Introduction

Traders and investors that have skin in the game should understand these concepts well to appreciate the stock market.

First, the US stock market reflects the economy and more. Existing economic conditions and historical ones are already priced into the stock market as old and current news. More importantly, the US stock market prices into current stock prices, future expectations of the economy.

Second, news and social media are designed to appeal to human emotions in order to get the most engagement. It is not set up to act in your best interest with regard to stock trading.

Third, professional traders are aware of how much influence typical news and social media feeds have on the average retail trader/investor, and they exploit that fact. In reality, news and social media do provide the information you need in order to forward look, you just need to know where and how to look for it.

Let’s begin by exploring the underlooked themes that will impact the stock market in 2022!

Current News that are treated by the Stock Market as Old News

These are current news related to the Fed’s monetary tightening plans that are already expected by financial analysts, traders and investors. Therefore, if future news headlines materialise as per these expectations, it is very likely to have been baked into the stock market price.

1

March Rate Hike

The Federal Reserve kept interest rates unchanged in their latest statement in January 2022, but signalled that a rate hike may be coming in March.

In a statement, the central bank’s policy making committee said a quarter-point hike is likely coming soon. That would be the Fed’s first rate hike since 2018.

“With inflation well above 2 percent and a strong labour market, the Committee expects it will soon be appropriate to raise the target range for the federal funds rate,” the statement said.

2

The Fed’s balance sheet reduction plans

The Fed did not state when they will reduce their bond holdings that have contributed to its balance sheet ballooning to nearly $9 trillion.

What the Fed had announced is that they would start shrinking the balance sheet after raising interest rates. This likely came unexpected to many market participants which probably explains why the stock market has sold off in Jan 2022, mainly because many were expecting the Fed to hold off shrinking the balance sheet while it navigated the rate hikes.

However this was what the Fed had communicated instead.

“The Committee expects that reducing the size of the Federal Reserve’s balance sheet will commence after the process of increasing the target range for the federal funds rate has begun,” the statement said.

3

Fed is sounding upside risk to inflation

Jerome Powell said that there’s a risk that inflation will not reduce to its pre-pandemic levels any time soon, and in fact that there are possibilities that inflation could continue to rise, as supply chain issues are still persistent. The potential for inflation to continue to scare financial markets could therefore have already been priced into the current stock market.

“Inflation risks are still to the upside in the views of most FOMC participants, and certainly in my view as well. There’s a risk that the high inflation we are seeing will be prolonged. There’s a risk that it will move even higher. So, we don’t think that’s the base case, but you asked what the risks are, and we have to be in a position with our monetary policy to address all of the plausible outcomes,” Powell said.

4

The Fed’s does not think rate hikes will derail the labour market and economy

“I think there’s quite a bit of room to raise interest rates without threatening the labour market,” Powell said.

The Fed Chair pointed to the fact that job openings currently outnumber unemployed Americans as one reason that the labour market is “very, very strong.”

“In light of the remarkable progress we’ve seen in the labour market and inflation that is well-above our 2% long-run goal, the economy no longer needs sustained high levels of monetary policy support,” Powell said during a press conference.

“That is why we are phasing out our asset purchases…and we expect it will soon be appropriate to raise the target range for the federal funds rate,” added Powell.

There are two ways to view these strong statements sent by the Fed Chair, and both views have been taken favourably by stock market participants. This further suggests that the Fed will not do anything dramatic to hurt the stock market. The 2 views are:

- The Fed will not raise rates too dramatically to harm the labour market and therefore the economy.

- The labour market is so strong that even if aggressive rate hikes were undertaken, it is unlikely to materially affect companies’ strong earnings growth.

5

Price Stability is key

The stock market also took solace from this Fed message:

“We’re committed to our price stability goals,” Jerome Powell said in the press conference. “We will use our tools both to support the economy and a strong labour market and to prevent higher inflation from becoming entrenched.”

