The resilience of the U.S. economy could spell trouble for the market. In October, wholesale prices, reflected in the 0.2% increase in the Producer Price Index (PPI), pointed to persistent inflationary pressures. Core inflation, driven primarily by rising service costs, climbed by 0.3%, pushing year-over-year inflation to 3.5%. This trend suggests the Federal Reserve may be reluctant to implement aggressive interest rate cuts.

Retail sales outpaced expectations, increasing by 0.4% in October. A strong labor market and steady consumer demand underpinned these figures, showcasing the economy’s robustness. However, manufacturing production saw a slight decline, reflecting sector-specific challenges.

U.S. Equity Markets Volatile Amid Fed Policies and Trump’s Agenda

U.S. equity markets are experiencing heightened volatility and trouble ahead due to shifting Federal Reserve policies and macroeconomic factors. The S&P 500, Dow Jones, and Nasdaq indices have seen significant swings. Optimism surrounding President-elect Donald Trump’s policies, which focus on deregulation and pro-business reforms, has buoyed investor sentiment, although uncertainties around trade and fiscal policy persist, adding to the market’s uncertainty.

Fed Signals Caution on Rate Cuts

Considering the possibility of market trouble ahead, the Federal Reserve’s cautious approach to further rate cuts, driven by strong economic indicators, has reduced expectations for substantial monetary easing. Inflationary pressures, along with potential tariffs under the incoming administration, could exacerbate market volatility.

Source: Anadolu Ajansı

GLOBAL CONCERN

Trump's Tariff Plans Threaten Global Trade

President Trump’s renewed focus on tariffs may reshape global trade. The proposed 60% duties on Chinese imports and broader tariffs could worsen global inflation and disrupt supply chains, contributing to the trouble ahead. This poses significant challenges for multinational corporations and industries such as manufacturing and technology.

WATCHOUT

Tesla Stock Fluctuates Amid Market Uncertainty

Although Tesla initially benefited from post-election momentum, trouble ahead led to stock volatility as broader market concerns dampened investor sentiment.

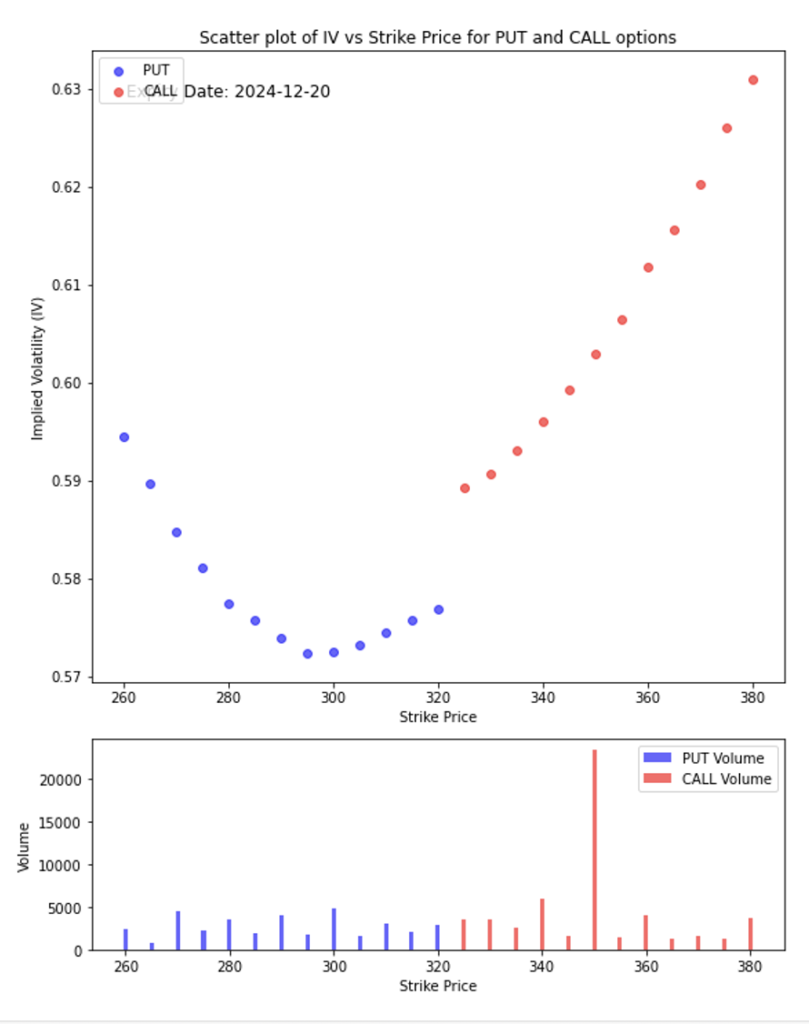

Short-Term Outlook (Next Few Weeks):

Likely Range: 320–340.

