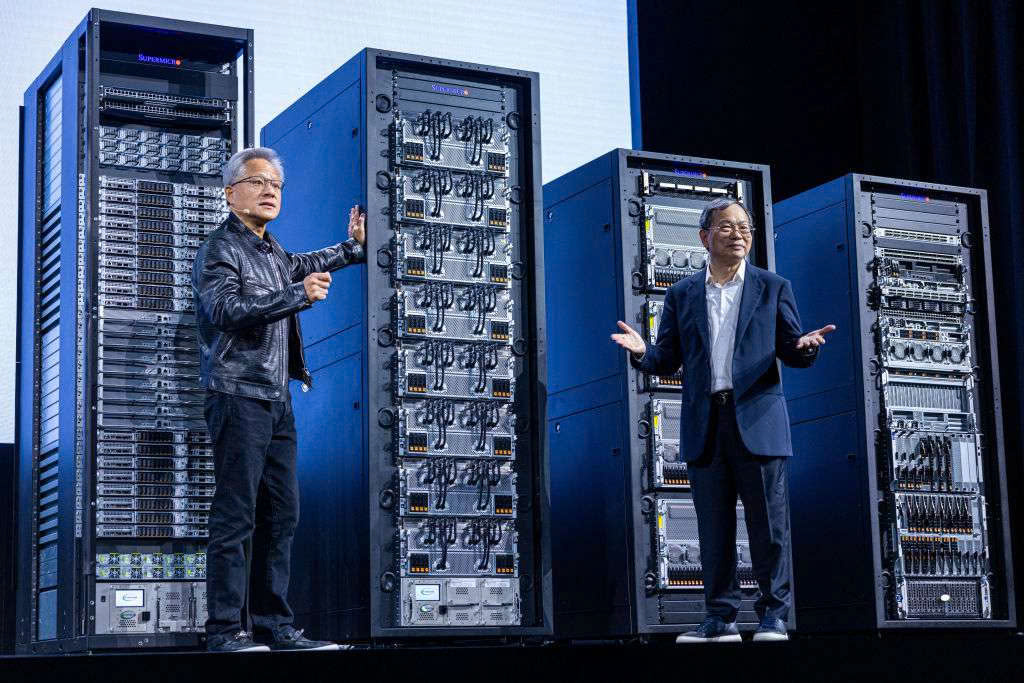

Sovereign AI Gains Momentum with Saudi Arabia’s $100B Bet

The rise of “sovereign AI” is becoming a significant trend, with Saudi Arabia taking center stage in this movement. During a visit by President Trump, discussions were held around the Kingdom’s push to build its own AI infrastructure, backed by AI chips from U.S.-based companies like Nvidia and AMD. This effort is part of Saudi Crown Prince Mohammed bin Salman’s $100 billion “Project Transcendence” to establish the country as a global tech hub. While Saudi Arabia initially uses AI chips from Groq, it plans to build large-scale data centers in the next five years with advanced Nvidia and AMD chips. This shift towards sovereign AI, which aims to retain national control over AI technology and culture, is gaining traction globally, with India also investing in similar projects.

Source: Enterprise News Egypt

Humain, Saudi Arabia’s sovereign AI initiative, is a critical part of this transformation. Bank of America estimates that sovereign AI deals could eventually account for 10% to 15% of annual AI infrastructure revenue, amounting to around $50 billion annually for companies like Nvidia and AMD. The political dynamics surrounding AI exports have also shifted with Trump’s approach, offering more flexibility for countries like Saudi Arabia to secure access to advanced AI technology, despite concerns about Chinese involvement in the projects.

International Issues

U.S.–China Trade Thaw: Trump Slashes Tariffs on Small Shipments

The Trump administration has announced a reduction in tariffs on low-value parcels from China, cutting the “de minimis” tax from 120% to 54%, marking another step toward trade de-escalation between the U.S. and China. This decision follows a 90-day trade truce between the two countries, with the U.S. agreeing to lower tariffs on most Chinese goods to 30% from 145%, while China will reduce its levies on U.S. products to 10% from 125%. The de minimis exemption, which allows shipments valued under $800 to bypass import taxes and customs inspections, was previously suspended in February, causing significant disruption for e-commerce retailers and logistics operators. Despite the tariff cut, experts suggest it may not fully alleviate the challenges faced by Chinese e-commerce firms like Shein and Temu, which still face significant tariff rates.