One of the reasons why the stock market sell down has been fairly muted is the fact that the Fed is still committed to being supportive of the economy. While it acknowledges that inflation is running high, market participants are currently pricing in the Fed not really taking too much weight off the financial liquidity paddle.

How to get ahead of the Fed?

1

The Fed will be watching Wages tightly

Key Takeaway #1

“Wages have also risen briskly, and we are attentive to the risks that persistent real wage growth in excess of productivity could put upward pressure on inflation,” the Fed Chair said.

This also means that the Fed will be focusing on wage growth, rather than inflation.

Inflation is the symptom, and strong wages are the cause.

2

Interest Rate Hike and Balance Sheet Reduction not on AutoPilot

Do you remember the late October to late December -20+% correction that occurred in 2018?

On the surface many superficially think that was because the Fed wanted to reduce the balance sheet and set a course for interest rate hike.

Actually the main thing that the markets did not like was the fact that Jerome Powell communicated he intended to set an ‘Auto Pilot’ course for balance sheet reduction and interest rate hikes.

This is what Jerome Powell had to say in his most recent statements:

“The Committee views changes in the target range for the federal funds rate as its primary means of adjusting the stance of monetary policy.”

“…primarily by adjusting the amounts reinvested of principal payments received from securities.”

“The Committee is prepared to adjust any of the details of its approach to reducing the size of the balance sheet in light of economic and financial developments.”

Key Takeaway #2

Stock market participants are welcoming the fact that the Fed is not introducing an Auto Pilot tightening programme like it did in 2018.

Readers should look out for any changes in the Fed’s statements in the future. If they ever introduce an Auto Pilot scheme, it will likely result in further stock market downside.