The stock price is expected to move slightly upward, with the market focusing on 340 as a key level.

Support exists at 300–320, limiting downside risks.

Medium-Term Outlook (1–2 Months):

If the stock breaks above 340, it could trend toward 360, as speculative interest in higher CALL strikes suggests traders are positioning for further gains.

Downside risk appears limited to 300, where IV is lowest and PUT volume is moderate

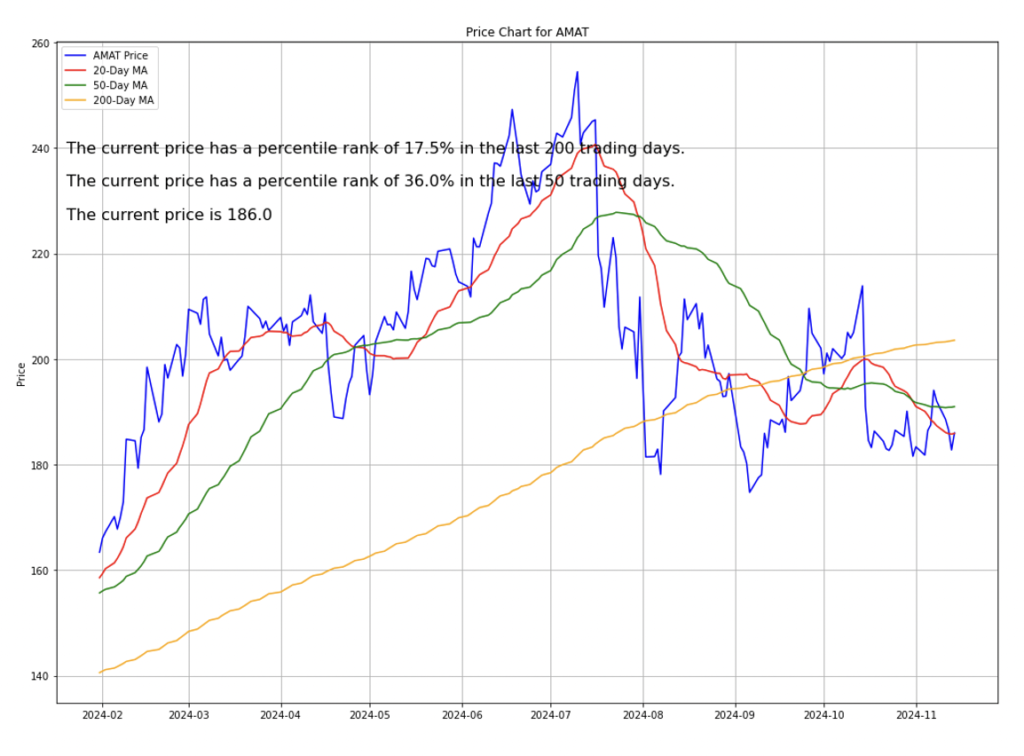

Trade Tensions Disrupt Chip Supply Chains

Companies like Applied Materials (AMAT) and Lam Research (LRCX) faced declines due to weaker forecasts, highlighting vulnerabilities to global trade tensions and supply chain disruptions.

