As of Friday’s market close, U.S. stocks completed their sixth consecutive week of gains in the market rally, achieving a new record high. This rally has been fueled by strong corporate earnings results across multiple sectors, boosting investor confidence. In addition to robust earnings, lower crude oil prices and declining Treasury yields contributed to the market’s upward momentum. Falling crude prices, down to under $69 per barrel, provided relief from inflationary pressures, while easing Treasury yields further supported the positive sentiment across Wall Street.

Furthermore, U.S. consumer spending remains a strong pillar of the economy, reinforcing the market rally. In September 2024, retail sales grew by 0.4%, outperforming expectations. Spending at restaurants, bars, and clothing stores was especially robust. This data reflects ongoing strength in the U.S. economy, helping to buffer against fears of a recession and supporting broader market growth.

GLOBAL CONCERNS

Weak Chinese Demand Challenges Multinational Companies

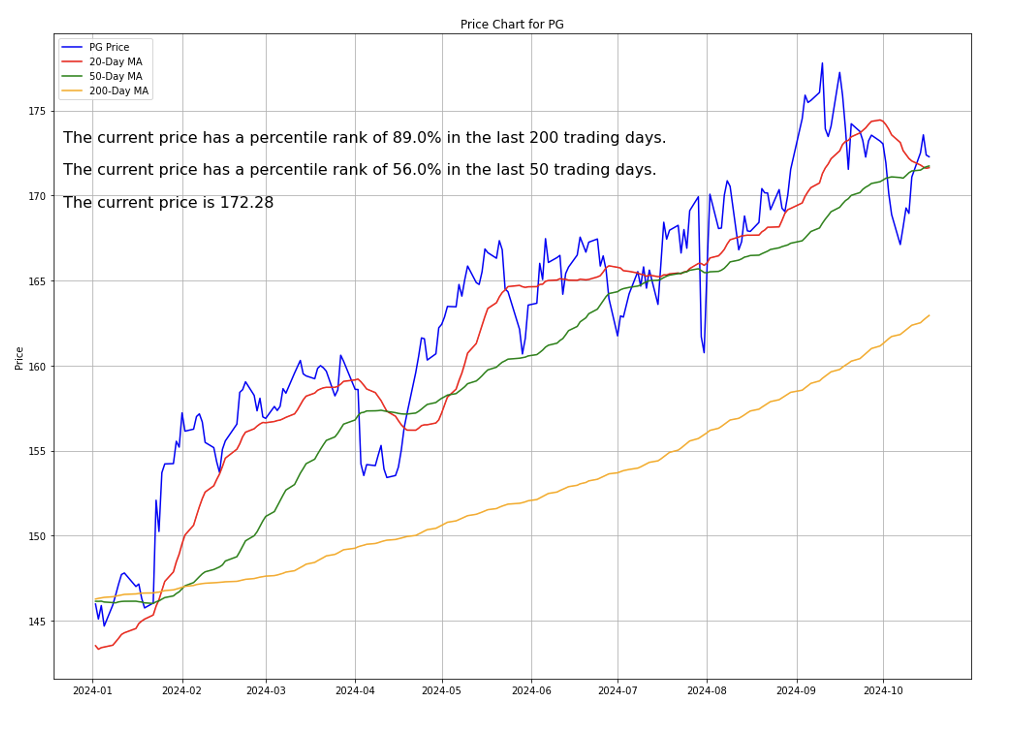

On the global front, challenges such as a slowing Chinese economy and conflicts in the Middle East have weighed on multinational companies like Procter & Gamble. Weak demand in China and anti-Japanese sentiment have significantly impacted sales of high-end products like SK-II. Despite these headwinds, companies continue to focus on core markets, with U.S. consumer demand proving resilient.

Source: CNBC

P&G Sales Decline

P&G reported a 1% decline in sales, impacted by a weaker Chinese economy and ongoing geopolitical risks. However, the company continues to hold steady on its pricing strategy for premium products like Tide detergent, with expectations of 2% to 4% sales growth for FY2025.

