Trump’s Win Sparks Market Optimism, Economic Shift

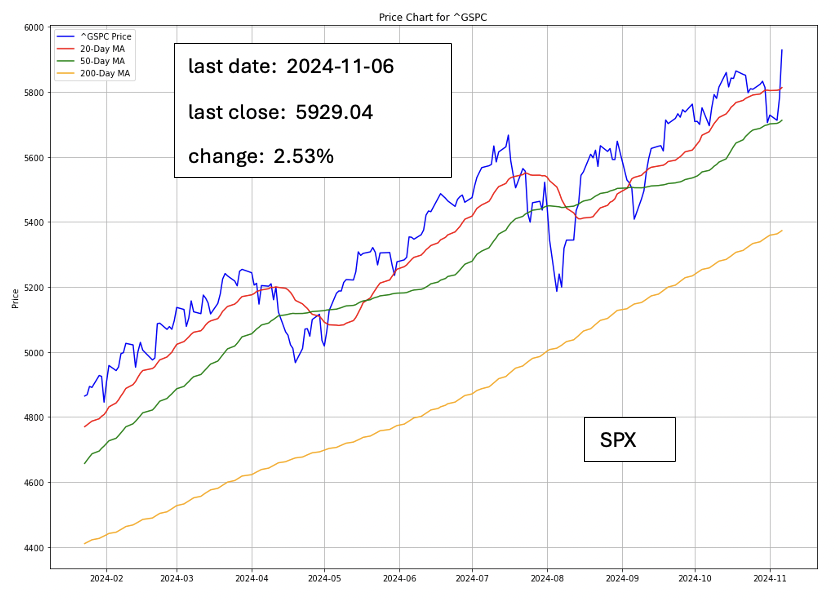

After Donald Trump wins, U.S. markets soared to record highs, fueled by expectations of pro-business policies like tax cuts, deregulation, and a focus on domestic growth. Consequently, the approach is likely to shift inward, supporting industries like manufacturing and driving strong investor optimism.

Source: NBC 5 Chicago

Many American voters expressed discontent with the state of the economy, pointing to high prices for goods and services, challenges in housing affordability, and a general sense of diminished financial security. Following Trump wins, this frustration highlights a disconnect between strong economic indicators in official data and the everyday struggles of Americans facing inflationary pressures.

Market Rises on Tax Cut Optimism, Fed Watch

Stock indexes soared as Trump wins made the potential for reduced regulatory constraints and lower corporate taxes more tangible. However, investors tempered this optimism by focusing on the Federal Reserve’s interest rate decisions. While the Fed is expected to cut rates soon, rising inflation could limit its ability to maintain aggressive rate cuts, potentially dampening market enthusiasm over time.

WATCHOUT

Fossil Fuels Gain Boost as Renewables Stall

The Trump administration’s anticipated support for traditional energy sources over renewable energy has energized fossil fuel companies, which may face fewer regulatory hurdles. This shift could slow renewable energy stock growth, while fossil fuel companies stand to gain momentum from policy shifts favoring fossil fuel production and domestic energy independence.