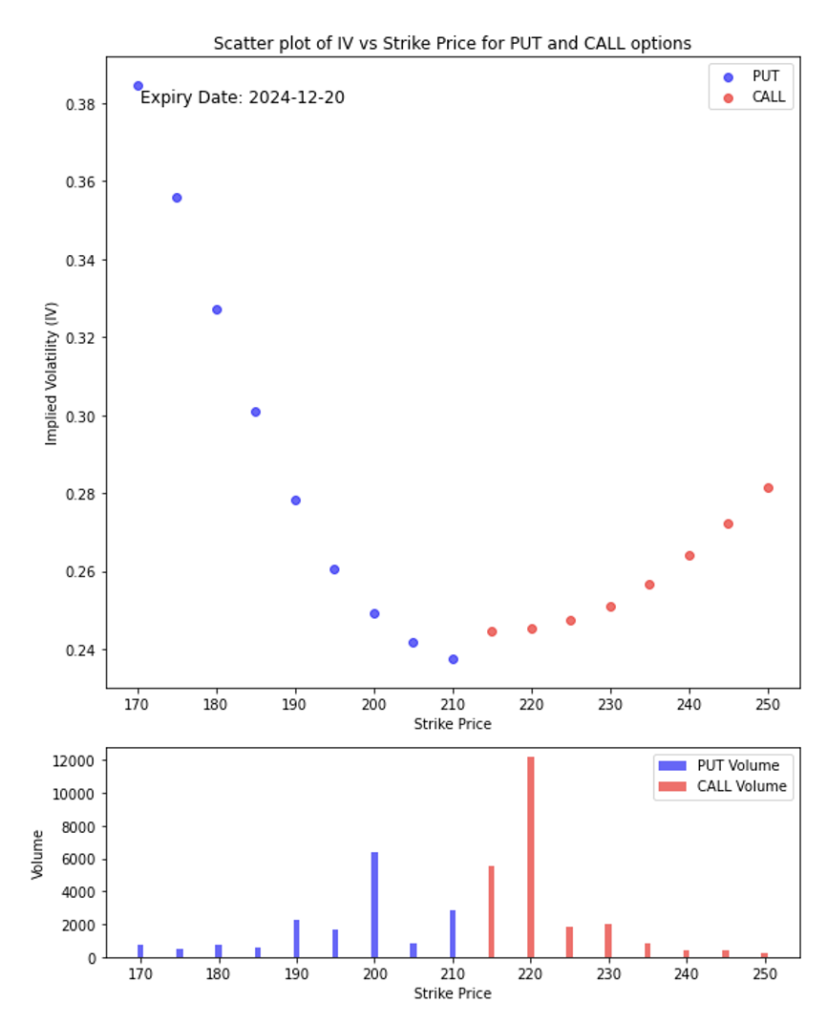

Bearish Sentiment with Risk Hedging:

- The higher implied volatility for PUTs compared to CALLs indicates traders are more concerned about potential downside risk than upside opportunity.

- High PUT volumes further reinforce the idea that market participants are hedging or expecting a downward move.

Limited Bullish Speculation:

- CALL option activity suggests some optimism, but the IV skew indicates that the market is more focused on risk management.

Investment Opportunity & Risk

Despite potential trouble ahead, there are still opportunities for investors to explore:

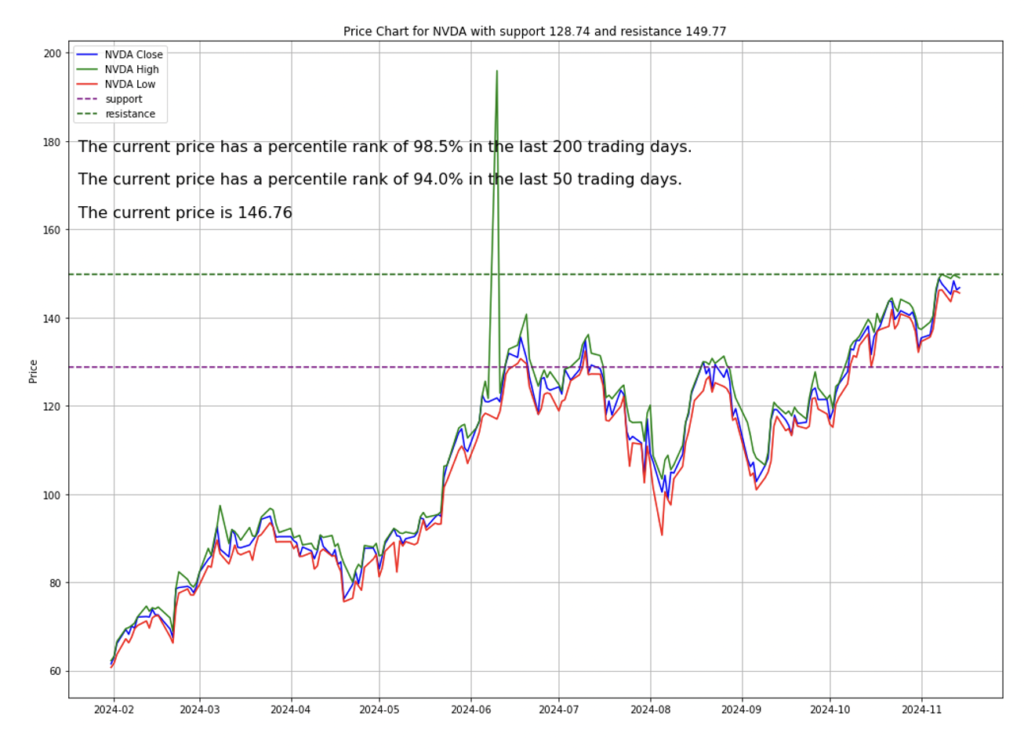

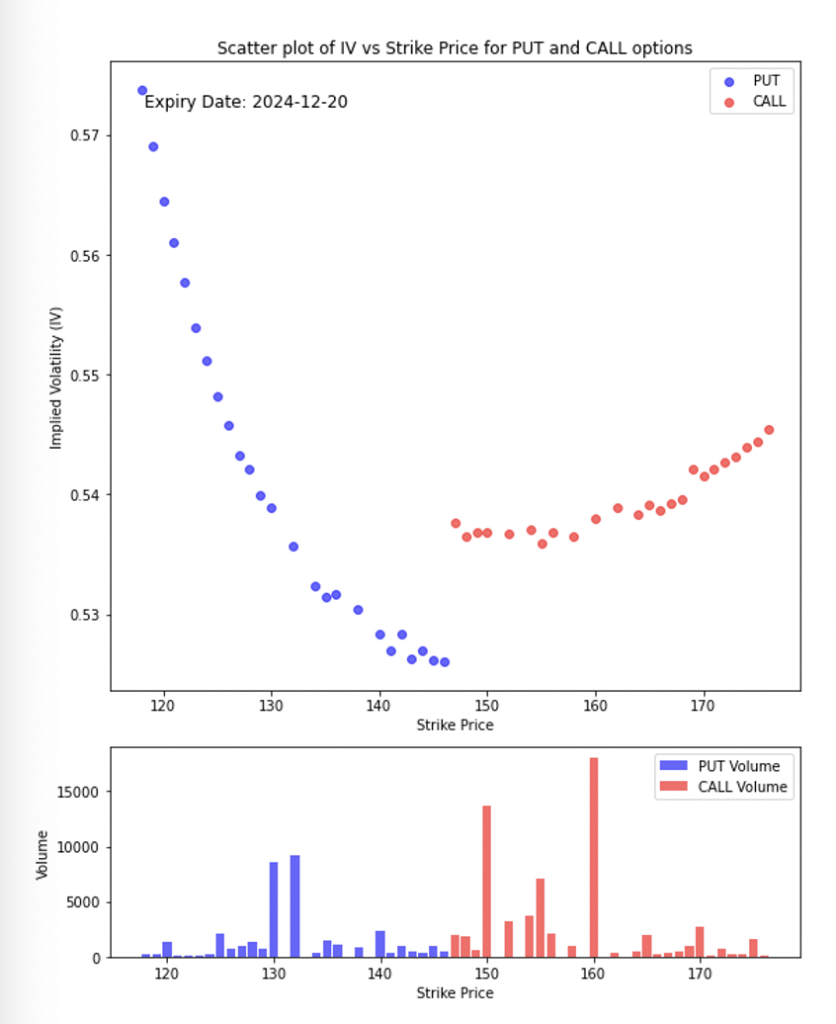

Nvidia (NVDA)

Nvidia continues to dominate the AI hardware market with its groundbreaking Blackwell GPUs, which are touted to deliver up to 30 times the performance of previous models. However, these new chips have encountered significant hurdles, particularly with overheating issues in customized server racks designed for their deployment. These problems have delayed shipments and prompted design changes, impacting major customers like Meta Platforms, Google, and Microsoft. Despite these challenges, analysts maintain a bullish outlook on Nvidia. Any stock pullbacks are viewed as buying opportunities, given the sustained demand for Nvidia’s AI solutions. The company’s efforts to resolve hardware constraints and ramp up production in early 2025 are expected to reinforce its leadership in the AI sector.

Short-Term Outlook (Next Few Weeks):

Likely Range: 150–160.

The stock price is expected to trend slightly upward, given the high CALL volume and relatively flat IV near these levels.

Strong support exists at 140, limiting downside risks.

Medium-Term Outlook (1–2 Months):

If the stock breaks above 160, it could move toward 170, where speculative interest in CALL options begins to increase.

