The U.S. economy has been experiencing a gradual market slowdown following an 18-month period of extraordinary gains across stock markets. Several key indicators signal this potential deceleration, including rising inflationary pressures, job market fluctuations, and recent shifts in consumer behavior.

Rising interest rates have further exacerbated affordability concerns, affecting both consumer spending and borrowing. With the Federal Reserve continuing its battle to curb inflation, businesses and consumers alike are adjusting to higher costs of borrowing, impacting housing, auto sales, and general consumption patterns.

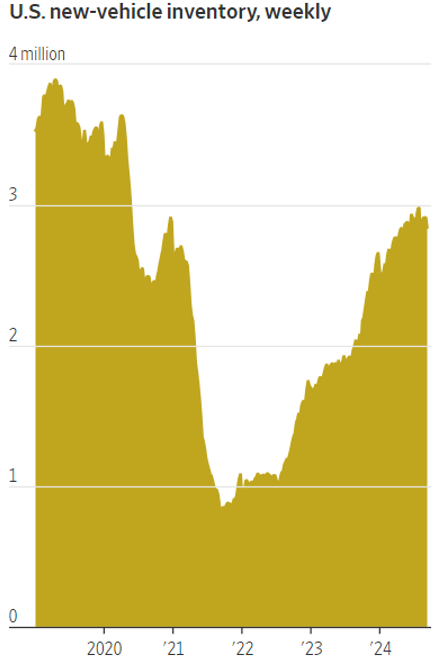

Source: Cox AutoMotive

MARKET CONCERNS

Oil Market and Inflationary Concerns

Geopolitical events, especially those in the Middle East, have led to fluctuations in oil prices, which could have a ripple effect on inflation, economic activity, and contribute to a broader market slowdown. Rising oil prices, driven by Israeli operations in Lebanon and concerns about wider regional conflicts, have fueled uncertainty in both Asian and U.S. markets. Moreover, dockworker strikes in U.S. ports have contributed to supply chain bottlenecks, further complicating trade flows and exacerbating market slowdown expectations.

WATCHOUT

Humana shares saw a significant drop following the release of lower-than-expected Medicare Advantage star ratings

The downgrade could lead to a potential revenue hit in 2026, with analysts estimating losses in the billions. The company’s strong reliance on Medicare places it in a vulnerable position amidst changes in federal policies, making it a stock to watch for long-term investors concerned about healthcare policy shifts.

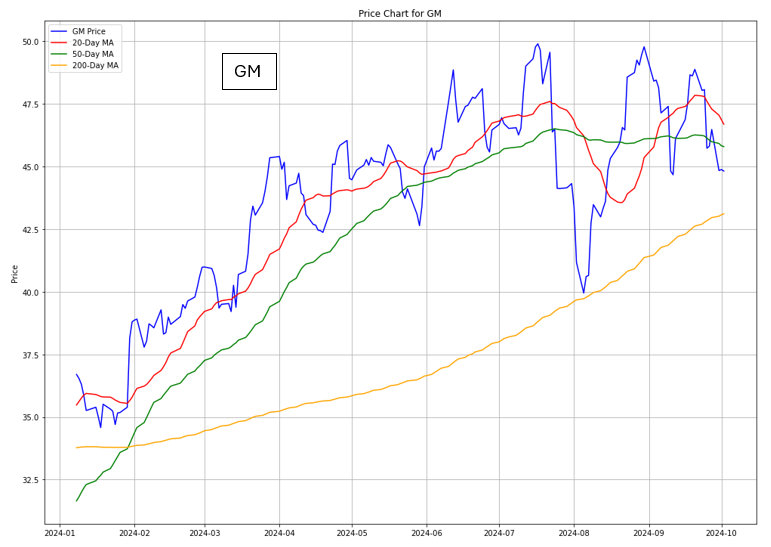

GM and Toyota have reported declines in sales for the third quarter of 2024

GM Chart

Toyota Chart

GM’s sales fell by 2%, with Toyota seeing a more substantial 5.6% drop. The auto industry continues to grapple with high prices and affordability challenges, which have deterred many consumers from purchasing new vehicles, even as availability has improved.

Investment Opportunity & Risk

The U.S. stock market has shown resilience despite these economic headwinds. However, increased volatility driven by geopolitical tensions, notably the conflict in the Middle East, has added to market uncertainty. Asian markets are particularly sensitive to geopolitical risks, including spikes in oil prices. Domestically, the stock market has reacted to a confluence of factors, including central bank policies, global trade disruptions, and industry-specific shifts. The current market environment has produced several significant stock performances across different industries:

Tesla (TSLA)

- Tesla reported a rise in global deliveries for the third quarter, marking a rebound after earlier declines. Tesla delivered 462,890 vehicles during the July-to-September period, reflecting a 6.4% increase year-over-year. However, Tesla still faces stiff competition within the EV space, and its sales growth is heavily dependent on continued innovation and managing rising competition from traditional automakers.

Nvidia (NVDA)

- NVIDIA‘s demand for its Blackwell product has surged, with CEO Jensen Huang noting the demand as “insane”. NVIDIA’s dominance in AI technology positions it as a market leader, with its GPUs being critical to advancements in generative AI. Despite some market fluctuations, the company’s strong AI-related revenue projections indicate robust long-term growth potential.

Broadcom (AVGO)

- Semiconductor stocks, including Broadcom, saw pressure following a revenue guidance miss that sparked a sell-off. Despite this, the company’s AI-related revenue growth is positive, highlighting the importance of long-term growth in artificial intelligence.

CONCLUSION

- The U.S. economy is currently balancing inflationary pressures, geopolitical risks, and market volatility. Investors are navigating an environment where key sectors, including healthcare, automotive, and technology, are undergoing significant shifts.

- Companies such as Tesla, NVIDIA, and Humana highlight the diversity of opportunities and challenges in today’s stock market, with AI and healthcare continuing to be pivotal themes for the future.

- This report underscores the need for vigilance in portfolio management, especially as bear market conditions may be on the horizon.

- Investors are advised to carefully evaluate macroeconomic trends and sector-specific risks as they position their portfolios for the remainder of the year.

Please note that all information in this newsletter is for illustration and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any investment products or services.

About the Author

Rein Chua is the co-founder and Head of Training at AlgoMerchant. He has over 15 years of experience in cross-asset trading, portfolio management, and entrepreneurship. Major media outlets like Business Times, Yahoo News, and TechInAsia have featured him. Rein has spoken at financial institutions such as SGX, IDX, and ShareInvestor, sharing insights on the future of investing influenced by Artificial Intelligence and finance. He also founded the InvestPro Channel to educate traders and investors.

Rein Chua

Quant Trader, Investor, Financial Analyst, Vlogger, & Writer.