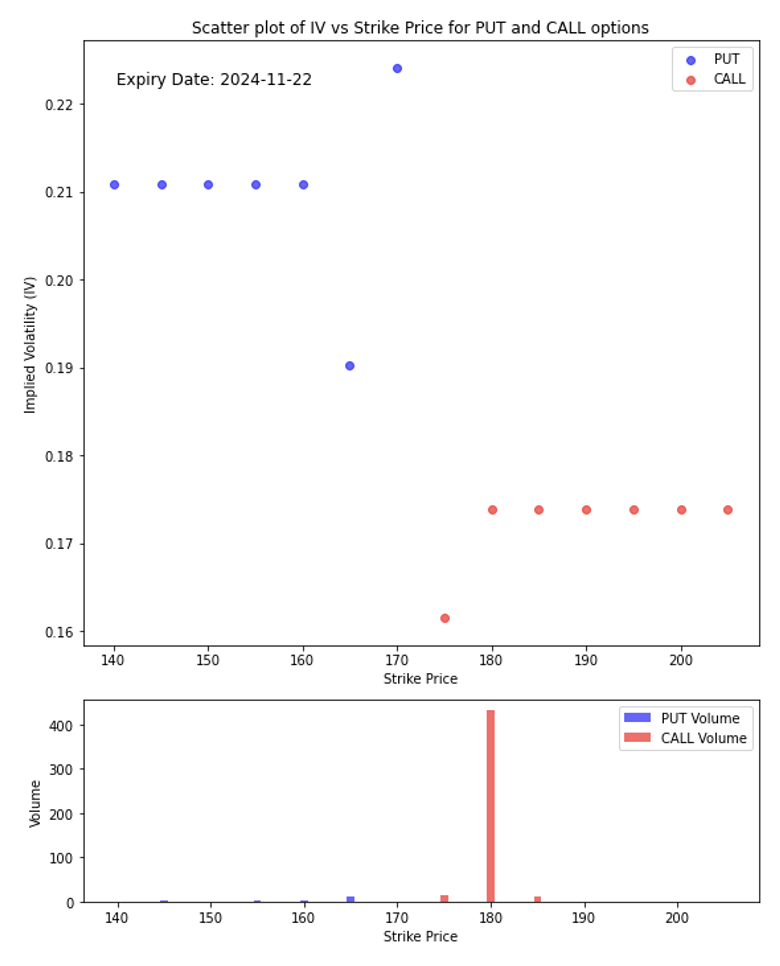

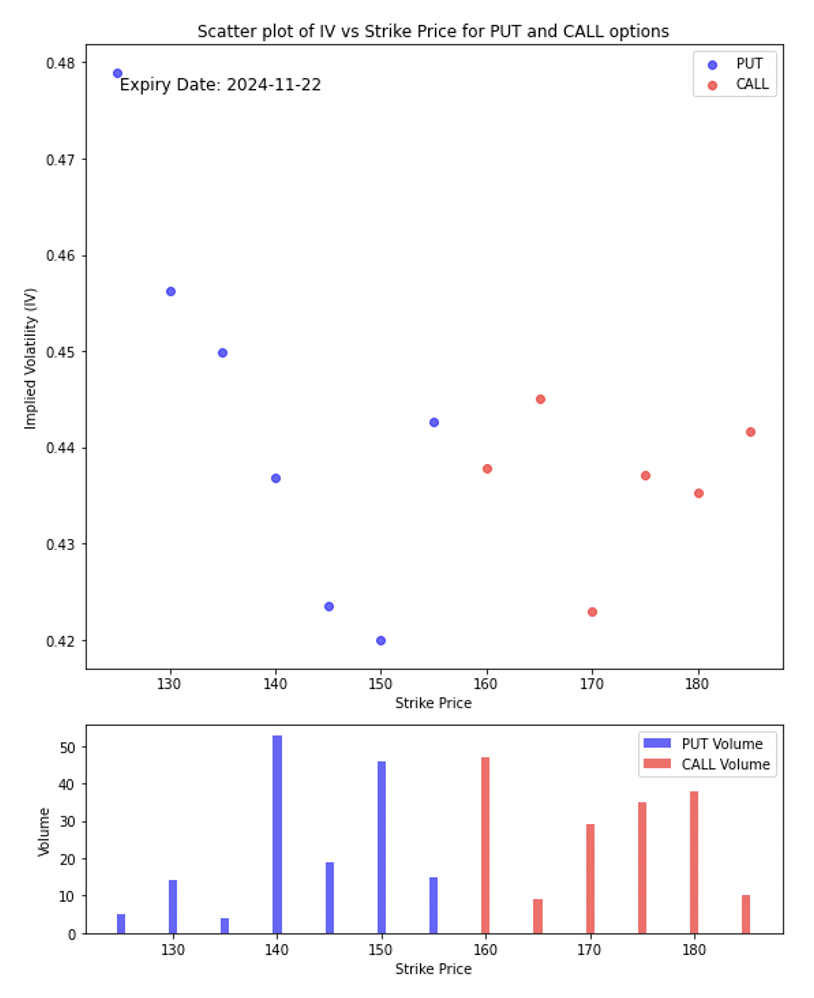

- Higher IV for PUTs at Lower Strikes: The higher implied volatility for lower-strike PUT options (140-160) suggests that traders anticipate more price volatility at these lower levels, likely due to downside risk protection.

- CALL Volume Spike at 180: The sharp increase in CALL volume at 180 might indicate bullish sentiment or significant positioning at that level, with traders focusing their strategies around the 180 strike price.

- Low CALL IV: The relatively lower IV for CALL options across all strikes shows that the market does not expect as much volatility on the upside.

This chart suggests that traders are concerned about downside risks (hence the higher IV for PUT options), while also showing a significant interest in CALL options at the 180 strike, which may be a key level of interest for market participants.