Downside risk appears limited to 140, supported by PUT volume and high IV for lower strikes.

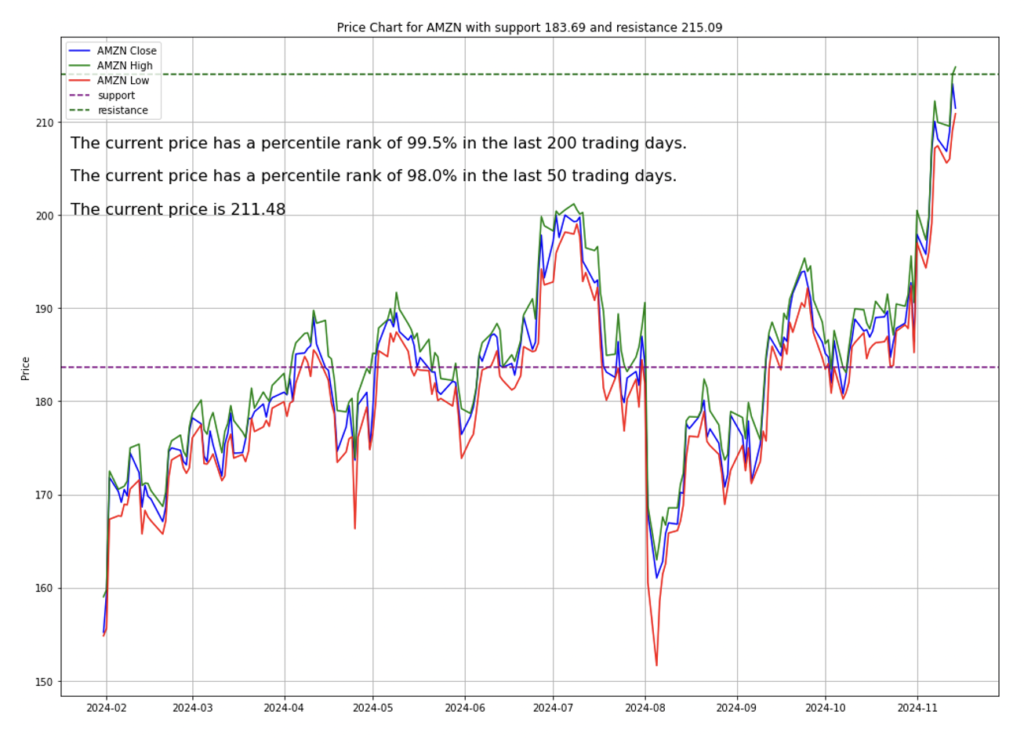

Amazon (AMZN)

Founder Jeff Bezos recently completed a prearranged Amazon stock sale, disposing of $5.1 billion worth of shares since July. While these sales were significant, Bezos retains substantial holdings, reinforcing confidence in the company’s long-term prospects.

Bullish Bias Around ATM Strikes:

The high CALL volume at 220 and a relatively low IV for these strikes reflect a moderately bullish sentiment.

Traders expect a slight upward movement or stability near 210–220.

Hedging Against Downside Risks:

The sharp increase in IV for far out-of-the-money PUTs (e.g., 170–190) indicates traders are protecting against downside risks, even though this sentiment is not strongly reflected in PUT volume.

Cautious Optimism for Upside Moves:

The increasing IV for higher CALL strikes (230–250) and the concentration of volume at 220 suggest expectations of moderate upward movement rather than aggressive bullish speculation.