3

Years with plenty of Rate Hikes

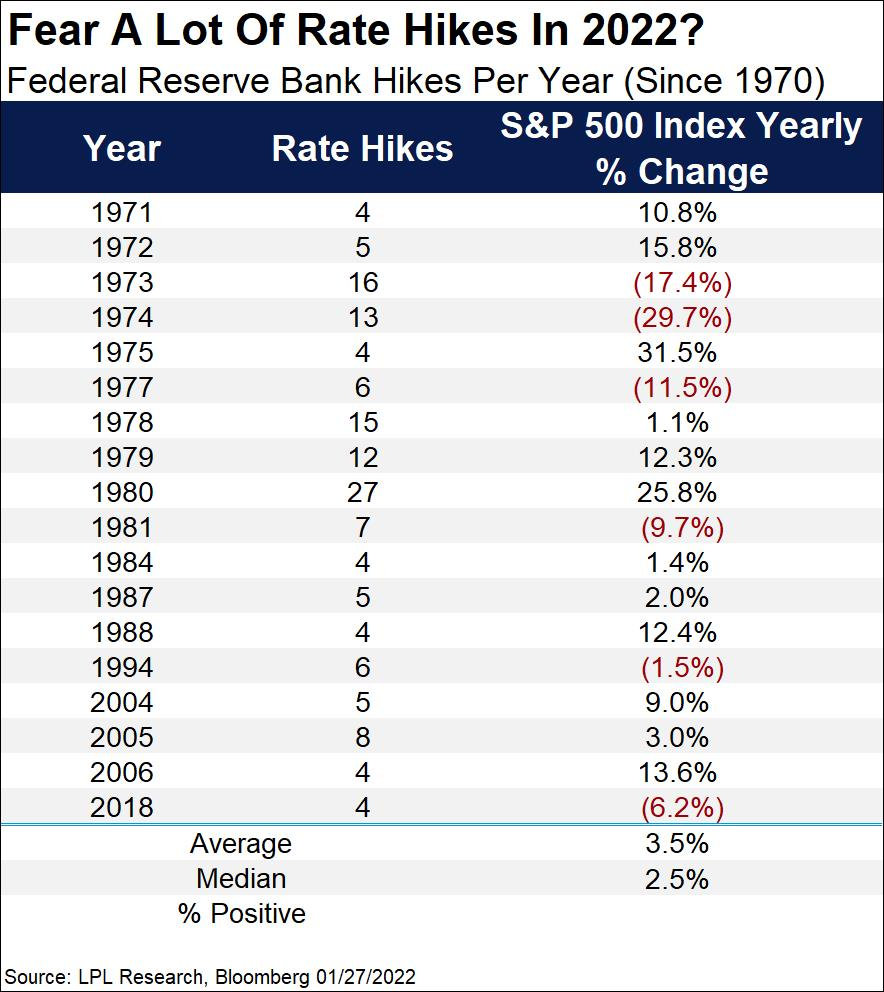

It is already priced in\, that 2022 will be a year of multiple rate hikes – at a minimum 4 or more. What does history tell us about the S&P 500 stock market return for years that experienced multiple rate hikes (4 or more)?

Based on the past 50 years, only 6 out of 18 times did the S&P 500 (33%) experience a negative return.

That means that 66% of the time where there were multiple rate hikes, the S&P 500 actually returned positive from a year to date perspective.

Key Takeaway #3

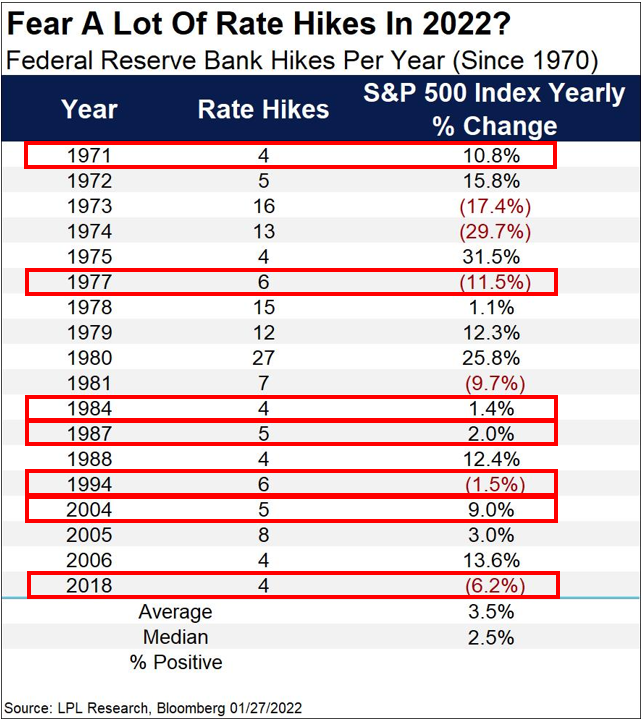

Furthermore, we can reduce the dataset even further to focus on the years where the Fed initiated a rate hike path (very similar to 2022):

The data is even more mixed, 3 out of 7 instances (43%), the S&P 500 was negative on a yearly return basis!

4

The key to whether the S&P 500 performance will fundamentally be dependent on the level of liquidity stress in the financial markets, as a result of the Fed tightening.

One way to assess the level of liquidity stress is to pay close attention to ‘Credit Spreads’.

If credit spreads are to start increasing in an uptrend manner, as a result of rate hikes and Fed balance sheet reduction, then it is very likely that the S&P 500 will suffer.