WATCHOUT

Rising Costs Strain Health Insurance Demand

The health insurance sector remains under pressure, with rising costs in Medicare and Medicaid plans. Companies like UnitedHealth Group and Elevance Health have reported disappointing earnings, citing elevated costs as a major concern. These challenges are expected to persist into 2025, adding uncertainty to the sector’s outlook amidst the broader market rally.

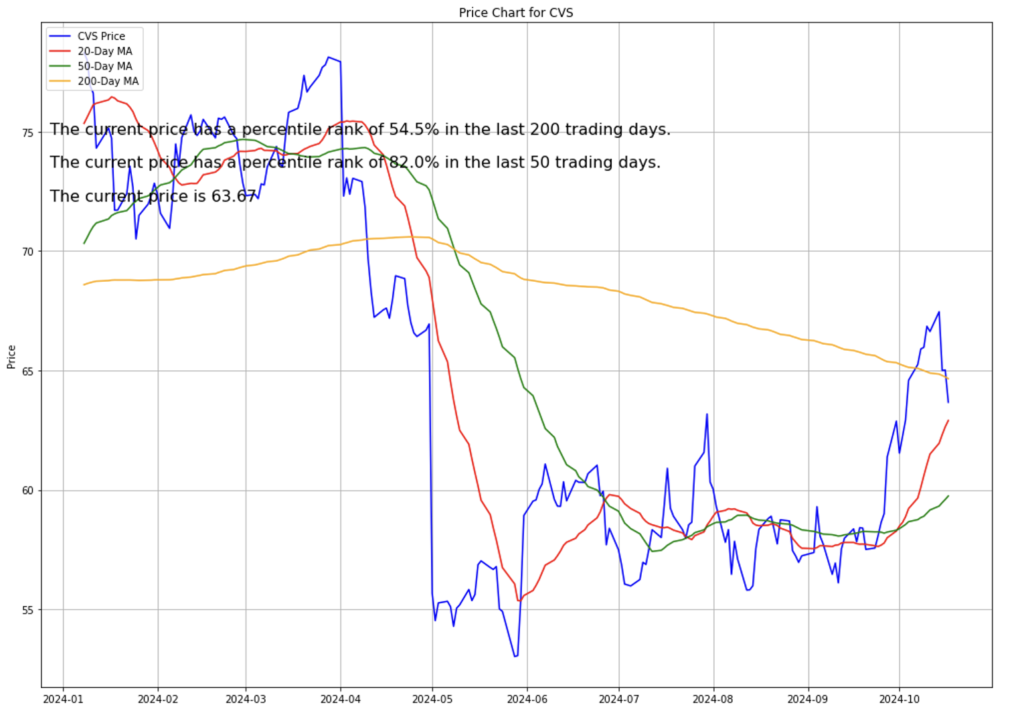

CVS Health has also been impacted by rising healthcare costs, particularly in its Medicare and Medicaid segments, resulting in reduced earnings and a 17.6% decline in its share price this year. The company faces ongoing challenges within the health insurance sector, and investors remain wary amidst escalating costs and operational hurdles.