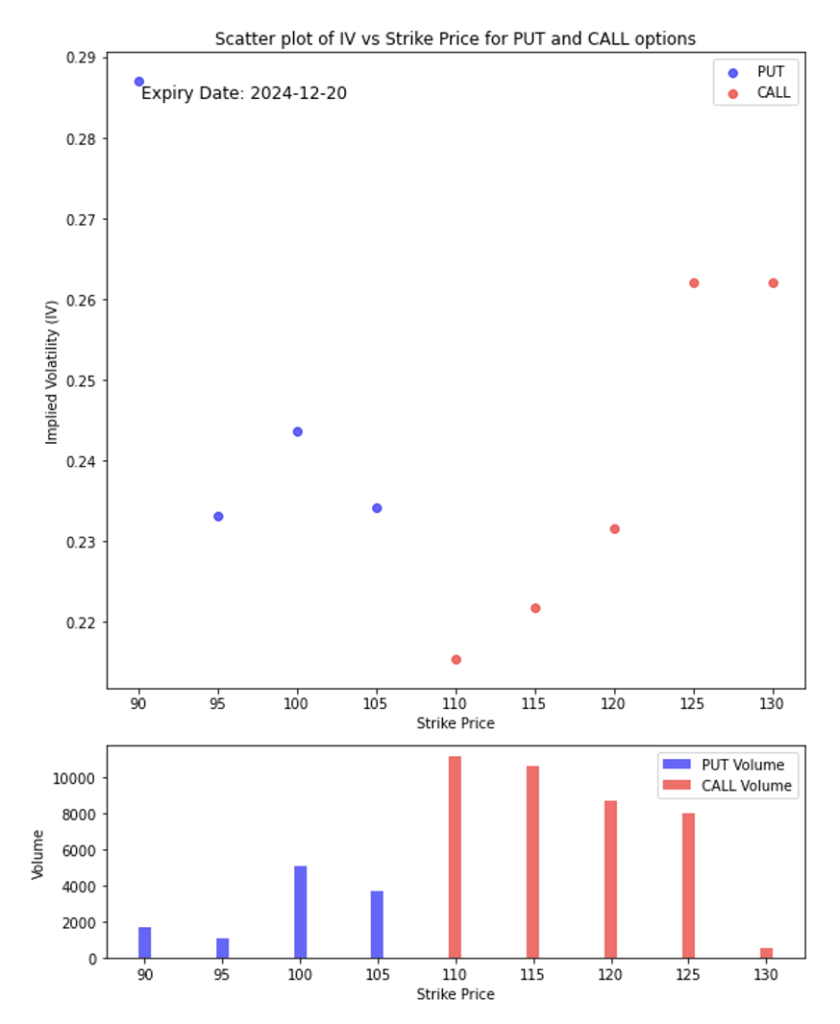

Disney (DIS)

Disney’s stock surged following a revised price target by Bank of America, reflecting optimism about its strategic initiatives and resilience in the face of macroeconomic headwinds.

Short-Term Outlook (Next Few Weeks):

Likely to move toward 110–120:

The high trading volume in CALLs at 110, 115, and 120 indicates that traders are positioning for moderate upward movement.

The low IV for ATM CALLs (110) aligns with the expectation of a gradual price increase.

Support at 100–105:

The presence of moderate PUT volume and relatively flat IV near these strikes indicates strong support around this range.

Medium-Term Outlook (1–2 Months):

If the stock breaks above 120, it could move toward 125 or 130, where speculative CALL interest is significant. Downside movement is less likely, but strong support exists at 100–105 if the stock experiences short-term weakness.

Microsoft (MSFT)

Capital expenditures for AI and cloud technologies, particularly Azure, demonstrate a commitment to long-term growth. Despite near-term cost concerns, Microsoft remains positioned for substantial gains.

Short-Term Outlook (Next Few Weeks):

Likely to remain range-bound between 425 and 450, as this is where both IV and volume align with market expectations.

Moderate bullish sentiment suggests potential for upside toward 450, but the steep PUT IV curve indicates strong resistance to price declines below 400.

Medium-Term Outlook (Next 1–2 Months):

If the stock breaks above 450, it could move toward 475 as CALL interest and volume are concentrated there.

If downside risks materialize, strong hedging and PUT volume suggest support around 400.

CONCLUSION

- A strong U.S. economy signals trouble ahead for the market.

- Investors should pay close attention to Federal Reserve signals, as upcoming data on inflation and employment will shape future rate decisions.

- Additionally, global developments, particularly around tariffs and geopolitical tensions, are poised to have outsized effects on market stability.

- Stocks tied to technology, manufacturing, and consumer spending will likely remain focal points as the U.S. navigates these evolving challenges.

Please note that all information in this newsletter is for illustration and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any investment products or services.

About the Author

Rein Chua is the co-founder and Head of Training at AlgoMerchant. He has over 15 years of experience in cross-asset trading, portfolio management, and entrepreneurship. Major media outlets like Business Times, Yahoo News, and TechInAsia have featured him. Rein has spoken at financial institutions such as SGX, IDX, and ShareInvestor, sharing insights on the future of investing influenced by Artificial Intelligence and finance. He also founded the InvestPro Channel to educate traders and investors.

Rein Chua

Quant Trader, Investor, Financial Analyst, Vlogger, & Writer.