The past few years have seen an implacable rise of interest in investing based on “ESG” or environmental, social, and governance factors.

With the promise of making money while doing good, ESG funds have drawn billions of dollars in investments, making the acronym one of Wall Street’s favourite buzzwords.

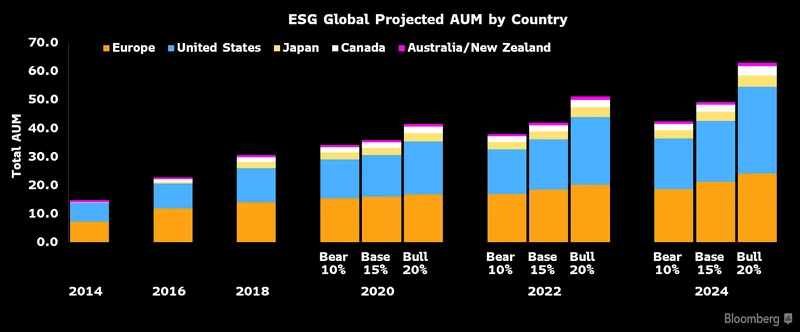

According to Bloomberg Intelligence, professionally managed assets with ESG mandates are expected to exceed over $50 trillion globally by 2025, accounting for one-third of total global assets under management!

Source: Bloomberg

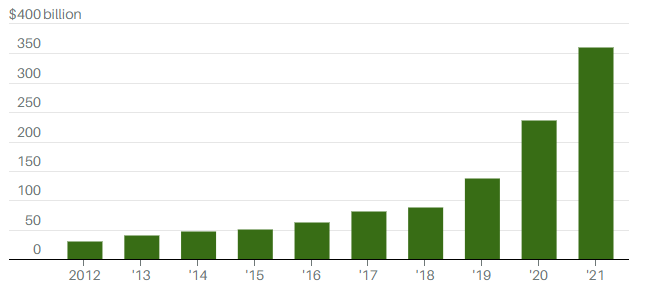

The ESG-focused ETFs in the US alone, as reported by Morningstar, have racked up an estimated $360 billion in investments in 2021, compared to $236 billion in 2020, registering more than 50% YoY growth.

Source: Morningstar

Great! But what’s the story?

What exactly is “ESG Investing” all about?

Well, ESG (environmental, social and governance) investing means different things to different people:

For nature and climate activists, it means investing in the companies that choose renewables instead of fossil fuels. It also means disowning those who leave heavy environmental footprints…

For social activists, it means paying close attention to the working conditions, gender & racial diversity of the companies and avoiding those that do not value human rights. And,

For morality seekers, it means not putting your money where someone is dealing with narcotics or engaging in questionable business practices (Governance).

Jumping on the Bandwagon

ESG investing won’t be a megatrend unless big money engages in it.

And Wall Street isn’t interested in anything if it’s not profitable.

But now, it is!

Why?

Because the risk of climate change has suddenly become so real. Global warming, extreme weather conditions, melting of ice sheets, greenhouse gas emissions, severe droughts, and rising sea levels…these events are no longer exceptional.

| According to a financial survey, the investment required to decarbonize the planet is expected to be more

than $41 trillion, giving sustainable businesses a once-in-a-lifetime opportunity to profit from the race to a

carbon-free society. |

Furthermore, in an era of immensely powerful social media, the risk of reputational loss as a result of social irresponsibility or poor governance cannot be overlooked.

It is now something institutions can no longer afford to ignore.

In turn, both large and small investment firms seized the opportunity to create and market new ESG funds.

BlackRock, an investment firm, launched six ESG-focused ETFs in 2020 alone—three just in June 2020, at the height of the pandemic. Recently, in 2022, Blackrock further added four more ESG ETFs.

Additionally, Bridgewater associates, JPMorgan Chase and Goldman Sachs have also jumped on the bandwagon, thinking of it as becoming more mainstream.

|

“Increasing political support, a sharper corporate focus and an unprecedented need for climate change are all set to further support the growth in ESG investing.” –Jennifer Wu – Sustainability research co-head, JPMorgan. |

But what about the performance?

Well, ESGs won’t disappoint you here as well!