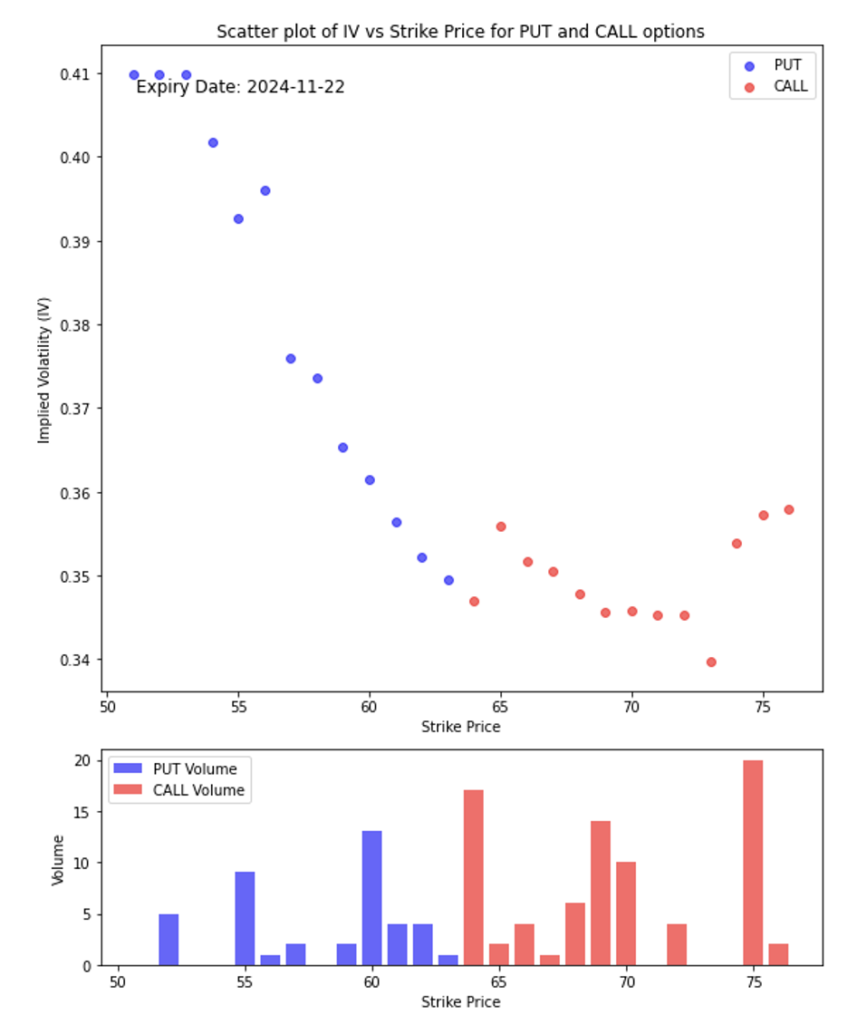

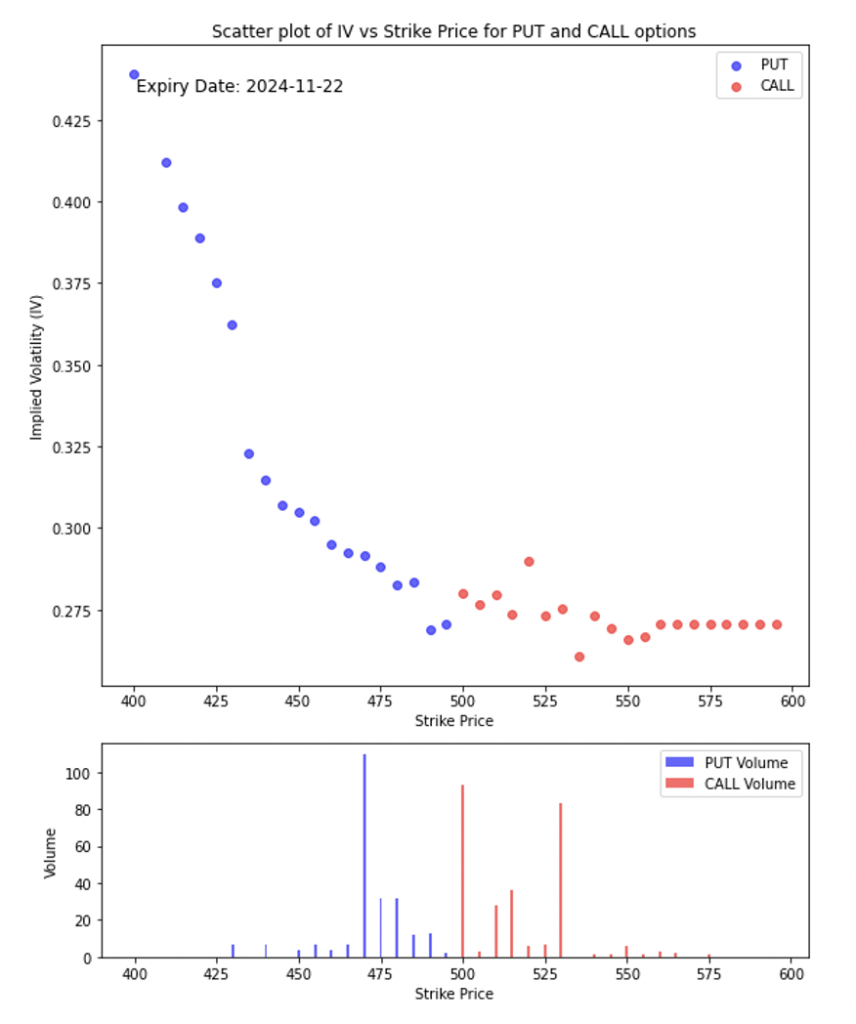

- The steeper IV for lower strike PUT options signals that traders may anticipate some downside pressure or a potential pullback.

- The slight uptick in IV for higher strike CALLs suggests some optimism for upward movement, as traders are likely speculating on higher prices while taking advantage of lower IV at these strikes.

- Higher PUT volumes at lower strike prices indicate that traders are protecting against downside risks near 55-60.

- The strong CALL volume at the 65-75 strikes suggests that traders are positioning for potential upward movement, with significant speculative interest near the 75 strike.

This IV smile and volume data suggest a market that is hedging against potential downside risks while also preparing for speculative upside moves.

UPS faces challenges but offers stable yield

UPS, yielding 4.8%, has faced challenges with declining revenue and profit margins but remains a top player in the package delivery sector. Earnings are expected to rebound by 15% next year, positioning UPS well in the e-commerce space. Dividend-focused investors may find UPS attractive due to its stable yield and long-term growth potential.

Boeing restructures, sells assets to recover

Boeing is in the midst of restructuring, selling off non-core assets and reducing its workforce to stem ongoing losses. The company has faced severe challenges with its supply chain and product quality, exacerbated by labor strikes. While Boeing’s financial situation remains precarious, its efforts to stabilize through asset sales and refocusing on core operations are critical steps for its recovery amidst the broader market rally.

- The volatility skew is more pronounced in PUT options, which often indicates that investors expect some downside risk or higher uncertainty about price decreases.

- The lower bar chart displays the trading volume for PUT (blue) and CALL (red) options. Higher volumes typically indicate more interest in these contracts and can reveal market sentiment.

- There is a notable concentration of PUT volumes around the 140-150 strike range, while CALL volumes are higher at 160-180 strikes.

The volume distribution suggests that there’s more interest in downside protection (puts) near 140-150, and speculative interest in potential upside (calls) around 160-180. This can indicate some uncertainty about short-term movements, with traders potentially hedging against near-term downside risk but also speculating on some upside potential.

Investment Opportunity & Risk

Corporate earnings have been a key driver of recent market performance in the market rally.