Source: Market Watch

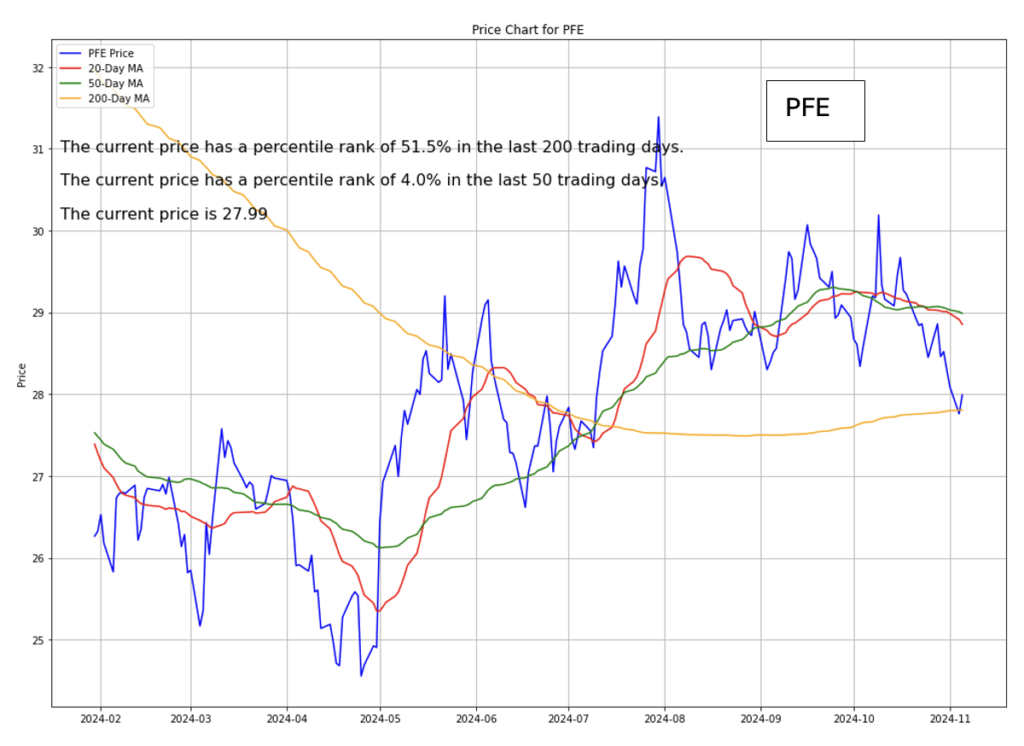

Food and Drug Policy in Flux with Kennedy Appointment

Trump wins, with reports of his intent to appoint Robert F. Kennedy Jr. to oversee health policy, particularly concerning vaccines and drug regulations. This could create a volatile environment for pharmaceutical companies like Pfizer and GlaxoSmithKline. Kennedy’s controversial views on vaccines may lead to policy shifts that impact vaccination rates and drug policy, introducing potential risks and uncertainties in the healthcare sector.

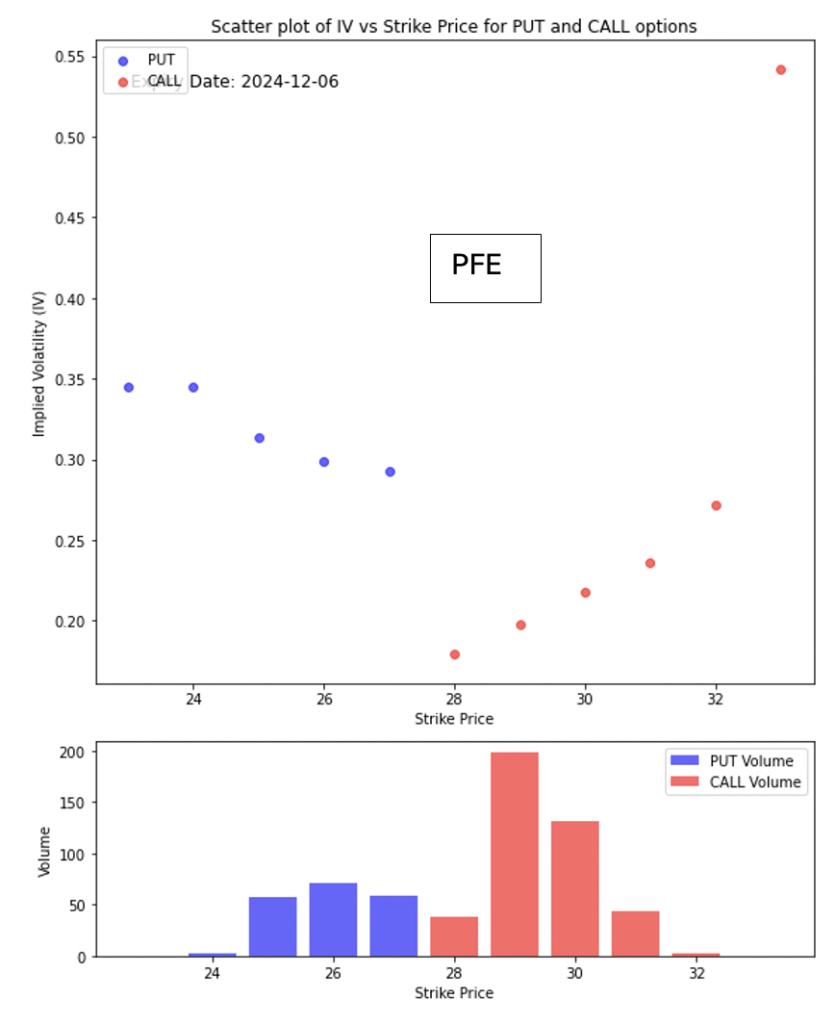

The volume bar chart shows much higher volume in call options, especially around the 28 and 30 strike prices, indicating that investors are more interested in call options, which typically reflect a bullish sentiment.

