Introduction

Trading and investing can be overwhelming and intense at times.

In fact, when markets are in turmoil or when your trades go against you – it can trigger emotional roller coaster moments.

So once in a while, let’s take our minds off the intense stuff and read about light hearted materials – trading and investing can be fun too!

In this article, we share some trivial and fun facts that you don’t probably know about famous investors and CEOs.

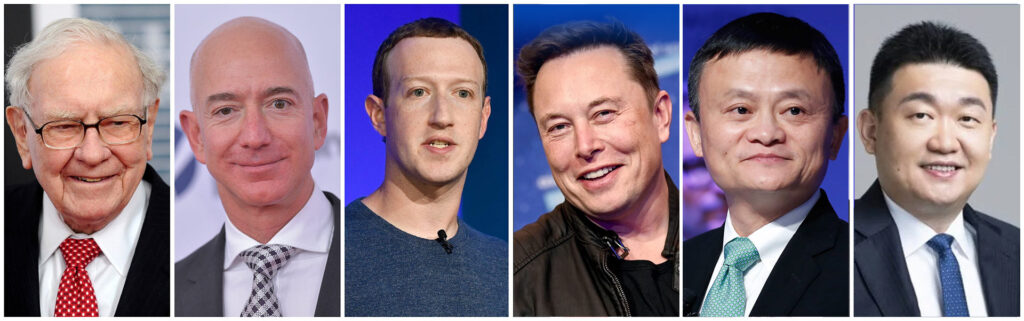

Warren Buffet

Maybe few will be surprised if we told you Warren Buffet owns 20 suits, because he is after so famous and rich.

Even fewer will be surprised after knowing he didn’t have to pay for any of these 20 suits.

What’s more interesting is the backstory on how he came to own 20 suits.

Once he went to China, and when he got to the hotel, 2 men jumped into the room and started taking measurements around him with tape measurements. After that, they asked him to pick his preferred fabric from a sample book and said to Warren Buffet “pick out a suit. Madam Lee wants to give you one.”

Without meeting her, Buffet agreed to pick a suit and subsequently another one.

Eventually he met this mysterious designer “Madam Lee”, and developed a professional relationship as she continued sending Buffet suits over the years.

Because of this, Madam Lee was given opportunities to attend Buffet’s annual meetings and even had the opportunities to make suits for other famous CEOs such as Bill Gates!

Maybe offering things for free to rich and famous people can sometimes open doors to another world?

Elon Musk

When Jon Favreau, the Director and writer for Marvel’s Iron Man needed inspiration to portray the Tony Stark character, guess who he looked up?

Elon Musk..

Jon was looking for someone that was futuristic, charismatic and definitely a tech CEO type character that had a certain swagger so Elon Musk was the guy.

Word had it was the actor Robert Downey Jr that made the suggestion to Jon.

So the link was established – Jon interviewed Musk and the rest became history. But what few know is that what we see, feel and know about Tony Stark in Marvel was, to a certain extent, influenced by Elon Musk.

Both Jon and Musk mutually benefited from this relationship. Jon managed to shoot parts of Iron Man 2 at the SpaceX factory.

Musk benefited also by getting ideas from his fictitious character, who would frequently wave his hands across virtual screens. Musk eventually found a way to replicate methods of designing rocket parts on a computer screen by waving his hands too.

Mark Zuckerberg

Do you know the CEO of Facebook is a vegetarian? Well kind of, unless the meat came from a source either his wife or he killed themselves.

The reason? Well apparently it is out of respect for animals as consumable poultry are killed inhumanely most of the time. So to be more thankful for the meat he has to eat, he felt it wasn’t responsible if he did not remember the animals he ate, used to be alive once.

Mark Zuckerberg once invited Jack Dorsey (CEO of Twitter) to his house for dinner, and served him goat’s meat which he raised to kill himself.

Apparently after cooking the goat in the oven for 30 minutes, Zuckerberg served Dorsey the meat.

What was really awkward was Dorsey found the meat to be cold, politely left it aside and just ate his salad instead!

Jeff Bezos

Did you know Amazon was almost called Cadabra instead?

That’s because the Amazon founder Jeff Bezos originally wanted to give his company a more magical sounding name. Fortunately (or unfortunately) enough, Todd Tarbet, Amazon’s first lawyer warned Bezos against it.

In the end, Jeff went with Amazon, naming the company after the world’s largest river because his vision was to build the world’s largest bookstore!

Jack Ma

Jack Ma was fascinated by the western world growing up, and really wanted to learn English badly. However, when he was growing up, there were hardly any English classes available in China.

In order to learn English, one of the things he did was to offer himself as a tour guide to foreigners at the Hangzhou hotel to get English exposure.

Forrest Li

Let’s finish off with our very own Singapore’s richest CEO, Forrest Li of Sea Ltd.

Slightly similar to Jack Ma, when Mr Li went to college, one of his tutor’s found it difficult to pronounce his Chinese name.

So Mr Li was asked to pick a ‘Western’ name, and the first thing that came to his mind was the movie Forrest Gump – The rest is history!