What Happened in the Market in December 2018

Traders and investors will remember what happened in December 2018 – unfortunately for most, the memory will not be a good one

In what was a violent December in 2018, the S&P 500 and the Dow created record lows in numerous areas – among which, it was dubbed the worst December performance since 1931, the biggest monthly loss since February 2009 as well as the worst year for stocks since the Great Recession.

To illustrate just how wild it was for investors, the S&P 500 was down more than 20% from its record high on an intraday basis, briefly meeting the requirement for a bear market on Christmas Eve (talk about a bad Christmas morning). The stock market would come soaring back up in the next few days, with the Dow jumping more than 1,000 points on 26 Dec, its biggest-ever point gain.

Unfortunately, the market did not change for the better for legendary Billionaire trader, John Paulson, who made a 70% loss over 4 years in one of his hedge funds.

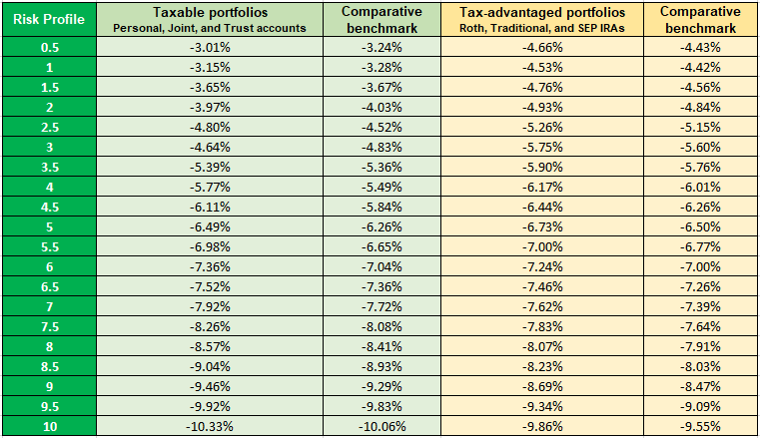

Robo advisors, which are passively managed and generally return similar yields or losses as the market, were also negatively impacted. Wealthfront, one of the largest robo advisors in the US market as well as one of the pioneers of robo advisory, yielded negative returns across all its portfolios and risk profiles.

Wealthfront’s Annual Net-of-Fees, Pre-Tax Returns for 2018

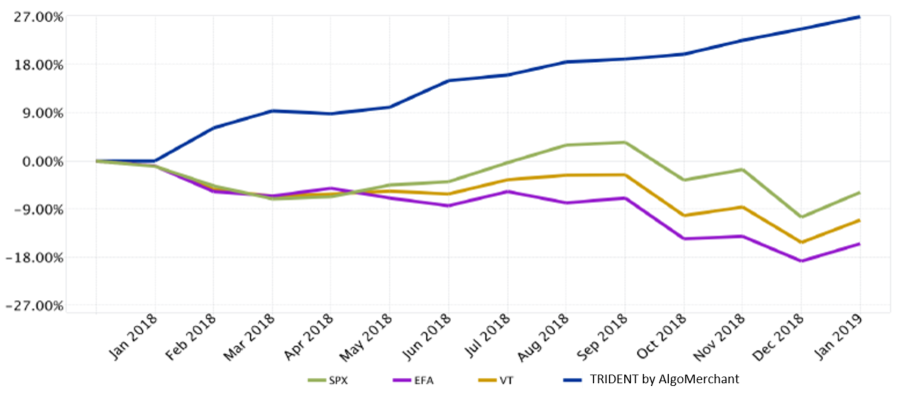

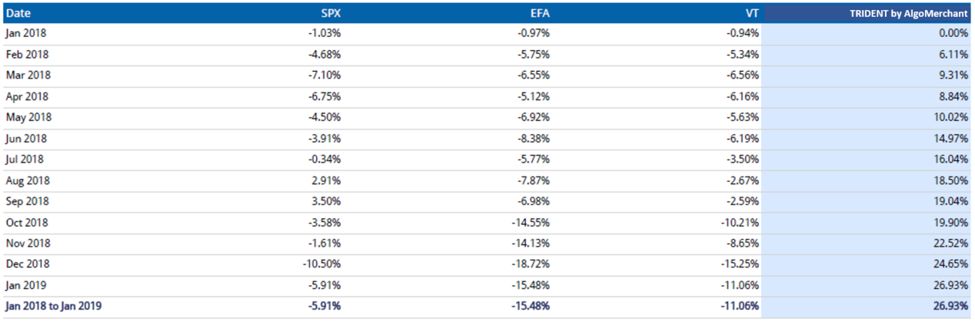

Update from RoboTimes (Vol 1): Trident’s Performance Against Benchmarks and Hedge Funds

Over the past 13 months (January 2018 to January 2019), Trident (based on a live account with Interactive Brokers) account has now yielded between 0% to 27%. In stark contrast, the S&P 500 (SPX), MSCI EAFE Index Fund (EFA) and Vanguard Total World Stock ETF (VT) are in negative territory.

Trident continues to outperform most global indices and funds by a wide margin, and also outperformed the average hedge fund in 2018. According to Hedge Fund Research Data, the average hedge fund was down 6.7% in 2018.