The concentrated volume in calls suggests that market participants may be positioning for or are more optimistic about potential upward movement.

TAKE: More bullishness

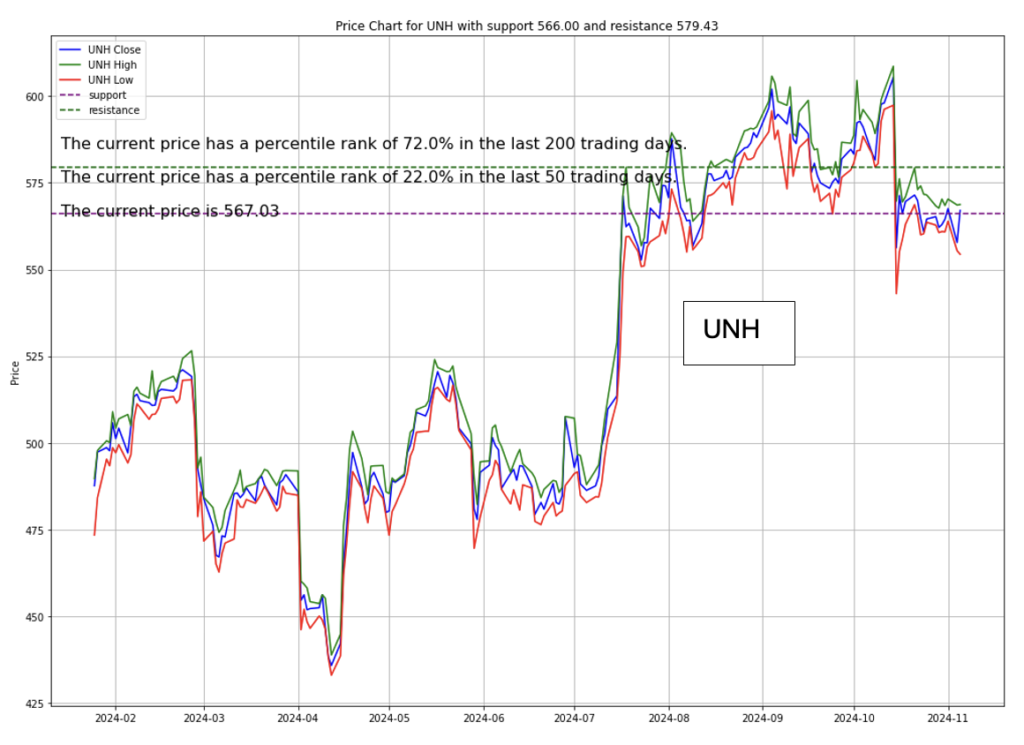

The Healthcare Sector Experienced Mixed Reaction

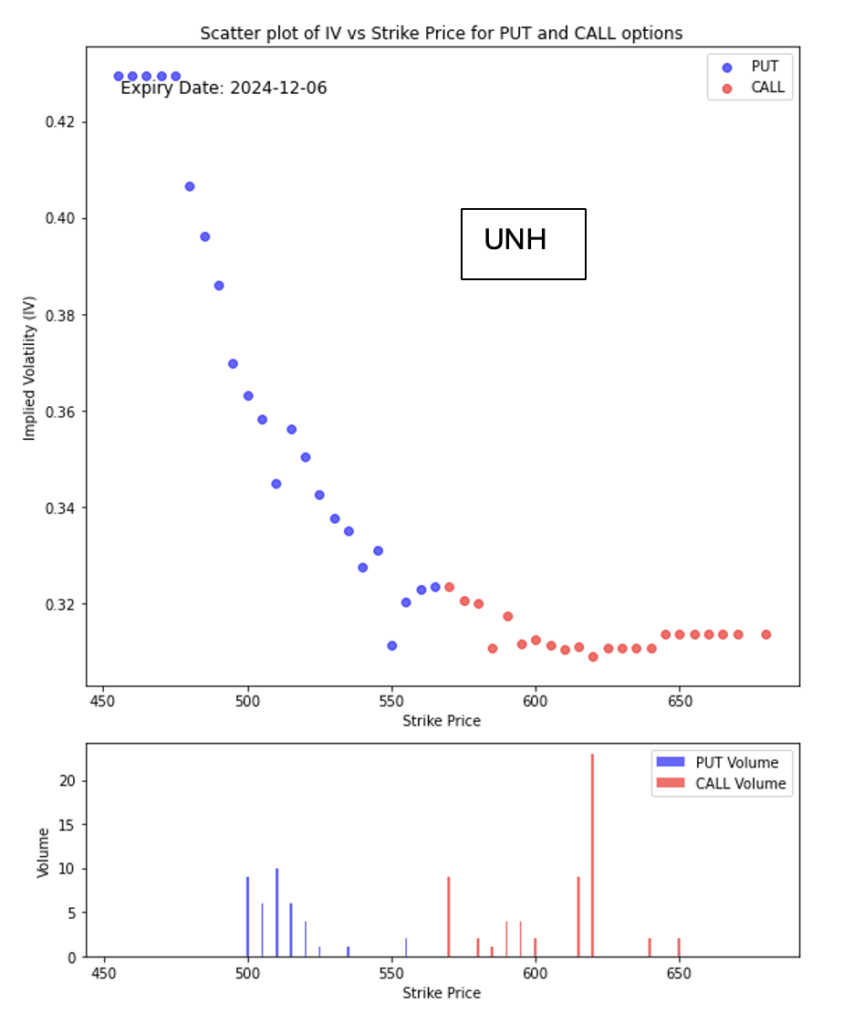

Companies involved in Medicare Advantage, such as UnitedHealth and Humana, benefited from expectations that Trump would favour less regulatory scrutiny and might promote private healthcare options. However, companies dependent on Obamacare and Medicaid, such as Oscar Health and Centene, faced declines due to fears of funding cuts and reduced federal support for these programs.

• While there are some peaks in call volume, the put volume is more evenly distributed across multiple strike prices, showing that there’s steady interest in put options across the range. The presence of significant put volume near lower strike prices suggests that investors may be preparing for, or hedging against, a potential decline in the underlying stock’s price.

• The fact that call volumes are lower and more concentrated in specific strikes suggests less optimism for a broad upside move.