Source: Financial Times

Trade Truce Boosts GDP Outlook, but Challenges Linger

The recent U.S.-China tariff rollback has lowered the threat of a trade-induced recession, with the effective tariff on Chinese goods reducing from 145% to about 35%. Economists see this as a positive development for the U.S. economy, as it alleviates pressure on businesses dependent on imports and helps avoid a significant economic slowdown. While the reprieve from tariffs is expected to boost GDP growth slightly, with UBS estimating an additional 0.4% growth, challenges remain, including continued high tariff rates and inflationary pressures. Oxford Economics also revised its recession forecast down to 35%, while Nationwide’s economist predicts modest growth for the year.

Source: China Briefing

However, concerns persist over potential cost increases for consumers and businesses, as well as uncertainty about the future direction of trade policies. The rollback has eased some immediate economic risks but has not resolved all challenges, such as reduced business investment due to ongoing tariff uncertainty and other political factors. Despite the lower tariffs, the shift could reduce reshoring of manufacturing jobs and cut tax revenue, signaling that both sides have experienced significant economic pain.

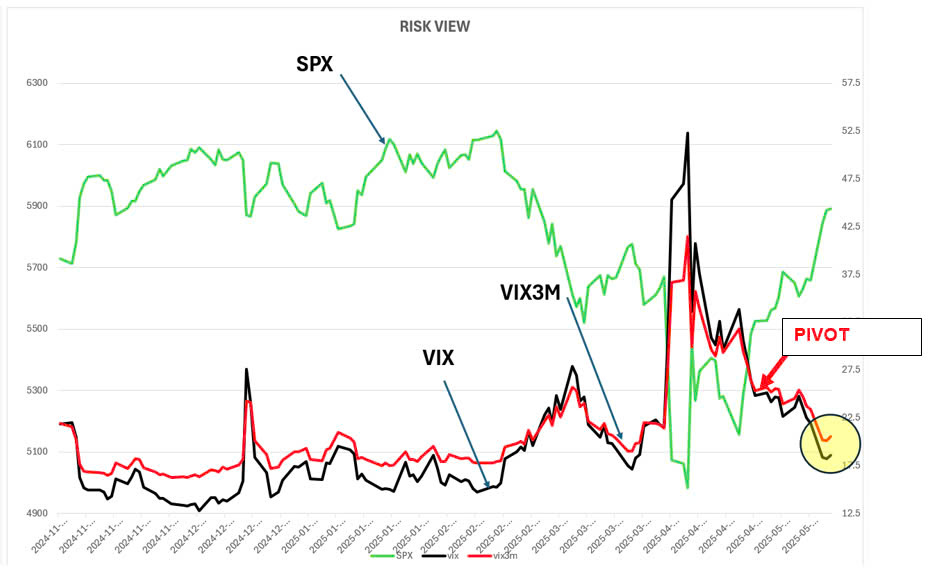

Market Risk

The risk picture seems to have levelled off quite convincingly ever since the pivot point.

CONCLUSION

- U.S. markets showed mixed performance due to sector-specific volatility and global economic shifts.

- Tech gains, led by NVIDIA, boosted the NASDAQ, while weakness in healthcare and energy weighed on the Dow.

- Investor sentiment was shaped more by geopolitical events than earnings reports.

- Renewed U.S.-China cooperation via tariff rollbacks provided temporary economic relief.

- Sovereign AI initiatives, especially from Saudi Arabia, signaled growing global competition in tech infrastructure.

- Despite easing tariffs, inflation concerns and uncertainty over long-term policy and AI dominance persist.

- Markets remain cautious as traders weigh short-term gains against deeper structural risks.

Please note that all information in this newsletter is for illustration and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any investment products or services.

About the Author

Rein Chua is the co-founder and Head of Training at AlgoMerchant. He has over 15 years of experience in cross-asset trading, portfolio management, and entrepreneurship. Major media outlets like Business Times, Yahoo News, and TechInAsia have featured him. Rein has spoken at financial institutions such as SGX, IDX, and ShareInvestor, sharing insights on the future of investing influenced by Artificial Intelligence and finance. He also founded the InvestPro Channel to educate traders and investors.

Rein Chua

Quant Trader, Investor, Financial Analyst, Vlogger, & Writer.