Trident’s Winning Stock Picks in December 2018

While the market was a fury of uncertainties, and even as the top hedge funds and robo advisors failed, Trident (based on a live account with Interactive Brokers) remained steady by intelligently picking the right stocks.

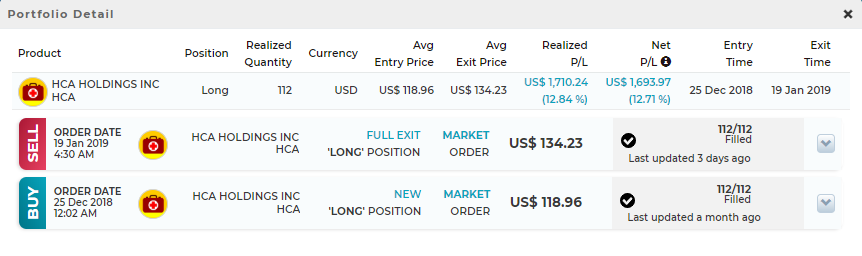

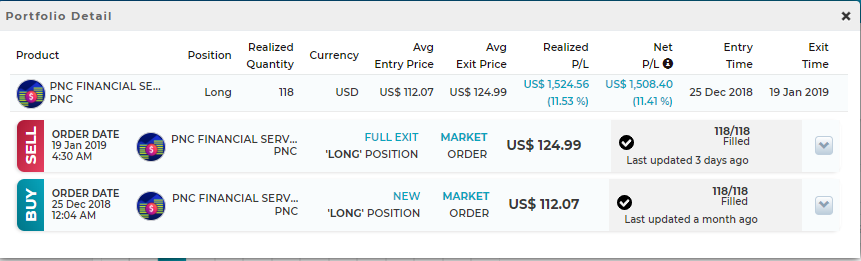

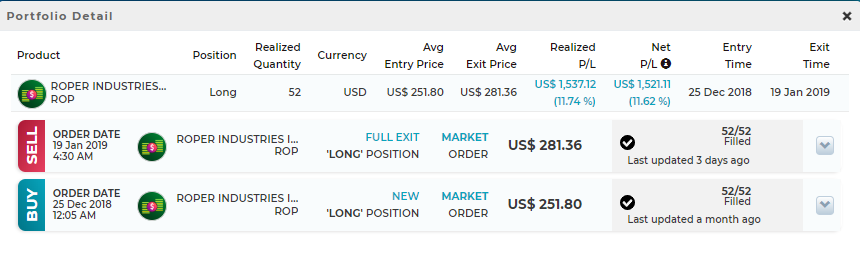

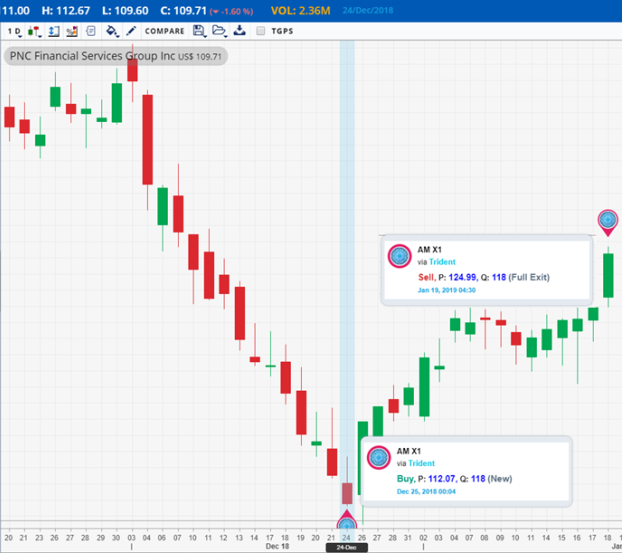

On 25 Dec 2018 (Singapore Time), Trident entered into three stocks simultaneously. Trident systematically held her positions and only exited all three positions on 19 Jan 2019 – realizing a profit of 12.84%, 11.53% and 11.74% for HCA Holdings (HCA), PNC Financial Services Group (PNC) and Roper Industries (ROP) respectively.

Here’s a snapshot of how your portfolio would look if you are a Trident subscriber.

A closer look at Trident’s intelligence below brings up 3 key questions for you as a retail investor:

- Would you have identified the three stocks (or similar stocks) correctly?

- If so, would you have dared to enter into a position right when the stock price was at a low?

- As the markets fluctuated, would you have stayed to the trade plan, and held your nerve to hold Trident till 19 Jan 2019, or would you have exited somewhere between Trident’s entry and exit, and settled for a ‘mere’ 7%, or even 10%?

For HCA:

For PNC:

For ROP:

Intelligence such as Trident’s is not new to institutions and the ultra-rich. Recently, Financial Times reported that the breakneck growth of AUM in more systematic, computer-powered investment strategies is so great that “the quantitative hedge fund industry is on the brink of surpassing $1tn of assets under management this year”.

As traditional hedge funds and even mutual fund groups reinvent themselves to be computer-driven firms, and if you have answered ‘no’ to at least one of the question above, join us at one of our upcoming events to find out how AlgoMerchant has instead revolutionized the way people invest, by providing institutional-grade technology to retail investors like yourself.

Happy trading!