TAKE: More bearishness

Investment Opportunity & Risk

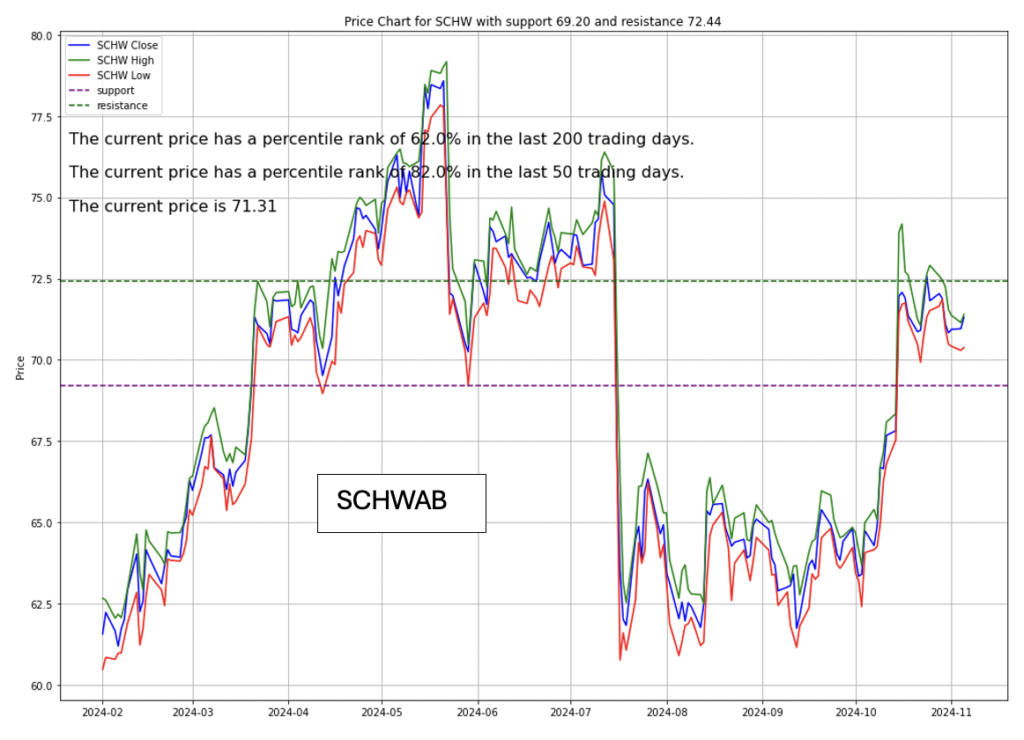

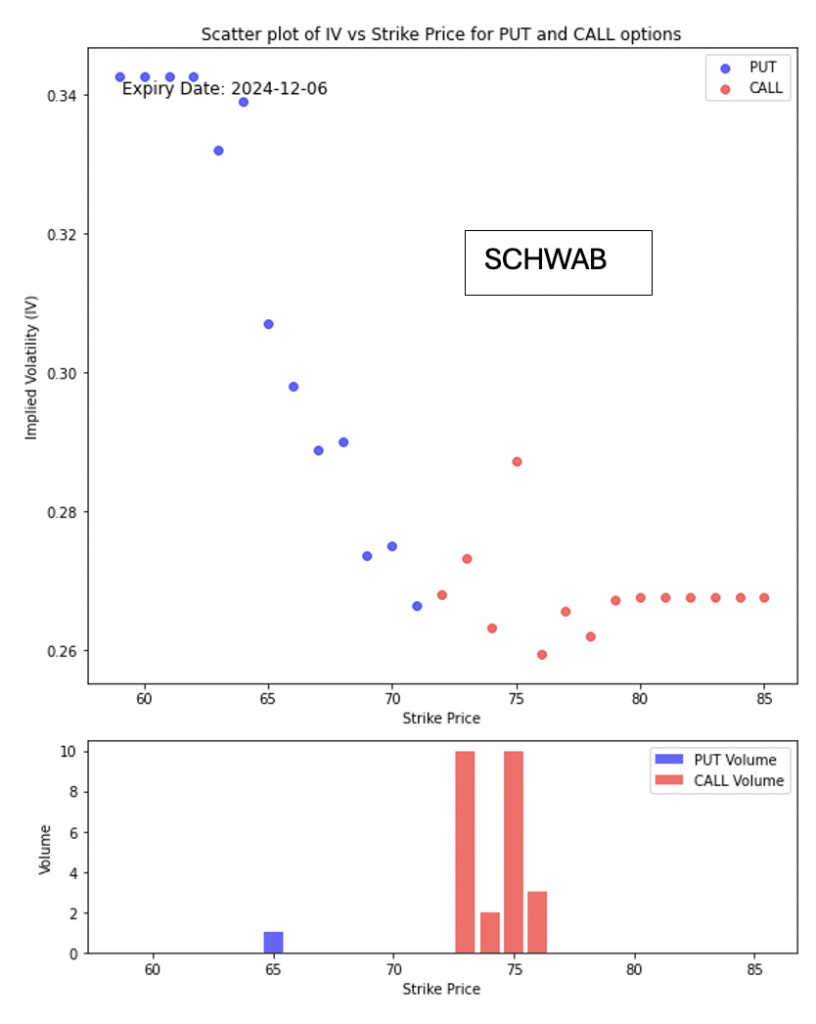

Charles Schwab Corporation (SCHW)

Financial stocks surged, with firms like Schwab, Interactive Brokers, and Robinhood seeing double-digit gains on expectations of a lighter regulatory regime and a more favourable environment for mergers and acquisitions. The SPDR S&P Bank ETF, tracking financial-services firms, jumped nearly 12% as investors anticipated a less interventionist approach from the new administration, likely benefiting the sector further.

The call volume clearly indicates a very bullish sentiment. However the expectation of its stock price to go to 80 and beyond is not supported.

Some investors are worried and they are hedging against the stock price falling to 65 and below.