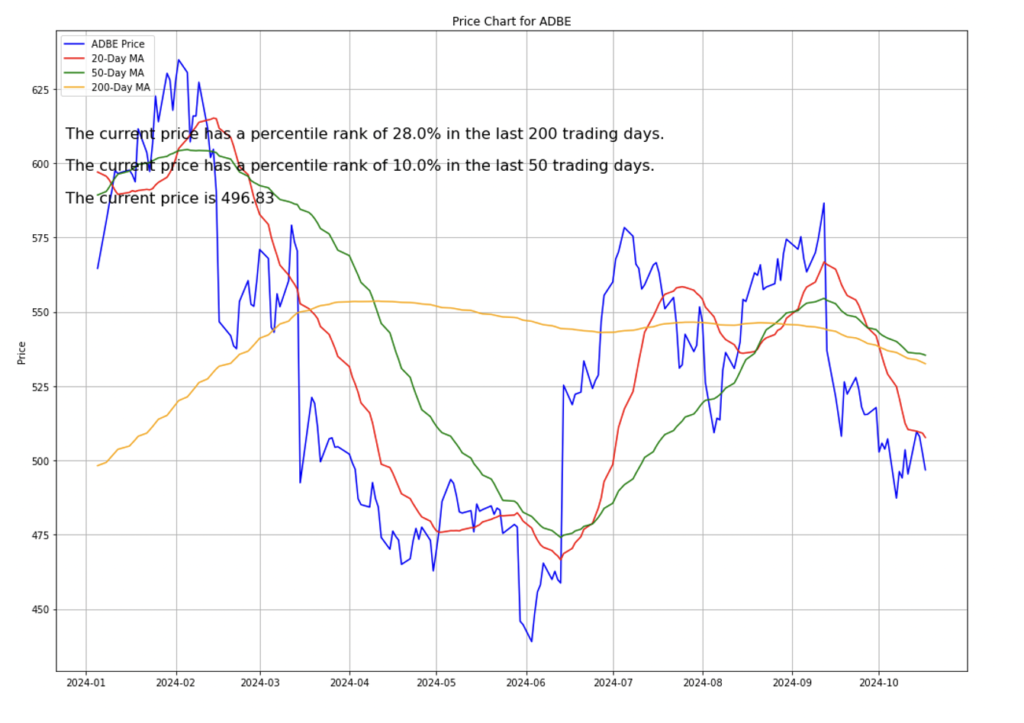

Adobe (ADBE)

- Adobe’s integration of artificial intelligence into its Creative Cloud products, including the Firefly AI tool, has made it a compelling play in the AI space. Despite short-term concerns about slowing growth, Adobe’s AI-driven revenue continues to climb, with significant margin expansion.

Adobe’s ability to monetize its AI offerings makes it a strong long-term buy, with expectations of continued growth driven by AI innovations across its product suite.

- High IV for Low Strike PUTs: The high IV at lower strike prices suggests strong demand for downside protection. This pattern is typical when market participants anticipate potential price declines in the underlying asset.

- CALLs with Stable IV and Higher Volume: The relatively lower IV for CALL options indicates that the market doesn’t expect extreme upward volatility. However, the increased volume at higher strike prices (500–525) shows that traders may still be positioning for moderate upside.

- Balanced IV Around 500 Strike: As both PUT and CALL IV converge around 500-525, this could suggest that market participants view these levels as relatively neutral, with fewer expectations of extreme volatility.

This chart demonstrates that the market has priced in more volatility for PUT options at lower strikes, with significant interest in both PUT and CALL options at key strikes, especially around 475 for PUTs and 525 for CALLs.