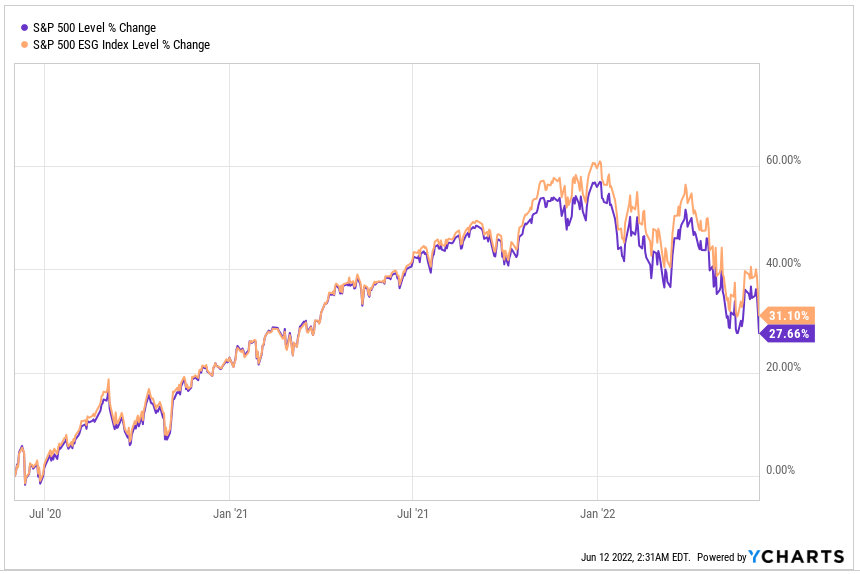

According to “S&P Global Market Intelligence,” 19 of the 26 top ESG ETFs grew between 27.3% to 55% between March 2020 and March 2021, compared to the S&P 500, which rose only 27.1% during the same period.

The S&P 500 ESG index has also outpaced the S&P 500 index by 3.44% over the last three years, thanks to trillions of dollars flowing in from both the public and private sectors!

Morningstar data has shown that ESG funds have demonstrated lower volatility and solid returns on equity in the last three years. Many of these funds have shown above-average longevity as well.

Is ESG investing megatrend here to stay?

As always, there are two sides to the same story, especially when it comes to financial markets. And ESG investing isn’t unique…

What is the reason?

Well, there are multiple…

Let’s start with the “feel good” reason:

The purpose of ESG investing in “responsible” companies is to build an ethical investment portfolio to earn market returns while making a positive social impact at the same time.

Feels good? Right?

But the problem with this approach, especially when it comes to climate change, is that buying stocks of environment-friendly companies has no impact on mitigating the climate change. The world continues to emit carbon despite the rapid growth and level of investments in ESG funds.

The idea of moving money away from companies that spew fossil fuels to the relatively “clean” companies sounds good in theory. Still, it does not hold up in reality because the major effects of ESG funds are on the secondary market, where only stocks/ETFs are traded, but no new money is being raised.

“You can’t change the world or fix climate change by buying and selling shares.” -Head, Royal London Asset Management |