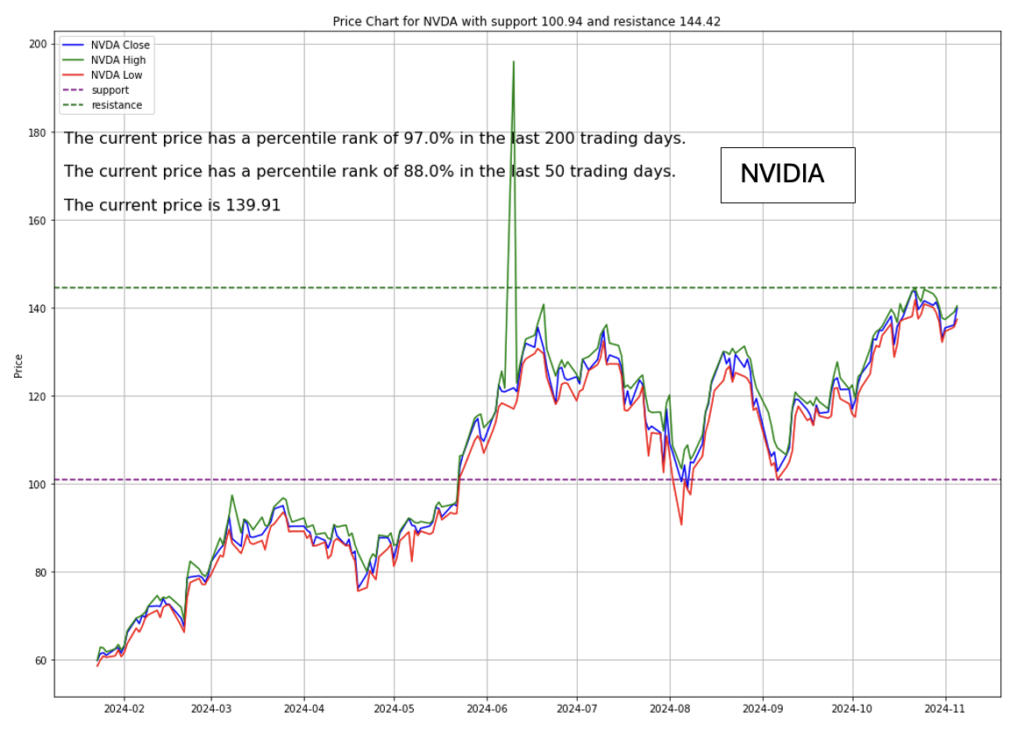

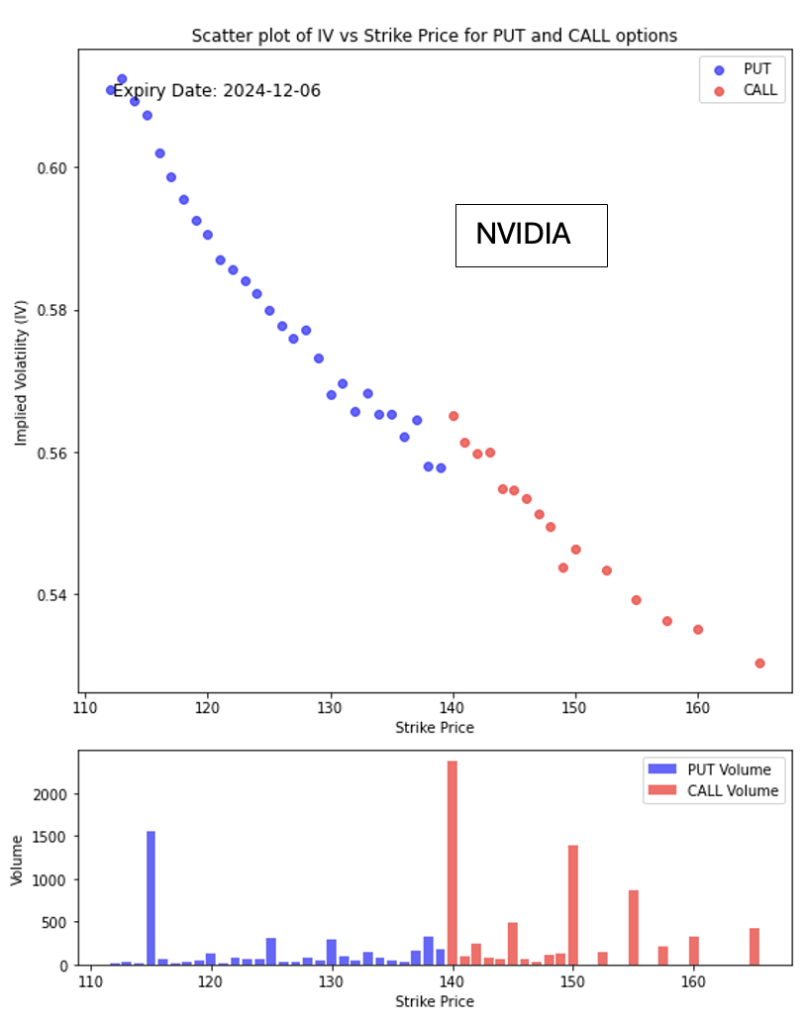

Nvidia (NVDA)

Nvidia‘s stock rose after Trump’s election, fueled by investor optimism over continued bipartisan support for U.S.-based chip manufacturing. Meanwhile, Taiwan Semiconductor Manufacturing (TSMC) faced a setback as Trump’s tariffs and nationalist trade policies may favor U.S. chip makers over foreign competitors. Intel also gained, with the focus on domestic manufacturing expected to benefit U.S. tech firms in the semiconductor space.

The option market is showing caution and inclining towards bearishness. The volatility smile shows that and the option volume distribution shows considerable fear the stock price will dip.