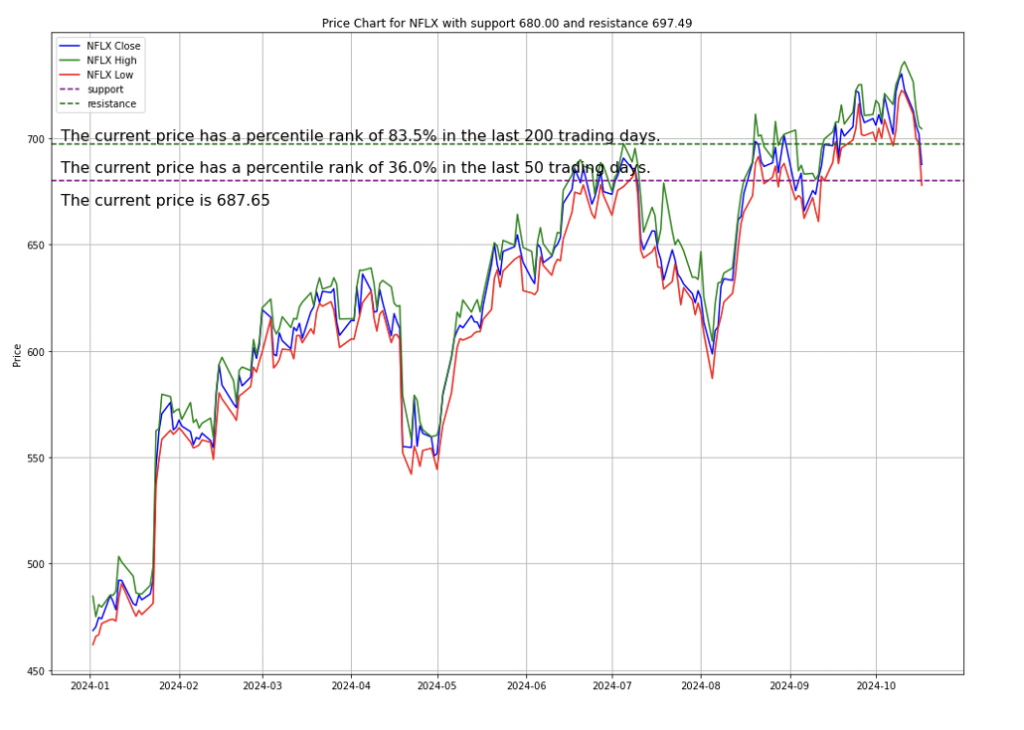

Netflix (NFLX)

- Netflix shares surged 11% following an outstanding third-quarter performance. The company reported earnings per share (EPS) of $5.40, beating estimates. Netflix continues to see strong growth in global paid memberships and expects further momentum driven by its robust content lineup.

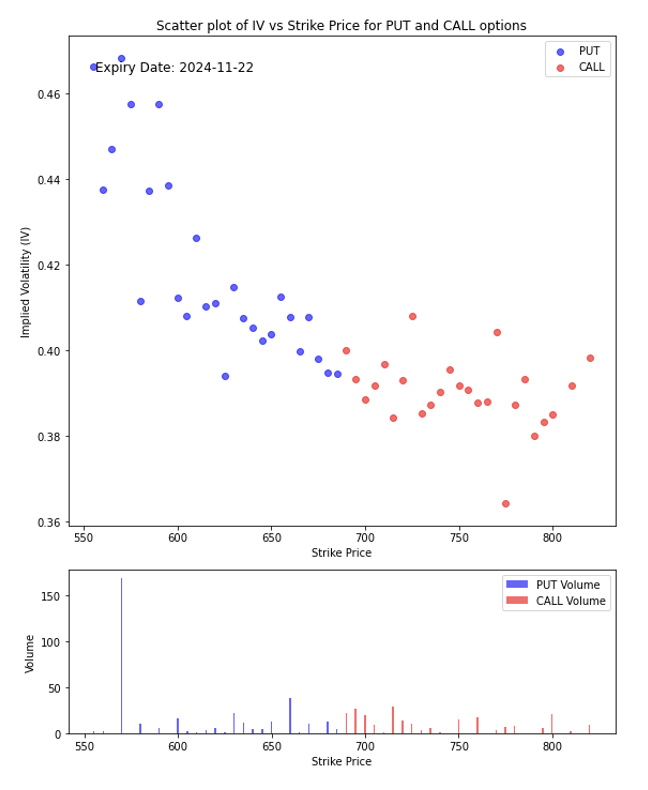

- The implied volatility is higher for both far OTM PUT options (around strike 550-600) and higher strike CALL options (near 800), indicating market expectations of potential large price movements.

- The spike in PUT volume near 600 could suggest traders are hedging against a decline or expecting a downturn in the underlying asset.

- The lower IV for strikes near 650-700 suggests that these strikes are closer to being at-the-money (ATM), where IV tends to be lower due to balanced demand between buyers and sellers.

CONCLUSION

- The U.S. stock market remains on a positive trajectory, bolstered by strong earnings results and continued consumer spending in the market rally.

- While global risks such as inflation, geopolitical conflicts, and healthcare challenges persist, the resilience of the U.S. economy has kept market sentiment positive.

- Investors should continue to monitor earnings and sector-specific risks but can remain optimistic about long-term growth prospects in key sectors like technology and consumer goods.

- This report highlights key factors driving U.S. and global markets, offering insights into individual stock performance and broader economic trends.

Please note that all information in this newsletter is for illustration and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any investment products or services.

About the Author

Rein Chua is the co-founder and Head of Training at AlgoMerchant. He has over 15 years of experience in cross-asset trading, portfolio management, and entrepreneurship. Major media outlets like Business Times, Yahoo News, and TechInAsia have featured him. Rein has spoken at financial institutions such as SGX, IDX, and ShareInvestor, sharing insights on the future of investing influenced by Artificial Intelligence and finance. He also founded the InvestPro Channel to educate traders and investors.

Rein Chua

Quant Trader, Investor, Financial Analyst, Vlogger, & Writer.