It’s been about 1 year since we first launched one of our RoboInvesting solutions, Trident, and we take pride in being able to declare that the results have been overwhelmingly positive. As the year draws close to an end, we would like to take this opportunity to take a look back at how Trident has performed so far.

Trident’s Performance

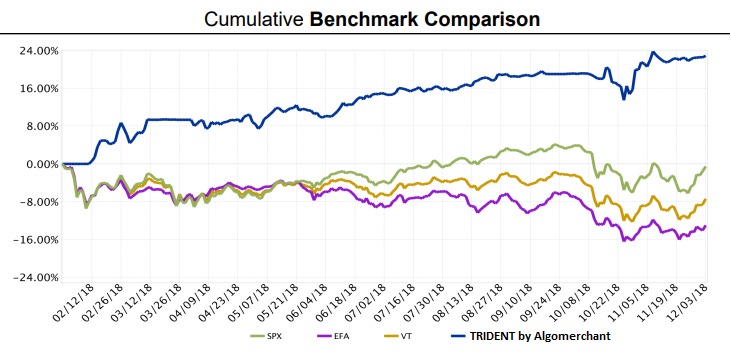

The following chart shows Trident’s (based on a live account with Interactive Brokers) performance against widely used benchmarks such as the S&P 500 (SPX), MSCI EAFE Index Fund (EFA) and the Vanguard Total World Stock ETF (VT).

Over the past 10 months (February to November 2018), the Trident account yielded between 0% to 24%. In stark contrast, SPX is in negative territory. In the same timeframe, EFA and VT have also largely yielded negative returns. Trident has in fact outperformed most global indices and funds by a wide margin.

The chaotic market has affected not just the average retail investor, but even top professionals. Built to thrive in such turbulent times, however, Trident remains unaffected by all the unnecessary noise – even as the Dow plunged 800 points. On the contrary, Trident recently managed to identify yet another winning opportunity despite the turmoil.

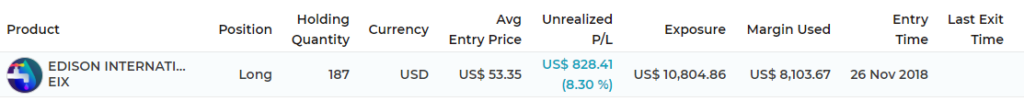

Case in point, the picture above shows an opportunity that Trident had identified and entered into for Edison International (EIX) on 26 Nov 2018. To date, this opportunity alone could have earned you an 8.30% return if you were a Trident subscriber – definitely not bad considering the market conditions.

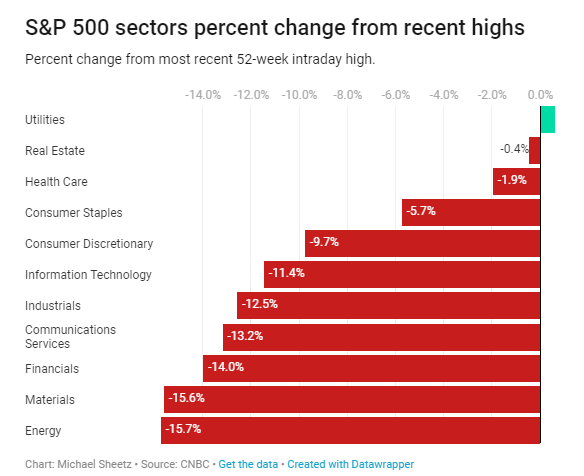

Trident’s recognition of EIX, a utility stock, is not by chance. Utility stocks soar to highest levels in a year as investors rush to safe havens and Trident’s intelligence has enabled her the first-mover advantage, and the clarity to avoid potential sector pitfalls.

If you have been paying attention to the markets, you would also have noticed that the US market, in general, has been struggling. Coupled with the trade war between the 2 giants (US and China), raising fears of an economic slowdown have triggered a series of bearish sentiments all around, and have resulted in a volatile stock market.

Testimony for Trident

How should you ride the volatile stock market? Well, if Trident sounds good so far, witness more great feedback about Trident’s prowess from our satisfied subscribers. Click on the link below to hear from one of the many subscribers whom Trident has made trading much better and profitable for.

Trident Events – Rise of RoboInvesting

If you’re keen to find more about Trident, do keep a lookout for our upcoming events. During the events, we will share more about the RoboInvesting technology behind Trident, how she has intelligently managed to navigate the market, as well as how you can benefit from using Trident for your trading needs.

Stay tuned, and happy trading!