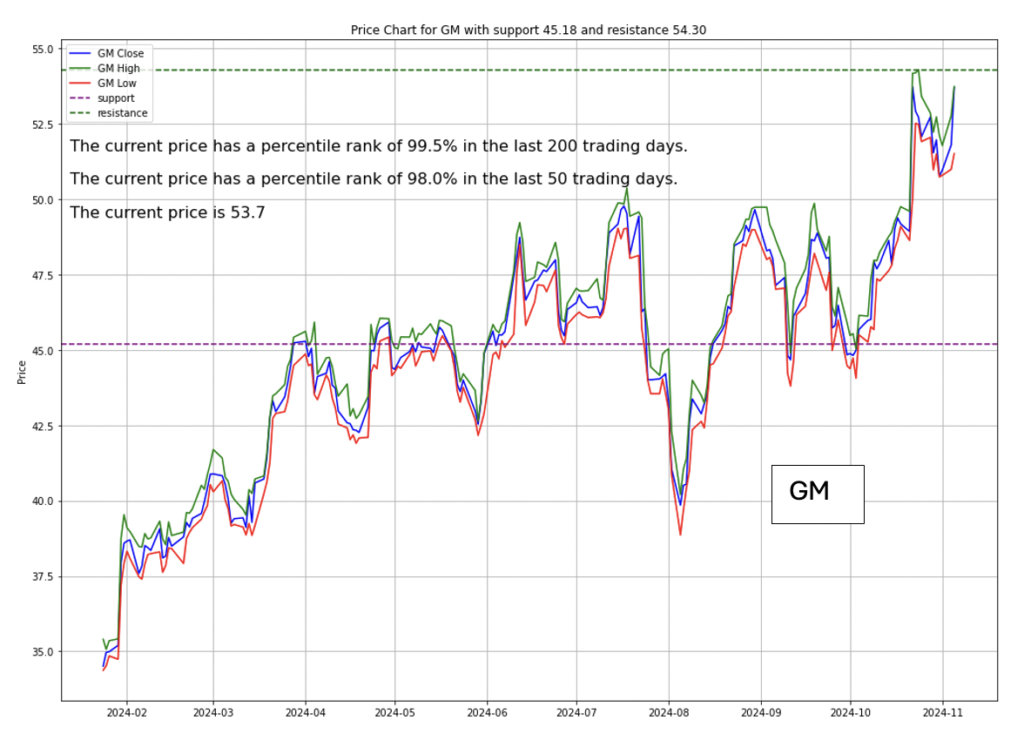

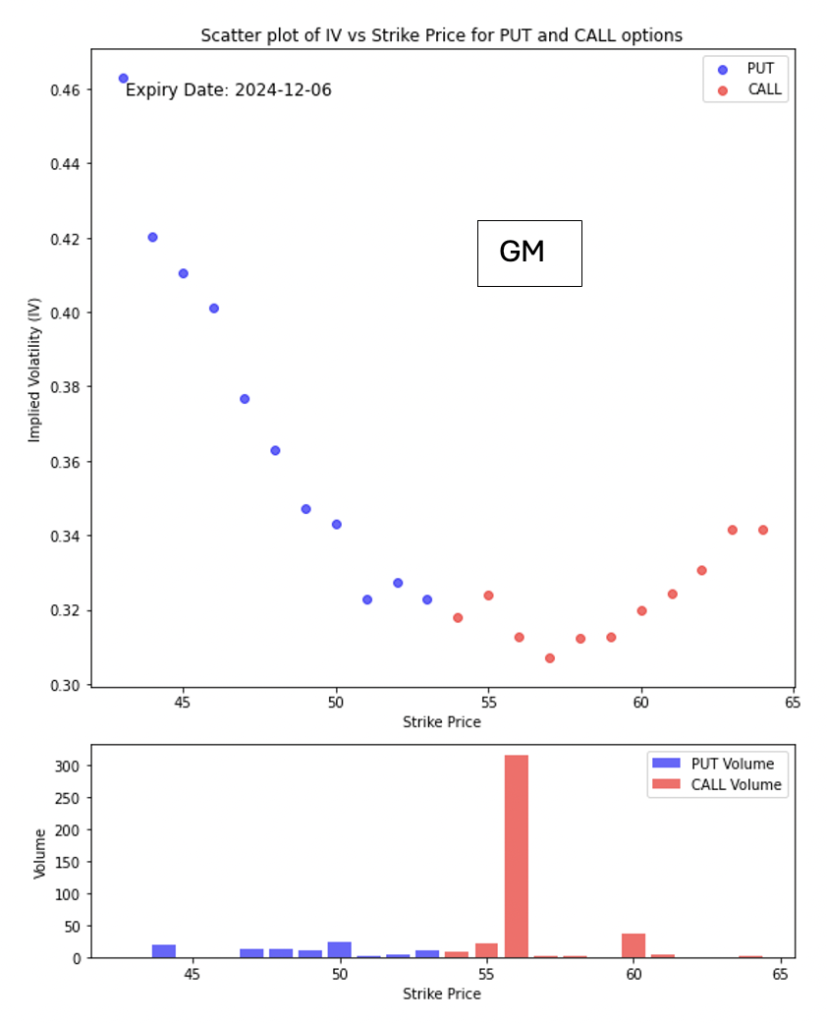

General Motors (GM)

Traditional auto stocks like Ford and General Motors rallied, benefiting from Trump’s stance on reducing EV subsidies and increasing tariffs on imports, which could boost demand for American-made gas-powered vehicles. Tesla’s stock saw even stronger gains, as investors speculate that the company’s established foothold in the EV market will be an advantage in a reduced-subsidy environment.

- There is a significant spike in call volume around the $55 strike price, suggesting that investors are interested in taking advantage of potential upside moves or protecting positions with calls at this level.

- The relatively low put volume compared to calls further supports a bullish sentiment, as there seems to be more interest in positioning for upside than in hedging against downside.

TAKE: More bullishness

CONCLUSION

- In summary, Trump’s victory has catalysed a rally in multiple sectors across the U.S. stock market.

- Financial services, energy, and manufacturing are set to benefit from expected policies, while tech, healthcare, and select auto stocks may gain from targeted industry support.

- However, inflation risks, global shifts, and complex healthcare policies may add caution for investors in the coming months.

Please note that all information in this newsletter is for illustration and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any investment products or services.

About the Author

Rein Chua is the co-founder and Head of Training at AlgoMerchant. He has over 15 years of experience in cross-asset trading, portfolio management, and entrepreneurship. Major media outlets like Business Times, Yahoo News, and TechInAsia have featured him. Rein has spoken at financial institutions such as SGX, IDX, and ShareInvestor, sharing insights on the future of investing influenced by Artificial Intelligence and finance. He also founded the InvestPro Channel to educate traders and investors.

Rein Chua

Quant Trader, Investor, Financial Analyst, Vlogger, & Writer.