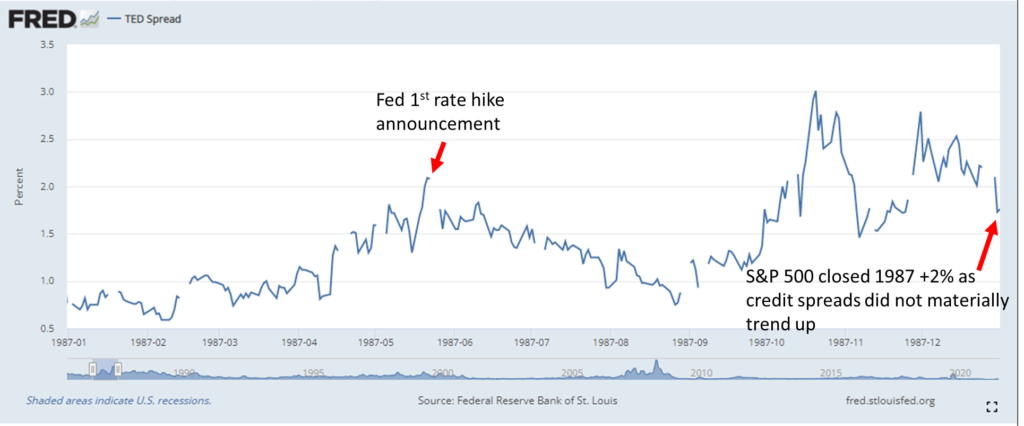

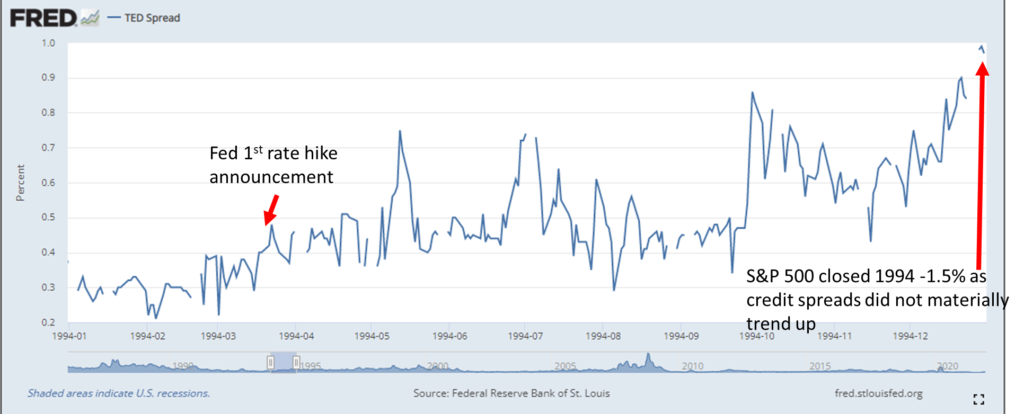

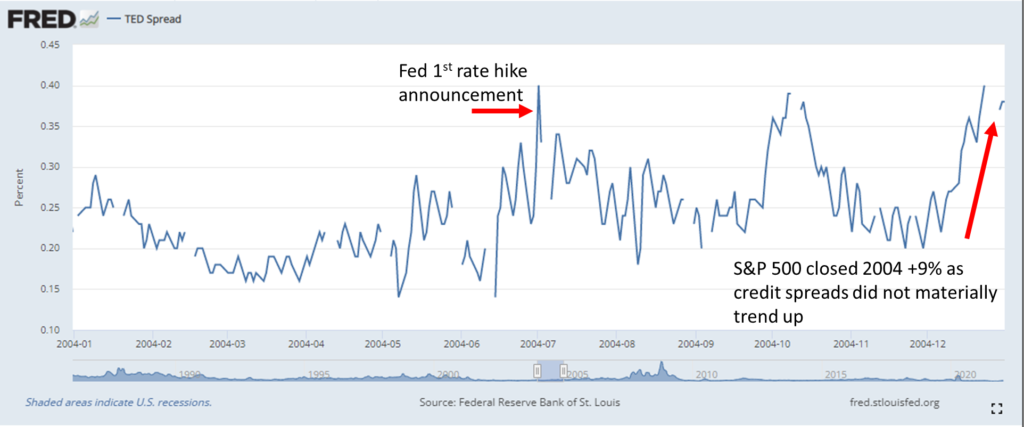

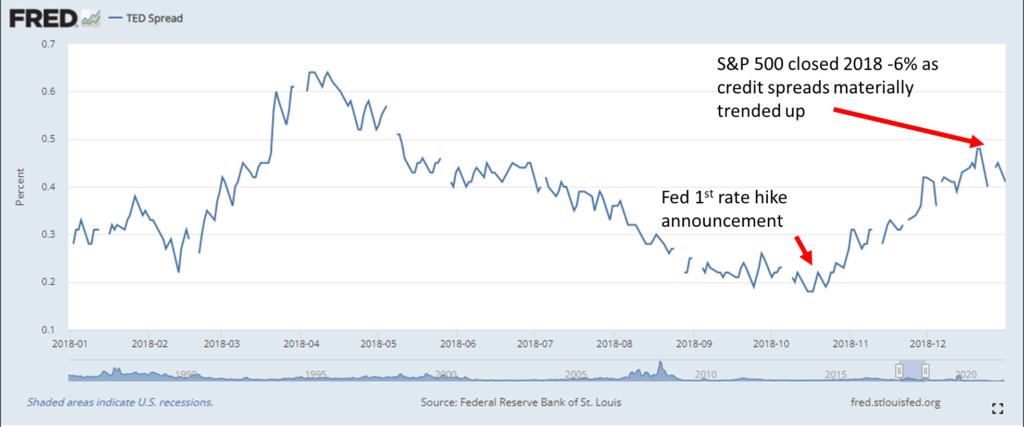

The following charts show the years where the Fed first hiked rates, how the credit spreads behaved as a result, and comparing how the S&P 500 behaved as a result

1987: Credit spreads did not materially trend up following Fed rate hike. S&P 500 closed +ve annually.

1994: Credit spreads trended up following Fed rate hike. S&P 500 closed -ve annually as a result.

2004: Credit spreads did not materially trend up following Fed rate hike. S&P 500 closed +ve annually.

2018: Credit spreads trended up following Fed rate hike. S&P 500 closed -ve annually as a result.

Key Takeaway #4

There appears to be a correlation between the S&P 500 and credit spread movement as a result of Fed monetary tightening.

The huge drawdowns experienced in the 1970s were a result of the Fed’s extreme rate hike and monetary tightening to fight persistent inflation.

The key for 2022 is to monitor the manner in which the Fed will execute the rate hikes and balance sheet reduction, and most importantly whether their moves will increase credit spreads.

If credit spreads were to increase in a material way, 2022 may not be a good year for the stock market.

Conclusion

- Do not depend purely on news headlines to make trading and investing decisions, as many of them will already be priced in.

- To increase your chances of beating other traders and investors in 2022, it is all about focusing on factors that are important, that are not talked about in great detail via news and social media.

- In this article, we have identified 3 factors that are important to watch out for, but aren’t really talked about in mainstream media – How wages will progress in 2022, whether the Fed will announce an Auto-pilot scheme and most importantly whether credit spreads will widen when the Fed tightens.

Please note that all the information contained in this content is intended for illustration and educational purposes only. It does not constitute any financial advice/recommendation to buy/sell any investment products or services.

If you find trading extremely difficult or are worried and not confident you can achieve portfolio profitability in 2022 – please rest assured you are not alone in feeling that way.

In fact, many professional traders, analysts and stock investors are getting ready for a tough 2022! The reason is because the stock market has run up a lot since the Covid lows, and the stock market is overpriced with high valuations. Coupled with the Fed making financial less accommodative than we had seen in the past 2 years, the only natural thing is for the stock market to take a break.

Therefore, the US stock market is expected to either trade sideways or in the worst case, experience a correction in 2022.

Do you know that when markets trade sideways or enter into correction territory. AlgoMerchant’s fully automated AI trading strategies are designed to exploit such market conditions?

If you are keen to explore alternative ways to profit from a tough market next year, we have an upcoming VIKI seminar. Click the link below to register for the event to learn how VIKI can profit when the market cannot!