Now, let’s get back to the performance…

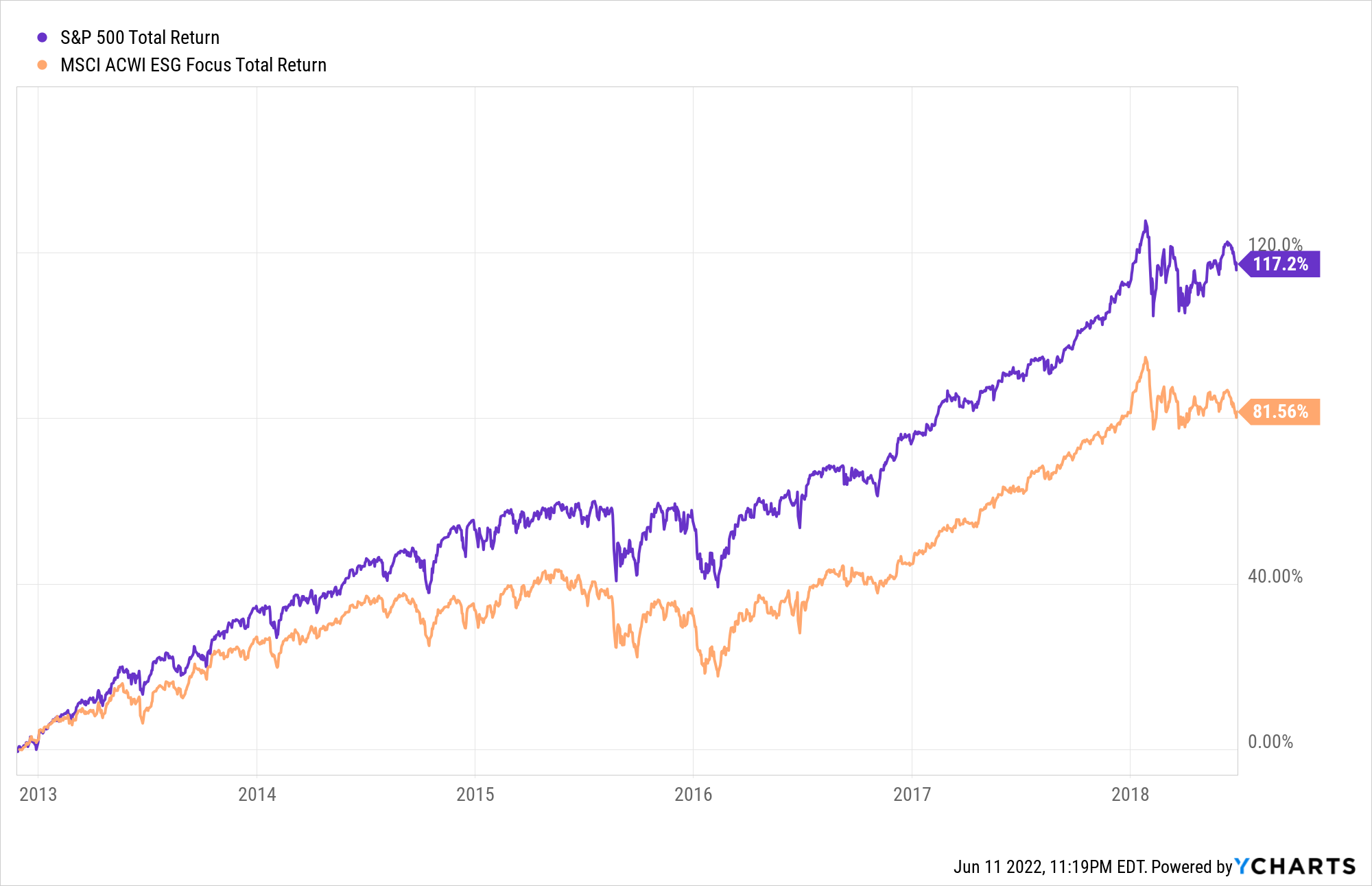

Even if ESG outperformance has been even more prominent in the previous three years, the MSCI ESG-focused Index returned just 81.56% from 2012 to 2018, whereas the S&P 500 index returned a staggering 117.2%.

The current year-to-date performance tells no different story.

Because of ESG’s climate-friendly stance, most ESG funds lagged the S&P 500 as they avoided the traditional oil/fossil fuel equities, which were on a home run, citing the Russia-Ukraine war.

Also, the ESG funds have embraced low-carbon-footprint technology businesses, which underperformed the markets due to rising interest rates.

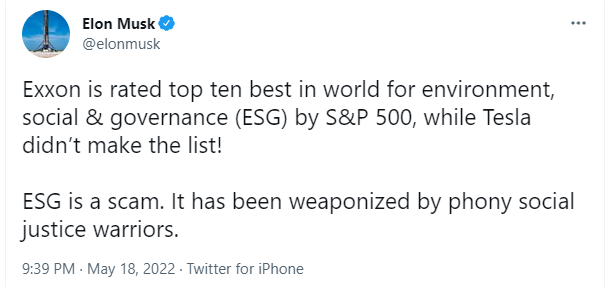

Additionally, in the last month, Elon Musk called ESG “a scam” on Twitter!

He objected that Exxon Mobil, an American oil & gas corporation that is involved in controversy over climate denialism allegations, is still ranked in the top ten for ESG. And at the same time, his electric car company boosted off the list entirely.

And he may have a point because S&P Global’s ESG standards aren’t that well defined. The companies are reshuffled entirely based on the disclosures made by the companies themselves, which aren’t necessarily correct.

So why is there so much buzz?

If ESG funds do not mitigate climate change or do not consistently outperform S&P 500, what is the motivation for promoting these funds to investors?

The simple answer is that the investment industry, which includes prominent hedge funds and mutual funds, make a lot more money when investors buy ESG funds where the management fees are SIX times higher versus plain-vanilla index funds.

And the fact behind ESG’s outperformance over the last three years is that their exorbitant management fees have balanced out their slight outperformance.

FINAL WORDS

- In recent years, ESG funds have been presented to investors as “Making money while doing good” investments that outperform the benchmarks.

- While this may be true for some funds in the short term, the long-term record suggests that investors risk higher costs and lower returns from investing in ESG funds.

- Also, the narrative of investing in ESG funds to support climate change seems invalid as buying and selling shares/ETFs in secondary markets won’t fix the climate change.

- However, it is worth noting that the risk of climate change is for real, and the unprecedented need for a carbon-neutral economy may present life-changing investment opportunities in the near future.

Please note that all the information contained in this newsletter is intended for illustration and educational purposes only. It does not constitute any financial advice/recommendation to buy/sell any investment products or services.